International Journal of Advancements in Technology

Open Access

ISSN: 0976-4860

ISSN: 0976-4860

Research Article - (2025)Volume 16, Issue 2

The purpose of this study is to investigate the impact of supplier, customer and intra-firm integration on firm performance and global competitiveness in manufacturing industries. Specifically, the performance of the textile industry in the Ethiopian scenario in terms of production capacity, raw material capacity, import and export, quality, finance, supply and demand and job creation potential was examined. Deficiencies in resource utilization, poor production processes, insufficient information flow, insufficient technical capacity, infrastructure problems, storage system problems and weak and inadequate supply chain integration were identified. Insufficient logistics infrastructure existed. As a result, the performance and competitiveness of the local textile and clothing industry at national, regional and global levels are poor and weak. The study also revealed important findings regarding the substantial and highest positive relationships between organizational performance and internal, supplier and customer integration, from the highest to the lowest levels. Based on our findings, the best internal quality, better suppliers, proper integration of customers and fair government support have a positive impact on the textile and clothing industry's performance and global competitiveness. Field observations, questionnaires, interviews with company representatives, company reports and data were collected from 33 companies in Ethiopia's textile and clothing industry and 175 people responded to the survey. Primary and secondary data were analyzed using descriptive analysis, Statistical Package for the Social Sciences (SPSS) and FAHP tools. Finally, the policy implications for supply chain integration capabilities of supply chain strategies were highlighted and future research agendas were proposed.

Gearing power; Supply chain integration; Firm performance; Textile and apparel industry; Competitiveness

The manufacturing sector, which includes the production of furniture, fabricated metal products, plastic products, wearable clothing and textile products, among others, continues to be a key driver in sustaining the country's financial growth and improvement, employment development and poverty alleviation. [1]. Previous research has shown that pressures drive continuous change processes within companies, impacting all aspects of the supply chain, from rapid technology upgrades to significantly shortened product lifecycles. It is shown that there is. The textile and apparel industry supply chain has changed from regional cooperation and coordination to a global supply chain that spans the globe, with Asia, the United States, Europe and Africa all playing a role in textile supply chain activities. According to studies, the Ethiopian textile and clothing industry faces many technological challenges, including structural, operational and performance issues, at different levels of the supply chain.

Despite the fact that most of the Ethiopian textile and garment industries are faced with the challenges of garment manufacturing, the garment industry faces many technical challenges. The industry continues to operate on a small scale and in dilapidated production due to non-compliance with standards regarding working conditions and the origin of materials. Moreover, each sector is made up of many entities, some of which are structured as part of the supply chain and others of which are unstructured. Therefore, the Ethiopian textile and clothing industry faces the need to gain a competitive advantage in the global supply chains of which it is a part. Business process integration is gaining attention as the textile and apparel industry struggles to be competitive due to poor supply chain practices.

Competitiveness, the means to productivity, determines the ability to conquer new markets and outperform other market participants [2]. This is of great importance to policymakers, who need to understand how competitive their companies are, how they compare to other companies and how this competitive position develops over time. The need for evidence-based policy explains the media focus on composite indicators of “competitiveness” that compare an individual company's performance with that of its competitors. Nevertheless, several African countries with large textile industries are also recovering from adverse changes in international trade policies. Especially in most eastern regions of Africa, manufacturing may play a limited role in regional GDP and job creation [2]. For example, the share of manufacturing performance and competitiveness in the GDP of the surveyed countries is relatively small (3.8% to 11%), but the level of manufacturing is typically associated with developed countries (30% to 11%).

Moreover, supply chain performance and competitiveness, especially in the manufacturing industry in Ethiopia, are nil and poor due to weak and fragmented supply chain. The textile and clothing industry is one of the areas of particular focus for the government, as it is a means of job creation for university graduates and a pillar of the country's economy. However, the Ethiopian textile industry faces various challenges, including a lack of competitiveness and profitability both domestically and globally.

Additionally, fragmented and un-integrated supply chain processes in local manufacturing, including Ethiopia's textile and clothing industry, are highly dependent on imported raw materials and semi-finished textiles and clothing. The textile sector's supply chain, from cotton farms to domestic and international end customers, is full of challenges. This mismatch between fragmented supply chain processes and poor material and resource capacity tends to result in a failure of global competitiveness, contribution to GDP and viable development. Also, weak and inadequate supply chain integration leads to local resource utilization problems, inadequate production processes, inadequate information flow, insufficient technological capabilities, infrastructure problems, problems with storage systems and inadequate logistics infrastructure. As a result, the performance and competitiveness of the local textile and clothing industry are poor and weak at national, regional and global levels. The production performance of this weak region needs to be improved and research needs to be carried out to integrate policies and institutions into a sustainable economic contribution to the region in general and the country in particular. Therefore, the purpose of this study is to investigate the impact of supplier, customer and intra-firm integration on firm performance and global competitiveness in the textile and clothing industry. Specifically, the performance of the textile industry in the Ethiopian scenario in terms of production capacity, raw material capacity, import and export, quality, finance, supply and demand and job creation potential was examined.

The field observations, questionnaires, interviews with company representatives, company reports and data were collected from 33 companies in the textile and clothing industry in Ethiopia and 175 people responded to the survey. Researchers used semistructured interview questions to explore how supply chain levels and supply chain integration relationships influence firm performance in order to improve the global competitiveness of the textile and apparel industry [3]. Primary and secondary data were analysed using descriptive analysis, Statistical Package for the Social Sciences (SPSS) and FAHP tools. Finally, the policy implications for supply chain integration capabilities of supply chain strategies were highlighted and future research agendas were proposed.

An extensive literature review is conducted to highlight the position of this study in the current literature. The main idea of the current research is supply chain integration. The impact and roles of various supply chain dimensions on firm performance and the gearing powers of supply chain integration on manufacturing industries were considered.

Supply chain

In the current digital business environment, there are constant changes in customer needs, technology and social and economic factors. For the competitive environment, non-integrated companies have no chance of achieving optimal customer value. Instead, this is achieved through the harmonious cooperation of these companies as a supply chain. The flow of goods, services, money and information within and between business organizations such as suppliers, manufacturers and customers is characterized by supply chains. It also includes all types of companies involved in transportation, storage, data processing and material handling. Functions across the supply chain include sourcing, procurement, production planning, manufacturing, order fulfilment, inventory management, warehousing and customer service. The ultimate goal of SCM is to meet consumer demand more efficiently by delivering the right product in the right quantity, in the right place, on time and in good condition. Furthermore, Supply Chain Management (SCM) is defined as the management of a network of facilities that produce raw materials, transform them into intermediate and final products and deliver the products to customers through the "Lima Junior" distribution system. The ultimate goal of SCM is to meet consumer demand more efficiently by delivering the right product in the right quantity, in the right place, at the right time and in the right condition.

Supply chain in the Ethiopian context

In the supply chain system, the traditional non-integrated supply chain is based on a combination of electronic and paper-based processes and documentation. Developing nation including Ethiopia, supply chains are traditionally linear, but with separate flows of design, planning, sourcing, manufacturing and delivery. However, in today's business environment, supply chains are becoming dynamic, interconnected systems. The shift from linear, sequential supply chain operations to connected, open delivery operations systems could lay the foundation for how companies will compete in the future. These digital supply networks have the potential to change the competitive landscape for manufacturing as they integrate information from disparate sources to drive production and distribution. The country's industrial improvement approach essentially introduces standards specific to promoting agricultural-led industrialization, export-oriented progress and the expansion of labour-intensive enterprises. The country's industrial development strategy considers the value-added private sector to be the engine of sector growth. The Ethiopian government is focusing on domestic implementation. The industrial sector received the most emphasis through the promotion of export-based and import-substitution industries. Both vertical and horizontal connections between agriculture and industry are supported. It also emphasizes the commercialization and agro-industrialization of the agricultural sector, as well as the value chain approach. Despite great efforts and successful economic processes, the Ethiopian economy continues to suffer from structural problems. Within business processes, issues such as skilled labour, out-dated technology and a lack of relevant literature on practical experience in supply chain integration are trends and challenges for manufacturing companies in Ethiopia.

According to, supply chain integration and industrial cluster processes have been studied in infancy. The research implications and further research directions on the role of supply chain management and benchmarking of firm performance have also been included. Also shows that the fragmental supply chain practices highly effect on the performance and competiveness of textile, leather industry and other industries in the country. Mainly, in sufficient literature, traditional supply chain systems are the main constraints, addressed in the study shows green purchasing, marketing practices, investment recovery, organizational commitment, ecodesign and environmental practices the main challenges of Ethiopian tanneries in related to the green supply chain integration practices on manufacturing industries. Moreover, the lack of government support policies has also been investigated as challenges in implementing green supply chain management in the sector). The visibility of the inventory status, planning, forecasting and sharing of supply chain information was investigated as a gap for breweries with their suppliers and customers. According to this study, upstream supply chain systems were less reliable and flexible than the downward supply chain due to limited local suppliers’ capacity and long import process [4]. This implies that the practices and performance of the supply chain process in these sectors are weak and inadequate. According to the five key areas including corporate culture and decision making, partnership and collaboration, Airport SC information management system, performance measurement, value adding and optimizing in the airport SC activities were investigated, that needs to emphasize for enhancing for improved performance supply chain management processes/practices relevant to the airport industry in were studied and investigated. Form the above literature analysis highlights the patterns and complexities of the Ethiopian supply chain system studied by different analysts. The progress of accessibility chains in Ethiopia is still in its infancy, fragmented and out-dated, especially for the elemental metals segment. Therefore, the accessibility chains are fragmented and out-dated. An analysis of this literature shows that the common future of modern Ethiopia is in its infancy, with poor and un-integrated supply chains, inadequate measurement of supply chain performance, a lack of supply chain integration methodologies and strategies. However, these problems have undermined the production capacity, performance and international competitiveness of the manufacturing sector (Figures 1 and 2).

Figure 1: Developing countries leather supply chain systems.

Figure 2: Textile supply chain.

The textile business currently covers a large number and variety of processes that add value to fiber. These procedures can include everything from yarn manufacture to garment sewing, fabric embossing and composite manufacturing. However, when considering the textile fiber as the fundamental component of any textile product, the two types of textile manufacturing can be distinguished: Traditional and technology textiles (Figure 3).

Figure 3: Wood industry supply chain.

The previous study in Figures 1-3 indicates typical supply chain integration frameworks developed in various sectors. Particularly, the models were designed to integrate developing nation industries manufacturing industries.

Components of supply chains process

Different types of supply chain segments and components can be employed in developing and executing supply chain integration frameworks. In broad terms, the main steps involved in the process include entering orders, receiving and inspecting goods, shipping them, managing suppliers, scheduling production, managing warehouses, providing customer service and handling the design, development, procurement and distribution of materials and products. All company members are required to be involved in a unified and collaborative system for these activities.

Input and raw materials supplier: The raw materials used in textiles are more than just a set of qualities that result in a basic product. Instead, materials have the potential to determine how operations are carried out, as well as the technologies and product forms used in the production process. This can also extend to the design and structure of buildings. Raw materials refer to substances or elements that have not undergone any form of processing or treatment. Threads may require cleaning, soaking or application of different chemicals before they are made. Materials that occur in nature or are produced artificially are utilized in the textile industry [5]. The selection of the raw material depends on the kind of textile being made and the method of manufacturing being utilized. For instance, a cottonweaving mill may employ distinct machinery compared to a mill that weaves synthetic fabrics such as nylon. In terms of supply chain management, textile materials determine the range of potential suppliers, distributors of raw materials, or inventory on different segments of the supply chain. The performance of supply chain firms in the textile and apparel industry is significantly influenced by how well they manage and optimize the raw material supply chain. Therefore, implementing integrated systems in the supply chain for raw materials helps to reduce the cost of production and enhance profits by aligning the supply and demand of raw materials with the production process.

The manufacturer: Anywhere this idea is used, a supply chain refers to all of the stages involved in producing and distributing a product. Starting with the raw material, controlling and coordinating numerous manufacturing, communication and information technologies and finally delivering the finished product are all part of this process. Manufacturing, sourcing, shipping, logistics and retail operations are all part of the textile supply chain operations program. Globally, the textile industry plays a critical role in the country’s economic development. The textile and apparel manufacturing industry is responsible for fulfilling the country's domestic demand in addition to fulfilling the country's external demand for clothing and clothing products. Globally, textile manufacturers and merchants have embraced the concept of supply chain management to improve product development, quality and delivery goals and eliminate waste. Textile and apparel manufacturers can produce various types of textiles and parallel products to fulfill customer demands. Therefore, the textile and apparel manufacturing industries should have integrated supply chain systems for the performance and comparative advantage of the sectors. Customers due to global markets offering a variety of products of different quality and cost, customers look for more choices, better service, higher quality and faster delivery. During the supply chain process, a customer makes a request through a dealer and seller and the specification is then communicated to the textile manufacturer and producer. The fashion, clothing and textile industries have all been affected by today's awareness of customers and the focus on brand loyalty to transparent businesses. Consumers want to know about the origins, materials and history of the product. The only way to achieve these objectives is through traceability. The helix platform for natural textile fibers (such as cotton, wool, cashmere, silk, etc.) gives users a trustworthy tool to track and identify their products from source to retail, ensuring their long-term viability and integrity. In modern supply chains, the integrated, effective and efficient management of relationships between material suppliers, product manufacturers, distributors and retailers within supply chain companies is becoming increasingly important. Thus, textile and apparel material suppliers, material manufacturers, distributors, retailers and customers must adopt new supply chain improvement strategies, including total quality management, lean philosophy, agile and Just-in-Time (JIT) supply chain systems.

The conceptual framework developed for this study is formulated based on the concepts, strategies and investigations conducted in the literature review studies. From the literature review, it was found that the theoretical work developed in the previous period was, in fact, concentrated on single concepts and there was a lack of agreement in the literature and inconsistency on some components and levels of supply chain integration [6]. This framework provides a framework to clarify the leading ideas, the significance of concepts and a path for the direction of this study (Figure 4).

H1: Internal company integrations will have moderate and positive integration with supplier and customer integrations.

H2: Customer and supplier integration will moderate the relationship between internal integration and firm performance.

H3: Strong supplier, internal and customer integrations have the highest and most positive relationship with firm performance.

H4: Supplier and customer integrations have an equal positive relationship with firm performances in production capability, raw material capability, import-export, quality, financial and resource utilization.

H5: Internal and supplier integration will strengthen the relationship between customer integration and firm performance.

H6: Supplier, internal and customer’s integration will have a positive horizontal relationship between them.

H7: The highest supply chain integration performances have a positive impact on the comparative advantage and global competitiveness of the sectors.

Figure 4: Proposed conceptual model for supply chain integration.

Methodology

This study combined primary and secondary data sources with exploratory qualitative methods to address the main research objectives. Empirical analysis was used and field survey figures are among the qualitative data that were supported. The researchers used primary and secondary data types in their data analysis, resulting in a triangulated result.

Sampling techniques

A sample is an ideally representative set of units drawn from a population in order to ascertain facts about that population. To put it another way, it's the process of learning about a whole population by looking at a subset of them. The sampling strategy used determines the representativeness level. According to various scholars, sampling is used in research due to workload and resource constraints (time, money). We employed purposive sampling in this study because the researcher's intention to focus on a specific group is what gives a no probability sample its inherent selectivity [7]. When combined with exploratory qualitative research techniques, the purposive sampling technique-a kind of non-probability sampling-works best for studying a particular cultural domain with knowledgeable experts. Purposive sampling was thus chosen as the sampling strategy for this investigation.

Populations and sample size of the study

Determining the appropriate sample size is also crucial because too-large samples can waste money, time, and resources, while too-small samples can produce unreliable results. An ideal sample is one that satisfies the needs for reliability, flexibility, efficiency and representatives. The goal of the study, the size of the population, the possibility of choosing a poor sample and the permitted sampling error are some of the variables that affect sample size [8]. To be more precise, the percentage of confidence intervals that include the true value of the parameter will match the confidence level Anvar if they are created from numerous independent data analyses of repeated (and possibly different) tests.

Generally speaking, for every sample or sub-group that needs to be analyzed, a statistical sample needs to include 50-100 cases. If the sample size, n, the population proportion size, N, σ is an estimate of the standard deviation, where Z (we considered 95% confidence precision) is the z score associated with the confidence level required, z=1.96, E is the required precision is 0.05 and to estimate mean, s, sample of 25 is considered accordingly the mean and standard deviation of the variables are found as the mean=13.73 and standard deviation is 3.71 which gives the mean=0.338. Then the calculation becomes: n=(Z2 × σ2)/(E2)=(1.962 × 0.3382)/(0.052)=175. Thus, a total sample size of 175 responses is considered form the targeted area.

Methods of data collections

As data collection techniques, both primary and secondary data collection methods were used. The primary data was gathered via questionnaires, interviews and field observations from specific and targeted companies and groups. In addition, secondary data was gathered from various sources such as reviewing published journals, conference papers, working papers and existing research work, in order to achieve the research objectives. The gathered data was examined, analyzed, debated, quantified and the results were subjected to validation and verification.

Data sources

Primary data: The primary data is collected during field observation and interviewees, from selected Ethiopian textile and apparel industries. During the data collection process individuals, government organizations and private company and institutions were considered.

Secondary data (literature review): Under this, the selected articles which were related to supply chain, roles of supply chain, gearing powers of supply chain integration on textile and apparel industries were investigated and studied. All secondary data in this research have been compare, validated and crosscheck with the primary data.

Data analysis, reliability and validity method and tools

Data analysis: After collecting the primary and secondary data, the input data was validated and checked the reliability of a data collection method or instrument is considered reliable if the same result is obtained from using the method on repeated occasions [9]. If it is needed outcomes are verified and then the data are qualitative and quantitatively analyzed, interpretation, discussion, quantify synthesis.

Subsequently development of framework and experimentation/ testing in accordance with the objective of the research is done.

Reliability analysis: Research requires dependable measurement. Reliable data is dependable, trustworthy, unfailing, sure, authentic, genuine, reputable. Consistency is the main measure of reliability. Measurements are reliable to the extent that they are repeatable and that any random influence which tends to make measurements different from occasion to occasion or circumstance to circumstance is a source of measurement error. In this study Cronbach's alpha were used as a measure of internal consistency, that is, how closely related a set of items are as a group. It is considered to be a measure of scale reliability.

Analysis tools: The empirical/quantitative analysis has been done using the Fuzzy TOPSIS and SPSS tools. The Fuzzy TOPSIS mainly apply for ranking on the variable to make decisions based on the priority on impacting levels for each performance measures. Because the fuzz TOPSIS, were used for the decision-making process that can be the input can be obtained from actual measurement such as price, quality, weight, rank, etc. and from subjective opinion such as satisfaction feelings and preference during our data collections. Using SPSS offers a detailed description and correlation analysis of the supply chain practices with textile and apparel industry performance were employed.

Why t, C and np chart?: Due to monitoring manufacturing processes, managing an attribute quality characteristic is easier and faster than a variable quality characteristic using control charts. Control charts are widely employed to establish and monitor statistical control of a process. It is an effective tool for assessing process parameters [10]. As result we have to evaluate using t,c and np charts. Both A c-chart is an attributes control chart used with data collected in subgroups that are the same size.

C-charts show how the process, measured by the number of nonconformities per item or group of items, changes over time. np-charts are used to determine if the process is stable and predictable, as well as to monitor the effects of process improvement theories.

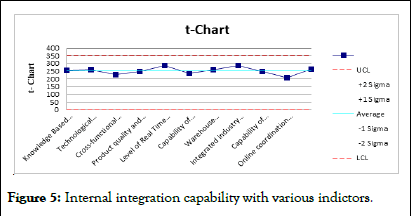

This section covers knowledge-based skills and manpower capability, technological machine capability (newness, variety and efficiency), cross-functional integration in new product design and development capability, warehouse management system and facility, online coordination and material flow and integrated industry and project management skills that determine the performance of the internal supply chain capability for the production of textile and apparel products. The control charts are employed to ascertain the normalcy or abnormality of the process operation and the determinate factors. While the region between UCL and LCL defines the range of normal variability, within the control limits, the process operation is deemed to be normal or "in a state of control [11]." For this reason, in the figure below, the target (or centerline) is the desired (or expected) value. Thus, the following method can also be used to determine the supply chain integration determinant factors (Figure 5).

Figure 5: Internal integration capability with various indictors.

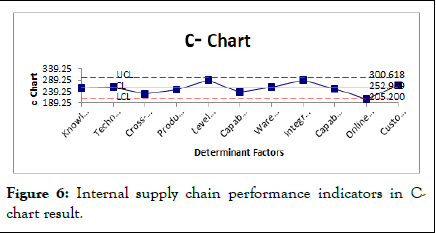

In this control chart, the capability range is determined by the upper, lower and average ranges of the determinate factors. Also, the variation between the determinate factors was determined and studied. In the following figure, the c-chart is used to determine the levels of supply chain performance indicators that determine the performance of internal supply chain integrations for the production and manufacturing of textile products. The sample mean (average) and the average impact level of the determinate factors are plotted in the central line of the Control Charts (CL). If the determinate factors are far from the CL, which can be weakly implemented in the industry, those determinate factors highly influence the performance and competitiveness of internal supply chain integration in manufacturing industries [12]. While product quality and flexibility are near the UCL, online coordination and material flow are near the lower critical limits of the control charts. The two determinate factors have the highest variations between them (Figure 6).

Figure 6: Internal supply chain performance indicators in Cchart result.

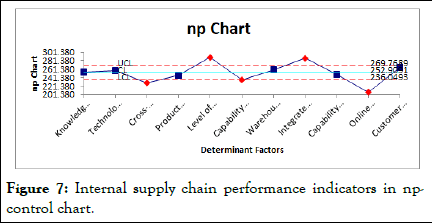

In the analysis, the most determinate factors, including online coordination and material flows, integrated industry project management skills and mutual understanding, warehouse management system and the facility, the capability of material handling and equipment in the facility, level of real-time access to information for high visibility and product quality and flexibility, are far from the average value (the central lines) on the control charts. Those determinate factors have a high influence on the performance and internal supply chain integration. These are due to weakly implemented regulations on local industries. As a result of poor online coordination and material flow, integrated industry and project management skills and mutual understanding, warehouse management system and facility, the capability of material handling and equipment facilities, the level of real-time access to information for high visibility and the product quality and flexibility productivity, the overall performance of the local industry for the production of textile and apparel products are poor and infant (Figure 7).

Figure 7: Internal supply chain performance indicators in npcontrol chart.

Furthermore, the empirical result is shown in the above: Npchart cross-functional integration in new product design and development capability, level of real-time access to information for high visibility, integrated industry, project management skills, close relationships and mutual understanding and online coordination and material flows are out of control. The determinate factors do not work in the industry and it needs to work for the improvement of the systems.

Locally, most manufacturing industries have fragmental integration, weak cooperation, poor speed and flexibility in their systems as well as infant project management skills and capability. Due to this weakness and insufficient performance, the capability of the textile and apparel industries is poor and weak [13]. Due to this insufficient performance, there was a shortage of quality textile products to fully fill the demand of the country.

Supply chain integration influences to local industry performance

Supply chain integration is the strategic integration of both intra- and inter-organizational processes and gauges the extent to which supply chain partners work collaboratively together to achieve reciprocally beneficial outcomes. And conducted research on the positive effects of supply chain systems on manufacturing industries. Meanwhile, in this study, the Ethiopian textile and apparel industry's supply chain integration trend and practice were investigated. The result shows that in Ethiopia there is a fragmented, weak and poor supply chain system for textile industries. This leads to financial issues, skilled labor constraints, unbalanced material demand and supply, rigid business processes, outdated technology, poor information exchanges and challenges in innovation and technology transfer to firms. Moreover, based on the data collected from selected companies production head, quality, logistic, procurement and managing directors, The Ethiopian Ministry of Industry and the Ethiopian MIS, the supplier, internal company and customer relations and supply chain practices were investigated in the following manner.

The correlation analysis in the Table 1 above indicates that supplier, customer, internal and supply chain integrations have a strong and positive impact on firm performance in raw material capability, quality, flexibility, speed, finance and technological capabilities. Firms with strong internal, customer, supplier and supply chain integrations improve their supply chain performance. Textile and apparel manufacturing industries should be integrated strongly at the internal, supplier, customer and supply chain integration levels so as to improve firm performance [14].

Correlations |

||||||

|

SCIP |

SSCI |

SI |

II |

CI |

|

Supply chain integration performance |

Pearson correlation |

1 |

|

|

|

|

Strength of supply chain integration |

Pearson correlation |

0.931** |

1 |

|

|

|

Supplier integration |

Pearson correlation |

0.875** |

0.767** |

1 |

|

|

Internal integration |

Pearson correlation |

0.911** |

0.806** |

0.686** |

1 |

|

Customer integration |

Pearson correlation |

0.819** |

0.732** |

0.796** |

0.599** |

1 |

Note: **Correlation is significant at the 0.01 level (2-tailed) |

||||||

Table 1: Correlation analysis on supplier, internal, customer supply chain integrations with supply firm performance.

This empirical investigation shown in Table 1 indicates that the supply chain integration performance has a strong correlation with customer (0.819), supplier integration (0.875), internal integration (0.911) and supply chain integration (firm performance) (0.931) from the lowest to the highest level, respectively. The comparative advantage and global competitiveness of firms mainly depend on the levels of customer, supplier, internal company integration and firm performance integration. According to shows that the linkage and power of supply chain integration have a positive impact on supply chain performance. Therefore, for competitive comparative advantage and global competitiveness, firms must be highly integrated in supply chain integration, internal integration and supply chain integration performance, compared to customer and supplier integrations (Tables 2 and 3) [15].

| CA and GC | SCI | II | SI | CI | SCIP | |

| Comparative advantage and global competitiveness | 1 | |||||

| Supply chain integrations | 0.914** | 1 | ||||

| Internal integrations | 0.907** | 0.806** | 1 | |||

| Supplier integrations | 0.849** | 0.767** | 0.686** | 1 | ||

| Customer integrations | 0.754** | 0.732** | 0.599** | 0.796** | 1 | |

| Supply chain integrations performance | 0.972** | 0.931** | 0.911** | 0.875** | 0.819** | 1 |

Table 2: The bivariate correlation analysis of various type supply chain integration with comparative advantage and global competitiveness.

| Correlations | |||||||||||||

| SI | II | CI | RMC | FRP | ITTC | LIC | LMC | QSFCS | WMP | GMP | TCP | ||

| Â SI | Pearson correlation | 1 | |||||||||||

| II | Pearson correlation | .483* | 1 | ||||||||||

| CI | Pearson correlation | 0.31 | 0.267 | 1 | |||||||||

| RMC | Pearson correlation | -.601** | -0.37 | -0.289 | 1 | ||||||||

| FRP | Pearson correlation | -0.124 | 0.353 | -0.061 | 0.215 | 1 | |||||||

| ITTC | Pearson correlation | .726** | 0.377 | 0.256 | -.485* | 0.209 | 1 | ||||||

| LIC | Pearson correlation | .732** | 0.372 | 0.258 | -.491* | 0.189 | 1.000** | 1 | |||||

| LMC | Pearson correlation | .747** | 0.353 | 0.264 | -.510* | 0.129 | .997** | .998** | 1 | ||||

| QSFCS | Pearson correlation | .723** | 0.381 | 0.254 | -.481* | 0.221 | 1.000** | .999** | .996** | 1 | |||

| WMP | Pearson correlation | -.678** | -.414* | -0.236 | .433* | -0.348 | -.990** | -.986** | -.975** | -.991** | 1 | ||

| GMP | Pearson correlation | .730** | 0.373 | 0.257 | -.490* | 0.194 | 1.000** | 1.000** | .998** | 1.000** | -.987** | 1 | |

| Â TCP | Pearson correlation | -.660** | -.423* | -0.229 | .415* | -0.39 | -.982** | -.978** | -.963** | -.984** | .999** | -.979** | 1 |

| Note: *Correlation is significant at the 0.05 level (2-tailed); **Correlation is significant at the 0.01 level (2-tailed) | |||||||||||||

Table 3: Bavaria correlation analysis for the practices of supply chain integration with various indicators.

From Table 1 to 3 above, it shows that, because of a strong supplier, internal and customer integration firms have positive and strong overall performance and competitiveness. According to these findings, strong integrations provide the means to reduce resource constraints, improve production capacity, enhance efficacy, share resources and improve the speed and flexibility of manufacturing firms. Thus, for global competitiveness and strong performance, the textile and apparel industries should be integrated into the supplier, manufacturer and customer levels of the various strategic, tactical and operational intensities. But depending on the firm type and the levels of firms, business organizations should integrate into various strategic functions of supply chains. For instance, in the supply chain process, the supplier and manufacturing company integrate in a harmonized way for their demand and supply projections, distribution and logistics infrastructure with collaborative planning, forecasting and mutual benefit. A bivariate correlation analysis was also performed on supply chain integration, internal integration, supplier and customer supply chain integration performance, supply chain performance with comparative advantage and global competitiveness. According to these correlation results, the level and type of supply chain integrations are positively correlated, but the influencing factors and levels of integrations are different from scenario to scenario. Both empirical and literature analysis revealed that the Ethiopian manufacturing sectors were in their infancy at the national and regional levels. Poor and non-integrated supply chains, improper supply chain performance measurement systems, a lack of supply chain integration methods and strategies and poor supply chain management practices and systems were the common futures of the current Ethiopian manufacturing sectors.

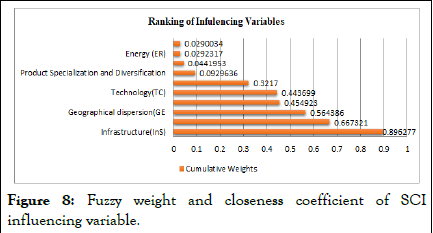

Fuzzy AHP analysis and ranking of supply chain practices

The fuzzy AHP analysis and ranking, as shown in Figure 8, revealed that infrastructure, raw materials, geographical condition, technology, human capability and financial issues were ranked as the most influential variables on the performance and strength of supply chain integrations. Product design and development, innovation, energy and sustainability issues are considered the lowest influencing variables for supply chain integration in the textile and apparel industries. This implies that an effective and capable infrastructure facility, including the capability of production machines, conveyor systems, warehouse and material flow systems, transportation, logistics and distribution capabilities, has higher and positive gearing power on the performance and competitiveness of the textile industry.

Figure 8: Fuzzy weight and closeness coefficient of SCI influencing variable.

The fuzzy AHP analysis, prioritization and ranking shows that the infrastructure issue has the highest and sustainability issue has the lowest influencing variables that impact on the performance of supply chain integration. Thus, this empirical result clearly shows that the geographical dispersion, infrastructure, raw materials, human factors and technological capability have all highly influenced the performance and competitiveness of firms within the supply chain process (Table 4).

| Average weighting vector of SCI criteria ((Fuzzy weight) (wi) | The relative fuzzy weights of each driving factors/ Weighted normalized fuzzy decision matrix (Ѿi) | |||||

| Geographical dispersion | 8.3875 | 8.5125 | 11.0625 | 0.130901 | 0.134932 | 0.122729 |

| Technology | 7 | 7.5625 | 10.5625 | 0.109247 | 0.119873 | 0.117182 |

| Raw material | 8.7875 | 9.075 | 11.7375 | 0.137144 | 0.143848 | 0.130218 |

| Human factors | 7.5875 | 0.375 | 10.8875 | 0.118416 | 0.005944 | 0.120788 |

| Sustainability issue | 4.9125 | 6.1125 | 9.1 | 0.076668 | 0.096889 | 0.100957 |

| Finance | 7.5875 | 8.4625 | 9.4 | 0.118416 | 0.134139 | 0.104285 |

| Product specialization and diversification | 8 | 10.5625 | 6.5625 | 0.120873 | 0.117182 | 0.109247 |

| Innovation | 6.225 | 7.4125 | 8.6875 | 0.097152 | 0.117496 | 0.096381 |

| Energy | 5.9 | 6.3625 | 8.7875 | 0.09208 | 0.100852 | 0.09749 |

| Infrastructure | 7.6875 | 9.2125 | 9.9125 | 0.119977 | 0.146027 | 0.149971 |

| Column sum | 72.075 | 73.65 | 96.7 | Normalized weights | ||

Table 4: Fuzzy weights of the decision variables.

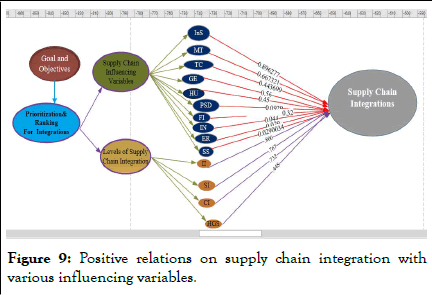

At different levels of the decision hierarchy, the aggregate local priorities compound global priorities for the alternatives based on the weighted sum method. The investigation and ranking of influencing variables on fuzzy AHP results in the figure above shows that INS>MT>GE>HU>TC>PSD>FI>IN>ER>SS from the highest to the lowest, respectively. The following research evidence supports these empirical results: While the range and values of the empirical investigation variables illustrate to some extent how they are directly affecting the supply chain performance and the integration process of the firms, Furthermore, according to these empirical investigations, infrastructure issues, raw materials, geographical conditions, human capability, technology and finance have the highest impact on the performance of supply chain integrations (Figure 9).

Figure 9: Positive relations on supply chain integration with various influencing variables.

Based on the investigations, the evaluations were ranked as INS>MT>GE>HU>TC>FI>PSD>IN>ER>SS from the highest to the lowest, respectively. While the level and type of information integration and information sharing, the impacts of infrastructure on supply chain integrations, technology and Information Technology (IT) have a stronger impact on upstream integration and technological capability impacts on performance. Sustainability issues, impacts of innovation and internationalization, transportation, logistics and information technology infrastructure, raw material impacts on SCI geography and facilities and the impacts of culture geography) have a great impact on the performance and competitiveness of supply chain integrations. Thus, the performance and competitive advantage of supply chain integrations in manufacturing industries are influencing the capability of these driving variables. From this result, we perceive that supply chain firms should put more and more emphasis on their efforts on geographical infrastructure, human development, technology and the issue of raw materials to be competitive in their business in the global market. Laterally, firms should work together to implement more effective and efficient strategies for resolving the issues and bottlenecks of infrastructure and geographical desperation in their integration. Therefore, managers and leaders should be considering the impacts and levels of these drivers’ factors on the supply chain integration process. Finally, our finding indicates that most of our hypotheses were supported or partially supported, broadly indicating that the positive impacts of supplier, internal and customer integration are related to firm performance. Specifically, applying the correlation analysis approach, we found that supplier, internal and customer integration was directly related to production, quality, speed, flexibility and financial performance of the textile and apparel industries.

According to our investigations, internal integration has an important impact on firm performance, but in a different way than supplier and customer integration. While supplier and customer integrations have different impacts on relationships with firm performances in production capability, raw material capability, import-export, quality, financial and resource utilization, rather, internal, supplier and customer integration have positive impacts on firm performance, from the highest to the lowest, respectively. Wal-Mart, for example, used digital, cloud-based systems to implement innovative, integrated and competitive supplier and manufacturer integration strategies. With the help of Radio Frequency Identification tags (RFID), Wal-Mart can control a handheld scanner that allows employees to quickly learn which items need to be replaced so that shelves are consistently stocked and inventory is closely watched. In this scenario, Wal-Mart improves its performance and competitiveness through integrated, flexible and digital integration and collaboration mechanisms and facilities. According to the empirical investigation found in the previous sections, internal integration has a higher and more positive impact than supplier and customer integrations in a supply chain process. Internal integration is done across departments and functions in production, planning, sales, distribution, innovation, resource utilization, etc. under the control of the manufacturer in order to fulfill customer requirements. Like Wal-Mart, local manufacturing industries at the internal supply chain integration level may be provided by cross-functional teams that bring together a carefully selected array of specialists who share information and make product, process and manufacturing decisions jointly and simultaneously. These internal integrations have a higher impact than supplier and customer integrations on local textile and apparel industry performance and global competitiveness. Furthermore, manufacturing firms can achieve firm performance improvement and global competitiveness with high levels of internal functional integration, including in production, sales and distribution, to a greater extent. Therefore, the highest internal, best supplier and good customer integration have a positive impact on the performance and global competitiveness of the textile manufacturing sectors at national, regional and global levels. As a result, internal integrations have greater gearing power than suppliers, customer-to firm performance and global competitiveness in the national textile and apparel industries. Therefore, strong and high integration in managing the raw materials, logistics, transportation, distribution, allocating the resources and optimizing the inventory process has the highest gearing power for the entire performance of manufacturing industries. Consequently, firm performance and global competitiveness are more positively and negatively influenced by the levels of supply chain integration. Thus, firm performance in supply chain integration has direct and positive impacts on the global competitiveness and comparative advantage of the textile and apparel industries.

In this study, the role, trends and impacts of supply chain integration on textile and apparel industries performance and global, regional and national economic contributions were studied. The performance in production capacity, raw material utilization, import-export, information flows, financial demand-supply and job creation potentials of the textile and apparel industries in the Ethiopian scenario were studied. A study shows that the practice of supply chain systems, resource utilization, technological capability and market performance are poor and infant. As a result of the above concepts and the combined effects of each performance dimension, the sector has weak and poor performances in terms of global competitiveness and regional GDP contributions.

Moreover, the impact and gearing powers of various levels of supply chain integration on supply chain performance and competitiveness were also studied and investigated. Descriptive statistics, bivariate correlations and the control chart analysis were incorporated for the analysis and investigation. The various levels of integration, including internal integration, supplier integration and customer’s integration, have the highest and most positive impact on the overall performance of the firm and the global competitiveness of the sectors. The findings also show that internal supply chain integration has a higher positive impact on supply chain performance in terms of supplier and customer integration..

Hence, for a firm to improve overall performance through the coordination of information, material, information, technology and money among supply chain partners, it must first launch an effective and efficient internal integration within the functional department and equivalent firms to fulfill customer requirements. Supplier and customer integration with supply chain partners also has a positive impact on firm performance and global competitiveness. Government support and higher education integration are also considered influencing variables on firm performance and the global competitiveness of manufacturing industries. The levels of influence are lower than internal, supplier and customer levels in a supply chain process. Therefore, the levels and gearing power of supply chain integration segments, including internal integration, supplier integration and customer support integration, were considered from different perspectives.

In accordance with the journal policy and my ethical obligation as a researcher, we are reporting that, we assure that the authors did not receive support from any organization for the submitted work. No funding was received to assist with the preparation of this manuscript. No funding was received for conducting this study and no funds, grants or other support was received. We have disclosed those interests fully to journal and have in place an approved plan for managing any potential conflicts arising from this arrangement.

The authors have no relevant financial or non-financial interests to disclose. The authors have no conflicts of interest to declare that are relevant to the content of this article. All authors certify that they have no affiliations with or involvement in any organization or entity with any financial interest or non-financial interest in the subject matter or materials discussed in this manuscript. The authors have no financial or proprietary interests in any material discussed in this article.

The data that support the findings of this study are available from the corresponding author, upon reasonable request.

This article does not contain any studies with human participants or animals performed by any of the authors.

The collected data used to support the findings of this study are available from the first author upon request.

The authors would like to express their appreciation for the editor and reviewers’ valuable comments and very detailed remarks, which were of significant help to improve the quality of this paper.

[Crossref] [Google Scholar] [PubMed]

Citation: Damtew AW (2025) Gearing Powers of Supply Chain Integration on Firm Performance and Competitiveness: (Case of Ethiopian Textile and Apparel Industry). Int J Adv Technol. 16:344.

Received: 13-May-2024, Manuscript No. IJOAT-24-31344; Editor assigned: 16-May-2024, Pre QC No. IJOAT-24-31344 (PQ); Reviewed: 30-May-2024, QC No. IJOAT-24-31344; Revised: 20-Mar-2025, Manuscript No. IJOAT-24-31344 (R); Published: 27-Mar-2025 , DOI: 10.35841/0976-4860.25.16.344

Copyright: © 2025 Damtew AW. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.