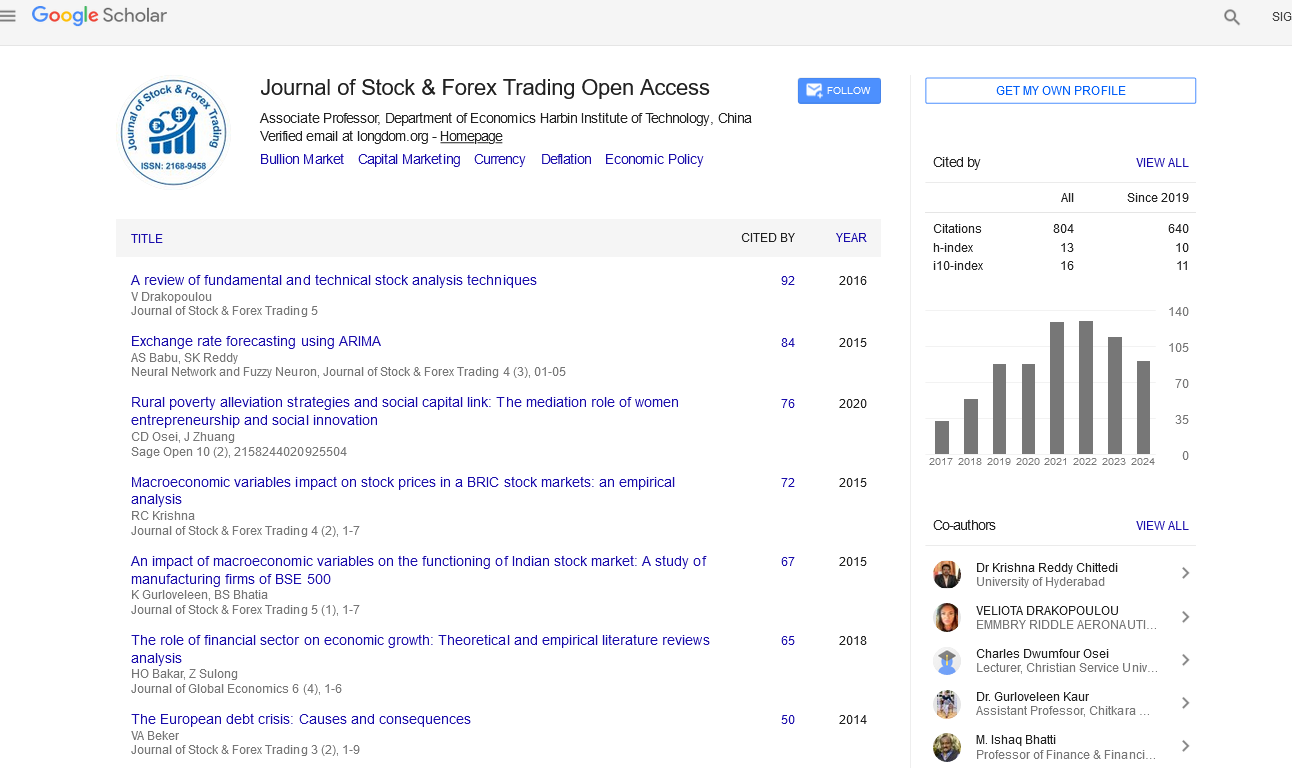

Journal of Stock & Forex Trading : Citations & Metrics Report

Articles published in Journal of Stock & Forex Trading have been cited by esteemed scholars and scientists all around the world. Journal of Stock & Forex Trading has got h-index 13, which means every article in Journal of Stock & Forex Trading has got 13 average citations.

Following are the list of articles that have cited the articles published in Journal of Stock & Forex Trading.

| 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Total published articles |

28 | 32 | 20 | 23 | 28 | 7 | 6 | 0 | 13 | 21 | 33 | 12 | 17 |

Research, Review articles and Editorials |

4 | 9 | 5 | 0 | 0 | 7 | 5 | 0 | 10 | 16 | 25 | 12 | 17 |

Research communications, Review communications, Editorial communications, Case reports and Commentary |

12 | 23 | 15 | 0 | 0 | 0 | 1 | 0 | 1 | 54 | 8 | 0 | 0 |

Conference proceedings |

0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Citations received as per Google Scholar, other indexing platforms and portals |

107 | 113 | 132 | 129 | 89 | 88 | 54 | 33 | 40 | 18 | 6 | 0 | 0 |

| Journal total citations count | 813 |

| Journal impact factor | 5.58 |

| Journal 5 years impact factor | 5.03 |

| Journal cite score | 5.02 |

| Journal h-index | 13 |

| Journal h-index since 2019 | 11 |

Important citations (371)

Yohanes, steven. pengaruh harga komoditas minyak mentah, nilai tukar, investasi, dan risiko bisnis terhadap nilai perusahaan pada industri manufaktur subsektor logam dasar dan sejenisnya yang terdaftar di bursa efek indonesia tahun 2014–2018. diss. universitas atma jaya yogyakarta, 2020. |

|

Gupta, priya. "impact of fdi inflows on stock market performance in india." apeejay business review: 27. |

|

Zhang, zhenlan. the impact of macroeconomic factors on stock market prices in ireland. diss. dublin, national college of ireland, 2020. |

|

Ming, kelvin lee yong, and mohamad jais. "impacts of macroeconomics environment and governance quality on the stock market in the fourteen developing countries." jurnal ekonomi malaysia 54 (2020): 3. |

|

Hakim, lukmanul. the influence of macroeconomic and global factors on the composite stock price index (cspi) in indonesia stock exchange (idx) for the period 2013-2017. diss. stie perbanas surabaya, 2019. |

|

Sidhu, kawerinder singh. "an empirical study of correlation between the macro-economic indicators and stock market performance in india." journal of critical reviews 7.19 (2020): 8662-8677. |

|

Misra, pooja. "an investigation of the macroeconomic factors affecting the indian stock market: an analysis." |

|

Sunil, n., geetanjali purswani, and neethu rose benny. "interrelationship and interdependence among macroeconomic variables in india." arthshastra indian journal of economics & research 8.1 (2019): 50-60. |

|

Khandaker, sarod, and omar al farooque. "institutional quality, macroeconomic factors and stock market volatility: a cross-country analysis for pre, during and post global financial crisis." the journal of developing areas 55.1 (2021). |

|

Goyal, anil kumar, and gaurav malhotra. "heb cass." |

|

Saxena, swami prasad, and sonam bhadauriya. "system dynamics modeling of macroeconomic determinants of stock market volatility in india with special reference to nseil." indian journal of research in capital markets 6.3 (2019): 7-22. |

|

Singhal, mansi. effect of macroeconomic variables on stock market: indian perspective. diss. 2020. |

|

Srivastava, himadri, dr priya soloman, and stayendra pratap singh. "impact of real exchange rate and trade openness on sectoral indices of banking and auto industry: an analysis of vecm based granger causality test." annals of the romanian society for cell biology (2021): 15965-15972. |

|

Dhingra, k., and s. kapil. "impact of macroeconomic variables on stock market—an empirical study." trade, investment and economic growth: issues for india and emerging economies (2021): 177. |

|

Jebadurai, d. joel. "impact of select macro-economic variables on the movements of bse sensex." somtu journal of business and management research: 245. |

|

Chemutai, angela. the effect of macro-economic variables on financial performance of commercial banking sector in kenya. diss. university of nairobi, 2019. |

|

Mohan, abha, tomy mathew, and k. subramanian. "stock indices and inflation through industry prisms." international conference on economics? and finance. springer, cham, 2018. |

|

Thuo, teresia w. the effect of selected macro economic variables on non-performing loans in commercial banks in kenya. diss. university of nairobi, 2017. |

|

R reddy, venkatamuni, and nagendra s. nagendra s. "impact of macro-economic factors on indian stock market-a research of bse sectoral indices." international journal of recent technology and engineering (2019): 1-6. |

|

Mishra, pallavi, and sathya swaroop debasish. "econometric analysis of relationship between selected economic variables and bse stock index in india using tests of co-integration." ilkogretim online 20.1 (2021). |

|