International Journal of Advancements in Technology

Open Access

ISSN: 0976-4860

ISSN: 0976-4860

Research Article - (2016) Volume 7, Issue 3

As the worldwide shipping continue to face numerous challenges, recent policies will meaningfully limit the extent of sulfur Oxides emissions from vessels, these include North America and northern Europe. Liquefied Natural Gas is a possible solution for attaining these requirements. This is due to its practically no sulfur content with its combustion producing very low NOx compared to conventional fuel oil and marine diesel oil. Liquefied Natural Gas is cleaner - burning, and also economic advantageous over other marine fuels. Due to these scenarios and results, there have been recent developments to encourage use of Liquefied Natural Gas as a bunker fuel. This research work therefore is on espousing Liquefied Natural Gas as marine propulsion fuel: prospects and challenges. Specific objectives in line with the broad objective were formed while hypotheses and research questions were also formulated in consonance with the objective of the study. Literature was reviewed to address objectives and the research questions. Statistical data were also extracted from different global marine companies. Expo facto research design and survey research were used in this study. The data collected were used to test the four hypotheses using appropriate statistical tool for each hypothesis. The statistical tools include Regression (Time Series Analysis), Cost Benefit Analysis (Net Present Value- NPV), Factor Benefit Analysis (Kaiser's Measure of Sampling Adequacy) and the Pearson’s Product Moment Correlation coefficient (PPMCC). The results of the analyses showed that LNG is highly significant with time while MDO and IFO are not significant with time. This study further revealed that the major factor influencing the adoption of LNG as marine propulsion fuel is not the factor influencing IFO and MDO marine fuels. It also showed that the cost-benefit of espousing Liquefied Natural Gas as a marine fuel is better than cost benefit of espousing MDO and IFO, it also revealed that there is a relationship between espousing LNG fuel and its associated challenges which include initial high cost of investments in infrastructures, cost of LNG vessels among others. The study concluded that Liquefied Natural Gas should be adopted as a marine fuel. The study therefore recommended that the use of Liquefied Natural Gas as marine fuel should be encouraged by all vessels to ensure emission compliance and that strict regulation should also be enforced to checkmate violators of emission regulations among other recommendations.

<Keywords: LNG; Marine; Propulsion; Fuel; Prospects; Challenges

Energy is an important component in a nation’s economy and for the living standard of its people. The societal importance of the energy sector, in combination with the threat of climate change opened up a new research field analyzing the future energy system. Models have been developed in order to analyze future energy system [1]. The move toward using Liquid Natural Gas (LNG) as a marine fuel is continuing to get momentum as new environmental regulations are enacted and bunkering facilities are expanded [2].

A market insight firm that emphases on the maritime sector, nearly 10,000 vessels could be embracing LNG propulsion by 2020 compared to less than 100 today [3]. LNG would become the predominant fuel source for all merchant ships within 40 years [4]. The reason for such growth is strict emission regulations requiring sulphur oxides (SOx) and nitrogen oxides (NOx) to 0.1 percent Emission Control Areas (ECAs) by 2015 and 0.5 percent globally by 2020 [4].

Anna of National Energy Policy Institute on his paper “Liquefied Natural Gas as a Marine Fuel, a Closer Look at TOTE’s Containership Projects”, New rules by the International Maritime Organization and the U.S. EPA have created limitations on the sulfur emissions for the marine industry and changed the economics of LNG as a marine fuel. Compared to other emissions compliance options, LNG is an economically viable option for some vessels. Over time the lower operating costs (fuel and emissions compliance) can pay for the large capital investment in an LNG conversion project or new build LNG powered vessel.

Statement of the Problem

This research is aware of the following threats which has been posed by conventional shipping fuel that;

• Global shipping is a key source of SOx, NOx and COx discharges and accounts for almost 4% yearly emissions of SOx, 7% NOx and 3% COx emissions.

• Ecological modernism in the marine sector has significant role in reducing climate change threats

• Emission of other harmful substances proven to be health unfriendly.

• There are more harsh rules on sulfur content in crude oil-based marine fuels.

• IMO, has set upper limits for sulfur content.

• High need for alternate answers to ensure a viable and naturally responsive shipment.

Some of the current and alternative fuels and the associated problems are as follows.

HFO (Heavy Fuel Oil): sulphur cleaning technology is needed from 2020, high carbon content, limited total supply of oil.

MGO (Marine Gas Oil): this is associated with high carbon content in the fuel.

BTL (Biomass-to-liquid): this fuel is associated with Limited supply of biomass due to competition with food production.

GTL_CTL (Coal-to-liquid_Gas-to-liquid): associated with large carbon emissions, especially when the fuel is produced from coal.

Hydrogen: New technology (few example exists), expensive fuel production, new infrastructure needed, more space onboard.

Electricity: Not seen as an option in this study due to technical reasons with e.g. battery capacity.

Contribution today is negligible and may not find public acceptance in the future. It is also not seen as an alternative in this study.

Considering the above mentioned threats and problems posed by the conventional marine fuel, this research would deep into the prospects as well as the challenges of replacing high content Sox, NOx and Cox fuel with liquefied natural gas.

The challenges linked with the espousal of LNG as marine propulsion fuel include the high level of technological need and requirement, timing uncertainties, low demand for LNG fuel. These constitute to the problem statement.

The aim of this research is espousing liquefied natural gas as marine propulsion fuel: prospects and challenges. But specifically, the objectives of this research are as follows

• To find out if the price of LNG relative to prices of MDO and IFO is significant with time

• To determine the factor benefits and drivers for espousing LNG as a marine fuel

• To examine the cost benefit of espousing LNG as a marine fuel

• To examine the challenges of espousing LNG as a marine fuel

From the above specific objectives, the following research questions were raised in other to address the main purpose of the study.

• Is the price of LNG relative to prices of MDO and IFO a prospect of espousing LNG as marine propulsion fuel?

• What are the factor benefits for espousing LNG as a marine fuel?

• Does LNG marine fuel have cost benefits over MDO and IFO?

• What are the challenges of espousing LNG as a marine fuel?

Statements of hypotheses

The hypotheses were presented in their null (Ho) forms.

H01: The price of LNG is not more significant with time relative to the prices of MDO and IFO.

H02: The major factor influencing the adoption of LNG as marine propulsion fuel is not the factor that influences the MDO and IFO marine fuels.

H03: The cost-benefit of espousing LNG as a marine fuel is not better than cost benefit of espousing MDO and IFO.

H04: The challenges associated with espousing LNG as marine propulsion fuel are not significant.

Scope of the study

In content, this research work is on espousing liquefied natural gas as marine propulsion fuel: prospects and challenges.

Geographically, though this research work is a global scenario, the need to domesticate some of the information arose from the dearth of global data in this area. But Nigerian LNG in Port Harcourt was used as a study area. Time scope of this study is between 2005 and 2012.

Conceptual framework

Present regulations in the shipping industry have necessitate increased response to adoption of low sulfur fuel and less continued dependence on the conventional fuel used in marine industry which has high emission materials. Due to this ongoing scenario, LNG fuel has being seen as the most alternative fuel that is not only cleaner but also in the present rising of fuel cost. The Emission Control Areas (ECA) which was introduced (European, US and Canadian territorial waters) and the IMO’s Marine Environment Protection Committee will have a significant impact on international shipping over the next years [5].

Drivers for LNG in the shipping industry

There are three drivers which make liquefied natural gas (LNG) more suitable in the shipping industry: First, LNG as ship fuel reduces Sulphur Oxide (SOx) emissions by between 90 and 95 per cent and Nitrogen Oxide (NOx) emissions to comply with IMO Tier III limits. Second, LNG’s lower carbon content leads to a reduction of Carbon dioxide (CO2) emissions by 20 to 25 per cent. Third, current LNG prices in Europe and the USA is comparable to heavy fuel oil (HFO) [6].

Due to a nearly non-existent supply chain and lack of sufficient studies for supply, bunkering and ship design, LNG was never considered a serious alternative to traditional marine fuel in the past. However, recent studies by DNV GL in collaboration with maritime stakeholders and the results gained from more than 40 successful LNG projects have led to a change in thinking and new solutions [7].

Various ways of meeting IMO Annex VI requirement and relative economics

There are three major ways in which operators in the maritime industry can meet the low sulfur limits of IMO. These include:

Combination of marine distillate oil with very low sulfur diesel: To meet the 1% sulfur limit while operating inside of an Emission Control Area and marine distillates to meet the 3.5% limit while outside of the ECA. This choice significantly increases fuel costs for vessels while operating within the ECA.

Propulsion with traditional or conventional fuel with scrubber technology installation: Scrub-off pollutants technologies such as scrubbers when installed in the marine engines helps to get rid-off ‘capture engine exhaust and scrub’ [5], pollutants such as SOx and Particulate Matters before it could be released to the environment. This technology allows a ship to meet the Sulfur (SOX) and Particulate Matter (PM) standards while using residual fuel oil or marine distillate.

Installation of Waste heat recovery technology: The waste heat recovery (WHR) system consists of an exhaust gas heated boiler supplying steam to steam turbine. To boost the electricity output, the system can be extended with a gas turbine utilizing the energy in the exhaust gas not used by the turbocharger.

Building or conversion of new vessels propelled through LNG: This choice is the best choice among the above options, this is because it totally reduces SOx (1ppm), PM emissions, NOx ~90% and CO2 emissions by ~20%. While sulfur fuels and scrubbers do not take care of NOX and CO2.

Challenges of espousing LNG as marine propulsion fuel

The use of LNG as a marine fuel is very attractive from an emissions compliance perspective, but there are some significant challenges that must be addressed by a marine operator that chooses to convert its vessels to LNG.

Limited LNG infrastructures: Limited LNG infrastructures are in place such as marine ports, and these are present hiccups in the shipping industry, the overall cost of infrastructural development adds to the overall fuel cost and it presents a hurdle to LNG adoption.

Current regulatory hurdles and high cost of barging fuel to vessels: This is a serious challenge in adopting LNG fuel as marine propulsion fuel in the shipping industry. As new industries springs up, cost of investing in barging facilities will finally add up to the fuel cost as well as new regulations and legislations.

Challenge of the expensive nature of vessel purchase or conversion to LNG: Challenge of the expensive nature of vessel purchase or conversion to LNG fuel is another problem or challenge in the adoption of LNG propulsion fuel. The cost of LNG conversion is very high while new purchase is as well a challenge.

Vessels spend significant proportion of time inside the Emission Control Area (ECA): This might add to overall operating cost of the vessels while others operating outside ECA boundaries do not experience high cost related to sulfur compliance.

There is also significant proportion of space to be occupied by LNG tanks unlike conventional marine fuel tanks: This also limits the proportion of space to be occupied by cargo.

The Table 1 below shows the established ECA limit for Sulfur Oxides and particulate matters emissions, though this is subject to review in 2018 on LNG fuel availability.

| Outside Emission Control Areas | Inside Emission Control Areas |

|---|---|

| 4.50% m/m (1 January 2012) | 1.50% m/m (prior to 1 July 2010) |

| 3.50% m/m (on/after 1 January 2012) | 1.00% m/m (on and after 1 July 2010) |

| 0.50% m/m (on and after 1 January 2020*) | 0.10% m/m (on and after 1 January 2015) |

Table 1: The Emission Control Areas (ECA).

The ECA established are:

• Baltic Sea area as defined in Annex I of MARPOL (SOx only).

• North Sea area as defined in Annex V of MARPOL (SOx only).

• North American area (entered into effect 1 August 2012) as defined in Appendix VII of Annex VI of MARPOL (SOx, NOx and PM) and

• United States Caribbean Sea area (expected to enter into effect 1 January 2014) as defined in Appendix VII of Annex VI of MARPOL (SOx, NOx and PM).

Empirical framework

According to the work of Aagesen on Lloyd’s Register LNG Bunkering Infrastructure Study, which its objective was to enable outlook on the technological equipment and advances and propulsion options on the worldwide viewpoint and weighing the prospects and challenges for LNG bunkering internationally [7]. The study finally develop a model for projecting the demand for LNG based on diverse scenarios, it finally provided a position for the newbuilding demand in the future.

Literature Gap

Though some previous works have attempted researches on this area of study, but literature gap still exist in the following areas.

• Literatures on the significance price level of LNG relative to prices of MDO and IFO with time

• Factor benefits and drivers for espousing LNG as a marine fuel

• The cost benefit analysis of espousing LNG as a marine fuel

• Other challenges of espousing LNG as a marine fuel.

Research design

Research design adopted for this investigation is ex-post facto design. Isan edighi, Josnuwa, Asim and Ekuns pointed out that ex-post factor design in research is the one in which there is a systematic empirical inquiring in which the researcher does not have direct control of independent variables. The ex-post factor design is justified for use in this study because the variables it investigates have no direct control by the researcher.

The study involves time series data. It analyses the LNG, MDO and IFO monthly data within the period of 2009- 2012. This is because it involves timely effect.

This study also employed a field survey approach. A research design is a plan or blueprint which indicates how data relating to a given research situation should be collected, analyzed and interpreted. Variables manifested by the items are identified for study.

Population

In respect of the study, the population includes the various levels of staff in the Nigerian Liquefied Natural Gas Port Harcourt, Rivers State. Due to the nature of this study, the operations and the traffic departments were used as major focus point; the staff of these departments was made up of about 139 staff.

Sample size determination

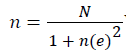

For this research work the confidence level is placed at (0.05) which is 5% representative probability. The workers from different pyramid made up the population since it may be difficult to collect data from the entire population. The researcher used some basic techniques to determine the sample size. From the population obtained through the application of the Saro Yemens formula shows as follows:

n = sample size sought

e = error margin

N = population size

e = 0.05

Interpretation

Y = X1 + X2 + X3

where Y (time) is the dependent variable and X1, X2, X3 are the independent variables of prices of LNG, MDO and IFO

Degree of freedom is 47-3 = 44

For the joint test, F0.05,3,44 = 2.76

The data collected were analyzed using four different statistical analytical tools. Each hypothesis was tested with a unique and peculiar statistical tool. The Time Series Analysis was used based on the assumption of Ordinary Time Series in testing hypothesis one. Decision: Accept null hypothesis if the critical F-value is greater than the computed F-value otherwise reject the null hypothesis.

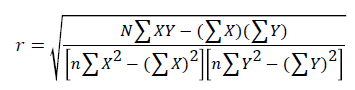

Kaiser Measure of Sampling Adequacy of factor analysis was used for testing hypothesis two. Net Present Value (NPV) method of Cost- Benefit Analysis of LNG, IFO and MDO was used for hypothesis three while the Pearson’s Product Moment Correlation Coefficient (PPMCC) was used in testing hypothesis four (Figure 1).

Test of hypotheses

Test of hypothesis one: The price of LNG is not more significant with time relative to the prices of MDO and IFO.

From the above analysis, since the F-cal (81.31) is greater than the F-table (2.76), it implies that LNG, MDO and IFO are jointly influenced by time.

The R2 of 0.8501 shows that 85% of the variations in the quantities of LNG, MDO and IFO are due to time variation, hence the model is a good fit since the remaining 15% is captured by the error sources.

Individual test for significance

The computed t-test for LNG (2.4907) is greater than the critical ttest (1.645), hence the null hypothesis is rejected and the researcher concludes that the price of LNG is more significant with time relative to the prices of MDO and IFO.

The computed t-test for MDO (0.8846) is less than the critical t-test (1.645), hence the null hypothesis is accepted and the researcher concludes that an MDO price is not significant with time than LNG prices.

The computed t-test for IFO (0.6167) is less than the critical t-test of IFO (1.645), hence the null hypothesis is accepted and the researcher concludes that IFO prices is not significant with time than LNG prices.

Hypothesis two: The major factors influencing the LNG production are not the factors influencing IFO and MDO production. Research question two was used to address this hypothesis. The factors influencing the adoption of marine fuels include the following; Economic factors, technical factors and environmental factors.

To test hypothesis two: Using kaiser measures of sampling adequacy of factor analysis.

Analysis on economic factors: From the KAISER Tables 1-3, using KAISER of sampling adequacy of factor analysis, it can be inferred thatLNG, IFO and MDO are significantly influenced by their respective economic factors with Kaiser Value of 0.4827, 0.4572 and 0.4978 respectively.

| S/N | Year | Outflows ($Million) | Discount factor (DF) 10% | Present Value ($Million) |

|---|---|---|---|---|

| 1 | 2006 | -5,500,000.00 | 1 | -5,500,000.00 |

| 2 | 2007 | 2,500,000.00 | 0.909 | 2,272,500.20 |

| 3 | 2008 | 2,700,000.00 | 0.828 | 2,235,600.00 |

| 4 | 2009 | 3,000,000.00 | 0.751 | 2,253,000.00 |

| 5 | 2010 | 3,200,000.00 | 0.683 | 2,185,600.00 |

| 6 | 2011 | 3,500,000.00 | 0.621 | 2,173,500.00 |

| 7 | 2012 | 4,000,000.00 | 0.564 | 2,256,000.00 |

| Gross Present Value (GPV) | nbsp; | 13,376,200.00 | ||

| Net Present Value (NPV) | nbsp; | 7,876,200 | ||

Table 2: Scrubber technology (IFO and MDO).

| S/N | Year | Outflows ($Million) | Discount factor (DF) 10% | Present Value ($Million) |

|---|---|---|---|---|

| 1 | 2006 | -5,000,000.00 | 1 | -5,000,000.00 |

| 2 | 2007 | 4,000,000.00 | 0.909 | 3,636,000.00 |

| 3 | 2008 | 4,300,000.00 | 0.828 | 3,551,800.00 |

| 4 | 2009 | 4,500,000.00 | 0.751 | 3,379,500.00 |

| 5 | 2010 | 4,700,000.00 | 0.683 | 3,210,100.00 |

| 6 | 2011 | 4,900,000.00 | 0.621 | 3,042,900.00 |

| 7 | 2012 | 6,000,000.00 | 0.564 | 3,384,000.00 |

| Gross Present Value (GPV) | nbsp; | 20,204,300 | ||

| Net Present Value (NPV) | nbsp; | 15,204,300 | ||

Table 3: LNG fuel.

A further comparative analysis of economic factors (Table 4a) shows that MDO economic factor is the most significant factor influencing MDO usage, this is followed by IFO fuel and lastly by LNG fuel.

| S/N | Year | Outflows ($Million) | Discount factor (DF) =10% | Present Value ($Million) |

|---|---|---|---|---|

| 1 | 2006 | -9,000,000.00 | 1 | -9,000,000.00 |

| 2 | 2007 | 2,700,000.00 | 0.909 | 2,454,300.00 |

| 3 | 2008 | 3,000,000.00 | 0.828 | 2,484,600.00 |

| 4 | 2009 | 3,200,000.00 | 0.751 | 2,403,200.00 |

| 5 | 2010 | 3,500,000.00 | 0.683 | 2,390,500.00 |

| 6 | 2011 | 3,700,000.00 | 0.621 | 2,297,700.00 |

| 7 | 2012 | 4,300,000.00 | 0.564 | 2,425,200.00 |

| Gross Present Value (GPV) | nbsp; | 14,454,900.00 | ||

| Net Present Value (NPV) | nbsp; | 5,454,900.00 | ||

Table 4a: Scrubber technology + WHR.

This is in line with a research carried out by TOTE which asserted that technical factors are currently the challenges of LNG fuel adoption due to high skill requirements for operation and expansion in infrastructures [8].

Test of hypothesis three: The cost-benefit of espousing LNG as a marine fuel is not better than cost benefit of espousing MDO and IFO.

For the test of hypothesis three, a study conducted by MAN Diesel & Turbo was adapted [9].

The Tables 4b and 4c below are two scenarios of cash outflows on a 2,500TEU of a container vessel which operates in ECAs (minimum of 1.5% sulfur 2005 Annex VI of MARPOL) IMO requirement [10].

| S/N | Year | Outflows ($Million) | Discount factor (DF) 10% | Present Value ($Million) |

|---|---|---|---|---|

| 1 | 2006 | -8,900,000.00 | 1 | -8,900,000.00 |

| 2 | 2007 | 4,200,000.00 | 0.909 | 3,817,800.00 |

| 3 | 2008 | 4,500,000.00 | 0.828 | 3,726,000.00 |

| 4 | 2009 | 4,600,000.00 | 0.751 | 3,454,600.00 |

| 5 | 2010 | 4,900,000.00 | 0.683 | 3,346,700.00 |

| 6 | 2011 | 5,000,000.00 | 0.621 | 3,105,000.00 |

| 7 | 2012 | 6,100,000.00 | 0.564 | 3,440,400.00 |

| Gross Present Value (GPV) | nbsp; | 20,890,500.00 | ||

| Net Present Value (NPV) | nbsp; | 11,990,500.00 | ||

Table 4b: LNG + WHR.

| S/N | Item | SA | A | D | SD | Total |

|---|---|---|---|---|---|---|

| 1 | LNG infrastructural problems | 200 | 135 | 10 | 0 | 345 |

| 2 | Barging fuel to vessels is more expensive and presents regulatory hurdles | 208 | 120 | 10 | 3 | 341 |

| 3 | The high cost of vessel conversion or replacement | 160 | 120 | 24 | 8 | 312 |

| 4 | Percentage of time spent inside the Emission Control Area (ECA) | 180 | 135 | 10 | 5 | 330 |

| 5 | Loss of cargo space for larger LNG tanks | 208 | 45 | 36 | 15 | 304 |

| nbsp; | TOTAL | 956 | 555 | 90 | 31 | 1632 |

Table 4c: Cost advantage to LNG fuel when compared with other marine fuels.

Computation formula

From the above NPV analysis, the researcher rejects the null hypothesis and concludes therefore that the cost-benefit of espousing LNG as a marine fuel is better than cost benefit of espousing MDO and IFO.

The researcher also made a further comparative analysis of LNG +WHR and scrubbers + WHR as show below. The table below shows the comparative analysis of the annual cost advantage for 2,500 TEU container vessels compared to standard vessel using standard fuels, Where WHR is Waste Heat Recovery. NOTE: The WHR is a technology used to reduce fuel consumption rate and also to increase power output.

From the above Table 3 and 4d comparative analysis with WHR, the situation is the same given a cost advantage to LNG fuel when compared with other marine fuels with scrubber installation for achieving the required percentage of sulphur for a 2,500TEU of container vessel in an ECA (Emission Control Area).

| Responses Scale (x) | Aggregate Preferences (y) | X2 | Y2 | XY |

|---|---|---|---|---|

| Strongly Agree SD = 4 | 956 | 16 | 913936 | 15296 |

| Agree (A) = 3 | 555 | 9 | 308025 | 4995 |

| Disagree (D) = 2 | 90 | 4 | 8100 | 360 |

| Strongly Disagree (SD) = 1 | 31 | 1 | 961 | 31 |

| ∑x = 10 | ∑Y = 1632 | ∑X2 = 30 | ∑Y2=1231022 | ∑XY=20682 |

Table 4d: Source: Adopted from research question table.

Test of hypothesis four: There is no significant challenge/problem associated with espousing LNG as marine propulsion fuel.

Using research Question four: What are the challenges/problems of espousing LNG as a marine fuel?

Where

r = Pearson Product Moment Correlation

n = Sample size

Σ = sum of

X = Scores on variable I

Y = Scores on variable 2

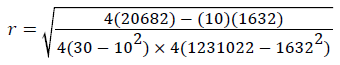

By substituting the data, we obtain as follows:

Interpretation

The degree of association between LNG and espousing it as marine propulsion fuel is + 0.8 indicating that a very strong but positive relationship exists between LNG fuel and its associated challenges. This implies that, adoption of LNG as marine fuel will mean readiness to face the challenges of its adoption.

This challenge include infrastructural facilities, bunkering facilities and other related investments as been reviewed by the researcher.

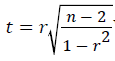

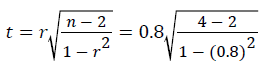

Computation Formula

Where t = t - test Pearson r

Where t = t - test Pearson r

r = correlation Coefficient

n = number of sample

r2 = Correlation Coefficient squared

Given that

r = +0.8

N = 4

r2 = 0.64

Applying the formula above, we get:

tcal = 1.89

d.f = 4-1 = 3

Given that: alpha level of significance = P ≤ 0.05 and degree of freedom d.f = 3, we proceed to Pearson (r) statistical distribution at 3.d.f under 0.05 alpha level, the Pearson r. critical is 0.878.

Decision /Conclusion

r.cal = 1.89 > r. critical =0.878

The researcher therefore rejects the null hypothesis (HO4), and concludes that there are significant challenges associated with espousing LNG as marine propulsion fuel.

In hypothesis one, it shows that the price of LNG as marine fuel is significant with time, this is in line with the research of TOTE company that the price of LNG will be more significant than other conventional marine fuel. In hypothesis 2, the researcher accepts the null hypothesis and concludes that the major factor influencing the adoption of LNG as marine propulsion fuel is not the factor influencing IFO and MDO marine fuels.

This is in line with the research carried out by MAN Diesel and Turbo on the Cost and Benefit of LNG as marine fuel for container vessels [9].

This is in line with Anna who asserted that LNG will be the next future marine fuel due to the stricter measures of IMO on emission regulation [5].

Hence this is line with Annex VI of the International Maritime Organization (IMO) International Convention for the Prevention of Pollution from Ships [10] which came into force in May 2005.

This mandate limits the sulfur content of marine fuels on a global basis to 4.5%. The limit was then lowered to 3.5% sulfur by January 2012. Annex VI also imposed a 1.5% sulfur limits on marine fuels in the four Emission Control Areas (ECAs) which include the Baltic Sea (May 2005), the North Sea (November 2007), North America [11] and US Caribbean [12] effective May 2006 and was reduced to 1% sulfur effective 1 July, 2010.

This regulation is expected to enforce lower sulfur emission in ECAs to 0.1 beginning January, 2015 and 0.5% sulfur on global basis effective 2020.

From the NPV analysis on hypothesis 3, the researcher rejects the null hypothesis and concludes therefore that the cost-benefit of espousing LNG as a marine fuel is better than cost benefit of espousing MDO and IFO.

From the Tables 4b and 4c, using the Net Present Value (NPV) method to evaluate the Cost-Benefit Analysis (CBA) of LNG fuel and the use of scrubber technology in IFO and MDO for a 1.5% sulfur in ECA regions, it was found out that the NPV of LNG is higher than that of Scrubber technology, hence LNG yields more benefit than the scrubber technology.

The above scenarios could be linked with the high cost of investment in scrubber technology which includes high cost of scrubbers, maintenance costs, scrubber engineer cost, exhaust system costs etc than that of LNG infrastructures.

Also hypothesis four which said that there are challenges of espousing LNG as marine fuel is in line with the work of Ann that low infrastructure is one of the factors affecting LNG as marine fuel [9].

LNG is the cleanest of all fuel options; LNG virtually eliminates SOx (1 ppm) and PM emissions. It also reduces NOx emissions 90% and CO2 emissions by 20%. On their own neither low sulfur fuels nor scrubbers do anything to address NOX or CO2. Pipeline natural gas is currently at least 70% less expensive on an energy equivalent basis than marine residual fuel and 85% less expensive than marine distillate fuel. This relative price advantage is thought to continue, and even increase, through 2035, according to the Energy Information Administration projections.

The cost of liquefying natural gas approximately doubles this price, making LNG more expensive than traditional distillate and residual fuel oils, but less expensive than the low sulfur fuel blends required to comply with ECA emission limits.

The alternative approaches to meeting IMO Annex VI requirements include: use a blend of marine distillates and Ultra-Low Sulfur Diesel, continuous use of Residual Fuel Oil or Marine Distillate and install an Exhaust Gas Treatment System or conversion of existing ships or build new ships powered by LNG.

There are problems and uncertainties related to the timing and application of low sulfur fuel requirements includes the expensive nature of barging fuel to vessels and the associated regulatory hurdles, the high cost of vessel conversion or replacement and the cost of LNG infrastructures (LNG fueling infrastructure is virtually non-existent, so development of the infrastructure to fuel the ships is likely to be required).

Based on the findings of this research work, the following recommendations are proffered

• The use of LNG as marine fuel should be encouraged by all vessels to ensure emission compliance.

• Stricter regulations should also be enforced to checkmate violators of emission regulations.

• Enough investments should be carried out in the area of LNG infrastructure.

• More researches should be carried out on the alternative s of sulfur emission reduction strategies.

• Faster technological development in espousing LNG as marine propulsion fuel.

• Diversification of technology should be encouraged, picking one technology among many not fully developed today could lead to a lock–in of technologies. It is too early to say which of the technologies that has the greatest potential.