Journal of Hotel and Business Management

Open Access

ISSN: 2169-0286

ISSN: 2169-0286

Research Article - (2022)Volume 11, Issue 1

The majority of economic activities depend heavily on new information and communication technologies (ICT) in the modern age of globalization. The impact of Fixed Telephone (FT), Mobile use (MOB), and internet (INT) on GDP per capita in Pakistan is examined in this paper. Two Stages Least Square (2SLS) and Three-Stage Least Square (3SLS) techniques are used to appraise annual time series data from 1995 to 2019. We also come across for nonlinearities and complementarities in the association among FT-MOB, FT-INT, MOB-INT, and FT-MOB-INT. Empirical results established a non-linear association between FT, MOB, INT, and GDP per capita. Additionally, the results reveal that FT and MOB have a substantial positive on economic development and linear impact is noticed in FT and INT. It is also shown that FT complements INT and MOB, while the combined effect of INT and MOB in catalyzing growth is unproductive. Furthermore, the findings show that FT-INT-MOB's complementarities positively impact economic growth, indicating that FT complements INT and MOB and improves its efficiency in promoting economic growth. Pakistan policy-makers will be tricky to set up specific policy initiatives to sustain the telecom sector's growth momentum.

United Nations General Assembly members endorsed an aggressive campaign in September 2015, incorporating 17 Sustainable Development Goals (SDGs) and 169 aspirations Assembly. The 2030 Agenda for Sustainable Development intends to solve the most pressing challenges of the twenty-first century in the interests of people, the environment, and economic development. Sustainable development efforts are undertaken to meet the demands of the current society without affecting future generations' ability to meet their own. Sustainable Development Goal (SDG-8) includes decent work and economic growth [1].

To attain sustainable economic growth, it is necessary to address the interconnected pillars of economic growth through supportive policies. With the start of the new century, a new movement emerges that will transform the future of humanity by reducing territorial barriers and pushing cultures and communities closer together. This force is known as ICT. ICT generates a contradiction of rich and poor; it crosses the divide between people while still isolating them. Over the last years of the twenty generations, there has been a drastic change in the world as a result of ICT, which has connected individuals and societies, improved quality of life and created opportunities for individuals all over the globe, facilitated rejuvenation, and increased output. According to social science researchers, ICT may play a significant impact on socio-economic growth, GDP, productivity and organizational capability, global collaboration in economy, commerce, capital flows (Foreign capital), poverty alleviation, creation of jobs, and political maturity among a country's citizens [2].

In recent years, technological advancement has accelerated dramatically. According to technological progress follows a rapid growth trend analogous to the "Rule of Increasing Returns." The rapid growth of ICT has resulted in a large body of knowledge examining the contribution of ICT to growth in the economy in light of the advantages of development, developing nations. According to developing nations have seen a huge increase in ICT investment. China, for example, had less than 0.01 billion individual computer users and less than 0.001 billion internet subscribers in 1997. In 2011, China, on the other hand, led the nation in home computer growth, use, and internet use, with India, South Asia, Latin America, Eastern Europe, and Sub-Saharan Africa following closely behind [3,4].

According to previous empirical work, the importance of ICT in economic growth across different regions and countries of the world has been extensively debated and yielded mixed findings in a time series and panel country research due to its characteristics. Nevertheless, due to differences in previous literature's uniqueness and findings, one country's findings cannot be generalized to another.

As a result, the main goal of this paper is to give a better perceptive of the economic impacts of FT, INT, and MOB on economic growth in Pakistan while also integrating other variables such as trade openness, urbanization, and financial development into the estimation models to get a clearer picture of the key growth factors. This research adds to the current literature by (1) examining the connection between FT, INT, MOB, and economic growth using time-series data from 1995 to 2019. (2) examining the presence of nonlinearities and complementarities in the association between FT, INT, and MOB—to the best of the authors' knowledge, no scholar has yet investigated the nonlinearities and complementarities among FT, INT, and MOB simultaneously; and (3) applying advanced econometric techniques based on time series data Two Stages Least Square (2SLS), and Three Stages Least Square (3SLS) estimators which allow accounting for potential endogeneity problems [5,7].

The continuation of the paper is structured as follows: part two and third provide the overview of telecom sector and economy in Pakistan, respectively. Whereas section four gives a systematic analysis of the literature, section five focuses on data source and definition, develops econometric structures, section six clarifies the findings, and section seven concludes the research.

Telecom sector in Pakistan

Pakistan is located in South Asia, with India, China, Afghanistan, and Iran as neighbors. It has about 150 million people and covers an area of 803, 940 square kilometers. In Pakistan, as in many other countries, ICT is seen as a driver of economic development and gaining a competitive edge. According to the government, ICT is one of Pakistan's four priority areas for integrating the country into the global knowledge economy. Before continuing, it is important to note that the IT and telecommunications industries in Pakistan are clearly defined: Computer software, system design and production, and service provisioning are all terms used to describe the IT industry. There are several sub-categories within the software and hardware industries. The telecommunications industry encompasses both fixed and wireless telecommunications and data communications networks and the infrastructure and production of telecommunications equipment. The government officially declared the status of telecommunications as a separate industry/sector in 2004 [8].

The government's IT strategy, which was introduced during the year 2000, aimed to maximize information technology's capacity as a key driver for Pakistan's long-term economic growth. Speeding up the growth of the country's ICT infrastructure has necessitated substantial effort and expenditure. Furthermore, the privatization policy of 2004 and the wireless policy and broadband policy, both of which were enacted in 2004, have completely transformed the landscape, introducing stiff competition, increasing teledensity by several times, and lowering prices.

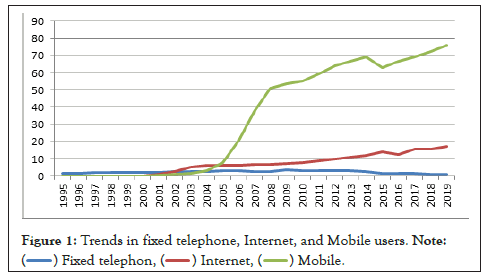

In Pakistan, the telecom sector has been expanding at an unprecedented pace for the past few years. The overall teledensity has increased from 7% to more than 24% in just three years. While typical of a developing world, most of the contribution comes from the cellular sector, which has grown from million subscribers in 2005 to 2008 and so on (Fig.1). The fixed-line teledensity is still poor, even though it is rising at a rapid pace after LDI license holders began using CDMA-WLL phones [9,10].

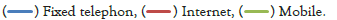

In January 2006, PTCL was privatized, and in April 2006, Etisalat, based in the United Arab Emirates, took over management control. Mobilink, Ufone, Paktel, Telenor, Warid Telecom, and Instaphone are among the six cellular operators currently available. GSM technology is used in both of them. Apart from multinational conglomerates such as Siemens, Alcatel, Nortel, Ericsson, and ZTE, Huawei Technologies is present in the country and takes part in implementing and testing next-generation technologies for new competitors. With a massive R&D center in Islamabad, ZTE is actively researching NGN technologies. The issuance of two new mobile licenses, 12 Long Distance and International (LDI), 76 Fixed Local Loop (FLL), and 92 Wireless Local Loop (WLL) licenses, was conducted at the end of the first phase of legalization. WAP, SMS, and GPRS are among the many 2G, 2.5G, and some 3G services commonly used globally. The country's PCO population is estimated to be around 2.5 million people (Figures 1 and 2) showing the rest of the analysis variables' tendency [11].

Figure 1: Trends in fixed telephone, Internet, and Mobile users. Note:

Figure 2: Trends in trade openness, financial development and

urbanization.

Overview of Pakistan economy

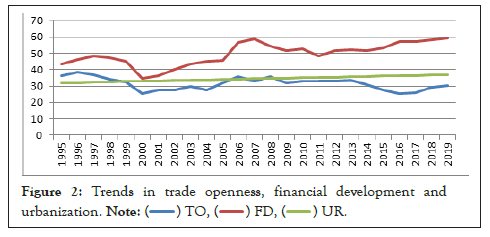

Pakistan is a lower-middle-income South Asian country. Referring to economic growth, Figure 3 shows the trend of Pakistan's economy. It can be seen that the GDP per capita of Pakistan has, by and large, progressed steadily over the 1965-2020 period. Until 1996, the economy of Pakistan was growing steadily, after which the GDP per capita figures somewhat declined and stagnated. However, from 2020 onward, the GDP per capita statistics surged again, implicating that the economic reforms in the early 2000s managed to uplift the economic conditions to a large extent.

Upon closer examination of the country's economic background, we can identify four distinct epochs of substantial economic development. Despite their combined efforts, none of these phases could bring a new era of sustainable economic growth in Pakistan. During the Musharraf administration, Pakistan experienced an increase in radicalization due to the country's failure to finish the third phase of economic growth. Pakistan must achieve sustainable economic development throughout the next expansionary cycle to prevent a further rise in extremism during this cycle. Pakistan's socio-political peace is improving, but the country's economic well-being is being badly affected by the country's security threats.

Moreover, the economy of Pakistan has increased at an annual pace of approximately 4% for the last five years. It is predicted to grow at a yearly rate of about 5% for the next ten years. Therefore, there is a growing sense of optimism about the prospects for long-term growth.

It was generally agreed that Pakistan had economic progress during the 1960s. Unfortunately, the increased defense spending throughout the late 1960s slowed the country’s economic growth and caused it to stagnate Robert E Looney. During 1958-1973, increased defense spending harmed economic growth, particularly during the India-Pakistan conflicts of 1965 and 1971 Robert E Looney. The second period of economic expansion occurred during the 1980s, with the most significant annual GDP growth of 10.2% reported in 1980 and a yearly growth rate of 6.1% over ten years of 6.1% on average. Despite this progress in economic development, the country was unable to maintain it until Zia's administration. Looney attributes the inability of the second economic growth stage during the Zia years to a combination of factors including stringent supervision over financial operations, protectionism, which hampered exports, an ineffective finance system, and foreign liabilities. For the final time, when the Musharraf government enabled structural changes, accepted globalization welcomed international trade and investment, Pakistan's economy progressed toward sustainable economic growth. This was the era from 2000 to 2007 during which the economy grew at a rapid pace. The economy grew, ranging from 7.0% to 7.5% in the final years of the Musharraf administration, primarily due to advances in the performance of the service sector. The Musharraf administration worked hard to reduce the country's large budget deficits and excessive public debt caused by the prior PML-N administration's poor economic managemen. According to Looney, the Musharraf regime did not adhere to the effective governance indicators set forth by the World Bank. These include political freedoms, public law and order, the efficiency of government through the rule of law, and the prevention of corruption, among other things. Based on the lessons learned during the Musharraf administration, it can be predicted that the social and economic consequences of another clumsy attempt at economic development will manifest themselves in the form of extreme right-wing violence in society.

Finally, Pakistan's GDP growth had slowed down much before the corona virus outbreak, growing by 1.9% in 2019 compared to a decade-high of 5.8% the previous year when Imran Khan's Pakistan Tehreek-e-Insaf came to power. PM Khan and his government’s economists have lately been telling Pakistanis and the world about his government’s success in navigating the economy. In essence, Pakistan should strive to maximize the benefits of the Sustainable Development targets (Figure 3).

Figure 3: Trend in the economic growth of Pakistan.

The purpose to “build resilient infrastructure, promote inclusive and sustainable industrialization and foster innovation” depicts Goal 9 from the 2030 Agenda for Sustainable Development. Telecommunications infrastructure has the biggest impact on information dispersion and organizational efficiency, supported by the endogenous growth model developed by Romer, which reveals that knowledge spillover strongly influences balanced growth. High-speed Internet connections allow people to broaden their skills and abilities by accessing a wide range of information and resources. As a result, individuals who use social media sites are exposed to a variety of cultural beliefs. Asserted that participation in community-led open source initiatives is made easier by the availability of high-speed Internet access. Thus, proposed that the internet supports the spillover effect of information across national boundaries, contributing positively and significantly to economic growth. Discovered that workers who use a computer earn 10% to 15% more than their non-computer-using counterparts. Discovered a positive relationship between investment in communications infrastructure and economic growth by looking at a sample of 27 Central and Eastern European countries over the years 1990–1995. Lloyd-Ellis has demonstrated that the expansion of information and communication technologies (hence referred to as "ICT") boosts worker productivity while simultaneously decreasing wealth disparities. In his statement, asserted the necessity of providing greater connectivity in order to increase global information infrastructure while also supporting good changes in social and economic growth. As a result, discovered a statistically significant relationship between Internet connectedness and information literacy. Roller discovered a statistically significant positive causal link between investment in telecommunication infrastructure and future economic success, using data from 21 OECD nations from 1970–1990. Vu discovered a statistically significant association between growth and Information and Communications Technology (ICT), demonstrating that the proliferation of personal computers, mobile phones, and Internet users has a strong causal effect on growth. Yousefi observed that information and communications technology (ICT) contributes to the rise of nations with high and upper-middle incomes, but that it fails to give assistance for countries with lower and upper-middle incomes. Similarly, Farhadi found a positive relationship between the growth rate of real GDP per capita and the index of ICT use, however the influence of ICT use on economic growth was stronger in the high income group rather than the other categories. According to Acemoglu, contrary to prior studies, technical advancements have had an impact on the structure of salaries and have resulted in a rise in income disparity in the majority of industrialized countries. Consequently, Noh discovered a negative relationship between Internet adoption and growth in nations with substantial wealth disparity, as previously stated.

Solow pioneered the use of technology in the growth model, which was followed by Barro, Sala-i-Martin, Blanchard, and Hall, and Mankiw. Technological advancement was established as a significant factor in economic growth in these studies. However, in contrast to the Solow growth model, which considers technology to be exogenous, a new growth model has arisen that considers technological development to be endogenous. Endogenized technological advancement has been defined by Aghion. For instance, Lucas thinks that technological advancement relies on human resources, whereas Romer believes that it is also dependent on discovering new ideas. He believes that the pursuit of new ideas affects technological advancement, which in turn influences economic development. Benefit maximization motivates firms in this model, which is why they invest in science. This viewpoint is similar to that of Grossman and Helpman, who believe that new products and improvements to existing products are the development engines. The neoclassical system is used by Oliner, Sichel, Triplett, and Gordon, who introduce information technology into the growth model. They show in their model that the rate of production growth is influenced not only by computing equipment (computer stock), other forms of capital, labor, and multifactor productivity but also by their respective shares of output. Broadening the basic model, Oliner and Sichel find that in the second half of the 1990s, hardware, software, and communication equipment accounted for two-thirds of US labor productivity growth. Communication equipment contributed about 0.1 percentage point annually to production growth, even though there is a large absence of scientific focused on the effect of telecommunications infrastructure in the growth model. We divide the literature on ICT growth into two sections time series and panel data studies.

Time series data studies

Some scholars on ICT-growth concentrating on the time series or single country are Ghosh. Erumban explored the direct and indirect influence of ICT on India's GDP from 1986 to 2011 and noted that ICT investment boosts India’s GDP growth. Shedding light on Australia, unearth that ICT augments Australia’s GDP. Vu scrutinized the impact of ICT on Singapore’s economic growth from 1990 to 2008 and finds that ICT raises Singapore’s economic growth. Ward and Zheng,scrutinized mobile and fixed-line effects on China’s economic growth from 1991 to 2011 and discovered that mobile and fixed-line raise China’s economic development. An optimistic effect of ICT on economic expansion has also been established in Sweden. On the other hand, uncover that ICT has an unimportant negative effect on Japan’s growth in both the short and long-runs.

Panel data studies

Nguyen scrutinize the effects of ICT and innovation on CO2 and GDP for 13 G-20 economies from 2000 to 2014 and notice that ICT incite G-20 economies’ economic growth. Toader check the effect of ICT infrastructure on EU countries’ economic intensification from 2000 to 2017 and find that ICT infrastructure urge EU countries’ economic growth. Donou-Adonsou compares economies with greater access to education to economies with less access to education to see how education modifies the effect of ICT on economic development. From 1993 to 2015, researchers looked at 45 Sub-Saharan African countries and discovered that, given better education, the internet leads to economic development. Haftu finds that cell phones help Sub-Saharan African countries develop economically, based on a study of 40 Sub-Saharan African countries from 2006 to 2015. Kumar, et al. described or investigate the effect of ICT on economic growth in Small Pacific Island States from 1979 to 2012, finding that ICT leads to economic growth in Small Pacific Island States in both the short and long run. Concentrating on OPEC Sepehrdoust find that information and communication technologies (ICT) aided OPEC's economic development from 2002 to 2015. Lee report that information and communication technologies (ICT) help ASEAN countries develop economically between 1991 and 2009. A study that focused on the BRICS discovered that between 2000 and 2014, ICT aided economic development in the BRIC countries. Comparably, Choi consider that from 1991 to 2000, the internet contributed to economic growth in 207 countries. Maursethon the other hand, found that the internet has slowed economic growth in 207 countries between 1991 and 2015.on the other hand, the impact of ICT on GDP in developed, emerging, and developing economies stay uncertain. Dedrick for instance, consider that advanced economies benefit more from ICT investment for 45 economies between 1994 and 2007. Comparably, find that developed countries benefit more from ICT investment than developing countries between 1993 and 2001. On the other hand, notice that low-income countries profit most from mobile broadband in 43 countries from 2005 to 2009. For 74 countries from 2006 to 2016, discovered that SSA countries benefit more from mobile telecommunications. In contrast, OECD countries benefit more from internet use. Eventually, from 1995 to 2010, reports that the benefits from ICT investment are similar in 59 countries (categorized as developed, emerging, and developing countries). The following is a summary of what we learned from the existing literature. First and foremost, the numbers of studies are focused on historical data. Second, the majority of research assumed that the data was homogeneous. Third, ignore the nonlinearities and complementries in the association among ICT indicators and economic growth of Pakistan. Besides this, the bulk of the models ignore endogeneity, omitted variables, and issues with heteroscedasticity. Ultimately, there are some discrepancies in the results of systematic reviews. In the following methods, we discuss these contradictions.

Data and methodology

Data: In this study, World Development Indicators and International Telecommunications Union reports were used to compile the data from 1995-2019. The following variables are used for the analysis; cell phones, internet users, and fixed telephone broadband; Gross domestic product per capita (GDP pc) (in constant 2010 US dollars) is used to measure economic growth, while urban population (UR) is used to measure urbanization. Whereas broad money is used for the proxy of financial development, and trade openness (import- export) is measure by the percentage of GDP. It shows the data and sources of all variables used in this study (Table 1).

| Variables | Abbrev. | Units | Sources |

|---|---|---|---|

| GDP per capita | GDP pc | US dollar | WDI-2020 |

| Trade openness | TO | % of GDP | WDI-2020 |

| Financial development | FD | % of GDP | WDI-2020 |

| Urbanization | UR | % of GDP | WDI-2020 |

| Fixed telephone broadband | FT | Per 100 inhabitants | ITU-2020 |

| Internet users | INT | % of population | ITU-2020 |

| Mobile phone users | MOB | Per 100 inhabitants | ITU-2020 |

Table 1: Data and sources.

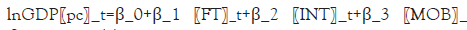

Econometric model and estimations: We investigate a growth equation parallel to that employed by Younsi in the FDI‐growth study, where growth is regressed on FT, INT, MOB, and a set of control variables:

where t=1, 2, …, T is the time period. GDP pc is real GDP per capita growth, FT is fixed telephone users, INT is the internet users, and MOB is mobile users. Xit symbolized a vector of control variables, including a constant term. β_0 is the country‐specific intercept, β_1–β_3 and δ are the parameters to be calculated. ε_t is the error term.

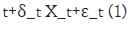

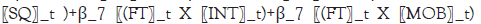

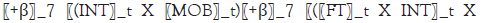

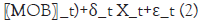

To examine a non-linear association between FT, INT, MOB, and economic growth as well as their complementing effect on economic growth, we expand Equation (1) into the following form:

where FT_SQ, INT_SQ, and MOB_SQ are the squared terms of FT, INT, and MOB, respectively. (FT × INT), (FT × MOB), (INT × MOB), and (FT × INT × MOB) explain their complementing impacts on growth respectively.

The 2 SLS approach has been used in several studies to analyze the panel and time-series data. When dealing with data with a limited sample size, econometric techniques such as co-integration can generate inconsistencies in estimates. Furthermore, the model includes the macroeconomic variables that are considered to be strongly correlated. In this case, the repressor may be correlated with the error term, posing a multicollinearity problem. As a consequence, the OLS method can yield erroneous results in the presence of multicollinearity. As a result, to monitor correlation among variables, a regression model is needed. Several regression approaches exist to address the issue, all of which use instruments to remove the effect of correlation between the independent variables and the residuals. Two-stage least square (2 SLS) regression, for instance, is recommended by Cumby. The 2 SLS method is a version of the OLS method. If the dependent variables and the error term are linked, this method may be used. As a result, the 2 SLS and later on 3 SLS approach is employed in this paper to examine the association between the variables under consideration. Since it can compensate for both endogeneity and contemporaneous correlation of error terms across equations, the 3SLS is recommended over the other instrumental variable (IV) approaches (2SLS and GMM) in this review. Furthermore, the 3SLS generated results that were nearly identical to those of the 2SLS (Table 2).

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| lnGDPpc | 25 | 4.75 | 0.346 | 4.178 | 5.244 |

| lnTO | 25 | 31.41 | 3.699 | 25.306 | 38.33 |

| lnFD | 25 | 49.509 | 6.786 | 34.799 | 59.037 |

| lnUR | 25 | 34.392 | 1.516 | 31.836 | 36.907 |

| lnFT | 25 | 0.359 | 0.14 | 0.056 | 0.544 |

| lnINT | 25 | 1.155 | 0.717 | 0.12 | 3.911 |

| lnMOB | 25 | 1.298 | 0.606 | 0.055 | 1.883 |

Table 2: Summary statistics.

Descriptive statistics for the Pakistan economy over the period of 1995-2019 is presented in Table 3. However, the lowest GDP pc was 4.178 percent; the highest GDP pc was 5.244 percent. Trade openness was 3.699 percent on the norm, and financial growth was 1.516 percent. The lowest and highest fixed telephone users were 0.056 percent and 0.544 percent, respectively, while internet users were 0.12 percent and 3.911 percent with the minimum and maximum values. Finally, standard deviation, lowest and highest values of mobile users were 0.606, 0.055 and 1.883, respectively (Table 3).

| Variables | -1 | -2 | -3 | -4 | -5 | -6 | -7 |

|---|---|---|---|---|---|---|---|

| (1)-lnGDPpc | 1 | - | - | - | - | - | - |

| (2)-lnTO | 0.412 | 1 | - | - | - | - | - |

| (3)-lnFD | -0.705 | 0.115 | 1 | - | - | - | - |

| (4)-lnUR | 0.995 | -0.418 | 0.737 | 1 | - | - | - |

| (5)-lnFT | 0.106 | 0.283 | -0.188 | -0.174 | 1 | - | - |

| (6)-lnINT | -0.375 | 0.453 | -0.052 | -0.367 | -0.386 | 1 | - |

| (7)-lnMOB | 0.711 | 0.176 | 0.804 | 0.699 | -0.14 | 0.223 | 1 |

Table 3: Correlation matrix

The correlation of study is presented in Table 3 and indicates that trade oppeness is positively correlates with GDP per capita. Similarly, financial development and internet users are adversely linked to per capita GDP. The urbanization is optimistically correlated to CO2 emissions. Fixed telephone users and mobile phone users are positively with GDP per capita (Table 4).

| Variables | Augmented-Dickey-Fuller- | DF-GLS | Phillips-Perron | |||

|---|---|---|---|---|---|---|

| I(0) | I(1) | I(0) | I(1) | I(0) | I(1) | |

| lnGDPpc | -1.166 | -4.940*** | -0.889 | -5.045*** | -0.889 | -5.045*** |

| lnTO | -2.122 | -4.876*** | -1.91 | -4.587*** | -2.14 | -4.875*** |

| lnFD | -1.166 | -3.976*** | -1.115 | -3.998*** | -1.166 | -3.919*** |

| lnUR | 2.507* | -- | 2.745* | - | -3.553** | -- |

| lnFT | -0.847 | -3.019*** | -0.847 | -3.019*** | -0.498 | -2.912** |

| lnINT | -3.856** | - | -1.890* | - | -7.307*** | -- |

| lnMOB | -4.605** | - | -3.256** | - | -1.087 | -1.858** |

Table 4: Stationary results.

To check the order of integration,the ADF, DF-GLS, and PP unit root tests were used, and the consequences of the three tests are shown in Table 5. Unit root test consequences have shown that all variables stationary at I(0) and I(1).

| VARIABLES | -1 | -2 | -3 | -4 | -5 | -6 | -7 | -8 |

|---|---|---|---|---|---|---|---|---|

| lnTO | 0.00625** | 0.00420* | 0.00640** | 0.00241 | 0.00189 | -0.00208 | 0.00600** | -0.000348 |

| - | -0.00261 | -0.00232 | -0.00274 | -0.00282 | -0.00272 | -0.00169 | -0.00277 | -0.00245 |

| lnFD | -0.00627*** | -0.00440** | -0.00587*** | -0.00683*** | -0.00543*** | -0.00405*** | -0.00635*** | -0.00494*** |

| - | -0.00191 | -0.0016 | -0.00205 | -0.00186 | -0.00168 | -0.001 | -0.00197 | -0.00144 |

| lnUR | 0.254*** | 0.254*** | 0.254*** | 0.235*** | 0.254*** | 0.231*** | 0.254*** | 0.243*** |

| - | -0.00937 | -0.00865 | -0.00997 | -0.0129 | -0.00808 | -0.00556 | -0.00957 | -0.00732 |

| lnFT | - | 0.597** | - | - | - | - | - | - |

| - | - | -0.252 | - | - | - | - | - | - |

| FTSQ | - | -0.696* | - | - | - | - | - | - |

| - | - | -0.378 | - | - | - | - | - | - |

| lnINT | - | - | -0.0283 | - | - | - | - | - |

| - | - | - | -0.0353 | - | - | - | - | - |

| INTSQ | - | - | 0.00647 | - | - | - | - | - |

| - | - | - | -0.00828 | - | - | - | - | - |

| lnMOB | - | - | - | 0.011 | - | - | - | - |

| - | - | - | - | -0.0668 | - | - | - | - |

| MOBSQ | - | - | - | 0.0196 | - | - | - | - |

| - | - | - | - | -0.0336 | - | - | - | - |

| FTXINT | - | - | - | - | 0.120*** | - | - | - |

| - | - | - | - | - | -0.0418 | - | - | - |

| FTXMOB | - | - | - | - | - | 0.116*** | - | - |

| - | - | - | - | - | - | -0.0147 | - | - |

| INTXMOB | - | - | - | - | - | - | 0.00213 | - |

| - | - | - | - | - | - | - | -0.00621 | - |

| FTXINTXMOB | - | - | - | - | - | - | - | 0.0796*** |

| - | - | - | - | - | - | - | - | -0.0184 |

| Constant | -3.875*** | -4.013*** | -3.864*** | -3.132*** | -3.826*** | -2.977*** | -3.865*** | -3.407*** |

| - | -0.309 | -0.313 | -0.326 | -0.454 | -0.267 | -0.193 | -0.317 | -0.252 |

| - | - | - | - | - | - | - | - | - |

| Observations | 25 | 25 | 25 | 25 | 25 | 25 | 25 | 25 |

| R-squared | 0.993 | 0.996 | 0.993 | 0.995 | 0.995 | 0.998 | 0.993 | 0.996 |

Table 5: Effects of FT, INT and MOB on the economic growth: 2SLS.

The findings of the 2 SLS models are shown in Table 5. In all of the 2 SLS calculated models, except for financial development, all of the coefficients have the predicted signs. Trade openness has a favorable and statistically important effect on economic development as compared to country-level control measures. According to Equation (1), a 1% rise in trade openness results in a 0.006 percent increase in economic growth. This consequence aligns with Musila, Yiheyis, Malefane and Odhiambo findings they found that trade openness positively affected the level of investment and the rate of economic growth. On the other hand, financial development has been shown to hurt economic growth. This means that a 1% rise in financial development corresponds to a 0.006 percent drop in economic growth. This finding backs up assertion that only negative shocks to financial development impact economic growth.

We evaluate the impact of FT, INT, and MOB on economic growth, as well as their squares, in separate regression models based on (Equations 2-4) to look for a possible non-linear association between FT, INT, and MOB and economic growth. The findings of 2SLS regression models show that economic growth has a nonlinear association. The coefficients effects of FT, INT, and MOB are different by their significance level and co-efficient, as shown in (Equations 2-4) estimations. It demonstrates that a 1% rise in the FT result in 0.59% percent spur economic growth. Whereas, INT does affect significantly but negatively to growth as its co-efficient showing that 1% increase in internet users, lead to decrease in economic growth by 0.028%. In this analysis, MOB is significant at 0.028% with a positive association. However, FT and economic growth's positive association is similar to Appiah-Otoo. Also, the positive nexus between MOB and economic growth is unlike to earlier findings, suggesting that ICT considerably and positively does not add to the economic development of Pakistan but similar to findings. Furthermore, the negative association between INT and economic growth is consistent with prior studies Haftu due to low technology diffusion.

While the coefficients of FT_SQ and INT_SQ are associated negatively and significantly with economic growth, thus presentation a non-linear association with economic growth. On the other hand, MOB_SQ has proved linear association while turned insignificant.

Nevertheless, the linear association between ICT indicators and economic development is in line with Albiman and Sulong earlier studies and suggest that all income groups of countries require to tactically focus on encouraging novel ICT modernization to make sure sustainable economic growth. As exposed in Table 1, the effect of FT_SQ and INT_SQ in encouraging economic growth is larger than the INT effect. Therefore, we can deduce that FT and MOB are the main foundations of economic growth in Pakistan.

We investigate the presence of complementarities in the association between FT-INT, FT-MOB, INT-MOB, and FT-INT-MOB using (Equations 5-8). According to the complementarities theory, our concentration variables have a "crowding in impact" on economic development. As a result, if the complementarities principle is upheld, a positive sign can be predicted. According to the results of (Equations 5-8), FT-INT has a positive complementing impact on economic development. FT-MOB has a statistically significant positive impact on economic development, while INT-MOB has a positive but statistically insignificant effect.

Consequently, our findings suggest that the FT-INT-MOB complementarities have an important positive impact on economic development. We may deduce that FT acts as a supplement to INT and locally owned investment to foster steady growth. The same complementary results are founded by Albiman. As previously stated, we use 3 SLS, the suggested by Arellano, to account for heteroscedasticity, endogeneity, and robustness of effects. Table 2 reports the estimates of the 3 SLS towards the effect of FT, INT and MOB on economic intensification. The findings support the hypothesis that urbanization and trade openness is positively and substantially linked to economic development. On the other hand, financial development is negative and strongly associated with economic growth in all design models. As can be seen in Table 1, these findings are similar to previous 2 SLS findings.

In terms of the non-linear correlation between FT, INT, MOB, and economic development, the 3SLS estimates suggest that there is a non-linear connection. In (Equations 2-4), the estimated coefficients of FT and MOB are positive and statistically significant. Still, the coefficients of FT SQ, INT SQ, and MOB SQ are all significantly positive. Concerning the complement effects of FTINT, FT-MOB, INT-MOB, and FT-INT-MOB on economic growth, our estimation proves that FT complements INT and make stronger its efficiency in encouraging economic growth in Pakistan. It demonstrates that FT strengthens INT, while the combined effect of INT-MOB is ineffective in catalyzing development. Moreover, the 3 SLS estimates show that FT-INT-MOB has a positive impact on economic intensification, implying that FT and INT serve as a complement to MOB, enhancing its effectiveness in fostering economic growth in Pakistan.

Using Pakistan's annual time-series data from 1995 to 2019, this article explores the relationship between FT, INT, MOB, and GDP and their impact on economic development. The 2SLS and 3SLS estimators are used to generate empirical shreds of proof. The findings support a linear relationship between FT, MOB, and economic development. According to the findings, FT and INT have a negative complementarities impact on economic development. It is demonstrated that FT enhances the effects of INT and MOB, whereas the combined effect of INT and MOB is ineffective in catalyzing development. The findings suggest that the complementarities between FT-INT-MOB have a positive impact on development. Consequently, the findings indicate that urbanization and trade openness positively impact growth, while financial development has a negative impact. The policy implications of these findings are important. In the few developing countries that still have a telecom market, FT-INT and FT-INT-MOB will help boost economic growth. When the advantages of FT-INT-MOB are acknowledged and the fact that they are a less unpredictable and more reliable source of numerous required telecom pillars, this is critical. As a result, many developing countries can broaden their economies away from the single dominant extractive industry to encourage economic development. Furthermore, the government must consider making significant efforts to improve telecom efficiency, sustain macroeconomic stability, and improve financial structures that support multinational corporations. More importantly, empirical findings indicate that the individual pillar is not conducive to Pakistan's development. Ultimately, Pakistan's governments would be wise to put concrete policy steps to boost the telecom sector's growth. To achieve long-term development, governments should also strengthen trade and develop infrastructure.

I would like to express by sincere thanks to Prof. Dr. Binayak Prasad Rajbhandari, Executive Chairperson, Himalayan College of Agriculture Sciences and Technology (HICAST), Kirtipur. I express my deep sense of gratitude to my thesis advisor Dr. Anupama Shrestha Shah, Adjunct Professor of HICAST, Kirtipur for her valuable guidance, and constructive suggestion at every stage of this study. I am extremely grateful to Dr. Sunil Aryal, Senior Scientist, NERC, and NARC for his continuous guidance during research tenure and thesis writing. I also acknowledge Ms. Resona Simkhada, Technical officer and Mr. Harka Balayar, Technical Assistant, NERC, NARC and Mrs. Kushum Shrestha who helped organizing material for smooth running of the experiment and the team for their encouragement and excellent guidance throughout the research duration.

The authors declare no conflict of interest.

Citation: Sohail HM, Li Z (2022) Effects of Fixed Telephone, Mobile Use and Internet on the Economic Growth of Pakistan: Nonlinearities and Complementarities. J Hotel Bus Manage. 11:004.

Received: 10-Jan-2022, Manuscript No. JHBM-22-48547; Editor assigned: 13-Jan-2022, Pre QC No. JHBM-22-48547 (PQ); Reviewed: 27-Jan-2022, QC No. JHBM-22-48547; Revised: 05-Feb-2022, Manuscript No. JHBM-22-48547 (R); Published: 12-Feb-2022 , DOI: 10.35248/2169-0286.22.11.004

Copyright: © 2022 Sohail HM, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.