Journal of Research and Development

Open Access

ISSN: 2311-3278

ISSN: 2311-3278

Research Article - (2025)Volume 13, Issue 1

This study proposes a handwritten signature verification method based on improved combined features, which combines dynamic features and static features by using the complementarity between classifiers and score fusion. The significance of this study is for the purpose of verifying the authenticity of the signature and protecting the safety of customer property by extracting more comprehensive and representative signature features. The traditional approach for signature verification in the bank uses the human sense organ of eyes and most of the time human judgment based on what is seen can be queried, especially in cases of impersonation, forgery, identity manipulation to name a few. Today the quest for fast money has driven a lot of frustrated people into various illegal acts and signature counterfeiting is one of the most common of this act. Banks and their customers occasionally fall victim because they lack adequate technology to verify signatures. Recently in most banks there are various cases of banking staff denying services to customers due to signature differences. This has resulted in a lot of misunderstandings, insults, quarrels and even losses to most financial institutions. This work presents a digital signature verification system to enhance customer services in the banking industry, with the aim of improving the staff customer relationship within the Banking domain. This will be developed using image acquisition tool, image processing tools and machine learning. (Clustering technique). Signature has been globally accepted as a general means of official authentication, for legal documents, cheques, bank drafts, tellers, withdrawal slaps, deposit slops, receipts and other official documents. This means has been widely accepted and implemented in all banking sectors due to its simplicity, confidentiality and unique nature, also compared to other biometric verification systems, human signature is one of the few biological modalities that remain the same over time. This authentication means has been abused time and time again through impersonation (identical twins) and forgery, as a result has caused a lot of damage and losses to individuals and financial institutions. This research work addresses this challenge using artificial intelligent technique to present a novel signature verification system that helps authenticate business transactions in all financial institutions. The growing number of online transactions and contracts need stronger protection. Electronic signatures are undoubtedly a huge step forward in efficiency, but electronic signature counterfeiting is extremely real and worrying, especially as large become increasingly dependent on them, especially at a time when the globe is facing a pandemic. Traveling for the sake of conducting business has become a luxury since the world has come to a halt. Today electronic signature is very important in carrying out day-to-day business but at the same time, we need to be increasingly cautious and alert to prevent any e-signature fraud with carefully considered practices and procedures.

Digital signature; Signature verification; Vector machine support; Combined signature; Dynamic time warping; Forgery; Bank fraud; Simple forgery; Random forgery; Skilled counterfeiting; IPC; Punishment for fraud; Fake signature; Forging signature; Tracking stimulation; Freehand forgery; Lifted forgery; Misuse of digital signature; Fraud investigation office; Wire fraud; Identity theft; Stolen cheque; Altered cheque; Cheque kitting; Skimming of card; Stealed bank cards; Phishing and internet fraud; International crime; High-tech crime; No-scene crime; Faceless crime; eMus; eMudhra

In recent years it has been seen that personal identity as an authentication is one of the growing interests. Therefore, consider authentication as a deep down part of social life. Higher security in increasing demand puts much more attention on biometrics. Individual recognition based on personal characteristics) for verifying a person. Generally, among distinct biometric parameters for identification of a person on any document drawn through a uniquely outlined writes as an identity using a signature. Any individual daily uses it for any legal documents whenever required. A signature through any person conveys an image of pattern of pixels. Therefore, one of the most common and effective ways to identify a person through signature is handwritten signature identification. From different reviews of distinct proposed systems clarifies more focus on verification than that of identification due to the use of signature in daily life use. So, the serious matter arises with this system when anyone tries to replicate that individual’s signature for any purpose. There are mainly two types of verification of signature, i) Offline/Static verification ii) Online/Dynamic verification. Static verification system captures signature shape so input data includes x, y coordinates of signature. The dynamic verification system uses devices for capturing surplus information such as pen up and down, time, pressure, azimuth, etc. Previous research listing and describing the below approaches for signature verification are described at various levels in this article [1].

Online handwritten signature verification process

Online handwritten signature verification is a process of testing whether a signature is genuine or fake. A signature can easily be forged. Forgeries of signatures are classified into three types: Simple, random and skilled counterfeiting.

Random forgery: It is produced by the forger without knowing the writers name as well as real signature.

Simple forgery: In which the forger has no idea what the signature to be forged looks like. This is the easiest type of counterfeit to detect because it is usually not close to the appearance of a genuine signature. This type of counterfeit will sometimes allow an examiner to identify who made the counterfeit based on the handwriting habits that are present in the forged signature.

Skilled forgery: In which the forger has a sample of the signature to be forged. The quality of a simulation depends on how much the forger practices before at-tempting the actual forgery, the ability of the forker and the forgery’s attention to detail in simulating the signature. A skilled counterfeit looks more like the genuine signature. The problem of signature verification becomes more and more difficult when moving from simple to skilled counterfeiting. Currently, there is a growing demand for the processing of individual identification to be faster and more accurate, therefore the design of a signature verification system becomes an important challenge.

Background of signature verification systems

The detailed background about signature verification is discussed. The module of signature verification system is shown in the Figure 1.

Figure 1: Module of signature verification systems.

Signature database: The biometric research laboratory, ATVS, of the Universidad Politécnica de Madrid, has promoted the plan of action and the development of the MCYT project, in which the design and acquisition of a large scale biometric bimodal database, involving fingerprints and signature traits, has been accomplished. Although there are some other commercial and forensic partners within. In the case of the MCYT signature subcorpus, 25 client signatures and 25 highly skilled forgers (with natural dynamics) are obtained for everyone. Both on-line information (pen trajectory, pen pressure and pen azimuth=altitude) and offline information (image of the written signature) are considered in the database. Therefore, 330 × (25+25)=16500 signature samples are considered in the MCYT baseline on-line corpus. Since the acquisition of each on-line signature is accomplished dynamically, a graphics tablet is needed. The acquisition device used is a WACOM pen tablet, model. The sampling frequency of the acquired signals is set to 100 Hz, taking into account the Nyquist sampler criterion, as the maximum frequencies of the underlying bio-mechanical movements are always below 2030 (Figure 2) [2].

Figure 2: Digital signature-mode.

Pre-processing: Pre-processing of online signatures is commonly done to remove variations that are thought to be irrelevant to the verification performance. Re-sampling, size and rotation normalization are among the common pre-processing steps. In the pre-processing phase, the signature is undergoing some enhancement process for extracting features. The signature images require some manipulation before the application of any recognition technique. This process prepares the image and improves its quality to eliminate irrelevant information and to enhance the selection of the important features for recognition and to improve the robustness of features to be extracted. Moreover, pre-processing steps are performed to reduce noise in the input images and to remove most of the variability of the handwriting. For online signatures, some important preprocessing algorithms are filtering, noise reduction and smoothing. They are also other pre-processing steps such as the pen-up durations and drift and mean removal, time normalization and stroke concatenation before feature extraction. To compare the spatial of a signature, time dependencies must be eliminated from the representation. Certain points in the signature such as the starting points and the end points of a stroke and the points of an orbit change, carry important information. These points are the critical points and are extracted and remained throughout the process (Table 1) [3].

| S. no | Description |

|---|---|

| 1 | Coordinate x(t) |

| 2 | Coordinate y(t) |

| 3 | Pressure p(t) |

| 4 | Time stamp |

| 5 | Absolute position r(t)=√x2(t)+y2(t) |

| 6 | Velocity in x νx (t) |

| 7 | Velocity in y νy (t) |

| 8 | Absolute velocity v(t)=√ν2x(t)+ν2y(t) |

| 9 | Velocity of r(t) νr(t) |

| 10 | Acceleration in x ax(t) |

| 11 | Acceleration in y ay(t) |

| 12 | Absolute acceleration a(t)=√x2(t)+y2(t) |

Table 1: List of common features.

Extraction: Signature verification techniques employ various specifications of a signature. Selecting the features to be extracted has a huge effect on the accuracy of the signature verification system. It is also the most difficult phase of the signature verification system due to the different shapes of signatures and different sampling situations. The feature extraction process represents a major tackle in any signature verification system. Even there is no guarantee that two genuine signatures of a person are the same. (Intrapersonal variations). Its difficulty also stems from the fact that skilled forgers follow the genuine pattern (Interpersonal variations). This is unlike fingerprints or irises where fingerprint or iris from two different persons varies widely. Ideally, interpersonal variations should be much more than the intrapersonal. Therefore, it is very important to identify and extract those features that minimize intrapersonal variation and maximize interpersonal variations.

Table 1 shows the list of common features. There is a lot of flexibility in the choice of features for verification of a signature extracting information from a signature is classified into two types:

• Parameter function based approach.

• Function feature based approach.

Parameter function based approach: Signature verification systems differ both in their feature selection and their decision methodologies. Features can be classified into two types: Global and local. Global features are features related to the signature, for example, the average signature speed, signature bounding box and Fourier descriptors of the signatures trajectory. Local features correspond to a specific sample point along the trajectory of the signature. Examples of local features include distance and curvature change between successive points on the signature trajectory. The most commonly used online signature acquisition devices are pressure-sensitive tablets capable of measuring forces exercised at the pen-tip, in addition to the coordinates of the pen. The pressure information at each point along the signature trajectory is another. A commonly used local feature. In some of these features are compared to find the more robust ones for signature verification purposes. Other systems have used genetic algorithms to find the most useful features.

Function feature based approach: In the function feature based approach the signature is characterized in terms of a time function whose values constitute the feature set, such as position, speed, pressure, etc.

Verification: After applying the feature extraction process, the test signature and the reference signature are compared with the minimum of the dissimilarity values, average of all the dissemblances and the maximum of all the disparities. Choosing any of the above dissimilarity values a decision is made whether it is a counterfeit signature or a genuine signature. This comparison is done using a threshold value for all the reference and test signature; if the value is approximately equal to the benchmark signal value, then it is assumed to be a genuinely signed signature and if the dissimilarities are above that threshold value the signature is rejected. This threshold value can be identical for all the signature or it can also be different for each of them.

Common threshold: Common threshold is more advantageous because it has the optimal threshed for all the writers. This value is selected after calculating the dissimilarities of the data signatures and a common threshold is chosen based on the minimum error the criterion.

Author/writer dependent threshold: In this type of threshold the writer is limited to one single person. The data for this threshold should be larger compared to the regular data. Here in this type of threshold selection the writer modifies the value every time after each enrolment.

A overview of handwritten signature

Handwritten signatures are widely used in life. With the development of machine learning and artificial intelligence, the research on handwritten signature verification is also deepening.

In terms of signature data collection methods, there are mainly two types. Offline signature image and online signature data.

Offline signature image refers to the handwritten name of the author on the paper, which is then transmitted to the computer through the scanning device to form the signature and then verified according to the image features. Online signature refers to verification based on signature tracks, such as coordinates and pressures during writing. In this paper, an intelligent pen with pressure sensor and camera is used to write the name on the paper with full dots. In the process of writing the signature, the offline image and online data are collected in real time. Signature verification usually includes two stages of training and testing. In the training stage, different numbers of real signatures are used for pre-processing and feature extraction and then put into the classifier to obtain the model. In the test phase, the signatures are put into the classifier for comparison and output verification result. In the feature extraction stage, offline signature image features are called static features, which are mainly divided into local features and global features. Local features are mainly It is divided into texture features and gradient features and global features are mainly geometric features. Online signature data features are called dynamic features, which are mainly divided into parameter based features and function based features. Parameter based mainly refers to the signature duration and the number of pen tip upwards. Functional based features mainly refer to signature trajectories and pressure data. Dynamic features based on functional features generally have better results [4].

Verification methods: There are two main verification methods, model based verification and remote verification. Model based methods mainly describe data distribution by generating models such as Hidden Markov Model (HMM), CNN and SVM. The distance based approach mainly uses the distance measurements to compare the test signature with the reference signature through DTW. This paper uses SVM to process offline signature images and DTW to process online signature data.

There are two main difficulties in signature verification. One is that there is a large intra class and inter class variability. The author’s real signature will also change with time, age and other factors and the forger will also imitate the signature with a lot of training in advance, so it is necessary to extract and select more comprehensive and representative signature features. Second, in real life scenarios, only a small number of real signatures can insufficient data is also a problem that needs to be solved. In order to solve these challenges, this paper proposes a score fusion method based on accuracy weighing, which combines the static features of offline signature images and the dynamic characteristics of online signature data through scoring fusion. Specifically, the image and data are pre-processed and feature extracted respectively and then the images and data are verified by SVM and DTW respectively. Through the two classifiers, we can get the verification results and decision scores of offline signature and online signature. Due to the different verification results between classifiers, there is a certain degree of complementarity. Finally, we use score fusion to offline and online combination and solve the problem of complementarity between classifiers. The rest of the paper is organized as follows:

Section 2 introduces related work of this study. Section 3 gives a detailed introduction to the proposed method. Section 4 is the experimental results and discussion. Section 5 presents the conclusion.

Offline signature verification and online signatures verification: In the offline signature verification system an image of a signature is captured by a digital camera or obtained by scanning an signature, which is on a paper or a document and then different features are extracted such as eccentricity, kurtosis skewness etc., while in the case of online signatures verification used the dynamic features of the image which is taken at the time of signature are made such as pressure, coordinates etc.

Punishment for fraud signature in India

India code-section details: Anyone who commits forgery, intending that the forged document or electronic record shall be used for the purpose of fraud, shall be punished with imprisonment of either description for a term which may extend to seven years and shall also be liable to fine.

The law of fake signature: The general penalty for forgery is two years and if forgery committed relating to making false documents, then the penalty can be extended up to ten years and if false will is related to false will or any valuable security then the punishment extended to life imprisonment.

Forging signature crime: Forging a signature is a form of false personification and a designated crime under the IPC (Indian Criminal Code), hence the person forges the signature is always at risk since the person whose signature has been forged, can always file a complaint for the offence by suppressing his prior consent to that effect.

Advice-what can I do if someone forged my signature in India: Submit a complaint with the police alleging forgery by which the matter will proceed to the court and the court upon application from your side orders the signatures to be tested by the forensic lab and that should do.

Types of handwriting forgery

Falsified/Forgery: It is possible to commit a crime by forging your own signature. Forgery is the creation of falsified material or the alteration of any writing with the purpose of defrauding or cheating. There are four basic types of counterfeiting traced, simulation, freehand and lifted. There are four basic types of counterfeiting traced, simulation, freehand and lifted [5].

• Tracking/Tracing

• Simulation

• Freehand

• Lifted forgery

Tracking/Tracing: There are a few different ways to do traced forgeries. With overlays as with tracing paper, transmitted light as with a light board, tracing the indentations left in the page under the original writing and tracing paters of dots that outline the writing to be forged.

Simulations: Simulation involves copying of writing from a genuine article, trying to imitate the handwriting of the original.

Freehand: Freehand forgeries are written with no knowledge of the appearance of the original, just writing off the top of your head and passing it off as something else.

Lifted forgery: The final type of forgery is a lifted forgery, in which sticky type is used to lift a signature from one document and place it on another. Freehand forgars are the easiest to detect. Simulation counterfeits are also easy to detect for several reasons: They are.

• It is very difficult to copy someone else’s handwriting.

• They style will not be as fluid because the writing does not come naturally.

• The forged writing will show tremors, hesitations and other variations in letter quality that ‘comfortable’ handwriting’t has.

• Traced counterfeits and lifts are easy enough to detect but the identity of the forger cannot be easily determined.

Forensic science usage: Every person who writes has unique characteristics. Handwriting analysis looks at letter formations, connecting strokes between the letter’s upstrokes, retraces, downstrokes, spacing, baseline, curves, size, distortions, hesitations and several other characteristics of handwritten. By examining these details and variations in a possible piece of evidence and comparing them to a sample of known authorship, forensic scientists can say whether the samples were written by the same person.

Handwriting analysis: True handwritten analysis involves careful examination of the design, shape and structure of the handwriting to determine who wrote it. The basic principle of handwriting analysis is that no drag people write something the same way. Handwriting analysis is useful in a range of circumstances. These include:

• Forging bank cheques and withdrawal forms.

• The deliberate alteration of business records and receipts.

• Threatening letters and ransom notes.

• The suicide notes.

Activity: How good a forger you are:

• Your name on a blank piece of paper as you world sign a receipt or some other document.

• Have several friends do the same. And swap apers. Take a few minutes and try to forge each other’s signatures.

• Even more difficult, collect some writing samples from a classmate and try to forge a paragraph of their writing. Share the paragraph and the original samples. Can anyone say that the paragraph is a fake?

Sample collections: Summary of the most essential factors for the researcher to remember.

Obtaining/Getting known writing: Handwriting identification depends on the quality of known writing: Handwritten examination begins with the investigator and the results obtained depend on how well the investigator does the job in obtaining handwritten from suspected known writing for comparison with questioned disputed writing.

Comparable: Questioned and known specimens must be comparable: A’s cannot be compared with G’s John Jones cannot be compared with Samuel Hansen. The J’s must be compared with J's and the Ohn’s with ohn’s. Handwriting cannot be compared to hand printing.

Conditions: Approximate the questioned writing conditions:

• If handwritten-get handwritten known.

• If upper-case hand printing-get upper case printing.

• If written in pencil-get known writing in pencil.

• If ball-point ink-get acquainted with ball-point pen.

• If writing is on a check-get known writing on checks.

• If writing is on ruled paper-get known on ruling paper.

• If a counterfeit-get a copy of authentic signature.

Duplicate the wording: The writing instrument and the space on the paper available for writing.

Appropriate/Adequate: In obtaining dictated known writing, get enough for the document examiner to study the normal variations in that person’s writing. Get several specimens for each questioned document.

Do not let suspect see previous specimen-Remove from sight.

Do not let suspect copy questioned writing-Dict the wording to the suspect.

In obtaining dictated known writing, get enough for the document examiner to study the normal variations in that person’s writing. Get several specimens for each questioned document.

Sample analyzed: This document is part of a handwritten comparison chart produced for display in court. The left side of the photo contains cut out letters from a forged document. The right hand side shows matching elements taken from a letter known to have been written by the suspect. Take careful note of the small numbers that indicate the matching elements (Figure 3) [6].

Figure 3: Sample analyzed.

Methodology

This work will use the clustering technique to solve this problem employing image acquisition tools, image processing tools, training image, testing image and unsupervised machine learning technique [1].

Acquisition of image: This is the first step, which involves acquiring the test signature of the customer using preferably HD scanner to test documents.

Imaging processing: This involves various procedures to prepare the signature for feature extraction. The procedures are binarization, segmentation, morphological erosion and dilation and normalization.

Binaryization: This technique is a preliminary processing step that converts the signature image to bi-level format of black and white.

Verification: This is the final process of the signature verification system using a matching point of the feature descriptor predicted by the exhaustive k-nearest neighbour search method according to the equation. However, we recommend approximate k-nearest neighbour method can be used in a larger dataset.

The segmentation: This image processing technique is employed to map the regions, curves and graphological patterns of the signature image.

Morphological dilation and erosion: This technique applies structural element to the signature image, based on the style of the signature and thus create a resulting output of optical character image with similar pattern.

Image normalization: This procedure not only removes noise from the image but also brings the image to a range of intensity value that is normal for feature extraction process.

Feature of extraction: This process involves the dimensional reduction of the signature image into a compact feature vector (i and j) using Hough transform.

Significance of the study

This study will help us to, a) How to obtain a fixed sized vector representation for signatures of varied size, b) How the resolution of the scanned signature impact system performance, c) The impact of fine tuning representations to other operating conditions i.e., different acquisition protocols, signatures from people of different locations, by using transfer learning to other datasets, low number of samples per user for training. Presence of partial knowledge during training.

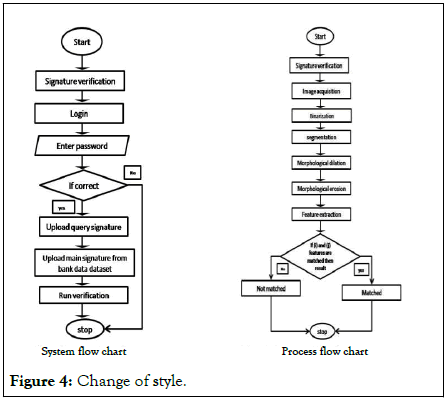

Change of style: This refers to the methodology by which the new system is introduced to banks. The parallel changeover style is suggested here for use since the banking system is already designed but lacks this verification technology [1]. According to, parallel method is applied when two systems are allowed to operate simultaneously. In this case, the existing system is still in use while the new system is introduced as a supplement (Figure 4).

Figure 4: Change of style.

Features of extraction: Features extraction is a very important role to play in signature recognition and verification system, features must provide significant difference to the classifier between genuine and forge signature and at the same time should be consistent between different signatures provided by the same signor [4].

Normalization of characteristics: After selecting the appropriate features from the signature, normalization is required as certain features magnitude are very high greater than 100 but at the same time some features have very small magnitude so, if the classification process done without normalization of features, then certain features whose magnitude is large are become dominant.

Classification: After features extraction and normalization certain type of classification process is required in many researches different types of classification system are designed SVM (Support Vector Machine), HMM (Hidden Markov mMdel), VQ (Vector Quantization), backpropagation neural network (Figure 5) [7].

Figure 5: System analysing flow chart.

Digital signature verification models: There are two possibilities, sign then encrypt and encrypt then sign. The receiver after receiving the encrypted data and signature on it, first verifies the signature using sender's public key. After ensuring the validity of the signature, he then retrieves the data through decryption using his private key [8].

Software solution for DSVS: Now a days most of the transaction sectors verifying digital signature through software. Some of the leading software details are given below (Table 2).

| S. no | Software and App |

|---|---|

| 1 | Abode Sign |

| 2 | DigiSigner |

| 3 | eSignlive |

| 4 | DocuSign |

| 5 | Signo |

| 6 | Thunder Sign |

| 7 | DigiTech |

| 8 | TravicSign |

| 9 | CoinsDo |

| 10 | Smartwaiver |

Table 2: Software and Appls.

Mathematical models: In this paper, the offline signature verification is proposed, block diagram of the whole system. In this model’s system uses neural network for verification and using general back propagation optimization method for training the neural network. For the first the signature from 6 different uses is taken on blank paper and convert that signature to digital image of jpg format and then applying pre-processing of the image for removing the noise from the image and then convert this noise free image into fixed size binary image of 200×200 pixels. After converting the image into binary image and then invert the image for more detail result then different features of that image are extracted from that image these features are as follows:

Skewness: Skewness is a measure of symmetry. A distribution or data set, is symmetric if it looks same to the left and right of the centre point. Skewness is a measurement of the distortion of symmetrical distribution or asymmetry in a data set. Skewness is demonstrated on a bell curve when data points are not distributed symmetrically to the left and right sides of the median on a bell curve.

Where the mean, s is the standard deviation and N is the number of data points. This formula for skewness is called Fisher Pearson coefficient of skewness. The skewness for a normal distribution is zero and any symmetric data should have a skewness near zero. Negative values for the skewness represent that data on which the skewness is calculated is skewed left and positive values indicate that data are skewed right.

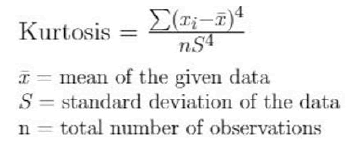

Kurtosis: It is a measure of the probability distribution of any real valued random variable. Kurtosis is a measure of shape of a probability distribution and just like skewness, there are different ways of calculating it for a theoretical distribution and corresponding ways of estimating it from a sample of a given population.

As we already know, skewness is the fourth moment of a distribution. The second moment of a distribution is its variance which will help simplify the equations.

Moment: Moments are scalar quantities used to characterize a function and to capture its significant features. Many types of moments are there and are widely used in statistics for description of the shape of a probability density function. General moment consider a grey-scale image g (x, y) of width w and height h and pixels values in the range 0-255. Geometric moments of a p+qth order of f.

Central moment: Central moment is a moment of a probability distribution of a random variable about the random variable's mean. The rth moment of any point A is called a central moment; it is the expected value of a specified integer power of the deviation of the random variable from the mean.

Entropy: Entropy is a measure of randomness of the pixels that can be used to characterize the texture features of the input image in digital image processing. Entropy is defined as sum (p.*log2 (p)) where p contains the histogram counts.

Mean: It is used to calculate the mean of all the white pixels in image and it can be useful as a feature of image because every signature has different lengths so total white pixels is also different.

The proposed work

Outline system overview: This figure shows the implementation process of the signature verification method [5]. The first is data acquisition. The offline image and online data of the signature are simultaneously obtained through the smart pen and the quality of the signature data is improved through pre-processing and feature extraction to ensure the accuracy of the verification result. For offline images and online data, SVM and DTW were used for verification and two scores score 1 and score 2 were obtained. Finally, the result of fusing offline and online features is obtained through SF-A (Figures 6 and 7).

Figure 6: System overview.

Figure 7: Signature identification.

Judgement orders

Supreme Court Bench of AM Khanwilkar and Dinesh Maheswari JJ has held that for invoking section 17 of the Limitation Act 1963, tow ingredients i.e., existence of a fraud and discovery of such fraud, must be pleaded and duly proved and that in case of failure to establish the existence of fraud, there is no occasion for its discovery [9].

Background of the case: The disputes dating back to 1990 pertains to a General Power of Attorney (GPA) purported to have been executed by the plaintiff in favour of defendant no.1 and consequently sale deeds executed by defendant no.1 as an attorney of the plaintiff. However, according to the plaintiff, reposing complete trust in her stepbrothers to stepbrothers, she had signed on blank papers under the guise of preparation and processing of documents for the propose of getting the estate left behind by their father mutated in their names. After analysing the evidence on record, the trail court dismissed the suit filed by the plaintiff and this order was upheld by the appellate court. The high court, however, reversed the concurrent opinions of two courts and held that the trail court as well as the first appellate court committed manifest error and misapplied the settled legal position. Challenging the high court decision before the supreme court, the defendants argued that interference by the high court was unwarranted as the same did not involve any substantial question of law. On merits, the aforesaid defendants contended that the evidence of the plaintiff was selfcontradictory, as she first claimed that her signature were taken on blank papers and then denied her signature occurring on the 1990 GPA. The plea that the signatures were taken on blank papers was not substantiated as the 1990 GPA was executed on stamp papers.

Analysis: The court held that the diverse grounds urged by the plaintiff in disputing the 1990 GPA and the sale deeds were unsubstantiated and untenable. Here are the key factors taken into consideration by the court.

• As the record revealed that the disputed documents were registered, the court, guided by the settled legal principle that a document is presumed to be genuine it the same is registered, was of the opinion that the initial onus was on the plaintiff, who had challenged the stated registered document.

• As the execuiton of the 1990 GPA and the sale deeds in the present cases was denied by the plaintiff, it became necessary for the plaintiff ot examine the attesting witnesses of the disputed documents to establish her allegation about its nonexecution, however, both the attesting witnesses were not examined.

The trail court had justly placed the initial burden of proof upon the palintiff as it was her case that the subject documents were forged or product of froud and moreso because the documents bore her signature. The first appellate court did not eloborate on that aspect even assuming the the burden had shifted upon the defendonts, the witness identifying singnatures of the deed attesting witness was examined by the defendonts. Therefore, the documents stood proved and the burden was duly discharged by the defendants.

The evidence of plaintiffs deed writed (PW$) unveiled that the stated documents were prepared on the basis of instrucitons of the plaintiff and had been duly executed by her in the presence of the attesting witnesses.

The trail court and the first oppellote court had relied upon the evidence of PW$. The high court, however, proceeded on surmises and conuecture and took a view which is perverse and tenuous. In that, the ground on which the high court rejected the evidence of PW$ is that he was known to the defendant No. 4 since his school days. We do not find it to be a correct approach to disregard the credible testimoney of the witness examined by the plaintiff herself (without declaring him as a hostile witness) at the instance of the plaintiff and as such, this port of his testimony would be storing at the plaintiff.

Since the attesting witness had proved the execution of the sale deeds, the primary onus upon the plaintiff had not shifted unto the defendatns. Further, the plaintiff was obliged to rebut the prositive evideance produced by the defendants regarding payment of consideration amount to the plaintiff, but also ought to have independently proved her case of non-receipt of the consideration amount.

Ruling: Concluding that the plaintiff failed to prove that her signatures on the subject document are forged, the court reiterated that the standard of proof required in a civil dispute is preponderance of probabilities and not beyound reasonable doubt. In the present cases, thought the discrepancies in the 1990 GPA are bound to create some doubt, however, in absence of any tangible evidence producted by the plaintiff to support the plea of fraud, it does not take the matter further, rather, in this case the testimony of the attesting witness, scribe and other independent witness plainly support the case of the efeendants. That evidnec dispuls the doubt if any, and tilt the balance in favour of the defendants [10].

Case of law

In Marketlend Pty Ltd v. Blackburn: Illustrates how fraud manifests itself in the context of electronic document execution and how the risk might be reduced. Marketlend provided the cash to a small business that sells mobile homes and residential vans, on the condition that the return would be guaranteed by the company’s directors, Matthew and Sarah. Matthew and Sarah were married, but they were no longer together. Marketlend required that agreements be signed electronically using DocuSign. Both Sarah and Matthew had DocuSign accounts. DocuSign, Inc. is an American company headquartered in San Francisco, California, that allows organizations to manage electronic agreements. Marketlend used the DocuSign platform to send many emails to Matthew’s company’s email address, each with a document attachment. Sarah allegedly used DocuSign to sign each document. Marketland had had no prior contact with Sarah. Matthew was declared bankrupt after the company went into insolvency. Sarah was chased by Marketlend for the remaining cash (almost $ 700,000). The court concluded that Matthew exploited Sarah’s account to sign the agreement without her knowledge or consent because she did not sign it when he asked her to. The evidence included DocuSign metadata and mobile phone location information. Sarah was not obligated to pay Marketlend the outstanding balance [11].

Barwick v Geico: 2011 Arkansas case where someone who applied for vehicle insurance on the internet was given a policy by Geico. The applicant waived medical benefits coverage as part of the application procedure and electronically signed a document to that effect. Arkansas law at the time stated that medical benefits coverage could only be denied ‘in writing.’ Arkansas, on the other hand, had already implemented the UETA when the application was filed. The applicant was driving the insured vehicle when it was struck by another vehicle. Geico denied their claim when they provided medical bills under the coverage. When Barwick sued, Geico cited the applicant’s acknowledgment of signing an electronic renunciation of coverage. However, the plaintiff contended that the waiver was ineffective because it was not in writing, as required by law. The court agreed with Geico and a higher court upheld the decision, citing Arkansas’ UETA implementation as support.

Misuse of digital signature

Digital signature is a tool for authenticating precious documents. It is handy and feasible, but misuse of a digital nature can create major issues from forgery and fraud (Figure 8).

Figure 8: Digital signature.

India is a country with a high number of internet users and a growing digital economy. However, the use of digital signatures in India is still not widespread and there are proports of misuse of digital signature. A digital signature is basically an electronic signature that can be used to verify the identity of the sender of a message or document. In India, the use of digital signature is regulated by the Information Technology Act 2000. However, there have been reports of misuse of digital signatures in India. For instance, in May 2017, it was reported that around 10,000 tax returns had been filed using forged digital signatures. In another instance, in Nov 2017 it was reported that a fake website was created using a digital signature belonging to the Prime Minister’s Office. The misuse of digital signatures can have serious consequences, as it can lead to fraud and identity theft. It is important for users to be aware of the risks associated with the use of digital signatures and to take measures to protect their own signatures [12].

Meaning of digital signatures

DSC Digital Signature Certificate online is a computer generated file that would be issued by a certifying authority (Pant sign CA, Safes crypt, e Mudra, Capricorn, Veasy’s. (n) Code Solutions, InDesign CA) on submission of the required documents, Nowadays, due to this handy tool, we can process online applications or return filing easily and effectively.

Functions of digital signatures

Digital Signature Certificate (DSC) can be used for authenticating any document digitally, i.e., by signing the document digitally. We must obtain a digital signature based on individual requirements and it has the following three classes (Table 3).

| Classes of DSC | Functions | Examples |

|---|---|---|

| Class 1 | These provide a basic level of assurance that the information provided in the application matches with the well-recognized consumer database i.e., the certifying authority. It is not used for document validation or signing a document | Testing purposes i.e., verifying the contact details of a person |

| Class 2 | The assurance provided by these certificates is relevant in an environment where the risk of data assurance is moderate, i.e., It involves a substantial amount of monetary risk. It is used to validate a document and holds validity to signing documents digitally | GST return filings. Income tax return filing. Provident funds filings etc. |

| Class 3 | This signature provides a high level of assurance with involves a high probability of fraud risk. These certificates are issued only on personal or physical appearance | Tender filing, e-binding etc. |

Table 3: Functions of digital signatures.

Legal consequences of misuse of a digital signature certificate

Information Technology Act 2000: Section 66C Punishment for identity theft: A person who acts fraudulently or dishonestly and makes use of the electronic signature, password or any other unique identification feature of any other person, shall be punished with imprisonment of either description for a term which may extend to three years and shall also be liable to a fine which may extend up to rupees one lakh.

Section 71: Misrepresentation of suppression of material fact to obtain any license or electronic signature: It is applicable in the following situations:

• If a person makes a misrepresentation to the controller or the certifying authority.

• If a person suppresses any material fact from the controller or the certifying authority.

Such misrepresentaiton or suppression of material fact only with the intent to obtain any license or electronic certificate from the controller or the certifying authroity is punishabel with imprisonment of up to two years and a fine which may extend up to rupees one lakh. The inforamtion to be provided to the controller or the certifying authority should be proper and correct. The presentaiton of wrong, incorrect or false information is an offence under section 71 of the act.

Section 73: Publication of electronic signature, which is false in certain particulars. The following situations shall amount to the publication of false particulars in an electronic certificate:

• Publication of electonic signature certifiat which the certifying authroity has not issued.

• Publication of electronic signature certificate which actual subscriber of the certificate has not accepted.

• Publication of the electronic signature certificate which is revoked or suspened.

Section 74: Information Technology Act 2000: Punishes the creation, publication or providing of an electronic signature certifiate for fradulent or unlawful prupose with imprisonment for a term which may extend up to two years or a fine which may extend upto one lakh. https://legislative.gov.in/actsoofparliamentfromtheyear/ inforamtion-technologyact- 2000/

The Indian Penal Code (IPC) 1860: Section 463 of INP 1860- Forgery. Whoever makes any false documents or false electronic record or part of a document or electronic record, with intent to cause damage or injury, to the public or any person or to support any claim or title, or to cause any person to part whith property or to enter into any express or implied contract or with intent to commit fraud or that fraud may be committed, commits forgery.

An explanation for section 463: Where any person either fradulently or dishonestly made, signed, sealed, executed or transmitted a document or electronic record or its part thereof affixed with an electronic signaute.

Where any person without proper authentiacation alters any docuemt or any record maintained electronically or materially its part thereof, executed or affixed with electronic signature either by himself or by any other prerson, whether such person is alive or dead at the time of such alternation.

Where any person acts in a fraudulent or dishonest manner by sign, sealing, executing or altering a document or an electronic record or affixing his or her lectronic signature on any electronic record knowing that such person is of unsound mind and the person is unaware about the contents of the signed document or the type of lateration made.

Section 465 of the INP 1860 punishment for forgery, whoever commits forgery shall be punished with imprisonment of either description for a term which may extend to two years or with a fine or with both. This offense is biable and triable by the Magistrate first class.

Safety measures to avoid misuse of digital signature

DSC is a facilitative tool but alos comes with a high risk. Following are some measures: Any person should keep the physical custody of the token whith himslelf/herself. If we are signing any document on behald of our client, we should first obtain an authorization letter. We should proceed further with it, eg. A pradcticing chartered accountant signing ITR or other GST returns on behalf of their client because practically, it is not possible to obtain custody of the take at every time of filing there might be a clash of timings. So they should obtain an authroization letter along with its custody.

A myth about digital signature

There is a myth about digital signature revolving among us that signing on a paper and simply scanning it is a digital signature, but this is wrong and might lead to fraud with an unknown person. In actuality, the digital signature is a token generated by the certifying authroity on an application made to them. This token signs the document with the utility of the respective platform.

The misuse of digital signature is a major problem in India and global level also. There are many ways in which people can misuse them and this can have serious consequences. It is important to be aware of the ways in which digital signatures can be misused and to take steps to prevent this from happening [13].

• How can I register for digital signature certificate.

• How can you create a digital signature.

Need for the study

Digital signature verification is a form of identity verification. It works by determining whether a person’s signature is genuine according to past iterations. The signature or its image is fed into signature verification software and compared to the image on file. The study is conducted to know the requirements of digital signature, digital signature acceptance documentation evidence, digital signature certificate, purposes of digital signature, importance goals of information security and prevention by cyber security. Digital signature certificates ensure that businesses save on cost and time with documents and contracts signed. There are huge savings in cost and time especially when the person is required to sign from a different place. The three main purpose of digital signature are used to meet important goals of information security, they are integrity, authentication and non-repudiation. Lastly the security protection against forgery by cyber security. A digital signature is a cryptographic output sued to verify the authenticity of data. A digital signature algorithm allows for two distinct operations, a signing operation, which uses a signing key to produce a signature over raw data.

Requirement for digital signature: Indian individual, bank account passbook, statement containing the photograph and signed by an individual with attestation by the concerned bank official, photo ID card issued by the ministry of home affairs of centre/state government and any government issued photo identity having name and address [14].

Review of related literature

Salem and Kovari: In this work, we studied the effect of the sampling rate of the input devices used for signature acquisition and the number of sample points on the accuracy of online signature verification systems [10]. The researchers proposed online signature verification based on signer dependent sampling frequency and DTW. Several configurations of a DTW-based verification system were used to assess the achievable EER at different sampling rates. Altogether, we conducted 2800 different experiments, which helped generalize the results regardless of the effect of other factors that may affect the system’s accuracy. To our knowledge, these properties have never been studied within the scope of online signature verification. The results showed that most of the best results could be obtained using a sampling frequency between 15 and 50 Hz and a sample count between 60 and 240 points. Using frequencies lower than these ranges greatly decreased the accuracy, whereas using higher frequencies decreased or did not affect the accuracy in 92.5% of the configurations of all databases acquired between 100 and 200 Hz. For these databases, 91.25% of the best results were obtained using a sampling frequency of less than or equal to 50 Hz and 93% of less than or equal to 75 Hz. The results showed that using the optimal frequency provides competitive systems for online signature verification. These results are auspicious and suggest that DTW-based online signature verifiers can be improved in the future by using different criteria for choosing the best sampling frequency for each signer.

Sharif and Khan: Biometric verification is a method of identifying the persons by their individualities or traits. Signature verification is the most generally used biometric to maintain human privacy. It is used in many areas as banking, access control, e-business etc and equally important in financial transactions. Research has progressed greatly in the area of signature verification but still, it is hard to discriminate between genuine signatures and skilled forgeries. Based on the idea of best features selection, a novel technique is introduced in this article for an offline verification system [14]. The presented system consists of four major steps: Preprocessing, features extraction, features selection and feature verification. Global features in the proposed work comprise of aspect ratio, the area of signature, pure width, pure height and normalized actual signature height. Local features consist of signature centroid, slope, angle and distance. In features selection component, a genetic algorithm is utilized to find appropriate features set which are later on given to support vector machine for verification. For experimental analysis, the selected datasets are CEDAR, MCYT and GPDS synthetic. The performance of proposed algorithm is based on three accuracy measures as FAR, FRR and AER.

Eman Alajrami, et al.: In their paper revealed that, offline signature verification is not efficient and slow for many documents [9]. To overcome the drawbacks of offline signature verification, we have seen a growth in online biometric personal verification such as fingerprints, eye scan etc. created CNN model using python for offline signature and after training and validating and the accuracy of testing was 99.70%. Every person has his/her own unique signature that is used mainly for the purposes of personal identification and verification of important documents or legal transactions. There are two kinds of signature verification: Static and dynamic. Static of off-line verification is the process of verifying an electronic or document signature after it has been made, while dynamic on-line verification takes place as a person creates his/her signature on a digital tablet or a similar device [15].

The RBI Ombudsman scheme for digital transactions: Defines digital transactions as “a payment transaction in a seamless system effected without the need for cash at least in one of the two legs, if not in both. This includes transactions made through digital/electronic modes wherein both the originator and the beneficiary use digital/electronic medium to send or receive money”. However, in our paper, a digital transaction is one where the payer and payee both use digital modes of payment. Policies in many parts of the world are being designed in favour of non-cash payments because of the various problems that cash poses. Cash fuels the parallel or black economy, therefore, phasing it out might solve this problem, especially with large denomination notes. The cost of printing, destroying and other cash related operational expenses in India are estimated at 1.7% of GDP. Cash, however, remains a significant part of all the transactions in most countries. They reveal that the choice of payment method is impacted by a host of consumer specific and technological factors. Transaction size has a significant impact on what mode of payment people choose. A cross-country comparison of payment diary survey data of seven countries showed that cash was the preferred mode of payment for smallest 50% and largest 25% of transactions. In another study, social marginal costs were computed for various instruments for small and large transaction sizes and it was found that for larger transaction sizes, there were significant differences in cost for electronic vs. non-electronic payments.

Shin J and Junichi Sato: In this paper, we propose to reject the possibility to accept the login by someone else, which is not by him or herself at multiuser online Kanji learning system with signature verification. Human’s signature is one of the human’s biometrics. Biometrics includes very personal information and characteristics of usefulness because it is human are looking or behaviour feature. By signature verification, we could verify the writer is proper or not with human’s writing behaviour, so dishonest writer will be rejected. Using signature verification as self-verification at the system, we could consider two advantages [13]. One advantage is advancement of security which will cause from deterrent of someone else’s scamming. The other advantage is advancement of usefulness which will cause from decrease of the number of using input device, only pen device will be need to handle the system. We adopt signature verification as calculating similarity by using some reference signature and the distance which will calculated by DP matching in this research. Input signature’s self-similarity will be calculated by dividing the average distance between input and each reference signature data with average distance between each reference signature data. From signature verification’s experimental results which changes using features, we adopted to use writing velocity and writing speed differential as using feature to verify the writer for the system. By using signature database which is construct with 20 genuine signatures and 20 forged signatures with 40 writers and written mostly by English or Chinese literal, experimental results of signature verification records 12.71% as maximum EER, 6.00% as minimum EER and 8.22% as average EER. Furthermore, when we establish the threshold as constant, to simulate the signature verification function is implement in actual running system, average of FRR records 10.29% and FAR records 9.72%. From mentioned above, we realized to advance the reliability and usefulness of the multiuser online Kanji learning system [16].

Saeidi M, et al.: Although signature verification is not the safest method of identification, it is extensively used in commercial affairs because of simplicity and ease of use. In this research paper after accomplishment of some pre-processing procedures like normalization of signature size, smoothing and elimination of rotation on signatures using algorithms based on extremum matching of signals and ant colony, their time duration will be equalized. Afterwards, similarities between signatures will be determined using extended regression and finally will try to distinguish between forgery signatures from genuine one using Support Vector Machine (SVM). The suggested online verification system is tested on SVC2004 signature set which is related to the first international signature verification competition and results are compared to respective results of participants [13]. The results state that suggested method exhibits Equal Error Rate (EER) 4.3% of in skilled forger group. From their research its shows that majority of them using digital signature verification system for their future process.

Objectives

Serious fraud investigation office: SFIO is a multi-disciplinary organization under Ministry of Corporate Affairs, consisting of experts in the field of accountancy, forensic auditing, law, information technology, investigation, company law, capital market and taxation of detecting and prosecuting or recommending for prosecution white-collar crimes or frauds.

Objectives: Take up for investigation cases characterized by complexity and having inter-departmental and multi-disciplinary ramifications. Substantial involvement of public interest to be judged by size, either in terms of monetary the possibility of investigation leading to or contributing towards a clear improvement in systems, laws, or procedures.

• Investigate serious cause of fraud received from department of company affairs.

• Investigate into the affairs of a company on receipt of the registrar or inspector under section 208 of the companies Act 2013.

• On intimation of a special resolution passed by a company that its affairs are required to be investigated in the public interest on request from any department of the central government or a state government.

• For more information visit serious fraud Investigation office.

Data analysis and hypothesis

Indian companies engaged in various business activities through online systems (Figures 9-12).

Figure 9: Data from Govt. of India Ministry of Corporate Affairs.

Figure 10: Data from Govt. of India Ministry of Corporate Affairs.

Figure 11: Foreign companies involved in various business activities in India 2022.

Figure 12: Data from Govt. of India Ministry of Corporate Affairs.

Data analysis

Review of meeting: Some of the salient review meetings were conducted with district and state cooperative banks, financial institutions (Tables 4-6 and Figures 13-15).

| Year | 2015-16 | 2016-17 | 2017-18 | 1018-19 | 2019-20 | 2020-21 | 2021-22 |

|---|---|---|---|---|---|---|---|

| Review meeting | 43 | 16 | 13 | 13 | 36 | 12 | 32 |

| Participants | 557 | 208 | 100 | 83 | 166 | 91 | 192 |

Table 4: Source of data from FIU-I.

| Type of reports | ||||

|---|---|---|---|---|

| Suspicious Transaction Reports (STR) | Cash Transaction Reports (CTR) | Cross Border Wire Transfer Reports (CBWTRs) | NPO Transaction Reports (NTRs) | Counterfeit Currency Reports (CCRs) |

Table 5: Data from FIU-I.

| Economic activity | Private | Public | Total | |||

|---|---|---|---|---|---|---|

| Number | Paid up capital | Number | Paid up capital | Number | Paid up capital | |

| Agriculture and allied activities | 64,793 | 22,413.27 | 2,257 | 17,625.80 | 67,050 | 40,039.07 |

| Industry | 434,919 | 874,391.32 | 24,241 | 1,886,364.44 | 459,160 | 2,760,755.76 |

| Manufacturing | 293,388 | 560,790.58 | 17,655 | 720,866.69 | 311,043 | 1,281,657.27 |

| Metals and chemicals and products thereof | 100,090 | 217,662.37 | 7,639 | 247,215.28 | 107,729 | 464,877.65 |

| Machinery and equipments | 68,315 | 221,517.01 | 3,362 | 382,869.86 | 71,677 | 604,386.87 |

| Textler | 36,239 | 34,539.40 | 2,524 | 34,957.95 | 38,763 | 69,497.34 |

| Food stuffs | 46,899 | 49,121.89 | 2,467 | 31,471.57 | 49,366 | 80,593.46 |

| Paper a paper products publishing printing and reproduction of recorded media | 17,707 | 14,496.51 | 798 | 9,987.09 | 18,505 | 24,483.60 |

| Others | 17,700 | 17,757.49 | 505 | 12,094.86 | 18,205 | 29,852.35 |

| Leather and products thereof | 3,390 | 3,129.11 | 184 | 1,070.62 | 3,574 | 4,199.73 |

| Wood products | 3,048 | 2,566.80 | 176 | 1,199.48 | 3,224 | 3,766.28 |

| Construction | 113,918 | 147,860.52 | 4,112 | 230,636.36 | 118,030 | 378,496.88 |

| Electricity gas and water supply companies | 15,078 | 133,724.23 | 1,776 | 879,720.49 | 16,854 | 1,013,444.71 |

| Mining quarrying | 12,535 | 32,016.00 | 698 | 55,140.90 | 13,233 | 87,156.90 |

| Services | 924,074 | 978,949.61 | 42,583 | 1,321,706.34 | 966,657 | 2,300,655.95 |

| Business services | 441,076 | 436,524.88 | 9,611 | 615,983.34 | 450,687 | 1,052,508.22 |

| Trading | 184,571 | 220,847.26 | 5,540 | 54,391.30 | 190,111 | 275,238.56 |

| Real estate and renting | 74,213 | 81,730.40 | 2,551 | 22,675.74 | 76,764 | 104,406.14 |

| Community personal and social services | 131,905 | 72,220.50 | 4,181 | 116,824.47 | 136,086 | 189,044.97 |

| Finance | 44,243 | 109,211.33 | 19,101 | 299,323.50 | 63,344 | 408,534.83 |

| Transport storage and communications | 46,904 | 56,485.03 | 1,452 | 169,517.35 | 48,356 | 226,002.38 |

| Insurance | 1,162 | 1,930.21 | 147 | 42,990.64 | 1,309 | 44,920.85 |

| Others | 11,255 | 18,116.34 | 2,219 | 70,774.50 | 13,474 | 88,890.84 |

| Total | 1,435,041 | 1,893,870.53 | 71,300 | 3,296,471.08 | 1,506,341 | 5,190,341.61 |

Table 6: Online transaction use of economic activity.

Figure 13: Transaction of use: FIU-India partners.

Figure 14: Digital transactions: Data from FIU-I.

Figure 15: Number of digital counterfeiting incidents across India in 2021 by leading state.

Testing the hypothesis: From this study of research reveals that its null hypothesis. So, the online transaction is very helpful and most of the user is satisfied with these facilities and it would have good future with safety monitoring systems (Table 7 and Figure 16).

| Service | Satisfied | % |

|---|---|---|

| Good | 673 | 95 |

| Bad | 37 | 5 |

| Total | 710 | 100 |

Table 7: User satisfaction with online services.

Figure 16: Awareness, frequency of use digital payment problem with percentage-data from IRRBT.

Purpose of the study: The purpose of this study citation methods has been adopted 93 research articles has been cited by the researchers in global level and 25 other websites have been published various disputes related to the signature fraud and online transactions technologies by the fraudulent acquests in the different modes of digital payment systems. Our study aims are understanding the impact of user satisfaction level, trust in payment systems, experience in online fraud, awareness about digital signature and online banking. Statistical tools have been used at various levels for testing hypothesis being tested at various stages. The research analysis of various baselines modes to utilize the transaction facilities i.e., paying cash, digital transactions and others.

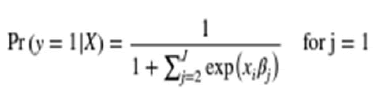

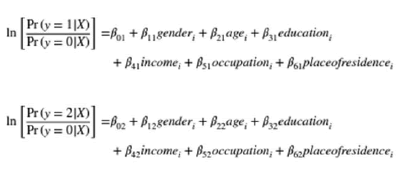

Parameter model used to know the usage by the utilizers. The model has j=1, 2 …. J categories for the dependent variable y and x are the matrix of independent variables. In a multinomial logit model, estimate a set of coefficients βj=(β1, β2) corresponding to each outcome j. Setting j=1 as the reference or base category (i.e., β1=0).

In these categorical independent variables, the following multinomial logistic model is estimated. The dependent variable is coded as:

y=0 for cash reference

y=1 for digital payments

y=2 for some times cas flow in other payment mode

Role of the Reserve Bank of India in fraud by banks

The committee is required to examine the role of the reserve bank of India regarding frauds reported by banks. The committee has examined the position obtaining in respect of commercial banks (other than Regional Rural Banks) in this regard. It is observed that the Reserve Bank of India has a comprehensive reporting mechanism whereby all banks are required to report actual/suspected frauds either to the central office or regional offices of the Department of Banking Supervision (DBS) of RBI. The banks are required to report all actual/suspected frauds more than Rs. 1 lakh each to the Regional Offices of DBS with full particulars in the prescribed proforma as soon as such frauds come to their notice but within three weeks of detection. The central office of DBS receives individual reports on actual/suspected frauds of Rs.1 crore and above and in respect of frauds by unscrupulous borrowers involving an amount of Rs.5 lakh and above. The fraud reports are required to indicate, among other things, the modus operandi of the fraud, amount involved, the amount of expected loss and chances of recovery, staff involvement and the action taken against the delinquent members of the staff. Cases of individual frauds involving amounts up to Rs.1 lakh each are not required to be reported individually. The banks are, however, required to report such frauds in a consolidated form category wise on a quarterly basis in the prescribed format. Besides, to enable Reserve Bank of India and the Government of India to have full information about the incidence of frauds and the action taken by banks to prevent them, the banks are required to furnish to RBI certain statements on quarterly/half-yearly basis. While quarterly statements deal with further developments in respect of frauds reported to RBI, half-yearly statement on frauds is required to indicate the stage of Police/CBI investigation as well as the recoveries made. Quarterly statements are also required to be sent by the banks on frauds outstanding and closed during the quarter. Besides, there are reporting systems in place for following up vigilance aspects in the public sector banks [17].

The above reporting system seems to have been designed to serve the following objectives:

• To examine new modus operandi, if any, adopted in respect of a fraud and circulate the same among banks.

• To issue caution advice to banks giving details of unscrupulous borrowers so that they will be careful while dealing with such borrowers.

• To ensure that banks have taken prompt steps to recover their dues and have reported to fraud cases to CBI/Police.

• To collate date relating to frauds and vigilance cases to report to the Board for Financial Supervision.

• To consolidate data pertaining to frauds/vigilance cases (in respect of public sector banks) to report to Government of India/Parliament from time to time. The committee feels that while violations of any regulation come within the purview of the regulator, any act of omission or commission by a bank or any of its employees or constituents or others attracts the provision(s) of a criminal law, it goes outside the purview of the regulator. The regulator has no further role to play. The committee is, therefore, of the view that the present system for monitoring fraud and its investigation is burdened by too many layers imposing large regulatory costs on the banks. Furthermore, it is felt that rather than following up each individual case of fraud, the RBI as a regulator/ supervisor should be more concerned about the systemic impact of such fraud. For instance, a fraud of Rs. 10 crore in a large public sector bank may not be of much regulatory/ supervisory concern; at the same time, a similar fraud in a small private sector bank may be of serious concern to the regulator/supervisor. It is, therefore, felt that the response of the RBI to such frauds should consider the whole picture. Furthermore, individual monitoring of frauds could be left to the banks themselves. A review of such monitoring could be made at the time of the periodical inspections of the banks. The investigating agencies, CBI and the police take unduly long time to complete the investigation and to close a case. In view of this, the RBI would be spreading its supervisory resources too thin if it were to follow up each individual fraud case up to its logical end. The committee is, therefore, of the view that the reporting system for frauds needs to be rationalized so that there is no duplication of efforts and that the reporting is done only in respect of information necessary for the Reserve Bank of India in exercising its regulatory/ supervisory responsibilities.

Credit transaction data registration and information sharing: In India there is no one law for credit transaction, no public registry and sharing of information. We follow the common law system of privity of contract. But there has been system reform in the home country of common law, but we have not changed. There is no one law for security interest creation, priority determination and enforcement. All these supplemented with no information sharing amongst the institutions and with the regulator concerned, cripple the financial service industry. Fraud is only the resultant action. Control, prevention and prohibition of financial fraud call for reform in both financial sector law and criminal law.

Recommendation for the future

The future work should address the challenges and issues involved in online sig nature verification and there is always a scope for new approach which may improve the performance, the future works may involve in exploring new features and new approaches which may be more effective in distinguishing forgeries from genuine signatures. There is a scope for reducing number of signatures required for training the model for reliable authentication. Comparison techniques LCSS and DTW can be used in combinations with other classifier models like HMM MLP model, SVM and other NN models. These classifier models can also be used in combination with other distancebased approaches like edit distance, Euclidean, city block distance computation techniques [18].

The RBI recommendation

Prologue: The committee, in its critical review of the system as obtained presently, observed two very wide systemic gaps in the law and practice in dealings of the banks and financial institutions with the public frauds. These systemic gaps are as follows: Firstly, wide gap in the law and practice of banking law and practice. As for example:

• No clear and certain best practice code in the organization.

• Weak internalization system of the rule of law being the best practices in the organization and management.

• No discipline in the use of discretionary power to be used in the manner and circumstances as laid down.

• No appreciation of administrative law to use discretionary power as being the judging power that involves decision and reasoning to be well documented and

• No institutional plan for the judging power to be linked with incentive and promotional system in the organization.

Secondly, the poverty in the criminal jurisprudence is also very apparent in India. Many jurists argued for a long time that criminal law in India is heavily class biased. Absence of financial fraud in the list of offences in the penal code is evidence that ‘white collar crime’ is treated differently in India with all leniencies. The committee has, therefore, prepared its suggestions in two parts.

Part I: Deals with the preventive aspects of management of financial fraud to keep it happen only in rare cases. This part suggests steps to contain a clean in-house financial management.

Part II: Deals with prohibition of financial fraud and introduction of a deterrent jurisprudence so that financial fraud, being a serious offence to derail a system, is adequately and firmly dealt with.

Bank fraud

Fraud is any dishonest act and behaviour by which one person gains or intends to gain advantage over another person. Fraud causes loss to the victim directly or indirectly. Fraud has not been described or discussed clearly in The Indian penal code but sections dealing with cheating, concealment, forgery counterfeiting and breach of trust has been discussing which leads to the act of fraud. In contractual term as described in the Indian contract act, sec 17 suggests that a fraud means and includes any of the acts by apart to a contract or with his connivance or by his agents with the intention to deceive another party or his agent or to induce him to enter a contract. Banking frauds constitute. Banking frauds constitute a considerable percentage of white collar offences being probed by the police. Unlike ordinary thefts and robberies, the amount misappropriated in these crimes runs into lakhs and crores of rupees. Bank fraud is a federal crime in army countries, defined as planning to obtain property or money from any federally insured financial institution. It is sometimes considered a white collar crime.

The number of bank frauds in India is substantial. It in increasing with the passage of time. All the major operational areas in banking represent a good opportunity for fraudsters with growing incidence being reported under deposit, loan and inter-branch accounting transactions, including remittances. Bank fraud is a big business in today's world. With more educational qualifications, banking becoming impersonal and increase in banking sector have given rise to this white collar crime. In a survey made till 1997 bank frauds in nationalised banks was of Rs.497.60 crore. This banking fraud can be classified as:

• Fraud by insiders

• Fraud by others

Fraud by insiders

Rouge trader: A rogue trader is a highly placed insider nominally authorized to invest sizeable funds on behalf of the bank; this trader secretly makes progressively more aggressive and risky investments using the bank's money, when one investment goes bad, the rogue trader engages in further market speculation in the hope of a quick profit which would hide or cover the loss. Unfortunately, when one investment loss is piled onto another, the costs to the bank can reach into the hundreds of millions of rupees; there have even been cases in which a bank goes out of business due to market investment losses.

Fraudulent loans: One way to remove money from a bank is to take out a loan, a practice bankers would be more than willing to encourage if they know that the money will be repaid in full of interest. A fraudulent loan, however, is one in which the borrower is a business entity controlled by a dishonest bank officer or an accomplice; the "borrower" then declares bankruptcy or vanishes and the money is gone. The borrower may even be a non-existent entity and the loan merely an artifice to conceal a theft of a large sum of money from the bank.

Wire fraud: Wire transfer networks such as the international, interbank fund transfer system are tempting as targets as a transfer, once made, is difficult or impossible to reverse. As these networks are used by banks to settle accounts with each other, rapid or overnight wire transfer of large amounts of money are commonplace; while banks have put checks and balances in place, there is the risk that insiders may attempt to use fraudulent or forged documents which claim to request a bank depositor's money be wired to another bank, often an offshore account in some distant foreign country.

Fake or fraudulent documents: Forged documents are often used to conceal other thefts; banks tend to count their money meticulously so every penny must be accounted for. A document claiming that a sum of money has been borrowed as a loan, withdrawn by an individual depositor or transferred or invested can therefore be valuable to a thief who wishes to conceal the minor detail that the bank's money has in fact been stolen and is now gone.