Journal of Information Technology & Software Engineering

Open Access

ISSN: 2165- 7866

ISSN: 2165- 7866

Review Article - (2021)Volume 11, Issue 7

Youth unemployment in Ghana is exceptionally high, with negative psychological, social, occupational and financial consequences. The focus of this paper is on the causes and consequences of youth unemployment in Ghana. In addition, the paper discusses forex trading as a Technical and Vocational Education and Training Programme (TVET) in Ghana. Conclusions were reached and recommendations was made on how TVET can help reduce youth unemployment in Ghana, including the following: Graduates of the programs should be encouraged to start their businesses by providing them with soft loans and or microcredit. Furthermore, suppose the expected outcome of employment creation is to be achieved. In that case, forex trading must be introduced as part of a technical and vocational educational course. National service personnel must go through during their service time so that unemployment can be reduced. With the global economic outlook being grim, I can only see things getting worse for our Ghanaian youth, which is why knowledge-based academic credentials must give way to skills-based training like forex trading.

Forex trading; Unemployment; Meta trader 4; National service

In most developing countries like Ghana, governments and policymakers are increasingly finding it challenging to deal successfully with the problem of youth unemployment [1,2]. This high level of unemployment can be attributed to lack of adequate provision for job creation in the development plans, the ever-expanding educational growth, and the desperate desire on the part of youths to acquire university education irrespective of course and course contents. As a result, several skills acquired from the university appear dysfunctional and irrelevant. The unemployment rate is increasing because most graduates lack relevant, marketable skills that will make them employable in industries or related organizations. As a result of this, there is a high level of unemployment in Ghana. Despite the high unemployment rate in Ghana, mobile technology adoption and use are surprisingly high.

For many in the developing world, mobile technologies open up new job opportunities and can even harness the power of Information and Communication Technologies (ICTs) for socioeconomic development. Mobile services and technologies are becoming more prevalent, including forex trading. These services and developments can be considered as potential answers to these countries' unemployment problems.

Research problem

According to Finance Minister Mr. Ofori Atta, approximately 16 million people enter the labour force each year in Africa, with 83% of them unable to find work.

As a result, he claims, the unemployment rate has risen year after year.

However, he stated that the solution to the country's unemployment problem was entrepreneurship and other skills training programs to put the youth in a position to create jobs for themselves.

Mr. Ofori Atta also used the occasion to encourage graduates from various tertiary institutions to participate in skills training programs that would expose them to entrepreneurship opportunities and help them become self-sufficient [3].

Therefore there is the need for the youth to focus on education that will lead to self-employment after school. Unemployed Ghanaian youths must engage in forex trading. Ghanaians must embrace it now that we have the COVID-19 pandemic because most people have lost their jobs. The lockdown has affected everyone. Even those who work are not earning as much as they used to everything has deflated to its lowest point. The borders have been closed. The economy is not stable.

"To escape unemployment and poverty, Ghanaians, especially the unemployed university graduates, must embrace forex trading. Considering South Africa, the exchange rate between the South African rand and the US dollar is very good, progressing steadily. However, when we compare cedis to dollars, the pricing rises and falls randomly which is inappropriate.

"It's heartbreaking to see other African countries' currencies performing better than ours." However, South Africa is doing well because its Government and people support forex trading.

Forex trading could reduce the unemployment rate in Ghana because people would have an avenue to improve their financial status. Forex trading is flexible and could be conducted efficiently by using a laptop or mobile phone from any location. Almost all unemployed graduates in Ghana have mobile phones or laptops that can access the internet. These phones and laptops could serve as offices, yet they walk around with application letters seeking jobs. Therefore, youths should embrace forex trading because it will propel them forward and bring about significant changes in our country. It's past time for us to invest in hands-on learning and specific skill acquisitions applicable in this digitalized age to be pandemic-proof in terms of sustainability and financial viability.

What this research sort to address:

• What is the alternative source of employment in the midst of pandemic?

• How can forex trading is helping to bridge the unemployment gap?

The objective the paper will want to achieve:

• Forex trading is a source of job that can absorb most unemployed youth without the Government being burdened.

Unemployment has been discussed in several other studies, resulting in a variety of different perspectives on the definition and causes of unemployment. However, for this study, we concentrated on the ILO's definition of unemployment. Unemployment occurs when more job applicants are “labour demand” than there is currently available job opportunities “labour supply”. Throughout emerging regions, unemployment primarily describes the set labour force, which is likely to be significantly smaller than the formalised labour force.

The labour department of the Ministry of Manpower and Employment defines unemployment as someone unable to find a job after three months of consistent job-hunt [4]. Since many job seekers concentrate their search within the government sector, they often fail to register with the labour department. Consequently, actual unemployment figures in the country are difficult, if not impossible, to ascertain. However, unemployment data from the 2000 Population and Housing census, presented in ` show that, more than four out of every ten unemployed persons are in Greater Accra and Ashanti Regions. Greater Accra alone accounts for more than a fifth (21.4 percent) of the unemployment and more than a third (36.4 percent) of urban unemployment, while Ashanti accounts for 21.1 percent of all unemployed and 25.4 percent of urban unemployment.

This leads us to consider the various types or categories of unemployment, ranging from the description mentioned earlier to unemployment in the forms for which this research work was conducted. The following are some examples of unemployment, but they are not exhaustive, “Friction, structural, Institutional and Cyclic” [5].

Frictional unemployment occurs when individuals progress between occupations within the labour force, rather than when social change and social interaction occur within the working population. This type of situation is primarily driven by asymmetric marketing intelligence information. It is caused by a mismatch between labour supply and demand for employment ventures in a given labour force. This type of situation is primarily driven by asymmetric marketing intelligence information. It is caused by a mismatch between labour supply and demand for employment ventures in a given labour force.

Structural unemployment is defined as a misalignment among both positions available and skills required, as a result of differences in skillsets and economic variations in a nation's economic required to optimise the flow, as well as some economic variables. Regulations and activities to improve the success benchmarks limitation, including developing skills and appropriate information sharing throughout the labour market, are by far the most prevalent prescriptions for structural unemployment. Several analysts fail to distinguish respectively for" frictional and structural unemployment", because with structural unemployment, former workers sort for employees begin search for alternative employment as soon as possible.

Changes in macroeconomic development across the financial system cause cyclical unemployment. When in an economic recession, a complete absence of growth in sales culminates in a scarcity of employment for people who wish to find employment. Organisations that are facing reduced demand may cut their workforce by dismissing off workforce a minimal workforce. Government employment programs are often utilised in reactions to cyclical unemployment because citizens just do not only provide jobs during a contraction. They are critically appropriate and contribute to enhance the unemployment challenge. Mainly in the event of this happens, it tells us the magnitude of the economic situation and gives us the picture of growth of the economy when business start employing more hands, deems a recovery from such downturn.

Institutional unemployment-results from a severely restricted working population and businesses lack of sufficient labour relate knowledge regarding jobs available and employee preferences.

Causes of youth unemployment the case of Ghana

There is a litany of reasons which have led to youth unemployment; the following cannot be limited to reasons associated to as the case of Ghana.

Failure to adapt to the changing business environment: The majority of these business owners lack the problem-solving abilities necessary to deal with business issues and stay in business. Worse yet, many small scale businesses continue to struggle with keeping accurate financial records in order to monitor their firms' performance.

Moreover, in circumstances where financial data is restrained, it does not provide an accurate picture of performance of the company. This has a negative influence on entrepreneurs' capacity to compete in today's market. As a result of their failure to adapt to the changing environment, they will eventually perish [6].

Lack of the needed skills that will qualify them to secure jobs: Organisations that realize they need to hire qualified experts may not know how to identify the talents they require. If we want to address the skills gap, we must throw a wide net and encourage people from a variety of backgrounds to join the profession, as well as trawl within our current workforce [7,8].

Lack of capital due to loan default: Because of the high rate of loan default, banks are hesitant to provide loans to new enterprises.

In addition, a high interest rate, insufficient loan sizes, a poor evaluation, a lack of monitoring, and poor customer selection are all factors. Training before and after disbursement, a suitable interest rate, client monitoring, and accurate loan appraisal are some of the techniques that have been discovered to control default [9].

The resistance of the majority of unemployed teenagers to work in agribusiness: According to the data available, majority of the populace are into agric sector which determined to have absolved about 60 percent of the population including the youth. The challenge therefore is the fact that most of the youth are not taking advantage of this grieve yard of oppportuntiy.

Because of the idea that it does not produce immediate returns, the agricultural sector, which should have supplied the most feasible choice for youth unemployment, is regarded unprofitable. In Ghana, farmers are also poorly appreciated. They are not provided any motivational packages. Tractors, for example, are exceedingly expensive to purchase [10].

The government's attempt to address the unemployment disparity

The Government has put in place mechanisms to help address this issue over the years, but population increase and the rate of available work opportunities are not compensating, resulting in the country's unemployment troubles. However, the following are some of the existing mitigation strategies in place.

Youth employment agency: The role is to enable youth between both the ages of 15 and 35 in transitioning from rising unemployment to business operations though the skill development as well as short term job components. The Government has put in place mechanisms to help address this issue over the years, but population increase and the rate of available work opportunities are not compensating, resulting in the country's unemployment troubles. However, the following are some of the existing mitigation strategies in place. Another issue for the program is a lack of funding to accomplish the employment goals they have set for it. It was a huge opportunity for the country to dramatically reduce the unemployment rate. The program's scope and models were well-crafted on paper but were not carried out in practice. It is now evident that the YEA program cannot be said to help reduce unemployment in Ghana.

Nation builders corps: During the 2016 election season, the NPP, as a political party, advocated various policies to raise the level of graduate unemployment in the country. This was necessary since the previous NDC government sought a financial bailout from the IMF, which led in several embargoes, including the freezing of employment on government payroll. This resulted in a massive backlog of unemployment into government institutions, affecting nurses, teachers, and doctors who had completed their service since 2010. So, in order to solve the problem that leads to the establishment of NABCO. The Government was able to absolve these teaming youth of around hundred thousand (100,000) of them were employed into numerous models (Revenue, Digitize, Feed, Educate, Civic, Heal and Enterprise Ghana) at the time. Unfortunately, the initiative was only supposed to last three years. The goal is for the Government to retain some of them at the completion of their services, while others will be able to find work on their own through other agencies. This means that those who have not been able to find work or have been absorbed by the Government after the stipulated period will atomically become unemployed, and their fate and cycle of unemployment will continue.

One district one factory: Another important initiative launched by the Government in 2016 is the establishment of industries in every region around the country. These factories will be led by the private sector, as evidenced by the fact that most government factories have been sold to private groups, with some becoming churches. To avoid the fate of these new manufacturers suffering the same fate as those established by Dr. Kwame Nkrumah, Ghana's first president, the movement is taking the initiative by ensuring that the new firms are handled by private organisations. The issue for these factories is that only 106 of them are currently operational, employing less than 200,000 people, and not every district has a factory. Again, the majority of these factories are operating at or near capacity. It is only a matter of time before these factories can solve our unemployment problems.

National entrepreneurship and innovation programme: NEIP which was established in July 2017 is a landmark political strategy of the Ghanaian Government with the main intent of giving comprehensive widespread support for start-ups and micro enterprises. NEIP's primary focus is on small and medium enterprises as well as startup which will be finance to form new companies to help them survive and expand.

Local entrepreneur skills development and educational program: LESDEP began in 2010 as just a Knowledge and skill Hub, arising as a public-private partnership on under sponsorship of the relevant department of technical education, for human and rural development. The principal goal of facilitating the achievement of technical and entrepreneurial skills between many youths. The major mission is to assist the nation's unskilled and uneducated youth. This also provides students with a variety of vocational training courses in order to spread and improve their talents for a reliable and stable tomorrow.

Nonetheless, these measures have not been shown to be sufficient in addressing the country's unemployment problems; much more effort is required. This brings to light the purpose of this study, which is to use forex trading as another route to supplement the Government's efforts to solve the country's unemployment problem.

Forex as a game changer to youth unemployment: The Forex Market as source of job or employment that can absorb most or all of the unemployed university graduates in Ghana without the Government being burdened. This is possible because two hundred thousand (200,000) members or new traders can be in a telegram chat group controlled by one experienced trader [11-14]. These professional traders will be doing all the analysis and rest of the members in the group will follow or copy their setups. So Ghana needs about forty well-trained professional traders to guide and facilitate all our unemployed graduates. Then, the problem of unemployment graduate association will be a thing of the past. There is no centralised location where these currency transactions take place in the exchange market.

Currency is traded in a variety of markets all over the world. This is the most significant financial transaction. Marketing to a world that trades more than $1.6 trillion per day [15-19]. The forex market is managed by a worldwide consortium of banks found in four predominant forex trading establishments located in various time zones: “London, New York, Sydney, and Tokyo” [20-23]. Since there is no prime hub, users could indeed trade forex 24 hours per day, seven days a week. The service will be provided a day, seven days a week 5 pm EST on Sunday to 4 pm EST on Friday. So even though exchange rates are all in high demand, this same market opens 24 hours a day, five days a week.

The foreign exchange market is divided into three major regions: “Australasia, Europe, and North America”. There are also several significant financial hubs inside of all of these major places. According to EST, for instance, forex trading hours move around the world like this: Available in New York is open from” 8 am to 5 pm.” EST (EDT); Tokyo is available from “7:00 pm to 4:00 am”. Eastern Time (EDT); Sydney is accessible from “5:00 pm to 2:00 am” Eastern Time (EDT); and London is available from “3:00 am to 12:00 pm” noon Eastern Time (EDT) [24].

This allows traders and brokers toers worldwide, together with the central banks from all continents, to trade online 24 hours a day.

There really are three main types of foreign exchange markets:

• The physical exchange of a currency pair that occurs at the time the trade is settled i.e. 'on the spot'-or within a short period of time.

• A contract is agreed to buy or sell a set amount of a currency at a specified price, to be settled at a set date in the future or within a range of future dates

The tangible benefits of forex trading

Forex provides free demo accounts that allow you to practice forex trading without risk, essentially serving as a "try before you buy" run the test. Demo accounts simulate a live trading environment allow you to become acquainted with a trading platform, become acquainted with market movements, and develop a risk management strategy without making any financial commitments among the most important benefits of forex trading is its accessibility. It is fairly simple to get started and does not necessitate a large upfront investment. Compared to other markets or businesses. As a result, you can become a bedroom businessman. That is to say; you can sit in the comfort of your room and still make money.

Anyone can trade 24 hours throughout the day: Foreign exchange is done Over the Counter (OTC), throughout 2016 as the base year, the UK's Over-the-Counter (OTC) interest rate derivatives business has increased significantly, meaning transactions are made directly between trading parties, facilitated by a forex broker [25]. Price increases are often bargained personally, as opposed to centralised platforms, resulting affects the relationship. Members of said "Group of Twenty" (G20) pledged to overhaul its OTC during 2009 [26]. Forex trading is not governed by the hours of operation of any centralized exchange system. Because it operates in this manner. Deals can take place anywhere in the world as long as there is a market open continued to operate to it users around all over the globe, “5 days a week, 24 hours a day, and traded electronically [27,28].

It is strictly regulated: Fiscal strategy resulted in some kind of a strict oversight with in trade of equity as well as hard currency, and hence a significant capacity to sustain the capital market within a stringent regulatory guideline [29,30]. Foreign exchange regulation is a difficult task because it occurs in a global and digital environment [29,31]. Fortunately, this works in a trader's favor and can be considered one of the benefits of forex trading. Because there is no centralised exchange system, independent bodies are in charge of regulation in each country [30,32]. In effect, influenced by the presence of a central administration which enforces there own issue, all jurisdictions as well as national systems must reach a compromise by determining common standards from brokers and currency exchange steering law enforcement agencies, as well as approved bodies in the field of forex trading [24]. The Financial Conduct Authority is the regulatory body in the United Kingdom (FCA) is primarily responsible for this function as China Foreign Exchange Trade System (CFETS) is responsible as in the case of China [33,34].

The volatility of the forex trading: Volatility synergies in European Community foreign exchange markets are managed to perform even though volatility and also its cross-currency spillovers influence decisions regarding hedging fully accessible forex positions [35,36]. A variety of external factors influence the forex market, including but not limited to; a given country's economic stability, global economic growth as a whole [37-39] contracts for trade, natural calamities [40,41] and politics news, events, and policies [42,43]. These can make the market highly volatile at times, implying significant movements in currency values and, as a result, the opportunity to profit significantly. Though this may be viewed as one of the benefits of forex trading, it also carries a high level of risk because the movement can occur in either direction. The above mentioned are just a few advantages to forex. However, one should note that forex is like any other business, and it comes with its risks, such as losing some or all the capital you invested when you do not know how to deal with trading [44-46]. These losses happen in every business, mainly when you are new to a business.

Tools and materials needed to trade forex

MetaTrader 4 and MetaTrader 5 are at the top of the list. These are trading platforms that provide a plethora of tools to assist you in developing having a good own edition of EA (Expert Advisor) software large extent, eliminating the need for you to analyse every situation manually.

MetaTrader 4; MT4 as it is also known-includes an editor and a compiler, as well as access to a free library of software created by users. It will provide you with new articles as well as all the assistance you need to make profitable trades and learn the software. Set the parameters and then wait for the software to generate a trading signal.

Journal of trading: Following that, we have a trading journal. This type of tool, while simple, is very important for traders, especially new traders who are still learning the ropes. The reason for this is that traders must become more aware of their own trading habits. When you first start trading forex, you will most likely have a lot of trades in a short period of time. That makes remembering every detail of every trade impossible, so the best thing you can do is write it down in a trading journal. Anything that you believe will help you notice and improve a pattern in your trading behavior should be recorded in the journal.

Economic calendar: There are economic calendars, which are very useful for traders who like to plan out their entire trading week. You can use your calendar to keep track of important events so you don't forget about them and have to read about them in the news. This could include all of the major events discussed in the news section, such as central bank policy and interest rate announcements.

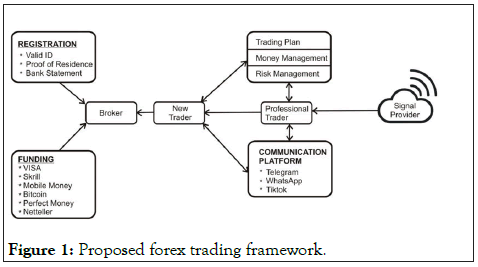

In Figure 1 is the summary of how the forex trading trajectory is been projected to solve the unemployment menance in Ghnaa. Each of the major block has been explained in detailed below.

Figure 1: Proposed forex trading framework.

Trading platforms: These platforms frequently include their own analysis tools, the majority of which have order entry capabilities and can track market changes in real time. This is certainly useful for keeping track of market changes as you place your order.

Another feature that they frequently have is a financial news feed, which can assist you in deciding what move to make. Then there's highly customisable, sophisticated trading software that lets you set up various parameters and use them to automate your trades. That way, you won't have to worry about passing up an opportunity that you think is good enough to get a job. Best of all, it is also very simple to find a platform that has its own mobile version, allowing you to trade while on the go. All these things can be access on the internet for free or a small cost.

There are numerous tools available to help you be more successful when trading forex and the majority of them are simple to use. When it comes to forex trading, the most important things to have are experience and knowledge. It is up to you to gain experience, but these tools can assist you in gathering information and determining the best course of action at any given time. Any serious university graduate can use six months to one year to gain experience and make money if he or she wants his or her financial freedom. This can be done during the national service period.

Papers and documents needed for verification

For proof of identification: Acceptable documents for identity verification include scan copies of the following: Papers and documents needed for verification to be recognised and be a verified trader one must scan and submit these documents for proof of identification. The individual need a colour highresolution scan copies or photos of a document that verifies their personality with name, photo, signature, date of birth, expiration date are clearly seen and valid for at least six months from the moment of applying. Acceptable documents for identity verification include scan copies of the following: Valid, current passports (national or international), Valid, current driver's license and Valid, current national ID card.

Proof of residence: You will need a colour resolution scan copy or a document where your full name and address are clearly seen and match the data indicated in your profile. The document should be issued not later than three months. The following are some the document’s one can use, thus; the details of your residence or house number for, Utility bill (water and electricity bill) and Bank statement.

Funding and withdrawals: There are several measures that can be taken fund or withdraw not limited to the following, skrill, mobile money, Neteller and others. However, card verification is required only if you want to use Visa/Master Card as deposit and withdrawal method.

Demo trading: You can start with a free demo. One can start trading with free unlimited demo account with real quotes. These help users to build confidence and to access your trading plan accuracy.

Trading plan: A trading plan will act as a guide that will keep you on the disciplined trading path.

Having a pre-defined trading plan in writing means you are making an effort to hold yourself accountable to something, which is essential for forex trading success because there is no one to hold you accountable as a trader. When trading the markets, you only have yourself to answer to,although it can be exceptionally hard to do what is ideal for your trading account when it contradicts just about anything you would like to do. purpose of having a forex trading plan: To have a physical reminder of what is best for your trading account at any given time. This strategy begins with the simple definition of a trading methodology. What currency pairings will be traded and when will they be traded are all part of the technique. Trading objectives, both short and long term, would also be included in the trading process. Traders should create daily targets for how many pips they wish to earn. When they reach their target, they cease trading, which eliminates excessive trading and the desire for greater risk. It will also contribute to the abolition of greedy trading, both of which you want to avoid in your firm. Longterm objectives include keeping traders motivated. Along with the objectives, the forms of analysis that each trader will employ must be specified.

Money management: One also need to manage his money well. Forex money management refers to a forex trader's processes to manage the funds in their forex trading account.

The central tenet of forex money management is to preserve trading capital. That is not to say that you will never have a losing trade in forex because that is impossible. However, forex money management aims to reduce trading losses to a ‘manageable' level. That is, if a trade loses, it does not prevent the trader from winning other trades. Money management is closely related to risk management because all risks are associated with your money when trading. However, the definitions differ slightly. Risk management is the process of anticipating and managing all identifiable risks, which can include something as insignificant as having a backup computer or internet connection. Money management for forex traders, on the other hand, is entirely concerned with how to use your money to improve your account balance without putting it in jeopardy.

The suggestions have been formulated in the following sequence to mitigate or reduce the level of youth unemployment in Ghana through the Technical and Vocational Education and Training Programme (TVET). The Government should come out with a clear-cut policy as to how forex trading can be taught as a subject in TVET institutions in terms of human capital development for employment creation

The Government should task the internet service providers to make the internet accessible and cheap so that the youth can afford as the internet is the primary source of connection for one to trade forex.

The society needs re-orientation in order to change their wrong perception about forex trading. In advanced nations individuals with such technical skills and experience in relevant fields are highly respected and thus work in tandem with those with formal education. The worth of every worker should depend on the person’s skills and knowledge and not the stack of academic degrees.

Forex trading should be encouraged by assisting them with soft loans and/or micro credit. The quality of forex technical knowledge must be improved if the expected outcome of employment creation and poverty reduction is to be achieved.

Awareness campaigns and initiatives to promote various digital labour types and micro-work opportunities should be promoted.

According to research findings and statistical data, there is a high level of youth unemployment in Ghana, despite the Government's initiatives in coming up with several programs to reduce the level of youth unemployment, which has failed to yield the desired result. For citizens to eradicate or reduce the level of unemployment in Ghana, greater emphasis must be placed on Forex trading. The promotion of forex trading program will lead to wealth creation, employment generation and sustainable livelihood. The Government should set up a Television and face book dedicated channel that will be used purposely for forex education and training.

The young people are encourage to start educating themselves on how to start up their own business and that forex is a sure way to go being one of the secrets of many banks today. You can learn how to start forex trading all by yourself. However, I also recommend you do more research on forex trading, watch videos as well so Users can become acquainted with the trading system.

Only when you have carried out enough free trades and you have developed a successful Forex trading strategy, you should consider trading with real money.

Technology is also changing how people work, giving rise to a free market economy in which Organizations hire freelancers for short-term assignments. Ghana therefore needs to develop an education and training system that is versatile and supports its young people in their efforts to adapt and thrive in the 21stcentury world of work.

Citation: Aning J, Kelly AE, Dawson JK, Benjamin AB (2021) Forex Trading as an Information Technology Tool to Mitigate Rising Unemployment in Ghana. J Inf Softw Technol. 11: 276.

Received: 23-Nov-2021 Accepted: 07-Dec-2021 Published: 14-Dec-2021

Copyright: © 2021 Aning J, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.