Journal of Stock & Forex Trading

Open Access

ISSN: 2168-9458

ISSN: 2168-9458

Review Article - (2023)Volume 10, Issue 3

This study is concerned with the comparative advantage of bilateral trade which plays a crucial role in the economic development of the developed and developing world. The study aims to investigate the Revealed Comparative Advantage (RCA) index used for determining the bilateral trade relationship between China and South Asia during the period of 2000 to 2019. This study has adopted a multiple regression model by analyzing time series data. The results of the multiple regression model showed that there has a positive significant impact of the chemicals, textiles and clothing, minerals, vegetables, metals, and footwear industries' RCA values on bilateral economic growth. While hides and skin products have a negative and significant impact on bilateral economic growth between China and South Asia region. The results further showed that among 20 products, 16 products have RCA values lower than 1, representing a weak bilateral trade relationship while the chemicals, intermediate goods, fuels, and minerals have most RCA values higher than 1 showing a strong relationship between bilateral trade and economic growth. Based on our findings, this study suggests easing trade among nations to get higher economic growth.

Bilateral trade; Gross domestic product; Import; Export; Revealed comparative advantage

Bilateral trade has a positive impact on the economic growth of a country [1]. Export plays an important role in increasing the productivity of a country [2]. Bilateral trade also helps in promoting bilateral relationships and people-to-people contact. It also encourages investors from across the globe and attracts foreign direct investment. This affects the living standard of the masses positively by providing more job opportunities that lead to an increase in the income of the people which enhances economic well-being and economic growth. Bilateral trade also promotes technology transfer from one country to another. To gain competitive advantage and productivity, technology transfers help in reducing the cost of products, and thus firms can better compete in the international markets. Which becomes a source of earning foreign exchange that is considered an important component of economic growth. It shows, countries or nations engaged in trade with one another may have an impact on their economic growth. Therefore, this study aims to examine the bilateral trade relationship between China and South Asia during the period of time 2000 to 2019. In addition, we also analyze the export products, South Asian countries exported to the world and China and import from them, and top three percent share of export and import products of China and South Asia. The study's objectives are to evaluate the bilateral trade interactions between China and South Asia in order to apply the Revealed Comparative Advantage (RCA) and to determine the effects of the RCA goods on the two countries economic growth [3].

China growth performance

China is one of the largest trade partners across the globe and is considered to be the strongest economy after the USA contributing more than 30% to the world economy. To be a trade leader, China opened its trade policy in 1978. That’s the reason why China’s economy showed upward growth within no time. According to, China has a positive trade balance with a total worth of 79.4 billion dollars including 315 billion dollars in export. The top main export products of China in 2022 are telephones with a total worth of 17.1 billion dollars; computers with a total worth of 15.7 billion dollars; integrated circuits export were reported at 11.9 billion dollars; semiconductor devices exports were recorded at 5.97 billion dollars and electric batteries were exported of 5.64 billion dollars. However, the current year's exports were reported less than the previous year 2021 showed a decrease of 9.27% less than in 2021. In contrast, China also imported a total value of 236 billion dollars in products. As per the current statistics in August 2022, the top five imported products were integrated circuits with a value of 33.3 billion dollars; crude petroleum showed 30.5 billion dollars; iron ore with a total worth of 10.8 billion dollars; gold reported 10.4 billion dollars and petroleum gas was recorded with a value of 7.53 billion dollars [4].

South Asia economic growth

South Asia region was established in 1985 and comprised eight countries including Nepal, Bhutan, India, Maldives, Pakistan, Afghanistan, Bangladesh, and Sri Lanka. It has a total population of 1.94 billion as per the statistics 2020. As per the statistics of the world bank, the total GDP of South Asia is 4.09 trillion dollars showing a growth of 8.9%. The largest economy in South Asia is India reported; a GDP of 3173.39 billion dollars followed by Bangladesh 416.27 billion dollars and Pakistan with 346.34 US dollars. In addition, the per capita GDP of South Asia has recorded 2176 US dollars. India has a 78% share of South Asia's total GDP and is considered the largest and strongest economy among these eight countries. Furthermore, India is the world’s third-largest country purchaser. If we compare the GDP growth rate of India with the combined GDP growth rate of the South Asian region, India reported an 8.9% growth rate as against the South Asian GDP growth rate of 8.3%. This is the highest GDP growth rate after 1988 (9.6%), the second largest economy in South Asia is Bangladesh with a total GDP of 416.27 billion dollars reported a GDP growth of 6.9% which is less than India and aggregate GDP growth of South Asia. However, the per capita GDP was reported at 2503 UD dollars which were more than the aggregate GDP of South Asia. The highest per capita GDP is reported by the Maldives with 8994 US dollars followed by Sri Lanka with 3814 US dollars and then Bhutan with 3000 US dollars [5]. However, Afghanistan reported the lowest GDP per capita of 516 UD dollars.

According to Focus Economics total growth rate of South Asia from 2000 to 2022 is around 6%, but all countries in South Asia region are facing problems like India facing high population and inflation rate is also a big problem in India, Sri Lanka also facing imbalance government and economic crisis, Maldives also facing imbalance in trade like imports are very higher than exports which effect GDP, Pakistan is facing high number of energy crisis which can't give environmental to industry sector to produce high number of products, Afghanistan facing lack of food production which increase poverty, Bangladesh facing weaker demand of exports from the world, Afghanistan is a county who's had lowest growth rate better all South Asia countries which is 3%, with food crisis Afghanistan also had political issues which effect GDP and did put trust on investors to invest in Afghanistan, Afghanistan is an agriculture country but can't able to produce that much agricultural products which county needs that's why they import from other countries which cost lots of money, Bangladesh is highest export in textile industry in South Asia region which put Bangladesh on top in growth rate which is 8% total that is higher than Indian growth rate which was 5.3% in 2019, if we talk about Bhutan which depend on tourism industry from where Bhutan get 87.7 million dollars in 2019 and government of Bhutan trying to invest more in tourism industry to increase economy growth of country, Bhutan also investing in three hydropower projects building from where they want produce energy to industries sector to increase their economy growth, India is a manufacturing country from where Indian economy depend more than other sectors and from fast few years Indian change their investment polices to attract foreign investors to invest in key industries like railways, real estate, defense and insurance companies and invest in those projects which are energy efficient, Nepal is an agricultural country which can produce high number of rice, Nepal also produced high number of electricity to apply advance techniques, Nepal producing high number of electronic products like electric windows which can produce 103 million dollars every year [6].

Objectives of the study

• To examine the bilateral trade relationship between China

and South Asia.

• To investigate the comparative advantage of 20 products

between China and South Asia.

• To explain the impact of the comparative advantage of 20

products on bilateral economic growth between China and

South Asia.

Balassa the comparative advantages explained the trade relationship between countries. Balassa examining the comparative advantages is a key to checking the industry's trade relationship between countries. For the past few years, China is the world's largest economy which had a total of 15.98 trillion dollars in 2020 and depends on trade more than 34% of the economy according to the world bank report, after China opened up the trade policies in 1978, Chinese economy growing very fast, in 1985 China trade relationship was started with Europe and Central Asia, in ten years from 1985 to 1994 total trade worth between China and Europe was 14.3 billion dollars to 45.6 billion dollars, than in 2007 passed a new agreement with China in which more than 24 sectors trade partnership started between China and Europe that make trade relationship more strong between China and the Europe and Central Asia. Widodo investigates that higher comparative advantages have higher the country's net-export productivity [7]. Furthermore, to increase the economic growth of the country, need to increase the comparative advantages of industries.

Adigwe investigate the bilateral trade relationship between European countries during the period of 2008 to 2018 by applying comparative advantages RCA, results examine that those countries which have RCA values greater than 1 have higher economic growth than those who have RCA values lower than 1. Benesova, Smutka et al., examine the bilateral trade relationship between Russia and Ukraine during the period of 2000 to 2015, to applied the comparative advantages RCA to measure the trade balance within import and export of mineral, fuels, lubricant, and related materials industries, estimated results showed that crude oil price and related price decrease significantly from 2000 to 2015, results explain that the revealed comparative advantages values greater than 1, that explain there had good trade relationship Moldova and Ukraine. Results also explain the close economies between Belarus and Tajikistan, but Ukraine, Belarus, Moldova, and Turkmenistan have the most open economies from 2009 to 2015, Russia and Kazakhstan's economies depend on raw materials, natural oil, and natural gas [8].

Tombolotutu, Khaldun et al., investigate the seaweed products' impact on the economic growth of Indonesia economy over the period of 2006 to 2016, estimated results after applying RCA showed that export competitiveness, productivity, Trade liberalization, rate exchange rate research, and development interest rate have a positive impact on RCA and inflation rate, productivity, research, and investment development have negative import on RCA. Qiao and Ma explain the probability of RCA greater than 1 and gave a concept of max proximity that what changes in the future between 2020 to 2030 and what impact on the Chinese product market, estimated results showed that capital-intensive products increase their productivity because of opinions trade to the world. Results of max proximity examine that if a country increases productivity in diversified goods then it can increase production on other goods which has a positive impact on economic growth, results also investigate that investment in development in trade will increase the productivity of a country [9].

Chen, Xie et al., examine the bilateral trade relationship between BRICS countries which are China, Brazil, Russia, India, and South Africa to use the revealed comparative advantages of RCA from 2000 to 2018. Estimated results BRICS countries export coal from China, South Asia, and Russia, the oil they can export from Russia and Brazil, and Russia are the main exporter of natural gas, RCA results also explain that China is a main coal exporter in the BRICS countries in large quantities but from 2000 to 2018 export of China decreased annually, which showed that China improves their trade structure which significantly decreases the cost export, South Africa and Russia are main competitive of the coal market in BRICS countries [10].

Irshad and Xin explain the bilateral trade relationship between China and Pakistan from 2009 to 2013 to apply the revealed comparative advantages of RCA. Estimated results explain that China and Pakistan had a very good trade relationship, China and Pakistan signed Free Trade Agreement (FTA) in 2007 which increased the bilateral trade relationship between China and Pakistan. Results showed that China export capitalintensive goods to Pakistan and Pakistan export textile and semi-manufactured goods to China. Bebek examine the RCA and test the traditional RCA model in both international and national trade shares in different countries, results showed that the developed countries have developed trade structures that are more effective and efficient compared to developing countries that's why developed countries getting more profit and productivity than developing countries [11].

Adigwe explains the trade structures and trade product improvements in Europe from 2009 to 2018 to use Revealed Comparative Advantages RCA. Estimated results of RCA showed that the European country's export depends on mechanized products rather than agricultural products, results also showed that the European Union countries have free trade policies which also help to increase their productivity. Handique examines the bilateral trade relationship between India and ASEAN-5 countries (Philippines, Singapore, Indonesia, Thailand, and Malaysia) during the period of 2000 to 2017 to apply the Revealed Comparative Advantages (RCA). Results showed that international trade and integration have a positive impact on economic growth, the RCA results showed that India and Singapore have great comparative advantages in all export and import 20 main products which that there is positive and significant impact of bilateral trade relationship between India and ASEAN-5 countries [12].

Gorton, Davidova et al., explain the competitiveness between Europe, Bulgaria, and the Czech Republic to applied the Revealed Comparative Advantages (RCA) over the period of 1989 to 1999, estimated results showed that the agriculture trade relationship between the Czech Republic and Bulgaria is less comparative advantages, because the Czech Republic is a large importer of agriculture and food products, results also explain that there has good bilateral trade relationship between Europe and (Bulgaria and Czech Republic). Chandran and Sudarsan examine the free trade agreement and how effective the trade complementarity between India and ASEAN countries is to use the revealed comparative advantages. Results explain that there is a comparative advantage in food products between Vietnam, India, Indonesia, Thailand, and Malaysia but has comparative disadvantage between Brunei, Philippines, Singapore, and Cambodia results showed that India is one the biggest fish exporters in ASEAN countries, India import about 60.61% of Marine, and export 77.6% Exclusion, results also examine that India increased export with ASEAN countries due to tariff between other ASEAN countries. Ranis and Stewart investigated the bilateral trade relationship between Latin and Asian Americans over the period of 1981 to 1997 to use the Revealed Comparative Advantages (RCA). Results explain that there has strong export competitiveness in East Asia countries and have lower tier economies between Latin America and South Asia countries. Turkey textile industry significant impact on the United State, Japan and European countries. Indian market has significant impact China by used Revealed Comparative Advantages (RCA). Indian food market has significant impact on H7 countries to applied Revealed Comparative Advantages (RCA). Leather market and leather products of Pakistan significantly positive impact by applied Revealed Comparative Advantages (RCA). Revealed Comparative Advantages (RCA) of Chinses industrial products have significant on East Asian countries. Revealed Comparative Advantages (RCA) impact significantly to check the bilateral trade relationship between countries. Pakistan construction market impact significant on the world market by applied the Revealed Comparative Advantages (RCA) [13].

Study design

This study has used a quantitative research design. In the paper, we investigate the bilateral trade relationship between China and South Asia, the data we took from the (Bank 2022) and (WITS 2022). We collected data for 20 years from 2000 to 2019 for 20 products to check the bilateral trade relationship between China and South Asia, main variables are China's export, imports to the world and South Asia, and South Asia's export, imports to the world, and China. And for the multiple OLS regression model we took the RCA values of all 20 products and for the dependent variable we took the GDP of China and South Asia then subtract the higher GDP from the lower and take natural lags to check the impact of RCA on bilateral economic growth between China and South Asia [14].

Econometric model

To estimate the bilateral trade relationship between China and South Asia, and the RCA product's impact on bilateral economic growth between China and South Asia, we applied two main models in the study to estimate the results which are the Revealed comparative advantage index and multiple regression models. Balassa gave a new concept to measuring product industries of one country to another, to check the trade relationship between two countries. Examine the comparative Advantage is a key to checking the industry's relationship between countries. Vollrath to check the bilateral trade impact on economic growth comparative advantages is an important tool to measure. Li and Qiaoyu Li examine the Trade Complementary Index (TCI) based on comparing the export and import of the Revealed Comparative Advantage index (RCA) [15]. Adigwe and Adigwe used the revealed comparative advantage index to check the bilateral trade relationship between European countries. Berkson gave a new concept to check the impact of one variable on another. Berkson and Bishop, Holland et al., were the researchers who improve the regression model. With time researchers developed multiple regression models similar to those. Based on Benesova, Smutka et al. and multiple regression model to check the impact of investment, interest rate, and inflation rate on the Revealed Comparative Advantage index (RCA).

Econometric model for the study

Revealed Comparative Advantage Index (RCA): Based on trade theory, is employed to demonstrate how productivity differences between nations influence their trade patterns. The RCA index by Balassa is typically calculated as follows:

RCAij=Zij/Zit/Zwj/Zwt

Where;

Zij and Zwj: Represent the total exports of the country i’s of j products and the products j exports of the world respectively,

Zit and Zwt represent the values of total exports of country I and the total export of the world. The country has revealed comparative advantage in that product if the RCA index value is larger than one, and vice versa, a nation is thought to have a strong export position in a certain product if it has a revealed comparative advantage in it. A country's export strength in the product i is inversely correlated with the value of its RCA for that product i. If RCA >1, the country i said to have a strong export relationship with j, but if a country has RCA<1 there must be a comparative disadvantage in the commodity [16].

To test the impact of the Revealed Comparative Advantage index (RCA) impact on bilateral economic growth between China and South Asian countries, we used a multiple-liner regression model. The estimated OLS model can be written based on the:

GDPC-SA=β0+β1RCA1+β2CA2+β3RCA3+β4RCA4+β5RCA5+ β6RCA6+β7RCA7

The variables explain as:

GDPC-SA=The bilateral trade GDP (high GDP–low GDP).

β1RCA1=RCA between China to South Asia chemicals.

β1RCA1=RCA between China to South Asia textiles and clothing.

β1RCA1=RCA between China to South Asia minerals.

β1RCA1=RCA between China to South Asia vegetable.

β1RCA1=RCA between China to South Asia metals.

β1RCA1=RCA between China to South Asia hides and skins.

β1RCA1=RCA between China to South Asia footwear.

Descriptive analyses

The estimated results of bilateral trade relationship and impact on bilateral economic growth between China and South Asia, in the first step we check the fluctuation of Gross Domestic Products (GDP), export of China to the world and South Asia, and import of South Asia from the world and South Asia to examine the bilateral trade relationship between China and South Asia.

Table 1 explains the total population, GDP, GDP per capita, economic growth, consumption, industrial production, investment, unemployment rate, retail sales, public debt, fiscal balance, money, inflation, inflation rate, stock market, policy interest rate, exchange rate, current account balance, current account, import, export, trade balance, external debt, imports, international assets, export % and import % of China over the period of 2015 to 2019.

| Years | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|

| Population (billion) | 1.375 | 1.383 | 1.39 | 1.395 | 1.4 |

| GDP per capita (Th $) | 7.945 | 8.134 | 8.858 | 9.916 | 10.212 |

| GDP ($ trillion) | 10.922 | 11.247 | 12.313 | 13.837 | 14.298 |

| Economic growth (difference in %) | 7 | 6.8 | 6.9 | 6.7 | 6.1 |

| Consumption (difference in %) | 7.4 | 8.6 | 6.8 | 9.5 | 6.8 |

| Investment (difference in %) | 7 | 6.8 | 4.4 | 4.8 | 4.5 |

| Industrial production (difference in %) | 6.1 | 6 | 6.6 | 6.2 | 5.7 |

| Retail sales (difference in %) | 10.7 | 10.4 | 10.3 | 9 | 8.1 |

| Unemployment rate | 4.1 | 4 | 3.9 | 3.8 | 3.6 |

| Fiscal balance (% of GDP) | -3.4 | -3.8 | -3.7 | -4.1 | -4.9 |

| Public debt (% of GDP) | 15.5 | 16.1 | 16.2 | 16.3 | 17 |

| Money (difference in %) | 13.3 | 11.3 | 8.1 | 8.1 | 8.7 |

| Inflation rate (CPI, difference in %, EOP) | 1.6 | 2.1 | 1.8 | 1.9 | 4.5 |

| Inflation rate (CPI, difference in %) | 1.4 | 2 | 1.6 | 2.1 | 2.9 |

| Inflation (PPI, difference in %) | -5.2 | -1.3 | 6.3 | 3.5 | -0.3 |

| Policy interest rate (%) | 4.3 | 4.3 | 4.3 | 4.31 | 4.15 |

| Stock market (difference in %) | 9.4 | -12.3 | 6.6 | -24.6 | 22.3 |

| Exchange Rate (vs. $) | 6.49 | 6.95 | 6.51 | 6.88 | 6.96 |

| Exchange Rate (vs. $) | 6.28 | 6.64 | 6.76 | 6.62 | 6.91 |

| Current account (% of GDP) | 2.8 | 1.8 | 1.6 | 0.2 | 1 |

| Current account balance ($ billion) | 304 | 202 | 195 | 25.5 | 141 |

| Trade balance ($ billion) | 594 | 510 | 420 | 351 | 421 |

| Exports ($ trillion) | 2.273 | 2.098 | 2.263 | 2.487 | 2.499 |

| Imports ($ trillion) | 1.68 | 1.588 | 1.844 | 2.136 | 2.078 |

| Exports (difference in %) | -2.9 | -7.7 | 7.9 | 9.9 | 0.5 |

| Imports (difference in %) | -14.3 | -5.5 | 16.1 | 15.8 | -2.7 |

| International assets (Th $) | 3.406 | 3.098 | 3.236 | 3.168 | 3.223 |

| External debt (% of GDP) | 12.7 | 12.6 | 14.3 | 14.3 | 14.4 |

Table 1: Chinese economy from 2015 to 2019.

In Table 2, we examine the total GDP, GDP %, total import, total export, % change in GDP, growth rate, and GDP per capita of the South Asia region during the period of 2000 to 2020.

| Years | Total GDP billion | % of GDP | Total exports billion | Total import billion | % of GDP | Growth rate | GDP per capita |

|---|---|---|---|---|---|---|---|

| 2000 | $630.43 | 15.10% | $85.37 | $96.51 | 13.62% | 4.06% | $453 |

| 2001 | $645.87 | 14.78% | $86.33 | $97.14 | 13.40% | 4.50% | $456 |

| 2002 | $677.63 | 15.98% | $98.43 | $109.01 | 14.66% | 3.65% | $470 |

| 2003 | $791.00 | 16.34% | $119.58 | $129.90 | 15.27% | 7.38% | $539 |

| 2004 | $917.09 | 19.53% | $158.32 | $178.10 | 17.54% | 7.58% | $614 |

| 2005 | $1,050.59 | 22.38% | $197.82 | $235.38 | 19.08% | 7.60% | $692 |

| 2006 | $1,196.09 | 24.51% | $241.86 | $294.32 | 20.47% | 7.72% | $775 |

| 2007 | $1,504.19 | 24.73% | $298.78 | $373.22 | 20.02% | 7.33% | $959 |

| 2008 | $1,527.47 | 28.71% | $339.19 | $440.09 | 22.53% | 3.24% | $959 |

| 2009 | $1,683.46 | 25.26% | $323.77 | $426.97 | 19.40% | 7.13% | $1,042 |

| 2010 | $2,060.78 | 25.93% | $431.98 | $539.15 | 21.00% | 7.70% | $1,257 |

| 2011 | $2,274.55 | 29.79% | $520.02 | $681.90 | 23.04% | 5.14% | $1,369 |

| 2012 | $2,300.18 | 30.04% | $520.37 | $693.34 | 22.87% | 5.50% | $1,366 |

| 2013 | $2,360.02 | 27.58% | $551.24 | $653.15 | 23.66% | 6.08% | $1,384 |

| 2014 | $2,584.55 | 25.46% | $552.01 | $660.76 | 21.63% | 6.99% | $1,496 |

| 2015 | $2,700.21 | 22.14% | $500.63 | $601.67 | 18.81% | 7.49% | $1,543 |

| 2016 | $2,926.35 | 20.87% | $523.14 | $614.85 | 18.08% | 7.78% | $1,652 |

| 2017 | $3,348.22 | 21.81% | $584.14 | $734.67 | 17.61% | 6.63% | $1,868 |

| 2018 | $3,436.88 | 23.69% | $632.21 | $820.63 | 18.62% | 6.44% | $1,894 |

| 2019 | $3,596.91 | 21.37% | $627.86 | $775.11 | 17.55% | 4.02% | $1,959 |

| 2020 | $3,351.52 | 18.47% | $556.54 | $627.32 | 16.78% | -6.58% | $1,805 |

Table 2: South Asia economy from 2000 to 2020.

Table 3 explains the descriptive statistic of all twenty different products which showed that intermediate goods, chemicals, fuels, textiles, and clothing and minerals have maximum values higher than 1 and other production values are lower than 1.

| Products | Average | Max | Min | Standard deviation |

|---|---|---|---|---|

| Capital goods | 0.1329 | 0.1885 | 0.0796 | 0.032 |

| Consumer goods | 0.1777 | 0.2508 | 0.1157 | 0.0445 |

| Intermediate goods | 0.9127 | 1.2234 | 0.7889 | 0.1227 |

| Raw materials | 0.3818 | 0.8325 | 0.244 | 0.1673 |

| Animal | 0.0396 | 0.0648 | 0.016 | 0.0154 |

| Chemicals | 1.2142 | 1.6453 | 0.9582 | 0.1989 |

| Food products | 0.088 | 0.312 | 0.0351 | 0.0575 |

| Footwear | 0.147 | 0.2344 | 0.0701 | 0.0523 |

| Fuels | 0.425 | 1.0291 | 0.1125 | 0.2183 |

| Skins and hides | 0.1258 | 0.2188 | 0.0455 | 0.0632 |

| Elec and mach | 0.319 | 0.4243 | 0.2002 | 0.0608 |

| Metals | 0.4085 | 0.538 | 0.2827 | 0.08 |

| Natural minerals | 0.5663 | 1.4144 | 0.3175 | 0.2903 |

| Miscellaneous | 0.182 | 0.2452 | 0.1173 | 0.0354 |

| Rubber and plastic | 0.3623 | 0.4461 | 0.24 | 0.0635 |

| Glass and stone | 0.3236 | 0.3904 | 0.1925 | 0.0646 |

| Clothing and textiles | 0.4742 | 0.6057 | 0.3924 | 0.0481 |

| Transportation | 0.2547 | 0.4852 | 0.1833 | 0.0754 |

| Vegetable | 0.3863 | 0.603 | 0.2675 | 0.0901 |

| Wood | 0.2451 | 0.3759 | 0.1002 | 0.0885 |

Table 3: Descriptive statistic comparative advantage index RCA between China to South Asia.

In Table 4, we explain the results of the Revealed Comparative Advantage (RCA) index between China and South Asia, we have 20 years of data for the revealed comparative advantage index between China and South Asia from 2000 to 2019. Estimated results of RCA explain that most values of the capital goods, stone and glass, textiles and clothing, transportation, consumer goods, fuels, hides and skins. Mach and Elec, intermediate goods, raw materials, animal, chemicals, food products footwear, metals, minerals, miscellaneous plastic or rubber, vegetable and wood industries are less than 1 which gives us knowledge that there is a weak revealed comparative advantage index between China and South Asia, the lowest value of revealed comparative advantage index between China and South Asia is 0.0171 which belongs to 2009 of animal industry of the fifth column and the highest value of revealed comparative advantage index is belongs to 2000 of chemicals industry of the sixth column which is 1.6065, all values are decried from 2000 to till now in 2019 which mean the relation going weak annually and the strongest revealed comparative advantage index between China and South Asia belongs to the sixth column which is chemicals industry. The Revealed Comparative Advantage Index (RCA) between China and South Asia we get the results which gives us the idea that there have weak RCA Index between China and South Asia because between 20 products 16 have RCA less than 1, intermediate goods, fuels, chemicals, and minerals are four products which have RCA most values are higher than 1. To investigate the impact of bilateral trade on bilateral economic growth between China and South Asia we apply a multiple regression model which mentions below [16].

| Europe one | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Capital goods | 0.0911 | 0.0964 | 0.1015 | 0.0796 | 0.1054 | 0.1045 | 0.1258 | 0.1479 | 0.1649 | 0.1885 | 0.1623 | 0.1608 | 0.1323 | 0.1181 | 0.1098 | 0.1161 | 0.1564 | 0.1758 | 0.1682 | 0.15 |

| Consumer goods | 0.1366 | 0.1157 | 0.1241 | 0.1337 | 0.1331 | 0.1370 | 0.1310 | 0.1442 | 0.1595 | 0.1706 | 0.1877 | 0.2021 | 0.1902 | 0.2060 | 0.2056 | 0.2159 | 0.2406 | 0.2508 | 0.2413 | 0,22 |

| Intermediate goods | 1.2234 | 1.1718 | 1.0665 | 0.9924 | 0.8926 | 0.8660 | 0.8419 | 0.8628 | 0.8238 | 0.9641 | 0.9864 | 0.9479 | 0.8202 | 0.7889 | 0.8102 | 0.8026 | 0.8247 | 0.8340 | 0.8825 | 0.85 |

| Raw materials | 0.8325 | 0.7609 | 0.6024 | 0.4107 | 0.4675 | 0.4346 | 0.3879 | 0.3158 | 0.3066 | 0.3333 | 0.3211 | 0.3143 | 0.2631 | 0.2499 | 0.2608 | 0.2819 | 0.2801 | 0.2831 | 0.2440 | 0.28 |

| Animal | 0.0561 | 0.0481 | 0.0475 | 0.0407 | 0.0318 | 0.0338 | 0.0212 | 0.0460 | 0.0221 | 0.0160 | 0.0195 | 0.0224 | 0.0255 | 0.0382 | 0.0516 | 0.0648 | 0.0601 | 0.0433 | 0.0395 | 0.06 |

| Chemicals | 1.5904 | 1.6453 | 1.5966 | 1.2964 | 1.1985 | 1.1099 | 1.1123 | 1.2500 | 1.1884 | 1.2381 | 1.3068 | 1.3045 | 1.1721 | 1.0804 | 1.0913 | 1.0851 | 1.0006 | 0.9582 | 1.0381 | 1.02 |

| Food products | 0.3120 | 0.0413 | 0.0519 | 0.0434 | 0.0351 | 0.1294 | 0.0721 | 0.0616 | 0.0601 | 0.0704 | 0.0834 | 0.0856 | 0.0846 | 0.0785 | 0.0769 | 0.0996 | 0.0913 | 0.1038 | 0.0898 | 0.08 |

| Footwear | 0.0852 | 0.0773 | 0.0701 | 0.1074 | 0.0832 | 0.0991 | 0.1212 | 0.1237 | 0.1383 | 0.1321 | 0.1426 | 0.1688 | 0.1508 | 0.1677 | 0.1836 | 0.2055 | 0.2207 | 0.2344 | 0.2150 | 0.21 |

| Fuels | 1.0291 | 0.8504 | 0.5438 | 0.4466 | 0.5967 | 0.4931 | 0.4697 | 0.2812 | 0.4207 | 0.1838 | 0.2346 | 0.2506 | 0.1125 | 0.2577 | 0.3528 | 0.3704 | 0.4737 | 0.4269 | 0.4438 | 0.26 |

| Hides and skin | 0.0455 | 0.0559 | 0.0550 | 0.0509 | 0.0502 | 0.0557 | 0.0712 | 0.0904 | 0.1011 | 0.1133 | 0.1429 | 0.1687 | 0.1484 | 0.1813 | 0.1724 | 0.1818 | 0.2093 | 0.2188 | 0.2077 | 0.19 |

| Mach and Elec | 0.2914 | 0.2940 | 0.2765 | 0.2002 | 0.2535 | 0.2468 | 0.2947 | 0.3415 | 0.3880 | 0.4243 | 0.3677 | 0.3808 | 0.3114 | 0.2739 | 0.2661 | 0.2776 | 0.3638 | 0.4047 | 0.3795 | 0.34 |

| Metals | 0.3249 | 0.3132 | 0.2827 | 0.3175 | 0.2900 | 0.2966 | 0.3980 | 0.4577 | 0.3947 | 0.4759 | 0.5380 | 0.4945 | 0.4217 | 0.3825 | 0.4186 | 0.4431 | 0.4788 | 0.4911 | 0.4923 | 0.45 |

| Minerals | 1.3070 | 1.4144 | 0.6827 | 0.5327 | 0.5763 | 0.5730 | 0.4270 | 0.3845 | 0.3915 | 0.6229 | 0.5369 | 0.4764 | 0.4658 | 0.3752 | 0.3449 | 0.4680 | 0.6220 | 0.4175 | 0.3898 | 0.31 |

| Miscellaneous | 0.1433 | 0.1560 | 0.1724 | 0.1454 | 0.1173 | 0.1715 | 0.1676 | 0.1688 | 0.1454 | 0.1619 | 0.1777 | 0.1853 | 0.1726 | 0.1939 | 0.2011 | 0.2157 | 0.2306 | 0.2446 | 0.2452 | 0.224 |

| Plastic or rubber | 0.2563 | 0.2400 | 0.2524 | 0.2691 | 0.3288 | 0.3425 | 0.3440 | 0.4264 | 0.3889 | 0.3821 | 0.4091 | 0.3989 | 0.3464 | 0.3831 | 0.3903 | 0.3840 | 0.4322 | 0.4461 | 0.4159 | 0.409 |

| Stone and glass | 0.2788 | 0.3902 | 0.3253 | 0.3197 | 0.3535 | 0.3806 | 0.3617 | 0.3602 | 0.3796 | 0.3904 | 0.3454 | 0.2871 | 0.1982 | 0.2032 | 0.1925 | 0.2698 | 0.3434 | 0.3845 | 0.3634 | 0.343 |

| Textiles and clothes | 0.6057 | 0.5064 | 0.4853 | 0.4963 | 0.5075 | 0.5018 | 0.4237 | 0.3924 | 0.4166 | 0.4253 | 0.4506 | 0.4821 | 0.4544 | 0.4737 | 0.4578 | 0.4236 | 0.4617 | 0.4807 | 0.5131 | 0.525 |

| Transportation | 0.4852 | 0.3729 | 0.3565 | 0.3082 | 0.2806 | 0.2434 | 0.2389 | 0.2181 | 0.2282 | 0.1934 | 0.1893 | 0.1991 | 0.2133 | 0.2094 | 0.1976 | 0.1833 | 0.2672 | 0.2355 | 0.2422 | 0.231 |

| Vegetable | 0.4281 | 0.4639 | 0.5773 | 0.3887 | 0.3594 | 0.3605 | 0.3932 | 0.3476 | 0.3873 | 0.6030 | 0.4898 | 0.4144 | 0.3610 | 0.3328 | 0.3152 | 0.2756 | 0.3385 | 0.3139 | 0.2675 | 0.307 |

| Wood | 0.1208 | 0.1002 | 0.1051 | 0.1211 | 0.1310 | 0.1485 | 0.2397 | 0.2847 | 0.2856 | 0.2993 | 0.2538 | 0.3004 | 0.2650 | 0.2933 | 0.3003 | 0.2998 | 0.3424 | 0.3759 | 0.3216 | 0.313 |

Table 4: Comparative Advantage index (RCA) between China to South Asia.

Table 5 examines the multiple regression model to check the impact of the Revealed Comparative Advantage index (RCA) products on bilateral economic growth between China and South Asia from 2000 to 2019, the estimated results investigate that there have a positive and strongly significant impact of chemicals, textiles and clothing, minerals, vegetables, metals and footwear industries RCA values on bilateral economic growth between China and South Asia, but hides and skins products have negative and significant impact on bilateral economic growth between China and South Asia region [17].

| Variables | Co-officiant | p-value |

|---|---|---|

| Chemicals | 0.3912 | 0 |

| Textiles and clothing | 0.9237 | 0 |

| Minerals | 0.0872 | 0 |

| Vegetable | 0.2541 | 0 |

| Metals | 0.3972 | 0 |

| Hides and skins | -1.2555 | 0 |

| Footwear | 1.3669 | 0.01 |

| Content | -0.3532 | 0 |

Table 5: Multiple OLS model.

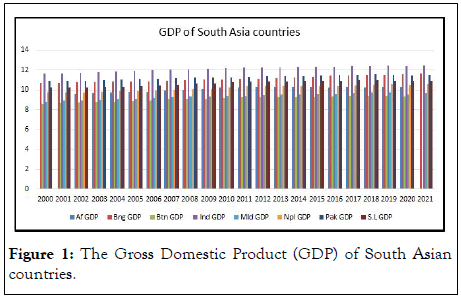

Figure 1 shows the gross domestic product GDP of South Asian countries from 2000 to 2019, the highest GDP had India, and the second highest was Pakistan in the third position there is Bangladesh. These top three countries GDP annually increased from 2000 to 2019.

Figure 1: The Gross Domestic Product (GDP) of South Asian countries.

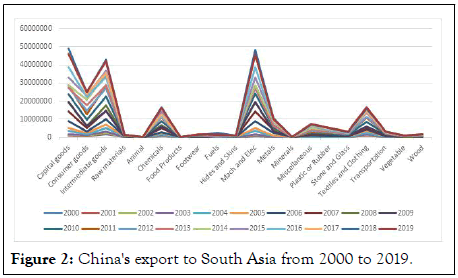

Figure 2 explains the total export of China to South Asia countries over the period of 2000 to 2019, results showed that the intermediate goods, consumer goods, chemicals products, animals, Mech and Elec, metals, minerals, and textile and clothing products are the main products which China export to South Asia countries [18].

Figure 2: China's export to South Asia from 2000 to 2019.

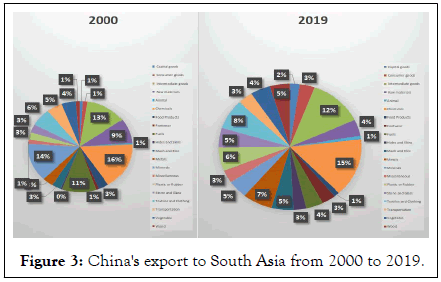

Figure 3 investigate the products export share of China to South Asia countries in 2000 and 2019, results showed that the top three product industries are intermediate good which had a total export share in 2000 was 13% are decline by 1% now in 2019 12%, the chemical products had total export shares in 2000 was 16% and in 2019 it is 15% which are also decreased 1%, and the minerals in 2000 have total export shares were 14% but now in 2019 it has total 7% of export shares which are 7% decreased from 2000 to 2019, this figure also explains that the bilateral trade relationship between China and South Asia going weak annually which is not good [19].

Figure 3: China's export to South Asia from 2000 to 2019.

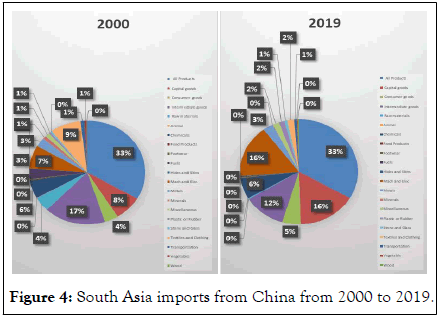

Figure 4 examine the import of South Asia from China from 2000 to 2019, three top import products are capital goods which had total import shares in 2000 was 8% and now in 2019 have 16% of total import shares are 8% increase, Intermediate goods had a total worth of import shares in 2000 was 17% now in 2019 had 12% which are decline 5% and the Mech and Elec had a total worth of import shares in 2000 was 7% which now in 2019 have total import shares are 16% which is 9% gain from 2000 to 2019 [20].

Figure 4: South Asia imports from China from 2000 to 2019.

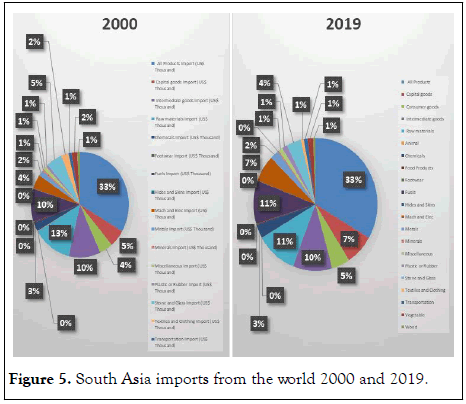

Figure 5 examine the top three product that which South Asia region import from the world which is intermediate good which had an import share in 2000 was 10% which are now in 2019 also is 10%, raw material which had an import share in 2000 was 13% which now in 2019 total import shares 11% decline 2% from 2000 to 2019, and fuels total import shares in 2000 were 10% and now in 2019 have 11% import shares with increased of 1%.

Figure 5: South Asia imports from the world 2000 and 2019.

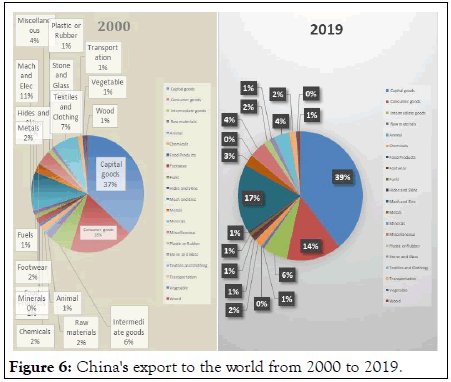

Figure 6 examines the total export of China to the world which shows that from 2000 to 2019. If we talk about the three top export products that China export to the world these are capital goods, consumer goods, and Mach and Elec which also changed from 2000 to 2019, 2000 capital goods share in total exports of China to the world was 37% which now in 2019 is 39% that gives us information about capital goods industry gain 3% share in total exports, consumer goods in 2000 had total export shares was 18% and now in 2019 is 14% which decline 4% from 2000 to 2019, Mech and Elec industry in 2000 had total export shares was 11% which now in 2019 is 17% that gives us knowledge that this industry gain 6% of total exports share from 2000 to 2019.

Figure 6: China's export to the world from 2000 to 2019.

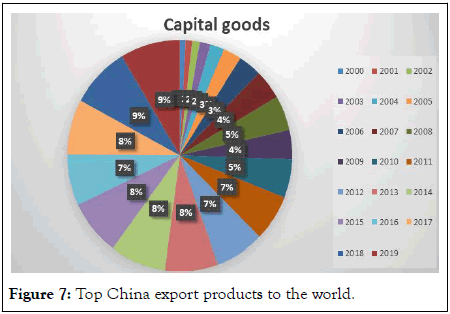

Figure 7 examines how the capital goods industry take part in total export shares of China to the work from 2000 to 2019, annually capital goods industry increased its export shares from 2% to 9%. Below in Table 1, we explain the results of the revealed comparative advantage index between China and South Asia, we have 20 years of data for the revealed comparative advantage index between China and South Asia from 2000 to 2019. In Table 1 we mention the descriptive statistic of China and South Asia for 20 years from 2000 to 2019 to check the descriptive statistic of data for the Revealed Comparative Advantage index (RCA) between China and South Asia.

Figure 7: Top China export products to the world.

This research aims to examine the bilateral trade relationship and its impact on bilateral economic growth between China and South Asia over the period of 2000 to 2019. The estimated results showed that Figure 1 explains the Gross Domestic Product (GDP) of Eight South Asia countries including Pakistan, Afghanistan, Bhutan, Bangladesh, Nepal, Maldives, Sri-Lanka and India Figure 1 showed that India has the highest GDP among all eight South Asian countries, Pakistan is second highest, and Bangladesh is on third highest GDP country. Figure 2 showed Chinese top 20 products export shares to the world over the period of 2000 to 2019. Figures examines that the top three products China exported to the world from 2000 to 2019 are capital goods which gain 3%, consumer goods decline by 4%, and Mech and Elec gained 6% of export shares from 2000 to 2019 which explains Chinese export productivity increased from 2000 to 2019.

In Figure 3, we investigate the export shares of Chinese top 20 products to South Asia, top three Chinese export products to South Asia are intermediate goods which decreased by 1%, chemical products also decline 1% and Minerals which decreased by 7% export shares between China and South Asia, results explained that export shares decreased from 2000 to 2019 which examine that bilateral trade relationship going weak annually which is not good for both China and South Asia. Figure 4 showed South Asia's 20 import products shares from the world from 2000 to 2019 are intermediate goods, raw materials, and fuels respectively, intermediate goods have 11% import shares which do not change from 2000 to 2019, raw material import shares decline 2%, and fuels import shares increased 1% from 2000 to 2019. In Figure 5, we explain the import share of 20 products that South Asia imported from China from 2000 to 2019, top three import products which have total import shares increased by 8% capital goods, intermediate goods decreased by 5%, and Mech and Elec gain 9% import shares from 2000 to 2019, top three products import of South Asia from China increased but overall import shares decreased from 2000 to 2019 which showed the bilateral trade relationship annually going weak.

To examine the bilateral trade relationship between China and South Asia we applied the Comparative Advantage index (RCA), estimated results explain that among 20 top products 16 have a Comparative Advantage index (RCA) of less than 1 only four products which are intermediate goods, chemicals, fuels and minerals have most values are greater than 1, which gave us information the bilateral trade relationship between China and South Asia is weak which need to improve that’s why China is investing money in belt and road to increase the bilateral trade relationship between China and South Asia. Adigwe and Adigwe results of RCA investigate the European country's bilateral trade with each other which showed that because of the free trade agreement there have very good bilateral trade relationships between Europe counties. We applied a multiple regression model to check the impact of product Comparative Advantage index (RCA) values on bilateral trade-economic growth between China and South Asia from 2000 to 2019, estimated results showed that the RCA values of chemicals, textiles and clothing, minerals, vegetables, footwear, and metals have a significant and positive impact on bilateral trade economic growth China and South Asia, but hides and skins has a significant and negative impact on bilateral economic growth. Tombolotutu, Khaldun used multiple regression models to check the investment, interest rate, productivity, and inflation rate impact on RCA products, results examine that the inflation rate has a negative impact on RCA, and productivity, interest rate, and investment have a positive impact on RCA values.

There are some limitations in study, the data sample which we took to examine the bilateral trade relationship between China and South Asian countries was from 2000 to 2019 which give us information that there is gap in data sampling, which will anyone can cover in future to take from different countries and regions and period also available for change, in study we applied multiple regression OLS model to check the impact on RCA product values on bilateral trade between China and South Asia countries and the Revealed Comparative Advantage (RCA) to investigate the comparative advantage of 20 products between China and South Asia, there also have gaps which will cover in the future to took other products than these 20 which we took in this study and also can use other models to check the bilateral trade relationship, for example the Trade Integration Index (TCD), Trade Complementarity Index (TCI), Term of trade, trade intensity index TII, intra-industry trade index GL and gravity model etc. to check the bilateral trade impact on economic growth.

The aim of this study is the investigate the bilateral trade relationship between China and South Asia to use the Revealed Comparative Advantage (RCA) and also check the impact of RCA 20 products on bilateral trade-economic growth between China and South Asia during the period of 2000 to 2019. To check the performance of trade in agricultural and industrial products between China and South Asia countries literature research used the Revealed Comparative Advantage (RCA). The estimated results examine after applied RCA that between 20 different products only 4 products which are Intermediate goods, Chemical products, Fuels, and Mech and Elec have the Revealed Comparative Advantage (RCA) greater than 1 that explains that these four products are strong comparative advantage between China and South Asia countries but other 16 product the stone and glass, textiles and clothing, transportation, consumer goods, fuels, hides and skins. Mach and Elec, intermediate goods, raw materials, animal, chemicals, food products, footwear, metals, minerals, miscellaneous, rubber and plastic, vegetable, wood, and capital goods, have RCA values of less than 1, which showed their weak comparative advantage, overall results examine that there is the weak bilateral trade relationship between China and South Asia countries.

To indicate the Revealed Comparative Advantage (RCA) 20 products impact on bilateral economic growth between China and South Asian countries we applied a multiple regression model, estimated results showed that the Revealed Comparative Advantage (RCA) values of chemicals, textiles and clothing, minerals, vegetables, footwear, and metals have a positive and significant impact on bilateral trade economic growth, but hides and skins has a negative and significant impact on bilateral economic growth China and South Asia. The results of the study explain that China has a weak bilateral trade relationship with South Asian country due to a few reasons, first is to for the past few years China does not have a good relationship with India which had world largest population in the world and export many things from other countries, but China is world biggest exporter so if China needs to improve the relationship with neighboring countries and make policies which help to improve the relationship with South Asia countries to increase productivity.

Policy implications

Based on the results of our analysis we suggest that China needs to make strike policies for the investors to invest in the country also government can change investment policies that are more friendly for investors to increase export productivity, and government can provide funds to the local investors to increase the export productivity, we also suggest that revise the export and import policies to decrease the import volume.

Upon request to the corresponding author, the data sets created for this study are made available.

Each of the mentioned authors contributed significantly, directly, and intellectually to the work.

Citation: Shahzad U, Xiaoyin H (2023) Influence of Bilateral Trade on Bilateral Economic Growth between China and South Asia. J Stock Forex. 10:231.

Received: 21-Dec-2022, Manuscript No. JSFT-22-21078; Editor assigned: 26-Dec-2022, Pre QC No. JSFT-22-21078 (PQ); Reviewed: 10-Jan-2023, QC No. JSFT-22-21078; Revised: 31-Mar-2023, Manuscript No. JSFT-22-21078 (R); Published: 10-Apr-2023 , DOI: 10.4172/2168-9458.23.10.231

Copyright: © 2023 Shahzad U, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.