Journal of Stock & Forex Trading

Open Access

ISSN: 2168-9458

ISSN: 2168-9458

Research Article - (2023)Volume 10, Issue 3

Due to scanty literature on the impact of technology on financial development in Sub-Saharan Africa via ICT, one can't help but wonder: How can technology influence the financial system in Sub-Saharan Africa? And which of the components of technology is a determining factor of financial development in this region?

Using Generalized Method of Moments (GMM) estimations to identify relationships between variables, this study examines the impact of technology on financial development in Sub-Saharan African countries from 2000 to 2021. By proving that fixed telephone services have an equalizing effect on financial development, the study adds to the body of knowledge on financial development. Mobile cellular subscriptions have also been shown to have a financial development equalizing effect. On the other side, secure internet servers have a negative equalizing effect on financial development. In order to focus resources into financial system growth, regulations aiming at upgrading fixed telephone services, mobile cellular subscriptions and secure internet servers should be supported.

Financial development; Information technology; Geography; Servers; Resources

The part of financial institutions in determining the expansion of any nation is gaining momentum in the recent years. According to Huang “among the profound evolutions in development economics in recent decades has been the renewed interest in and growing contributions on, the role of financial systems in economic development”. The development of the financial sector is critical to every country's economic prosperity, because via Increase in the savings rate, mobilizing and pooling money, creating investment information, enabling and promoting foreign capital inflows and improving capital allocation can all lead to economic improvement. Financial improvement and financial development can be used interchangeably, which means a process whereby the financial instruments, markets and intermediaries lower the controls of information, enforcement and costs of transactions, letting the financial sector to accomplish its key roles in the economy more effectively.

According to Alawadhi, et al. “financial development isn't just a by-product of economic expansion; it also helps to fuel it. Over extended periods, countries with more developed financial systems tend to expand quicker and a vast body of data implies that this influence is causal. It also decreases poverty and inequality by improving poor and vulnerable people's access to credit, enabling risk management by lowering their sensitivity to shocks and increasing investment and productivity, all of which result in greater income output” [1].

Most Sub-Saharan African countries' financial systems have shown signs of weakness and vulnerability, owing to deteriorating macroeconomic conditions as well as political interference in financial institution operations, negative real interest rate policies, a lack of required technology and directed credit policies. The world bank's figures, which indicate fluctuations in monetary sector’s credit to the private sector (percentage of GDP) in Sub-Saharan Africa, demonstrate this. It stood at 30.5 in 2000, but declined to 22.9 in 2003, then increased to 30.7 in 2008, but fell to 26.6 in 2020. These were exacerbated by structural flaws such as the lack of an appropriate legal framework to grant central banks independence in the pursuit of price stability; lack of necessary technology; weak operating procedures and the absence of effective instruments for market oriented monetary management; ineffective and non-competitive financial market structures; an inefficient bank regulatory and supervisory environment, partly due to a lack of supervisory autonomy and capacity; ineffective and non-competitive financial market structures.

Information and Communication Technology (ICT) is having an increasingly positive influence on the financial sector, increasing productivity and facilitating foreign investment. In addition, different nations create political and strategic relationships with one another, culminating in the formation of free economies.

As stated by Sassi, “In recent years, ICT has grown incongruent inside traditional systems in terms of boosting financial system efficiency. To match the strategic commerce of other countries, many developed countries improve ICT, business intelligence and business research. Through various innovation services, the information technology industry allows several industries to maintain a competitive advantage in the worldwide market” [2].

As cited in Alshubiri, et al., “Asongu, et al., the rise of the ICT sector in society has made it possible for many parts of corporate operations to communicate and perform commercial activities more efficiently through their digital networks. ICT has also considerably improved the efficiency of financial and economic company activities by resolving challenges connected to time limits and distance. Electronic finance has become one of the most significant tools for maintaining efficient internal control over financial reporting and the use of new financial apps has enhanced competitiveness in the communication sector. Because of the ICT sector's rapid worldwide growth, all countries must evaluate its causes, particularly in terms of financial applications” [3].

Financial technology and associated developments can aid Sub-Saharan African countries in improving their macroeconomic performance and broadening their economic base. Financial intermediation that is increased and more effective can help firms grow, especially if SMEs have greater access to financing. Furthermore, in economies dominated by the informal sector, new technologies might boost the incentives to formalize. Because they lack a well thought out development strategy, adequate budgetary resources and enough competent technical and management staff, the majority of Sub-Saharan African central banks are having a difficult time transitioning to a fully developed and well-functioning information technology environment.

Sub-Saharan Africa continues to encounter technological hurdles that must be addressed quickly if the financial sector is to contribute to the growth and rising per capita incomes in these nations.

For many years, several studies have focused on the likely factors of financial development. Much research has been conducted to see if macroeconomic policy variables may explain cross country differences in financial development. While some studies take into account institutions, geography and other factors, few studies have looked into the potential of technology as a factor that can influence financial development, particularly in Sub-Saharan African countries.

Information and Communication Technology (ICT) contributes to economic prosperity, yet many research works have ignored it as a determinant for financial development. Many pieces of literature capture the effect of many macroeconomic and institutional factors on financial development, yet no effort has been made to determine the technological features that suit financial development. According to Shehzad, et al., “ICT is described by the department for international development as technologies that facilitate contact and the processing and dissemination of knowledge through electronic means. Many studies have established the relationship between ICT and financial development. Some observed a positive correlation between economic development and phone usage while some focused on iPhone mobile applications and their impact on the social aspect”.

As a result of the limited works on the influence of technology via ICT on financial improvement in Sub Saharan Africa, one cannot but ask the following questions: How can technology influence Sub Saharan Africa's financial system; and which of the components of technology is a determining factor of financial development in this region?

Focus of the study: The primary focus of this study is to examine the effect of technology on financial development in Sub-Saharan Africa countries between the years 2000 to 2021. The specific focus is:

• To scrutinize the influence of economic factors on financial improvement in Sub-Saharan Africa.

• To examine the effect of technology on financial improvement in Sub-Saharan Africa countries.

Scope of study: This study is considering 29 Sub-Saharan African countries namely: Angola, Benin, Botswana, Burkina Faso, Burundi, Cape Verde, Cameroon, Chad, Comoros, Coted’Ivoire, Eritrea, Ethiopia, Gabon, Ghana, Lesotho, Kenya, Liberia, Malawi, Mali, Mozambique, Nigeria, Rwanda, Senegal, South-Africa, South-Sudan, Tanzania, Togo, Uganda and Zambia.

The time series data for this study is from 2010 to 2020 (10 years).

Theoretical literature

As cited by Samargandi, “the capital accumulation mechanism and the Total Factor Productivity (TFP) mechanism are two ways that financial development can affect growth. The capital accumulation mechanism, also known as the quantitative mechanism, is derived from Gurley and Shaw's "debt accumulation" idea. Individuals save from their disposable income and invest it in capital accumulation, which is how growth is formed. These savings can be invested in the productive sector as part of a financial growth strategy. As a result, it assists in the accumulation of capital and the expansion of the industry”.

He cited further, “Total Factor Productivity (TFP) stresses the significance of financial technology innovation in eliminating asymmetric information that obstructs effective financial resource allocation and project monitoring. A sound financial system also promotes the adoption of innovative technologies that boost efficiency. Most economists think about the connection between financial development and economic growth. Schumpeter, McKinnon, Shaw and more recently, King and Levine, provided the groundwork for the link between financial development and economic growth. They stress the importance of the financial system in improving intermediation efficiency by reducing transaction costs, information asymmetries and monitoring expenses, all of which contribute to increased economic development. Schumpeter was a pioneer in the field of banker-entrepreneur interaction, highlighting the need for financial institutions to embrace new technologies to spur economic growth. According to him, a well-functioning financial system leads to technical breakthroughs, which contribute to economic growth. Following that, McKinnon and Shaw suggest that capital markets with less regulation will boost savings, enhancing the quality and amount of investment and hence increasing economic growth”.

Levine looks at the relationship between financial sector efficiency, financial intermediation quality and economic development. The so-called functional approach has a big effect on Levine's entire philosophy. This strategy is centered on the link between the quality of financial sector functions and economic growth. Goldsmith was the first to do an empirical study of the link between financial development and economic growth. He concludes that the two have a strong and healthy bond.

“McKinnon and Shaw produced two financial liberalization models that show various aspects of the impact of rising interest rates. McKinnon's model is based on possible links between the deposit rate and the investment rate, whereas Shaw's model is based on functional correlations between lending and borrowing affairs. The method of raising finances is the primary distinction between the two techniques. Unlike McKinnon's outside money model, which assumes that all funds are raised domestically, Shaw's inside money model assumes that funds are replenished from outside sources. Because most projects require a mix of internal and external funding, the two models should be integrated. The McKinnon-Shaw model has major financial development implications. It offers the idea of unrestricted real interest that fluctuates in response to market conditions. Nonetheless, according to de Gregorio and Guidotti, who argue that high interest rates indicate a lack of confidence in economic policy and the banking system, as well as the adoption of riskier investment strategies, interest as a leading indicator of financial development, is widely chastised”.

Empirical literature

Majority of the empirical studies on financial development deal with the impact of macroeconomic variables on financial development.

Ehigiamusoe, et al., study the effects of macroeconomic stability on financial development in West Africa. The study used five indicators to determine macroeconomic stability. They are: Inflation, real exchange rate, government debt, fiscal deficit and real interest rate. Using dynamic models on panel data, the findings show that macroeconomic stability has an impact on the region's financial development.

Inflation, real exchange rate and budget deficit all have negative consequences, whereas government debt and real interest rates have positive effects. Inflation, real exchange rate and budget deficit all have negative consequences, whereas government debt and real interest rates have positive effects.

Some other experimental studies concentrated on the effect of financial improvement on economic growth. Acaravci, et al., explore the causal connection between economic improvement and financial development in Sub-Saharan Africa between 1975 and 2005 via the panel co-integration of causality and the panel [4].

GMM estimation, the results of the panel co-integration evaluation shows that: They are no long term courts between economic improvement and financial development. The observed results in the paper display a two way causal link between actual GDP growth per capita and domestic credit by banking zones for a panel of 24 Sub-Saharan African countries.

In a study carry out by Christopoulos and Tsionas, they used a cointegration analysis to determine if there was a long-term relationship between financial and economic growth in 10 developing countries between 1970 and 2000. Their results support a unique cointegration vector between growth, financial development, investment sharing and inflation and a one way causal relationship from financial depth to growth [5].

Ghirmay trying to find the causal link between the level of financial development and economic growth in 13 Sub-Saharan African countries, using Vector Auto Regression (VAR). The empirical results show the evidence of the existence of a long run relationship between financial development and economic growth in almost all of the countries under study. It is also revealed that financial development plays a causal role on economic growth. This finding suggests that African countries can quicken their economic development by improving their financial systems.

There is several literatures on the determinants of financial development. According to Ellahi, et al., “Ehigiamusoe, et al. discussed that macroeconomic stability is an essential determinant of financial development. The West African region study found that macroeconomic stability is an important factor, particularly for financial sector development”. The findings suggest that macroeconomic stability has an impact on the region's financial development while inflation, real exchange rate and budget deficit all have negative consequences, but government debt and real interest rates have favorable benefits.

According to Asratie, “Mbulawa opines that economic growth, trade openness and institutional issues all have a role in financial development. In 16 industrial nations, Hofmann looked at the factors that impact loans to the private non-bank sector. The actual interest rate, according to the author, has a negative influence on financial progress”.

Asratie continues, “According to Akinlo and Oni, the prime lending rate and reserve ratio induce a decline in private sector credit. Private credit to the private sector rises when inflation rises, while real bank lending to the private sector tends to fall [6]. Using the main component technique, Badeb and Lean analyzed the key factors of financial development in the Republic of Yemen. According to the study, economic growth and trade openness have a positive influence on the rate of financial development. Natural resource dependency has negative consequences. By means of an auto regressive distributed lag model, Takyi and Obeng revealed the influencing determinants of Ghana's financial development. Per capita income, trade openness and per capita income have a positive substantial influence on a country's financial performance, according to the model. It was also revealed that inflation and interest rates have a positive significant impact in both the short and long run, while commercial bank reserve requirements have a negative statistically significant impact in both the short and long run. Borrowing by the government, on the other hand, has no bearing”.

As cited in Baoko, et al., “Assefa investigated the short and long run effects of bank specific, monetary policy and macroeconomic variables on bank loans to the private sector in Ethiopia using a supply side technique. The rule has no long or short term impact on commercial banks' lending to the private sector, according to the author” [7].

“According to recent studies, the ICT sector has had a favorable impact due to the correlation between this sector and other economic activities such as transportation, electricity, investment, inflation and so on. Fixed investment has a beneficial impact on economic growth and investment in public sector infrastructure, such as ICT, also plays a key role in fostering economic activity growth. It should also be mentioned that low and middle income countries benefit from the ability to invest in economic activities”.

Ejemeyovw, et al., studies the interaction of Information and Communication Technology (ICT) adoption and innovation and the role of this digital interaction in financial development in Africa and sub-regions. The study uses the Bayesian Vector Auto Regression (BVAR) model to simulate impulse response function and variance decay across Africa. The study shows that the interaction shock of ICT innovation positively stimulates financial development.

As cited in Alshubiri, et al., “Chowdhury focused on whether investments in ICTs may lead to improvements in a company's performance. The study created a data collection for small and medium scale firms in two East African countries: Kenya and Tanzania, using three performance indicators: Internal rate of return, labor productivity and local and export market expansion. The conclusions of this study concluded that investments in ICT have a beneficial influence on overall market expansion, but have a negative impact on labor productivity and that such expenditures have no meaningful impact on the firm's return or exporter status. Romer claims that predicting long term economic growth based on an increase in the production margin leads to an improvement in input quality, which helps to establish a competitive advantage. This is seen in the use of technology, which is progressing faster in larger countries than in smaller countries. He also claims that the long term return trend is higher than the short term return trend.

ICT promotes the role of competition in the creation of new goods that help to build successful activities in a macroeconomic country's rise in labor and demand, as well as indirectly contribute to social revenues. Waverman, et al., argue that mobile and fixed line phones indicate that countries have developed advanced mobile phone networks, resulting in an effective positive impact on growth in these developing countries. Madden and Savage explains the beneficial association between investment and infrastructure by emphasizing the importance of strengthening the ICT sector for economic growth”.

Frehund and Weinhold investigated the impact of Internet services on corporate operations and discovered a significant and favorable link. This research looked at how economic openness and trade freedom can help societies improve their wellbeing and technical growth. Economic openness has contributed to a rise in foreign investment, with technology playing a crucial role, as demonstrated in a study.

Various studies have been conducted on the impact of ICT on financial development. Some are investigated directly, while others are studied indirectly through economic growth. Among the indirect investigations is Farkhanda who investigates the relationship between the level of ICT (represented by four variables focusing on the results on mobile phone subscribers and internet users) and economic growth via its impact on financial development. He demonstrates that increasing the number of mobile phone customers and internet users improves financial depth, which leads to increased economic growth.

Pradhan, et al., investigate the relationships between Information and Communication Technology (ICT), financial development and economic growth in 21 Asian countries, concluding that the variables are cointegrated and that both ICT and financial development are important in determining Asian countries' long run economic growth. In their study, Asongu and Nwachukwu evaluate the impact of ICT (represented by mobile phones and the internet) in enhancing financial access through complementing financial sector development. They show that the interplay between ICT and financial formalization reduces (increases) financial activity, but that the overall net impacts are beneficial despite the negative consequences of financial in formalization.

Sepehrdoust examines the influence of ICT and financial development on OPEC countries' emerging economies over time, finding that a 1% increase in the financial development index and internet users improved economic growth by 0.048 percent and 0.050 percent, respectively. ICT lessens the detrimental impact of financial development on economic growth in high income nations, according to Cheng, et al.

Alshubiri, et al. investigate six Gulf Cooperation Council (GCC) nations and proxy for ICT by internet users, fixed broadband penetration, mobile subscribers, social media penetration and international bandwidth per internet user. They discovered that a 1% increase in fixed broadband resulted in a 2% rise in financial development, while a 1% increase in internet users results in a 0.09 percent gain in financial development. Lechman and Marszk look into the impact of ICT on several areas of financial development in European countries in a similar study. They discover that there is a beneficial association between ICT and financial progress in general, as well as on specific components of it.

According to Alnafrah, et al., “Farkhanda attempted to test the hypothesis that, given an economy's financial development, e-finance technologies promote economic growth by lowering processing costs for suppliers and information costs for consumers, thereby increasing access to credit for even low-income borrowers in remote areas. The Generalized Method of Moments (GMM) is applied to cross section data from 61 nations averaged over 13 years to investigate the indirect link between connectivity and economic growth its influence on financial development. Better connectedness, particularly through expanding the number of mobile phone subscribers and internet users, greatly improves financial depth, which is the backbone of any country's ability to thrive, according to the regression results” [8].

As cited by Sassi and Goaied, “Andrianaivo and Kpodar studies the impact of Information and Communication Technologies (ICT), particularly mobile phone rollout, on economic growth in a sample of African countries from 1988 to 2007. The study also investigates whether financial inclusion is one of the channels through which mobile phone development influences economic growth using the system Generalized Method of Moment (GMM) estimator. The outcomes endorse that ICT, plus mobile phone development; contribute significantly to economic growth in African countries. The influence of financial inclusion on economic growth has been shown to be amplified by the development of mobile phones, particularly in nations where mobile financial services have taken root” [9-12].

Del Gaudio, et al., find a positive relationship between bank profitability (ROA) and ICT adoption and dissemination and that ICT innovations improve banking industry performance, particularly in the transition from traditional to digital payment services. Furthermore, they discover that ICT deployment improves bank stability at the country level and that ICT dissemination and acceptance have a large beneficial impact on bank capitalization [13].

There are very few studies on the Influence of Technology (ICT) on financial improvement in Sub-Saharan African countries. As a result, the focus of this research will be on the Impact of Technology (ICT) on Sub-Saharan Africa's financial growth [14].

The research uses the McKinnon-Shaw model of financial liberalization and Schumpeter's innovation model to assess the impact of technology on financial growth in Sub-Saharan African countries from 2000 to 2021. They were able to link technology to financial improvement, which informs the choice of explanatory variables in this study, as well as the other major determinants as suggested by previous related literature [15].

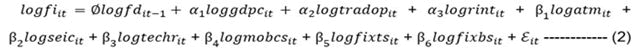

The model for financial improvement may be expressed in the equations below, which also reflect our empirical aims, based on the foregoing explanations for the posited drivers of financial improvement.

Model: The impact of technology on financial improvement in Sub-Saharan Africa countries [16].

Where;

Fiit=Representation for financial improvement;

logfdit-1=Natural logarithm of financial improvement;

logfdit-1=Natural logarithm of the lagged financial improvement,

Χ'it =Vector of control variables;

Ζ'it =Vector of technology of the variables;

μ=Unobserved country specific fixed effects;

ə=Time trend; Ø, α, β, μ and ə are parameters;

i=Number of cross sections (=1,......N);

t=Number of time series (=1,......T) and

ε=Error term.

The inclusion of the control variables is to determine whether the effect of gross domestic product per capita, trade openness and real interest rate on the financial improvement still hold having considered the effects of these covariates on financial improvement. In this model, the endogenous variable is the lagged log of financial improvement and others are treated as endogenous [17].

Control variables include log of gross domestic product per capita (loggdpc), log of trade openness (tradop) and log of renal interest rate (logint) while technology captures log of automated teller machine (logatm), log of secure internet service (logseic), log of technological readiness (logtechr), log of mobile cellular subscriptions (logmobcs), log of fixed telephone subscriptions (logfixts) and log of fixed broadband subscriptions (logfixbs)[18].

Equation 1 can be restated as follow:

Where;

logfd=Log of financial improvement (domestic credit to private sector by banks);

loggdpc=Log of gross domestic product per capita; logtrado=log of trade openness;

logrint=Log of real interest rate; logatm=log of automated teller machine;

logsies=Log of second internet servers;

logtechr=log of technological readiness;

logmobcs=Log of mobile cellular subscriptions logfixts=log of fixed telephone subscriptions;

logfixbs=Log of fixed broadband subscriptions;

θ=Coefficient of endogenous variable;

α1-α3=Coefficient of control variables;

β1-β6=Coefficients of exogenous variables;

ε;t=Error term;

i=Country in the panel;

t=Year in the panel.

The a priori expectations, based on the earlier discussion are that;

Ø>0; α1-α2>0; α3<0 while β1-β6>0

Data sources

Data for the analysis is sourced from the African Development Bank (ADB), World Bank's World Development Indicators (WDI), International Monetary Fund (IMF), and central banks of the selected countries and national bureaus of statistics of the selected countries, journals, reports and related textbooks, among other sources. E-view, STATA, and other software are used to analyze the data for this study [19].

Econometric methods of analysis

Generalized method of moment’s estimator is used to capture the persistent nature of financial development, address the problems of omitted variables, measurement error, endogeneity and country specific heterogeneity and address the problems of omitted variables, measurement error, endogeneity and country specific heterogeneity. A specification test is used to evaluate the consistency of the system GMM estimator. The Hansen test of over-identifying constraints evaluates the instruments' overall validity. The model is supported by the failure to reject the null hypotheses.

Analysis of empirical results

From the Table 1, the average value of financial improvement (fi) across the countries is 30.365 while they are 1,078, 19.374, 8.856, 4.472, 2.114, 4.234, 85.423, 2196.25, and 16.236 for gross domestic product per capita (gdpc), gross savings (gsav), inflation (inf), real interest rate (rint), fixed broadband service (fixbs), fixed telephone services (fixts), mobile cellular subscriptions (mobcs), secured internet servers (seis) and automated teller machines (atm) respectively.

| Variable | Obs | Mean | Std. dev. | Min | Max |

|---|---|---|---|---|---|

| Fd | 302 | 30.36528 | 29.00423 | 0.497601 | 128.8498 |

| Gdpc | 314 | 1.078533 | 4.72228 | -47.5906 | 18.06588 |

| Gsav | 292 | 19.3743 | 10.04624 | -3.43882 | 49.82915 |

| Inf | 304 | 8.856422 | 27.31085 | -4.29487 | 379.9996 |

| Rint | 259 | 4.472771 | 12.38017 | -79.8032 | 61.8826 |

| Fixbs | 310 | 2.114857 | 4.707086 | 0.000021 | 35.5537 |

| Fixts | 310 | 4.23452 | 7.238627 | 0 | 37.64051 |

| Mobcs | 314 | 85.42368 | 37.47227 | 15.77558 | 198.1522 |

| Seis | 310 | 2196.255 | 18619.34 | 0 | 264256.6 |

| Atm | 289 | 16.23645 | 19.68796 | 0.485454 | 89.99328 |

Table 1: Variable statistics.

The Table 1 reveals the deviation from the sample mean for gross domestic product per capita (gdpc), gross savings (gsav), inflation (inf), real interest rate (rint), fixed broadband service (fixbs), fixed telephone services (fixts), mobile cellular subscriptions (mobcs), secured internet servers (seis) and automated teller machines (atm) are 4.72, 10.046, 27.310, 12.381, 4.707, 7.238, 37.472, 18619.34, and 19.687 respectively while fd deviation from the mean is 29.

Table 2 is a correlation matrix for our series. It informs the study of the potential relationship between financial improvement and other variables. Financial improvement exhibits a positive relationship with gross domestic products per capita, real interest rate, as well as the components of technology (automated teller machines, fixed broadband services, fixed telephone services, mobile cellular subscriptions, and secured internet servers) but exhibits a negative relationship with gross savings and inflation rate.

| logfd1 | loggdpc | loggsav | loginf | logint | logatm | logfixbs | logfixts | logmobcs | logseis | |

|---|---|---|---|---|---|---|---|---|---|---|

| logfd1 | 1 | |||||||||

| loggdpc | 0.0041 | 1 | ||||||||

| loggsav | -0.1165 | 0.1348 | 1 | |||||||

| loginf | -0.164 | -0.1151 | 0.0126 | 1 | ||||||

| logint | 0.0236 | 0.1344 | -0.0425 | 0.052 | 1 | |||||

| logatm | 0.6544 | 0.0087 | 0.2513 | 0.056 | 0.1797 | 1 | ||||

| logfixbs | 0.6421 | -0.0729 | 0.2329 | -0.1953 | 0.094 | 0.7741 | 1 | |||

| logfixts | 0.5632 | -0.0244 | 0.247 | -0.2378 | -0.0497 | 0.7133 | 0.8248 | 1 | ||

| logmobcs | 0.5439 | -0.0241 | 0.3339 | -0.2115 | 0.0489 | 0.8172 | 0.7789 | 0.6797 | 1 | |

| logseis | 0.5977 | -0.1387 | 0.0416 | -0.063 | 0.1929 | 0.8238 | 0.7537 | 0.5845 | 0.7613 | 1 |

Table 2: Correlation matrix.

The dynamic model's findings are presented in Table 3. The baseline model's outcome is in the first column (1), followed by measures of technology and their interactions with financial improvement in columns 2 through 6. The lag of financial improvement (fi (-1)) in the first model (column 1) is statistically significant (0.41425) at the 1% level. This demonstrates that the region's financial progress is ongoing (Table 3).

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Constant | 0.41425 (5.22) | 0.40993 (5.44) | 0.442658 (7.08) | 0.39234 (2.29) | 0.10555 (-0.54) | 0.28332 (2.00) |

| logfi (1) | 0.93509 (38.4) | 0.92344 (29.35) | 0.93092 (47.37) | 0.92460 (19.79) | 0.85783 (34.69) | 0.99088 (27.68) |

| Loggdpc | 0.00847 | 0.00903 (2.15) | 0.005547 (0.77) | 0.00263 (0.31) | 0.01197 (2.34) | 0.001061 (0.16) |

| Logsav7 | -0.0574 (7.29) | -0.0369 (2.41) | -0.0597 (5.15) | -0.0443 (2.57) | -0.06716 (4.71) | -0.0633 (4.93) |

| Loginf | -0.0221 (3.77) | -0.0219 (3.93) | -0.0182 (4.08) | -0.0174 (2.95) | 0.00751 (0.89) | -0.0218 (3.41) |

| Logrint | 0.003468 (0.71) | 0.009817 (1.16) | 0.004012 (0.96) | 0.006152 (1.36) | 0.00187 (-0.28) | 0.004815 (0.79) |

| Logatm | -0.010994 (-0.34) | |||||

| Logfixbs | -0.000097 (-0.02) | |||||

| Logfixts | 0.03364 (3.21) | |||||

| logmobcs | 0.176185 (3.49) | |||||

| Logseis | -0.0138 (-3.61) | |||||

| No. of obs | 117 | 113 | 114 | 115 | 117 | 114 |

| Time dummies | Yes | Yes | Yes | Yes | Yes | Yes |

| No. of Instruments | 46 | 45 | 47 | 47 | 47 | 47 |

| Sargan/Hansen test | 0.9972 | 0.9968 | 0.9991 | 0.9998 | 0.9985 | 0.9997 |

Table 3: System GMM estimates (dependent variable: fi (log)).

By interacting real interest rate, growth and saving with the five technological variables, columns 2 to 6 depict the function of technology in the financial improvement nexus. It was discovered that the previous financial improvement is a significant predictor of the current level across all model parameters. This demonstrates that financial improvement is path dependent, implying that a country's financial progress in the current year has a significant impact on its financial improvement the next year.

Our findings show that only columns 2 and 5 have positive and statistically significant gross domestic product per capita. Gross savings, on the other hand, have a negative association with financial progress, which is statistically significant across all models. The inflation rate has a negative association as well, but only in columns 1, 2, 3 and 5 is statistically significant.

Column 4 in particular illustrates that fixed telephone services have a favorable and statistically significant link with financial growth. The fixed telephone services coefficient (0.03364) is positive and statistically significant at the 1% level. Mobile cellular subscriptions have a statistically significant positive link with financial improvement. It has a positive and significant coefficient of 0.176185. According to the interpretation, changes in fixed telephone services and mobile cellular servers have a favorable impact on financial improvement.

Secured internet servers, on the other hand, have a negative and statistically significant impact. The coefficient of safe internet servers (-0.0138) indicates that it has a negative link with financial improvement and is statistically significant at the 1% level. Other technological characteristics are unfavorable, but they are not statistically significant. These examples demonstrate that technology has an impact on financial progress [20].

From columns 1 to 6, the Sargan/Hansen test findings reveal that the instruments utilized are not over identified. As a consequence, our findings may be used to make well informed assumptions.

Using panel data from 29 countries from 2010 to 2020 and a range of literature on the issue, this study investigates the impact of technology on financial improvement in Sub-Saharan African countries.

By proving that fixed telephone services have an equalizing effect on financial improvement, the study adds to the body of knowledge on financial development/improvement. Mobile cellular subscriptions have also been shown to have a financial improvement equalizing effect. On the other side, secure internet servers have a negative equalizing effect on financial improvement.

Because three out of five technological components have a significant influence on financial success. We may deduce that technology can aid the financial growth of Sub-Saharan Africa.

As a result, initiatives targeted at strengthening fixed telephone services, mobile cellular subscriptions and secure internet servers should be supported so that resources may be channeled into financial system growth.

The authors certify that they have no affiliations with or involvement in any organization or entity with any financial interest or non-financial interest in the subject matter or materials discussed in this manuscript.

Citation: Adeyemi AE, David OO (2023) Role of Technology in Determining Financial Improvement in Sub Saharan Africa. J Stock Forex. 10:235.

Received: 05-Jan-2023, Manuscript No. JSFT-23-21275; Editor assigned: 09-Jan-2023, Pre QC No. JSFT-23-21275 (PQ); Reviewed: 23-Jan-2023, QC No. JSFT-23-21275; Revised: 03-Mar-2023, Manuscript No. JSFT-23-21275 (R); Published: 10-Mar-2023 , DOI: 10.35841/2168-9458.23.10.235

Copyright: © 2023 Adeyemi AE, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution and reproduction in any medium, provided the original author and source are credited.