Journal of Psychology & Psychotherapy

Open Access

ISSN: 2161-0487

ISSN: 2161-0487

Research Article - (2023)Volume 13, Issue 2

Background and objectives: The decline in GDP caused by the global economic recession of 2008 and that caused by the COVID-19 pandemic has resulted in the poor economy of countries around the globe with increased rates of unemployment and adverse job conditions. This systematic review aims to identify the impact of a financial crisis on psychological well-being, life satisfaction, health satisfaction, and financial incapabilities.

Methods: The literature included in the review was searched from Feb 1st, 2023 to March 26th, 2023 by using the PUBMED database as the search engine. Studies discussing the impact of the financial or economic crisis on psychological well-being, health, life satisfaction, and financial incapability published in the English language were included in this review whereas systematic reviews and meta-analysis, case reports, articles published in languages other than English and articles with limited access were excluded.

Results: Of the 26 articles found eligible for the study, there were 22 quantitative studies, 2 qualitative studies, and 2 mixed method studies. Most of the articles included in this study discussed the global economic crisis caused by COVID-19 and the global financial crisis of 2008. Almost 80% of the studies included in this review discussed psychological well-being and the prevalence of psychological disorders including depression, anxiety, stress, fear, loneliness, burnout, and suicide whereas the rest of the articles discussed mortality regarding mental disorders.

Conclusion: Financial crisis or economic recession results in an increased prevalence of common mental disorders affecting psychological well-being by increasing rates of unemployment and adverse job conditions. Policymakers with competitive financial behaviour and knowledge are essential elements for psychological well-being and life satisfaction.

Economic crisis; Indebtedness; Mental illness; Psychological well-being; Depression; Anxiety

The global financial crisis, that occurred in 2008, led to the development of the worst global economic recession since the 1930s and was even labelled as a much deeper, wider, and longer recession in comparison to the great depression of the 1930s [1]. The variable impact of this worst global financial crisis is still depicted in the economic structure of several countries around the globe because it led to a severe decline in Gross Domestic Product (GDP), resulting in increased rates of unemployment and monetary challenges [2]. The governments of many countries implemented austerity policies to survive the crisis at the cost of the health and social care budgets. A significant reduction in public spending gave rise to insecurities among the public leading to the development of social exclusion [3]. Mental health refers to the psychological well-being of any individual or population and is affected by social as well as economic determinants of health [4]. Financial crisis may pose a critical impact on mental health either via an increase in risk factors for mental stress including unemployment, vulnerable socioeconomic status, indebtedness, or a decrease in the occurrence of protective factors like the security of job and welfare protection programs [5]. Several researchers have studied the mental health consequences of the financial crisis and reported an increased incidence of psychopathologies including anxiety disorders, mood disorders, suicide attempts, and psychological distress [6]. These consequences of the financial crisis have motivated the vulnerable population to increase their search for the treatment of mental health yet the accessibility to mental health treatment is another challenge amidst the financial crisis owing to issues of affordability as well as availability [7]. Although the impact of the economic crisis overuse of mental health services in past is not clear in the available literature, researchers have found mixed evidence [1,8]. Studies have reported contradictory statements regarding the utilization of mental healthcare services during the financial crisis with Zivin, et al. [9], reporting increased mental healthcare admissions in the era of the financial crisis whereas Cheung, et al. [10], reported a decline in consumption of mental health services in the United States during economic crisis owing to limited access to insurance policies. It is evident from the literature that mental health or psychological well-being is affected largely during the financial crisis due to decreased utilization of mental health treatment resulting from accessibility issues, implementation of austerity measures, and enhanced stigmatization of mental illnesses leading to dissatisfaction among public and developing a sense of financial incapability among them [11]. This situation is further worsened by the advent of the COVID-19 pandemic which hit the global economy badly. According to Matsubayashi, et al. [12], the economic crisis triggered by the COVID-19 pandemic is proved to be the worst economic downturn globally since the global financial crisis of 2008 and the great depression of 1930. A recent report presented by International Monetary Fund (IMF) in 2020 revealed a 3.5% decline in global economic growth owing to the pandemic with increased rates of unemployment and psychological distress [13]. This systematic review aims to identify the impact of a financial crisis on psychological well-being, life satisfaction, health satisfaction, and financial incapability.

Search strategy

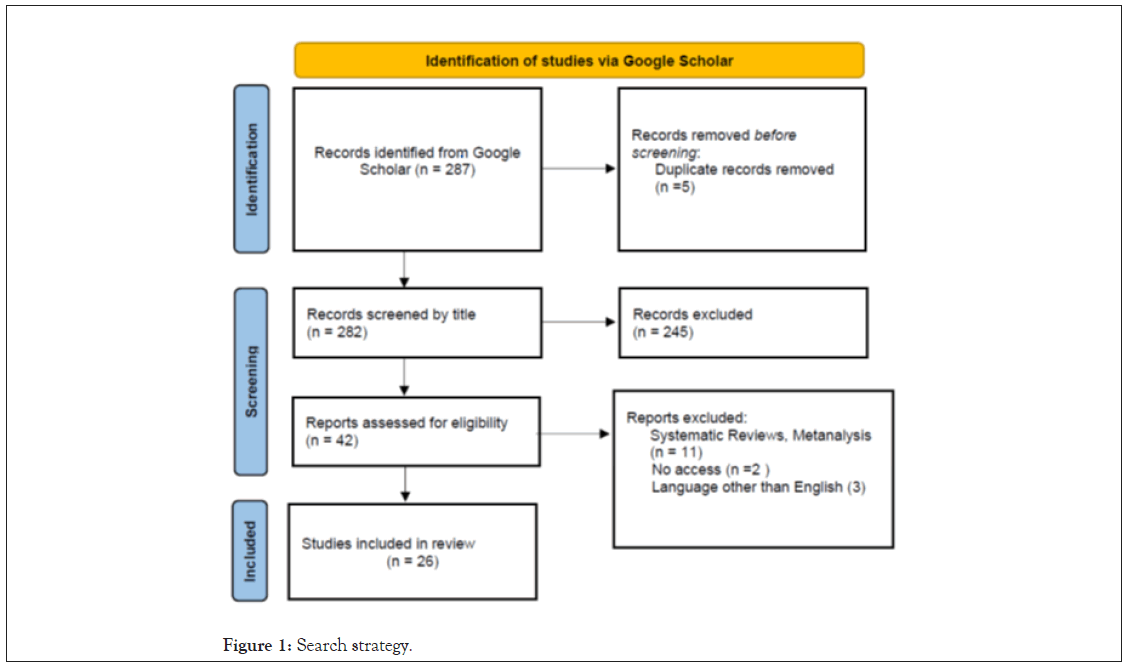

The literature included in the review was searched from February 1st, 2023 to March 13th, 2023 by using the PUBMED database as the search engine. The search strategy for the review article was constructed as (“impact” OR “effect”) AND (“economic crisis” OR “financial crisis” OR “indebtedness” OR “financial strain” OR “debt”) AND (“mental illness” OR “anxiety” OR “depression” OR “stress” OR “mental disorder” OR “psychological wellbeing”) using economic crisis, indebtedness, mental illness, psychological wellbeing, depression and anxiety as keywords. The reference lists of screened articles were searched to identify relevant articles. Duplicates were removed from the articles recruited by literature search. Studies retrieved by search strategies were further screened by title and the shortlisted studies were screened first via abstract. Studies found irrelevant by abstract were excluded. Studies remained after the title and abstract screening were tested for inclusion and exclusion criteria and the articles fulfilling the inclusion criteria were enrolled in the study. The complete search strategy including the number of articles retrieved by the database is given below in Figure 1.

Figure 1: Search strategy.

Inclusion and exclusion criteria

Studies discussing the impact of the financial or economic crisis on psychological well-being, health, life satisfaction, and financial incapabilities published in the English language were included in this review whereas systematic reviews and meta-analysis, case reports, articles published in languages other than English and articles with limited access were excluded. The selection of studies was done by two independent reviewers and the final selection of articles was agreed upon by both reviewers in collaboration with each other.

Recruitment and screening

A total of 287 articles were recruited by the search strategy and after the removal of duplicates, 282 articles were screened by their title and abstract. 245 studies were excluded after title screening and 42 studies were tested for eligibility via text screening. Of these 42 articles, 16 articles were excluded based on present inclusion and exclusion criteria. Resultantly, 26 articles were considered eligible for the review.

A total of 26 articles were found eligible for the studies of which, 22 were quantitative studies, 2 qualitative studies, and 2 mixed method studies. The summary of included studies including study author, year of publication, and type of study, sample size, place of study, financial crisis, and mental healthcare outcomes addressed is given below in Table 1. Almost 80% of the studies included in this review discussed psychological well-being and the prevalence of psychological disorders including depression, anxiety, stress, fear, loneliness, burnout, and suicide whereas the rest of the articles discussed mortality regarding mental disorders, absenteeism, and financial capability. Most of the articles included in this study discussed the global economic crisis caused by COVID-19 and the global financial crisis of 2008.

| Author | Year of publication | Place of study | Type of study | Sample size | Financial crisis | Mental healthcare outcomes | Key findings |

|---|---|---|---|---|---|---|---|

| Matsubayashi, et al. [ 12] | 2022 | Japan | Quantitative | 9000 | COVID-19 economic crisis | Anxiety, depression | The odds of having depression and anxiety were higher in those who had adverse job status (1.729, 95% CI: 1.459-1.999, 1.838, 95% CI: 1.502-2.174, respectively), low income (1.955, 95% CI: 1.601-2.308, and 1.517, 95% CI: 1.179-1.854, respectively) and poor educational status (1.283, 95% CI: 1.132-1.435 and 1.209, 95% CI: 1.032-1.386) respectively. |

| Sanchez-Gomez, et al. [14] | 2021 | Italy | Quantitative | 578 | - | Absenteeism, innovation at workplace | Economic stress is significantly correlated with absenteeism (r=0.11; p<0.001), innovative behavior (r=0.17; p<0.001) respectively. |

| Zilidis, et al. [15] | 2021 | Greece | Quantitative | - | Global financial crisis 2008 | Mortality due to mental illness | The rate of mortality due to mental illness increased by 59.6% in people over 75 years, by 60.4% in ages 65-74 and 25.2% in ages 55-64 (P<0.001) in comparison to mortality rates in pre-austerity period with greatest increase observed in Portugal, Greece followed by Ireland and Lithuania (150%) and Spain, Italy, Hungary and Poland (15 to 35%) with a significantly negative correlation of SDR DHI per capita and hospital expenditure per capita (P<0.001) while positive correlation with unemployment (P<0.001). |

| Borrescio-Higa, et al. [16] | 2022 | Chile | Quantitative | 2545 | COVID-19 economic crisis | Psychological-wellbeing, sleep problems, deterioration |

Unemployment had a statistically significant relationship with poor well-being, sleep problems and deterioration (F=0.779, R2=0.063; F=0.1300, R2=0.092; F=0.0630, R2=0.090 respectively. |

| Liu, et al. [17] | 2022 | China | Quantitative | 347 | COVID-19 economic crisis | Anxiety | The operational crisis, debt crisis and growth crisis of external enterprise had a significant impact over state anxiety (Path coefficient of 0.402, CR=4.235, p<0.05; 0.365, CR=4.083, p<0.05; 0.390, CR=4.546, and p<0.05 respectively). The financial distress prediction had a significant negative mediating effect on state anxiety and pressure management (Interaction coefficient-0.370, p<0.05). |

| Xiao, et al. [18] | 2022 | USA | Quantitative | 27,091 | - | Financial capability, financial distress, psychological wellbeing | Delinquencies of mortgage, credit card and student loan debts have positive association with financial stress (β=0.0876, 0.1088, and 0.0440, respectively). There is negative association between financial capability and level of financial stress. |

| Elbogen, et al. [19] | 2021 | UK | Quantitative | 34653 | - | Psychotic, bipolar, depressive disorder, homelessness | Financial strain accounts for 0.0338/0.0856=39% of the total effect of severe mental illness on homelessness. |

| Webster, et al. [20] | 2022 | USA | Mixed Method | 50 | - | Guilt, stress, anxiety, burnout | 56% of study participants felt psychological impact of debt over their lives in the form of stress, anxiety, guilt and burnout. |

| Gunasinghe, [21] | 2018 | UK | Quantitative | 2750 | - | Mental healthcare service utilization | Debt accumulation is strongly associated with common mental disorders. |

| Bichkoff, et al. [22] | 2022 | USA | Mixed Method | 1309 | COVID-19 economic crisis | Stress | COVID-19 economic crisis resulted in massive job loss (61.2%) and financial stress related to eviction, housing instability, and debt accrual |

| Samuel, et al. [23] | 2022 | USA | Quantitative | 3257 | COVID-19 economic crisis | Mental health, sleep quality, loneliness, hopefulness | People having decreased income during COVID-19 had significantly poorer mental health, sleep quality more loneliness and less time for themselves (b=-0.1592, p<0.001; OR=0.63, 95% CI: 0.46, 0.86; OR=1.53, 95% CI: 1.16, 2.02; OR=0.54, 95% CI: 0.40, 0.72 respectively.) |

| Petitta, et al. [24] | 2020 | USA, Italy | Quantitative | 864 | COVID-19 economic crisis | Emotional contagion, affective financial stress | Correlations among emotional contagion and economic stress factors ranged from -0.10 to 0.41 in the US and from -0.05 to 0.48 in Italy. |

| Wang, et al. [25] | 2020 | Italy | Quantitative | - | Global financial crisis 2008 | Bipolar disease, MDD, manic disorder | The rates of unemployment increased consistently since 2008 with peak in 2014 more in southern regions. Almost 1% point increase in unemployment gives rise to about 1 out of 100,000 residents being admitted to the hospital due to affective disorder. |

| Haurin, et al. [26] | 2021 | USA | Quantitative | 1026 | - | Debt stress | Consumer debt, mortgage debt and reverse mortgage debts cause’s financial stress yet the financial stress caused by reverse mortgage debt is relatively less. |

| Majumder, et al. [27] | 2022 | Bangladesh | Quantitative | 252 | COVID-19 economic crisis | Fear, anxiety, | Job insecurity destroys the mental health by 0.18 units on average leading to fear and anxiety. |

| Ke, et al. [28] | 2022 | Malaysia | Qualitative | 30 | COVID-19 economic crisis | Retrenchment, stress | Retrenched workforce experienced various adverse effects, both psychological and unemployment, brought on by retrenchment during the COVID-19 pandemic. |

| Ong, et al. [29] | 2019 | Singapore | Quantitative | 196 | - | Debt relief, cognitive functioning | The percentage of people suffering from GAD decreased from 78% to 53% after debt relief (z=5.306, P<0.00). Cognitive functioning significantly improved post-debt relief (t=8.361, P<0.000). |

| Latsou, et al. [30] | 2018 | Greece | Quantitative | 130 | Global financial crisis 2008 | Depression | 63.8% of participants who were unemployed had depression. A significantly positive association was observed between duration of unemployment and CES-D score (r=0.173), |

| Macassa, et al. [31] | 2021 | Portugal | Qualitative | 22 | Global Financial Crisis 2008 | Anxiety, depression, frustration, sleep problems | Participants suffering from unemployment during recession felt loss of identity, stress, and a sense of powerlessness due to unemployment, as well as a lack of purpose and structure in their daily lives. |

| Marshall, et al. [32] | 2021 | USA | Quantitative | 15,757 | - | Depression, anxiety | Participants with financial difficulty were likely to have high levels of depression and anxiety (RR ¼ 2.06, CI ¼ 1.75-2.42, p<0.001 and RR ¼ 1.46, CI ¼ 1.02-2.05, p<0.001 respectively. |

| Hertz-Palmor, et al. [33] | 2021 | USA, Israel | Quantitative | 4171 | COVID-19 economic Crisis | Depression | 58.9% participants experienced loss of income during economic crisis. COVID-19-related financial worries were associated with depressive symptoms (β=0.13, SE=0.01, t (15280)=13.35, p<0.0001). |

| Bodrud-Doza, et al. [34] | 2020 | Bangladesh | Quantitative | 1066 | COVID-19 economic Crisis | Anxiety, fear | There is a significantly positive association between economic crisis caused by COVID-19 and psychological wellbeing of population of Bangladesh. |

| Forbes, et al. [35] | 2019 | USA | Quantitative | 3621 | Global Financial Crisis 2008 | Depression, anxiety, panic disorders, suicides | The impact of global recession resulted in 1.3 to 1.5 time’s higher odds of symptoms of depression, generalized anxiety, panic, and problems associated with substance use. |

| Achdut, et al. [36] | 2020 | Israel | Quantitative | 390 | COVID-19 economic Crisis | Psychological distress, loneliness, optimism | Unemployed participants reported greater distress during crisis than those who had jobs and business during the crisis (16.61 ± 3.85) and 15.08 ± 3.57 respectively). Moreover, unemployment is significantly positively correlated with psychological disorders (t=3.82, p<0.001) |

| Al Hariri, et al. [37] | 2022 | USA | Quantitative | 74 | COVID-19 economic Crisis | Anxiety, depression | The household income was negatively associated with the participant’s scores on the GAD-7 and PHQ-9, |

Table 1: Characteristics of included studies.

The findings of our review depict that economic crisis poses a considerable impact on the psychological well-being of people by developing a sense of financial incapability among them hence affecting health and life satisfaction. This review shows that several authors have studied the association of depression, anxiety, and suicide mortality with economic recessions from 2008 to the global economic crisis caused by the COVID-19 pandemic in 2019 but the majority of these studies are from European countries including the United States of America and the United Kingdom while literature is deficient in data from central and south Asia. These findings are parallel to that of the review by Guerra, et al. [38], who reviewed 127 articles discussing the psychological impact of economic recessions of which more than 97% of included studies were from the European continent. The impact of global economic recessions on the psychological well-being of the global population is evident from literature in the form of increased prevalence of common mental disorders including depression, anxiety, fear, self-harm, suicide, bipolar disorder, psychosis and stress including debt stress after global economic recession in 2008 [38-40]. Studies have shown contradictory results regarding the utilization rate of mental health services during the economic crisis. Modrek, et al. [40], reported increased utilization of mental health services during the economic crisis due to the increased prevalence of depressive symptoms whereas Todd, et al. [41], and Chen, et al. [42], reported an overall decline in mental healthcare visits due to a lack of economic resources to access mental healthcare. According to Chen, et al. [42], the number of mental healthcare visits in women increased during the economic crisis in comparison to men although the overall statistics of mental healthcare visits remained constant. Similarly, an increase in the use of psychotropic drugs was observed in the post-recession era [43]. According to Guerra, et al. [38], the consumption of opioids increased drastically in areas of the United States suffering more from unemployment between 2007 to 2011. Several studies in our review have reported a highly significant positive correlation between the financial crisis and depression. This is similar to another review conducted by Guerra, et al. [38], in which almost 22 studies showed a positive correlation between unemployment and depression ranging from 0.139 to 0.68. According to Tapia, et al. [44], countries which had higher rates of unemployment in the post-global financial crisis era of 2008 in comparison to the pre- global financial crisis era were more prone to have an increased prevalence of psychological ailments. Similarly, increased rates of unemployment resulted in an increased probability of chronic mental disorders during the era of the global financial crisis in 2008. The adverse job status during the economic crisis caused by COVID-19 also resulted in an increased incidence of depression anxiety, fear, stress, and suicide attempts [45]. The findings of our review showed that the odds of having depression and anxiety are increased significantly by adverse job status and low income. This is similar to the findings of another review in which unemployment during the global financial crisis of 2008 increased the odds of mood disorders by almost 2 times in Greece and the Netherland, 22% in the USA, and 16% in some European countries [38]. Alternatively, the incidence of psychological disorders decreases rapidly with increased rates of employment as evidenced by Avdic, et al. [46], who stated that with every 1% increment in GDP per capita, distress related to loss of job and financial stability decreases by 0.09. Life satisfaction is an essential component for the evaluation of life standards. It is alternatively considered a comprehensive appraisal of life with or without any comparison [47]. Studies have shown a positive correlation between income inequalities with life satisfaction. It is evident from the literature that people with high income are more satisfied with their lives in comparison to people with low income and vice versa [47]. According to Avdic, et al. [46], a prominent sharp decline in life satisfaction among Germans was observed in the post-economic recession era of 2008 owing to the adverse financial situation of the economy, increased rates of unemployment, and poor job stability. Contrarily, findings from another study highlighted that life satisfaction and economic downturn due to the global economic recession of 2008 were observed in the post-crisis period rather than during the crisis due to social norms [48]. To support his idea of social norms, Volkos, et al. [48], provided the quotation [49]. “When unemployment is higher in the general population and therefore is considered a ‘social norm’ it is easier for a person to initially accept becoming unemployed and handles this situation as ‘socially expected’”. Xiao, et al. [50], described financial capability as an essential predictor of Life satisfaction. Financial capability is an alternative term for financial knowledge. It refers to an individual’s ability to apply appropriate financial knowledge to achieve financial well-being which in turn leads to life satisfaction [50,51]. This is parallel to the findings of our review which depicted a significant negative association between financial stress and financial capability. According to Thompson, [52], financial incapability leads to poor decisions regarding the economy and it may aggravate the psychological impact of economic recessions by developing financial instability and creating job insecurities. Policies developed by financially capable personnel can relieve the psychological distress associated with recession and improve life satisfaction [18,52].

Conclusively, this review suggests that financial crisis or economic recession results in an increased prevalence of common mental disorders affecting psychological well-being by increasing rates of unemployment and adverse job conditions. Moreover, it results in financial stress that leads to poor life satisfaction and is aggravated further by financial incapability. Policymakers with competitive financial behaviour and knowledge are essential elements for psychological well-being and life satisfaction.

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [GoogleScholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

Citation: Thompson PW (2023) Financial Crisis and its Effect on Psychological Well-Being, Health, Satisfaction, and Financial Incapability: A Systematic Review. J Psychol Psychother.13:449.

Received: 31-Mar-2023, Manuscript No. JPPT-23-22745; Editor assigned: 03-Apr-2023, Pre QC No. JPPT-23-22745 (PQ); Reviewed: 17-Apr-2023, QC No. JPPT-23-22745; Revised: 24-Apr-2023, Manuscript No. JPPT-23-22745 (R); Published: 01-May-2023 , DOI: 10.35248/2161-0487.23.13.449

Copyright: © 2023 Thompson PW. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.