Journal of Stock & Forex Trading

Open Access

ISSN: 2168-9458

ISSN: 2168-9458

Review Article - (2025)Volume 12, Issue 4

Any nation that experiences a financial crisis will see negative consequences on its financial environment and economy. The financial crisis caused financial institutions to be disrupted, the stock market to fluctuate, and unemployment. The majority of the research concentrated on the long-term consequences of the financial crisis on the economy as well as how it affected currency and stock market movements and how it affected the global economy. However, since the 1929 Global Financial Crisis (GFC), no research has offered a thorough examination of the effects of financial crises on the global economy. The main objectives of this study are to review through the evaluation of the global financial crisis since 1929 and to examine its impacts.

Financial crisis; Global financial crisis; Stock market; Fiscal policy; Depression; Financial system

A financial crisis situation that precipitously reduces the nominal value of financial assets. In a financial crisis, the value of financial assets decreases and businesses are unable to meet their financial obligations due to a lack of appropriate cash or convertible assets. During the financial crisis, commercial houses were unable to invest in projects and could not meet immediate needs. Financial crises include crashes in the stock market, blasts of financial bubbles, money crises, and sovereign defaults. Included are financial crises that disturb currencies; stock market crashes in real economies; unemployment; and failures of financial institution operations. Categorically, there are three stages of the financial crisis [1]. In the first step, the system and regulatory failures and mismanagement of finances. The second step represents the breakdown of the financial system, business operations, and consumers' inability to meet financial obligations. Finally, the nominal value of assets falls, and the overall debt increases. There is a difference between a financial crisis and a fiscal crisis. A financial crisis refers to the economic and financial environment, whereas a fiscal crisis includes a problem with the government's regulatory framework and balance sheet. A fiscal crisis relates to government debt or performance issues. In the same course, distinctions are made between the financial crisis and the Global Financial Crisis (GFC). It represents a period of stress in global financial markets and banking systems a clash of the stock market, credit crunches, the blast of financial bubbles, regulatory failures, and the currency crisis. The financial crisis is limited to a segment or country and is spread regionally or globally. Many factors are determined to influence the financial crisis. These are (i) Overvaluation of assets, (ii) Failures of regulations, (iii) Customers at a time withdrawing huge funds from financial institutions, etc. It is a generalized, systematic risk in the financial sector that exaggerates one country or another. Financial crises escalate but do not influence recessions. The main causes of the GFC were risk-taking in the macroeconomic environment and the mobilization of bonds and equities by banker investors. The government frames iniquitous regulations or policy faults, huge border transactions, and regulations as well as financial markets [2].

Causes of global financial inclusion

Added risk-taking in a positive macroeconomic environment. In the U.S., in recent years, the macroeconomic environment has been positive, with low inflation, unemployment, and interest rates. In this environment, house prices flourished strongly. Banks and other lenders are to take additional risks by borrowing huge amounts of money and lending in the housing sector. At repayment of loans by the borrower, there is no refund of loans, as in the GFC.

Grew borrowing by banks and investors: The main reason for the GFC is that banks and other investors are attaining huge funds on Mortgage-Backed Securities (MBS) and hypothesizing huge funds to purchase an asset (leverage). In the future, the value of the assets will decrease as banks and investors incur losses [3].

Regulations and policy errors: For the GFC, another cause is that the framing of policies and regulation errors is also swinging the GFC. Bankers and investors are providing loans based on MBS. At the time of repayment, the borrower is adjourning the payment of loans, influencing the GFC. The financial crisis is either right or wrong. It varies from country to country.

History of financial crisis

The financial crisis has a long history; it started in 33 A.D. and continues to this day. The financial panic was confronted in A.D. 33 due to massive loans taken by the Roman banking house. In the Roman5-284 A.D., the Roman Empire confronted a financial crisis due to civil wars, peasant rebellions, and political instability. The consequences of the crisis are the devaluation of the currency and economic depression. In the 7th century (692), the coin exchange crisis was met due to Arab gold coins' actual weight being less than nominal quality. This crisis distresses the financial system of that country. 14th century, 1345 banking crisis, the crash of the Peruzzi and the Bardi families, 17th century (1618–1648): Kipper and Whipper Roman Empire challenged a financial crisis by way of 30 years of war. The clout of tax payments, lower currency, and raised revenue during this time. In the 18th century (172), the U.K. South Sea Bubble was raised due to public and private partnerships and attempts to reduce the national debt. In the 17th-18th centuries, there were extensive crises in Europe, namely the Great Tobacco Depression in 1703 in British America and the 1769 Great East Indian Bengal Bubble Crash. In 1720, France-Mississippi Company-Business Monopoly in French Colonies. The company's activities increased or decreased because of the crisis. In 1763, Leendert Pieter de Neuville and Johann Gotzkowsky- Dutch merchants and bankers traded silk, linen, and grain. This crisis spread to Germany and Scandinavia. At this time, various business models were invented for the growth of the business. Great East Indian Bengal Bubble Crash 1769 Battle, Clive, and the company acquire increasing powers in Bengal. Overvaluation of East India stock between 1757 and 1769. The valuation of East India Company stock was raised between 1757 and 1769. In 1772, London and Amsterdam collapsed under bankers Neal, James, Fordyce, and down. In 1776, during the American Independence Financing Crisis and the French Revolution, there were 1.4 billion live investments; in that spin investment, there were 700 million. 19th Century, 1813–1818: Danish Economic Crisis: It was begun in 1813 and continued until 1818. For this reason, Denmark struggled with an economic crisis owed to Napoleon as the currency was devalued, which had an adverse effect on merchant bankers. In 1819, 1825, 1837, 1847, 1857, and 1866, due to economic cycle effects in the U.S., the British recession caused many banks to fail, a 5- year depression in the U.S., the collapse of British financial markets, a decreasing international economy, overexpansion of the domestic economy, and a downturn of international financial markets in London. 1873–1896 was a long depression faced by two countries: the U.S. and Europe. During this time, worldwide prices and the economic depression started in 1873 and continued in 1896. Afterward, the strong growth was accelerated by the second industrial revolution. During this period, bank failures and credit shortages in the U.S. Economic depression in Europe and North America, and a bank crisis in Australia due to building societies and the number of commercial banks turning. In the 20th century, major financial crises followed; these are the GFC's effects on various countries throughout the globe. In 1972, the credit crisis originated in London and spread to the rest of Europe. The British Empire had taken funds from colonial possessions and trade in the mid-1760’s. This news was spread in England and later in Europe. As creditors in panic started withdrawing funds from the British banks. This effect caused a crisis in Scotland, the Netherlands, and other parts of Europe. The great depression of 1929–1939 in the 20th century was one of the nastiest economic disasters. Wall street coded the policy inaccuracy of the US government as the reason this crisis occurred. This crisis was massive from 1929–1939, with pretentious national income, enlarged unemployment rates, and reduced output in industrial nations. In 1933, the unemployment rate was almost 25% [4].

Greenspan: Stated his opinion that the GFC influenced huge losses in equity homes, unlisted corporations, and noncorporate businesses. It estimates the loss of 2/3 of global GDP in 2009. In the study, Stephanie Brandenburg, and Jose Gabriel Palma emphasize his ideology about the facets and features as well as the long-term consequences raised by the crisis. The number of contributions has influenced the GFC from a short or long-run perspective. On the political side, any framing of new policies in terms of radical financial deregulation influences a financial crisis.

Perez: Researchers denote that the 1990 crisis is the same phenomenon as 1929. 1990's "dotcom’ internet crisis and the early 2000's crisis related to the liquidity boom. Hence, both crises have the same structure as the 1929 crash and depression.

Tregenna: States in a detailed investigation based on empirical analysis that, pre-crisis, the US banking sector concentrated more on profitability than efficiency. These study findings are to call attention to the increase in profitability of the banking sector, the need for future regulatory measures, and some issues relating to the banking structure and pricing behavior in this sector. Three decades of international financial crises: What have we learned, and what still needs to be done? This paper indicates that over the past three decades, we have learned about financial crises and worked to build a strong financial system to face a future crisis in the COVID-19 pandemic. Simple, based on past financial crises, strengthen our financial system in the future [5].

Research problems

Financial markets, financial institutions, financial instruments, and services in any country are all impacted by the financial crisis in some way. A financial crisis is being impacted by political and governmental policies and laws. In the short or long term, this will have an impact on banking, corporations, and non-corporate enterprises. This research focuses on the significant financial crises of the previous century and how they would impact the economies of the various nations as well as the world market. Using empirical research to assess how the financial crisis has affected the economy and develop preventative measures against future financial crises [6].

Aim of the study

To examine and investigate the impact of US interest rates on the global market index and to recommend the best financial and governmental policies for managing future financial crises.

Methodology of the study

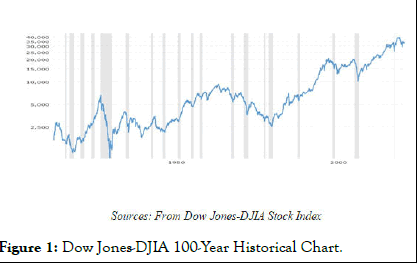

The information and data are based on secondary data and are used in empirical studies of research publications. Using information gathered from the Dow Jones-DJIA 100-Year Historical Data, we can examine how several financial crises have affected the global stock market since 1929 [7].

Data analysis

Researchers have measured the financial crises of many nations based on the data that is available from the website to understand each country or group of countries' financial crises and how they affected the stock market (Figure 1). Finding out the length of the financial crisis and its effects on the stock market using statistical approaches. Future investors can use this study to assist them in choosing wisely whether to invest in different stocks during a financial crisis [8].

Figure 1: Dow Jones-DJIA 100-Year Historical Chart.

Table 1 displays data on the Dow Jones Industrial Average from 1915 to 2022. This data reflects the approximately 107-year fluctuation in the worldwide stock market index. Investors will learn about several worldwide financial crises for the aforementioned period based on these statistics. Future researchers can use this information to study other financial options for protecting their investments and fostering economic growth amid the financial crisis fluctuations in the global stock market and interest rates [9].

| Year | s-DJIA-100 year-global stoc | Financial crisis | Year | s-DJIA-100 year-global stoc | Financial crisis | Year | s-DJIA-100 year-global stoc | Financial crisis | Year | s-DJIA-100 year-global stoc | Financial crisis |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1915 | 2177.52 | 1942 | 1796.58 | 1969 | 7940.65 | 1996 | 10883.75 | ||||

| 1916 | 2565.69 | 1943 | 2408.69 | 1970 | 6238.21 | 1997 | 12482.28 | ||||

| 1917 | 2445.07 | 1944 | 2420.68 | 1971 | 6858.74 | 1998 | 16455.64 | ||||

| 1918 | 1655.73 | 1945 | 2631.61 | 1972 | 6974.98 | 1999 | 19690 | ||||

| 1919 | 1687.17 | 1946 | 3409.02 | 1973 | 6411.31 | 2000 | 19009.75 | ||||

| 1920 | 1397.16 | 1947 | 2363.71 | 1974 | 5288.26 | 2001 | 18410.47 | ||||

| 1921 | 1316.83 | 1948 | 2297.22 | 1975 | 4421.47 | 2002 | 17655.49 | ||||

| 1922 | 1617.59 | 1949 | 2257.32 | 1976 | 4686.41 | 2003 | 13163.04 | ||||

| 1923 | 1855.72 | 1950 | 2648.57 | 1977 | 4686.41 | 2004 | 16504.07 | ||||

| 1924 | 1617.29 | 1951 | 3046.85 | 1978 | 3974.76 | 2005 | 15890.12 | ||||

| 1925 | 2116.62 | 1952 | 2960.43 | 1979 | 3673.51 | 2006 | 17118.91 | ||||

| 1926 | 2435.6 | 1953 | 3191.92 | 1980 | 2975.64 | 2007 | 18247.37 | ||||

| 1927 | 2807 | 1954 | 3422.68 | 1981 | 3441.27 | 2008 | 17425.57 | Recession of 20 | |||

| 1928 | 3804.56 | 1955 | 4655.01 | 1982 | 2641.09 | 2009 | 11623.23 | ||||

| 1929 | 5511.43 | The great depression of 1932 impact about 10 years | 1956 | 5820.29 | Suez Crisis 1956 | 1983 | 3773.02 | 2010 | 15323.99 | ||

| 1930 | 4982.86 | 1957 | 5375.18 | 1984 | 3444.35 | 2011 | 17281.42 | ||||

| 1931 | 2959.09 | 1958 | 4785.16 | 1985 | 3611.59 | 2012 | 17466.32 | ||||

| 1932 | 1224.6 | 1959 | 6316.15 | 1986 | 5070.28 | 2013 | 18995.84 | ||||

| 1933 | 1333.81 | 1960 | 6361.98 | 1987 | 6236.49 | 2014 | 21131.64 | ||||

| 1934 | 2323.1 | 1961 | 6888.09 | 1988 | 5265.77 | 2015 | 22871.55 | ||||

| 1935 | 2406.04 | 1962 | 6683.24 | 1989 | 5959.92 | 2016 | 22536.98 | ||||

| 1936 | 3225.57 | 1963 | 7138.24 | 1990 | 6251.36 | 2017 | 25705.05 | ||||

| 1937 | 3696.96 | 1964 | 7984.88 | 1991 | 6547.44 | 2018 | 29309.38 | ||||

| 1938 | 2128.91 | 1965 | 8616.67 | 1992 | 7046.92 | 2019 | 30932.92 | COVID-19 | |||

| 1939 | 2877.41 | 1966 | 8740 | 1993 | 7221.85 | 2020 | 28800.99 | ||||

| 1940 | 3216.33 | 1967 | 8221.46 | 1994 | 7576.92 | 2021 | 38481.83 | ||||

| 1941 | 2451.07 | 1968 | 8044.87 | 1995 | 8629.58 | 2022 | 36585.66 |

Table 1: Dow Jones-DJIA-100 year historical stock market index.

Financial crisis in the last century

There were nine foremost financial crises throughout the globe in the last century. These are the great depression of 1932, the Suez Crisis of 1956, the international debt crisis of 1982, the East Asian Economic Crisis of 1997-2001, the Russian Economic Crisis of 1992-97, the Latin American Debt Crisis in Mexico in 1995, the Global Economic Recession of 2007-09, and the European Economic Crisis of 2010 [10].

The great depression of 1932: On October 25, 1929, there was a dark Tuesday. The New York Stock Exchange bowed with 13 million shares. Behind this frightful situation, during 1922– 1929, the American economy had augmented by 20% every year for seven years, and the stock market was valued at 218% for the above period. 1929–1939 was the greatest depression in history because of the slump around the globe. Investors wiped out nearly $30 billion and lost their wealth [11]. About 15 million Americans were unemployed by 1933, and about 20 thousand companies were ruined. This depression spread or spilled over to European, Australian, and German countries. The biggest bank in Australia, Kredistanstalt, crumpled, and the money supply fell by 26% in the US, 27% in Germany, and 18% in France and the UK. The precautionary measure was started by the US, UK, France, and Germany through the swift expansion of industries. President Franklin D. Roosevelt promised to take up transformations in the form of a 'New Deal' to recover the economy. These were (a) Special aid to redundancy, (b) Reviewed regulations for industries, (c) Legal protection for workers, and (d) New programs for social security. During this period, the estimated GDP fell by 15% in 1929–32. The US GDP in 1939 was 93.5 $USD, 102.9 billion USD in 1940, and 166.0 $USD in 1942. When assets rose during the period, the latter figure was higher. The global recovery was slower after 1931, in most of the European nations, the recession started in the mid-1920’s. The industrial sector was severely affected by the crisis [12].

The Suez crisis: On the 26th of July 1956, the Suez Canal Company was nationalized by Egypt, France, Israel, and the U.K. A joint accomplishment on the global project started. These countries acquired financial assistance from the IMF on October 10, 1956. These countries faced speculative pressure and short-term capital outflows. For this global project, Egypt borrowed twice from the IMF, and Israel got a ratified quota of 50% of funds from the IMF. In this period, the stock market collapsed from 5,820 to 4,785 and the pound, or sterling, was $2.80 per dollar without the support of the US and Great Britain's obligatory 1.3 billion USD against the speculation of their currency, the pound [13].

The International debt crisis 1982–89: This crisis began on August 20, 1982, and continued indefinitely until 1989. It is one of the long-term debt crises. Mexico and Poland announced they were unable to pay the debt to the creditors, and this crisis struggled in several other countries such as Romania, Hungary, and Yugoslavia. In the mid-1970’s, all the developing countries borrowed huge funds from the global market at a low interest rate and maintained deposits with the oil-exporting nations. Year-by-year deposits have been increasing, resulting in the inability to pay the debt to oil-exporting countries. Mexico and Poland were the first lines in the crisis; besides those, other countries, viz., Latin America (Argentina, Brazil, Chile, Ecuador, Peru, and Uruguay), encountered debt servicing [14].

The East Asian crisis of 1997: This crisis was also high in 1997. Thailand was one of the sufferers of this crisis due to the excessive external deficit, the stock market prices amplified, poor regulation, and the absence of supervision in exchange rates resulting in the crisis. Currently, the current account deficit and the interest on foreign obligations are above 4% of Thailand's GDP. The creditors of Thailand deem that the current account deficit reflects high business investment, high-interest rates on savings, and a government surplus budget. Another country, Japan, was also a victim of this crisis. In 1996–97, the Japanese yen weakened by 35% against the dollar, and Thailand devalued by 15%–20%. Along with the two nations' Indonesian economic crisis, there have been about 30 years of uninterrupted economic growth, something it never saw in the 20th century. The currency of Indonesia was denigrated about six times by the US dollar. It went from 2500 rupiahs per US dollar in May 1997 to about 14000 rupiahs per US dollar by January 1998. Before the 1997 financial crisis, Korea was one of the leading economies in the 11th position on the globe with less than a 5% inflation rate, 3% unemployment, and an 8% per year GDP growth rate. The 1997 economic crisis was pretentious to Korean businesses, and financial institutions and increased short-term debt, which was 110 billion USD. It is three times the foreign exchange reserves [15].

The Russian crisis: In the mid-1990’s, Russia was coming out of the Soviet Union. This crisis harmed the country. The public did not have savings, or the necessities of life, and the central bank of Russia confronted huge budget deficit and capital devaluation. The inflation rate was lowered to less than 50% in 1996, and Russia survived international reserves through the issue of government papers. Russia had a strong external current account, rising international reserves, and high debt service costs. During this time, Russia declared a suspension of debt payments and private external payments and recovered very quickly by way of increasing oil and gas prices [16].

Latin American debt crisis 1995: This crisis has been felt many times in the past 200 years. The first crisis was in 1826, followed by 1828, 1873, 1890, and 1931. In the 20th century, the major crisis was 1982—Mexico's default; later, in 1994–95, the Tequila crisis; 2001–02, Argentina’s default; 1999–2003, the Brazil crisis; and major ones in the 2008–09 GFC. In 1995, Mexico approached the IMF and obtained 17.8 billion USD based on a standby arrangement. This considerable fund was not assigned by the IMF earlier for any crisis. Due to building confidence for the IMF members, the first allocation was made for supporting the financial systems of member countries [17].

The great recession of 2008–09: This crisis was widespread in the U.S. and Europe, and it exaggerated the deepest slump in the world economy. Regulatory failures and macroeconomic policies are prejudiced by imbalances in financial housing and commodity markets. Before this crisis, there were 11 companies’ financial assets of more than 350% of the gross domestic product and 25 countries whose financial markets were the same by 2007. Assets rose from 12 USD trillion to 196 USD trillion during 1980–2007 (McKinsey Mapping Global Financial Markets, October 2008). From 1986 to 2006, corporate profits increased from 10% to 30%. While the outstanding was increased to 116% in 2007 from 20% of GDP in 1980. Due to this cause, the international financial system collapsed suddenly. Of this, the U.S. GDP declined by 4% in the last quarter of 2008. World GDP fell by 3.75% from 5% during 2007–08, and this was reduced to 2% in 2008–09. The IMF estimated loan losses during this period at 1.5 trillion USD. The Lehman Brothers collapsed in September 2008. The commodity prices were reduced, and oil prices weakened by 50%, including food and other commodities. For recovery from the crisis, 2.5 trillion USD was contributed by the US and European Central Banks. In the same way, the US government instructed the purchase of risky assets using public funds, and European countries were also offered several packages to manage their financial supervision. By 2009, the crisis had turned economic growth into a positive inclusive range using various monetary and fiscal policies, programs, and systematic mellifluousness to move the economic graph towards growth in the form of the rebound in commodity prices, the productivity of manufacturing activities, and the gain of consumer confidence in housing markets. By 2010, the expected outcome of world GDP was 4.25%. It may be concluded that several reforms and repairs of the financial system are required to advance economies. This was taken up in subsequent years. The International Labor Organization (ILO) forecasts across the globe that unemployment must increase by 30 million to 50 million people during 2007–09. The condition will continue; this figure rose to 200 million people in developing countries thrown into poverty (Recommendations of the United Nations Commission of Experts on Reforms of the International Monetary and Financial System, March 2009).

The European crisis 2010: This crisis was in 2010 spread out in one. The fatalities were in Greece, Ireland, Portugal, and Cyprus. This crisis is due to public and private balance sheet imbalances within the Eurozone. The rating agencies were giving poor ratings to banks due to an increase in non-performing loans. In this crisis, Greece was given wrong reporting about fiscal data for getting foreign borrowing. For this, the IMF understands that arrangements of 28 billion euros and a bilateral program with the assistance of 15 associate euro countries will provide financial assistance from the capital of the Euro Central Bank. Apart from under-recovery, there was a need for additional programs in 2012, and Greece got 30 billion euros from the IMF. Greece will recover from the crisis Greece needs a big, sustained adjustment program to reduce the fiscal deficit, decline the debt ratio, and strengthen competitiveness. The crisis affected Ireland, as the Irish banking sector and Portugal had the lowest per capita income in this crisis. In 2010, Portugal was affected by low balances in the current and fiscal accounts. To recover this thirsty liquid position, 26 billion euros were borrowed from the IMF in the form of collective contributions by international partners [18].

GFC on COVID-19: In COVID-19, the substantial financial crisis was the 2020 stock market crash. This was primarily about 20–30% of the indices that fell between February and March of 2020. By October 2020, more than 10 million unemployment cases will have been noted in the U.S. In March, the financial markets were reduced 18 times due to bad news perceived in the markets. During this time, there were increases in daily consumer goods, a decline in industrial production along with services, and a low turnout in the stock market. The major countries were served due to their reserves, while small countries were pushed into recession or even depression [19].

The capital market in India has a long history, dating back over 100 years. Both markets (debt and equity) mobilize resources from savers and users of issuing companies for various productive purposes. The volume of funds and intermediation process is for the prediction of economic growth rate, capital accumulation, and productivity by Carlin and Mayer. In the U.S.A., the initial issue market is vibrant due to the start of new companies with new technologies. A growing economy needs risk and permanent capital resources in debt and equity. Therefore, a sustainable economy is dependent on a vibrant capital market [20].

Table 2 provides data for the global stock index and US interest rate percentages during a 71-year period. Based on the information's accessibility from the sources, specific data from 1915 to 1951 have not been provided. The latest worldwide interest rate was not yet available, particularly for the year 2022 (Table 3).

| Year | ones-DJIA-100 bal Stock Mark | U.S interest rate % |

| 1950 | 2648.57 | 5.9 |

| 1951 | 3046.85 | 6 |

| 1952 | 2960.43 | 0.8 |

| 1953 | 3191.92 | 0.8 |

| 1954 | 3422.68 | -0.7 |

| 1955 | 4655.01 | 0.4 |

| 1956 | 5820.29 | 3 |

| 1957 | 5375.18 | 2.9 |

| 1958 | 4785.16 | 1.8 |

| 1959 | 6316.15 | 1.7 |

| 1960 | 6361.98 | 1.4 |

| 1961 | 6888.09 | 0.7 |

| 1962 | 6683.24 | 1.3 |

| 1963 | 7138.24 | 1.6 |

| 1964 | 7984.88 | 1 |

| 1965 | 8616.67 | 1.9 |

| 1966 | 8740 | 3.5 |

| 1967 | 8221.46 | 3 |

| 1968 | 8044.87 | 4.7 |

| 1969 | 7940.65 | 6.2 |

| 1970 | 6238.21 | 5.6 |

| 1971 | 6858.74 | 3.3 |

| 1972 | 6974.98 | 3.4 |

| 1973 | 6411.31 | 8.7 |

| 1974 | 5288.26 | 12.3 |

| 1975 | 4421.47 | 6.9 |

| 1976 | 4686.41 | 4.9 |

| 1977 | 4686.41 | 6.7 |

| 1978 | 3974.76 | 9 |

| 1979 | 3673.51 | 13.3 |

| 1980 | 2975.64 | 12.5 |

| 1981 | 3441.27 | 8.9 |

| 1982 | 2641.09 | 3.8 |

| 1983 | 3773.02 | 3.8 |

| 1984 | 3444.35 | 4 |

| 1985 | 3611.59 | 3.8 |

| 1986 | 5070.28 | 1.1 |

| 1987 | 6236.49 | 4.4 |

| 1988 | 5265.77 | 4.4 |

| 1989 | 5959.92 | 4.7 |

| 1990 | 6251.36 | 6.1 |

| 1991 | 6547.44 | 3.1 |

| 1992 | 7046.92 | 2.9 |

| 1993 | 7221.85 | 2.8 |

| 1994 | 7576.92 | 2.7 |

| 1995 | 8629.58 | 2.5 |

| 1996 | 10883.75 | 3.3 |

| 1997 | 12482.28 | 1.7 |

| 1998 | 16455.64 | 1.6 |

| 1999 | 19690 | 2.7 |

| 2000 | 19009.75 | 3.4 |

| 2001 | 18410.47 | 1.6 |

| 2002 | 17655.49 | 2.4 |

| 2003 | 13163.04 | 1.9 |

| 2004 | 16504.07 | 3.3 |

| 2005 | 15890.12 | 3.4 |

| 2006 | 17118.91 | 2.5 |

| 2007 | 18247.37 | 4.1 |

| 2008 | 17425.57 | 0.1 |

| 2009 | 11623.23 | 2.7 |

| 2010 | 15323.99 | 1.5 |

| 2011 | 17281.42 | 3 |

| 2012 | 17466.32 | 1.7 |

| 2013 | 18995.84 | 1.5 |

| 2014 | 21131.64 | 0.8 |

| 2015 | 22871.55 | 0.7 |

| 2016 | 22536.98 | 2.1 |

| 2017 | 25705.05 | 2.1 |

| 2018 | 29309.38 | 1.9 |

| 2019 | 30932.92 | 2.3 |

| 2020 | 28800.99 | 1.4 |

| 2021 | 38481.83 | 2.5 |

Table 2: The information on US interest rate % and global stock index.

| Summary output | |||||

| Regression statistics | |||||

| Multiple R | 0.365757 | ||||

| R square | 0.133778 | ||||

| Adjusted R square | 0.121404 | ||||

| Standard error | 2.621557 | ||||

| Observations | 72 | ||||

| ANOVA | |||||

| df | SS | MS | F | Significance F | |

| Regression | 1 | 74.29737 | 74.29737 | 10.81073 | 0.001581 |

| Residual | 70 | 481.0792 | 6.872559 | ||

| Total | 71 | 555.3765 | |||

| Coefficients | Standard error | t Stat | P-value | ||

| Intercept | 4.843259 | 0.519989 | 9.314164 | 7.04E-14 | |

| X Variable 1 | -0.00013 | 3.91E-05 | -3.28797 | 0.001581 | |

Table 3: Relationship between interest rates and the global market index.

Both the great depression and the great recession have parallels to the current financial crisis. Financial crises bring about several problems, including unemployment, economic angst, social unrest, currency depreciation, trade obstacles, etc. The onset of the great depression abruptly halted the inflow of foreign capital into the United States and Europe. There are exchange limitations, capital controls, and trade hurdles because of this devalued currency. Due to the United States' massive deficits and lack of surpluses in 2008, the great recession hit other nations like China, Japan, and Germany which had surplus balances. It may be inferred from the great recession and the great depression that when global crises occur, international policy coordination and multilateralism support are required to deal with the worst-case scenario for the sustainability of the global economy.

The researchers recommend the federal government take the required precautions to shield the reserve bank repository and demonetization systems from financial emergencies. That prior crisis may be inferred to have caused poverty may continue to affect the general population if subsequent processes in the name of national development are undertaken.

It may be suggested that during a recession, the government will be alert and take transformational policies such as reviewing regulations for industries, protecting workers, and taking social security measures. In times of recession, those countries that are facing financial crises need support from the World Bank, which is the International Monetary Fund. In this way, during the Suez Canal crisis and international debt crises, the World Bank supported the victim countries. In a similar way, in a financial crisis, the devaluation of the victim country's currency. At such a time, the financial institutions will make the decision to mobilize the funds through the issue of short-term debt to protect against the financial crisis in that country. It may also suggest that during a recession, those countries that are suffering from crises but have external or international reserves based on government papers will borrow to meet their requirements, which will be covered with the help of increasing oil and gas prices. Finally, it is also suggested that those countries are financially strong enough to borrow for a short period of time, issue bonds, and mobilize funds from the borrowers to pay interest income to them. The analysis explores the positive relationship between interest rates and the global market index. In the same way, to meet emergency requirements and to resolve this problem in the future with the help of various sectors in the country.

[Google Scholar] [PubMed]

[Google Scholar] [PubMed]

Citation: Babu PR, Thangavel V (2025) An Empirical Evaluation of the Effects of Interest Rates and the Financial Crisis on the Global Stock Market Index. J Stock Forex. 12:279

Received: 23-Oct-2024, Manuscript No. JSFT-23-27767; Editor assigned: 25-Oct-2024, Pre QC No. JSFT-23-27767 (PQ); Reviewed: 08-Nov-2024, QC No. JSFT-23-27767; Revised: 26-Dec-2024, Manuscript No. JSFT-23-27767 (R); Published: 02-Jan-2025 , DOI: 10.35248/2168-9458.25.12.279

Copyright: © 2025 Babu PR, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.