Journal of Stock & Forex Trading

Open Access

ISSN: 2168-9458

ISSN: 2168-9458

Research - (2022)Volume 9, Issue 3

Aim: To help investors to enter and exit good quality of stocks.

Data and methodology: The data for the study are taken from the yahoo finance.com for the period from January 2022 – March 2022.

The present study is to analyze the performance of selected stocks from the automobile industry and consumer industry. The study consider sample of 10 companies listed at NSE, Five top stocks from automobile industry and 5 top stocks from consumer industry which are safe for investors to start investing. To Determining the strength of the stock of automobile and consumer goods Runs test upper limit, lower limit Have been used, to Testing hypothesis by comparing upper limit and lower limit with observed values Hypothesis Testing is been used, for Technical analysis to identify the factors which causes anomaly reaction in the positive and negative earnings.

Technical Analysis: RSI, Stochastic oscillator, Williams% R, MACD is used. And to compare expected earnings from CAPM to the returns CAPM Model is used.

After applying the statistical like run, it can be finish that the price motion of stocks of companies of NSE are random that nobody may be a hit in predicting a future facts on the basis of historical data. The null hypothesis is being accepted. There is no significant difference between observed runs lies between ‘upper’ and ‘lower’ limit in all selected companies. In the study after applying technical analysis we found that all the stocks of automobile industry have bearish condition and consumer goods industry has more number of stocks of bearish condition. The study shows that calculated returns from CAPM for automobile industry shows that two out of five stocks shows negative returns and in consumer goods industry all the stocks shows positive returns. By the support of findings we can conclude that Indian capital market has no significant difference between observed runs lies between upper and lower limit and according to the analysis and tests we can conclude that consumer goods industry stocks especially Nestle, Asian paints, Hindustan Unilever shows are good quality of stocks and are safe for investors to start investing with good returns.

Efficient Market Hypothesis; Technical analysis; CAPM; Run test

Efficient Market Hypothesis (EMH), is a marketplace of an inventory adjusts speedy and on common with no bias to new facts. As an end result, fees of the securities reflect all the available records in a timely manner. That’s why ‘EMH’ suggests that there is no cause to agree with that fees are excessive. The protection prices alter before an investor has time to exchange or make earnings from an exact what he paid.

Testing of weak form of EMH

The weak form EMH states that the current price of stock reflects past prices, volumes, and other market related information. This means, correlation among the past price and future price movements does not exist. Tests of weak form efficient market hypothesis look at the randomness. Run tests are available for this purpose.

Runs Tests: Under this, negative (-) sign is assigned if stock price decreases and positive (+) sign is assigned when the price increases in a given series of stock price. A run appears when the sign of two changes have no difference, the run ends when sign changes and another new run begin. In order to test the independence, the series run are matched with runs in purely random series and statistical difference is checked.

Technical analysis

Technical analysis is the study of chart patterns and statistical figures to understand market trends and pick stocks accordingly. Sounds complicated? Here is a simpler definition.

One day the share price is up, another day it may be down. But over time, if you look at the stock price’s movement, you may see trends and patterns emerge. The study of these chart patterns and trends in stock prices is called technical analysis of stocks. When you learn technical analysis of stocks, you will understand the big role that technical indicators play. The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. RSI between 25 and 45 is interpreted as a bearish condition. RSI between 45 and 55 is interpreted as a neutral condition. RSI between 55 and 75 is interpreted as a bullish condition. Stands for Moving Average Convergence Divergence (MACD) a trend-following momentum indicator that shows the relationship between two moving averages of a security's price. The MACD is calculated by subtracting the 26-day Exponential Moving Average (EMA) from the 12-day EMA.

The Stochastic Oscillator is an indicator that compares the most recent closing price of a security to the highest and lowest prices during a specified period of time. Readings between 55 and 80 indicate Bullish condition. Readings between 45 and 55 indicate Neutral condition. Readings between 20 and 45 indicate Bearish condition.

Williams% R it is a momentum indicator which indicates the current closing price of the stock in relation to its high and low of the past 14 days. Its purpose is to tell whether a stock is trading near the high or the low, or somewhere in between of its recent trading range. Readings between -20 to -50 implies bullish condition, readings between -50 to -80 implies bearish condition. CAPM is widely used throughout finance for pricing risky securities and generating expected returns.

Analysis of automobile and consumer goods industry stocks are:

Automobile industry

1. Eicher Motors Ltd.

2. Bajaj Auto Ltd.

3. Maruti Suzuki Ind Ltd.

4. Mahindra and Mahindra Ltd.

5. Tata Motors

Consumer goods industry

1. Nestle Ind Ltd.

2. Asian Paints Ltd.

3. Britanniya Industries Ltd.

4. Titan Company Ltd.

5. Hindustan Unilever Ltd.

Researcher analyzed the performance of India day by day stock market by means of usage of stock prices of ‘BSE’ capital index for term of Jan 04 to December 12 for small capital index [1]. BSE has examined auto correlation-statistics and run test, by then they find whether ‘Indian Stock market’ was no longer in susceptible form while testing duration. This end result will suggest stock prices in India do not replicate all facts of past prices. Investors may get abnormal return through exploiting ‘market inefficiency’ [2]. Analyzed 6 major market of NSE sectorial indices that is FMCG, Nifty junior, bank, MNC, IT, Pharma analysis of indices go back is carried the usage test of randomness or non-desk bound–unit root trying out, auto correlation function, run test and different method. This examine will also conclude, the Indian inventory markets are in vulnerable form.

Examination for vulnerable form of ‘Efficient Market Hypothesis’ the usage of last stock charges of numerous IT and automobiles, are selected from ‘NSE’ listed companies. To find market efficiency run test is used, this study showed Indian market efficiency is in weakly efficient [3].

Analyzed the market efficiency of ‘BSE India’, observed go back of ‘8 indices’ out of 12 specifically ‘BSE banked’, ’BSE automobile’, ’BSE capital’ items earned good return at ‘5%’ significant levels has compared vulnerable form of efficiency of NYSE and NSE, he provided proof of efficiency ‘NSE and inefficiency of ‘NYSE’, autocorrelation and runs check is easy to conclude the stock of ‘NSE’ is biased random time series, where ‘NYSE’ is independent random time collection [4].

Studies on ‘Indian stock markets’ are weakly green but not all the time. He tested on ‘CNX Nifty’, ‘CNX 500’, ‘CNX Bank’, ‘BSE 500’, ‘BSE Midcap’ and BSE Small cap reject the ‘random walk hypothesis’ and are characterized presence of linear dependencies [5,6].

Examination of the vulnerable form performance of 11 securities listed on ‘BSE’ the use of weakly information from July to October 2007 by means of applying ‘runs test ‘and autocorrelation test. This conclude that ‘BSE’ is weakly and stock charges all having impact on destiny price, that investors can’t reep out to odd profit, already present prices reflect the impact of beyond percentage past share stock charges [7].

‘Efficient Market Hyesis’ in its vulnerable form through making use of applying unit root test on sample of every day inventory return of ‘National Stock Exchange’ and ‘Bombay Stock Exchange’. Sample duration is from January 2007 to July 2009. Here the observe offers end result of vulnerable form of efficient [8].

‘Indian stock market’ with aid of use of check of efficiency degree in ‘Indian stock market’ and ‘random walk theory’ of inventory market place by using the usage of using c from January 1996 to June 2002. The study found that the collection of inventory in ‘Indian stock market’ biased random time series and now not confirmed random walk theory [9].

Examination the weak form and semi strong form efficiency of Indian capital market over the period of 6 years i.e. 2009 to 2014. NSE was taken to represent the market. Weak form was tested by using kurtosis, skewness, Jarque-Bera test, run test, K-S test, ADF test, autocorrelation test, Q-statistics, variance ratio test. Semi strong form was analysed by Abnormal Performance Index (API) and CAPI, and quarterly earnings announcement as taken as event. Based on results the study concluded Indian stock market as inefficient [10].

Efficiency over the study period from 2013 to 2016 constitutes 100 stocks and autocorrelation, run test, residual test and event study was used for analysis. It was found that the events had no bearing on returns, and inferred that market was efficient in both the forms [11].

EMH in Indian in context of budget 2016 event study methodology was applied and the results based on AAR and CAAR showed high level of efficiency in Indian stock market and researcher showed ‘Indian stock market’ was vulnerable form of efficient by using sample of, NSE India for duration of 1987 to 1994 [12].

The semi strong form of efficient market 53 hypothesis in context of trump’s tweets over the period from 9th November 2016 to 20th January 2017. Sample constitutes 15 tweets (events) about 10 publicly traded firms. Standard event study methodology was used. The results showed that on event day, positive tweet results in positive abnormal returns and negative tweet in negative abnormal returns. CARs were also found insignificant and the study inferred that the results were compatible with the EMH. Investigating the semi-strong form of EMH over the period of 2005 to 2013. Modified transfer function model was used with “Nigerian stock market index” as output series and computed index as input series. The result showed significant coefficient of transfer function which leads to the rejection of semi strong form efficiency. The efficiency of semi strong form of BSE in context of stock split announcement over the period from 2010 to 2017. Sample constitutes 59 stock split announcements and standard event study methodology was applied for analysis. Results of the study based on AARs and CAARs are found contradictory to each other, hence the study provide mixed results regard efficiency of BSE during the study period [13-15].

To study the performance of the automobile and consumer goods industry stocks

The above chart shows the result of runs test for 10 companies, using the upper and lower limit. All the observed runs falls within upper and lower limit, Eicher Motors Ltd has ‘30’ runs, Bajaj Auto Ltd has ‘30’ runs, Maruti Suzuki India ltd has ‘32’ runs, Mahindra and Mahindra Ltd has ‘33’ runs, Tata Motors Ltd has ‘27’ runs, Nestle India Ltd ‘35’ runs, Asian Paints Ltd has ‘32’ runs, Britannia Industries Ltd has ‘29’ runs, Titan Company Ltd has 36 runs, Hindustan Unilever India ltd has ‘31’ observed runs, so we can conclude that automobile industry stocks are not performing good it has more negative runs than the consumer goods industry (Table 1).

| Objectives | Statement of the objective | Method/Methodology |

|---|---|---|

| 1 | To examine the weak form efficiency of automobile and consumer goods industry stocks. | Secondary data: Runs test, upper limit, lower limit |

| 2 | To identify hypothesis by comparing upper limit and lower limit with observed values | Secondary data: Hypothesis Testing |

| 3 | To analyze the performance of the stocks in the given time period using Technical analysis | Secondary data: Technical Analysis: RSI ,Stochastic oscillator Williamsons %R,MACD |

| 4 | To identify stocks giving more expected returns and suggest investors to enter and exit good quality stocks | Secondary data: CAPM Model |

Table 1: Data for the study are taken from the yahoo finance.com for the period from January 2022–March 2022.

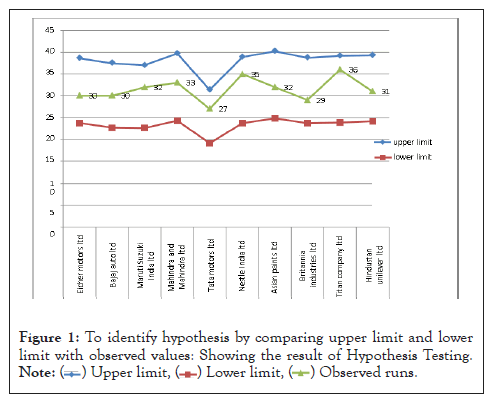

To identify hypothesis by comparing upper limit and lower limit with observed values: Showing the result of hypothesis testing

The above chart shows the result of runs test for 10 companies, using the upper and lower limit. All the observed runs falls within upper and lower limit, Eicher Motors Ltd has ‘30’ runs, Bajaj Auto Ltd has ‘30’ runs, Maruti Suzuki India ltd has ‘32’ runs, Mahindra and Mahindra Ltd has ‘33’ runs, Tata Motors Ltd has ‘27’ runs Nestle India Ltd ‘35’ runs, Asian Paints Ltd has ‘32’ runs, Britannia Industries Ltd has ‘29’ runs, Titan Company Ltd has 36 runs, Hindustan Unilever India ltd has ‘31’ observed runs, so there is no significant difference between observed runs lies between upper and lower limit. So null hypothesis is accepted (Figure 1).

Figure 1: To identify hypothesis by comparing upper limit and lower

limit with observed values: Showing the result of Hypothesis Testing.

To analyze the performance of the stocks in the given time period using technical analysis

In the technical analysis all the stocks of automobile industry shows the bearish condition. In consumer goods industry stocks nestle, Asian paints, Hindustan Unilever shows bullish condition and Britannia and Titan shows bearish condition. Which means Asian paints, Hindustan Unilever are performing better in the selected stocks (Table 2).

| Company | n1 | n2 | µ | Standard | Upper limit | Lower limit | Observed | Hypothesis testing | |

|---|---|---|---|---|---|---|---|---|---|

| Eicher Motors Ltd | 25 | 38 | 31.15 | 3.81 | 38.61 | 23.69 | 30 | Not reject | H0 |

| Bajaj Auto Ltd | 26 | 33 | 30.08 | 3.81 | 37.46 | 22.6 | 30 | Not reject | H0 |

| Maruti Suzuki India ltd | 23 | 37 | 29.86 | 3.62 | 37.05 | 22.54 | 32 | Not reject | H0 |

| Mahindra Ltd | 32 | 30 | 31.96 | 3.96 | 39.72 | 24.2 | 33 | Not reject | H0 |

| Tata Motors Ltd | 17 | 42 | 25.2 | 3.15 | 31.37 | 19.03 | 27 | Not reject | H0 |

| Nestle India Ltd | 33 | 28 | 31.29 | 3.9 | 38.93 | 23.64 | 35 | Not reject | H0 |

| Asian Paints Ltd | 36 | 28 | 32.5 | 3.96 | 40.26 | 24.74 | 32 | Not reject | H0 |

| Britannia Industries Ltd | 26 | 36 | 31.19 | 3.85 | 38.73 | 23.65 | 29 | Not reject | H0 |

| Titan Company Ltd | 30 | 31 | 31.49 | 3.93 | 39.19 | 23.79 | 36 | Not reject | H0 |

| Hindustan Unilever Ltd | 34 | 28 | 31.7 | 3.9 | 39.3 | 24.08 | 31 | Not reject | H0 |

Table 2: To study the performance of the automobile and consumer goods industry stocks.

To determine returns using CAPM

The above charts show the results of CAPM returns for the selected stocks for selected period. In the automobile stocks tata motors has -1.60% and Maruti Suzuki has -1.10 and all other automobile stocks Eicher motors, Bajaj auto ltd, Mahindra, Maruti suzuki has shown positive returns with 0.90%, 1.30%,0.90%. In the consumer goods stocks nestle, HUL, Asian paints has the highest returns 2.10%,1.60%,1.30% and Britanniya, Titan has low positive returns with 0.40% (Tables 3 and 4).

| S.no | Company | Technical analysis | ||||

|---|---|---|---|---|---|---|

| RSI | MACD | Stochastic oscillator | Williams% R | Bullish/Bearish condition | ||

| 1 | Eicher Motors | 34.53 | -73.62 | 27.82 | -72.3 | Bearish condition |

| 2 | Bajaj Auto Ltd | 33.32 | -92 | 27.69 | -72.3 | Bearish condition |

| 3 | Tata Motors | 32.16 | -14.54 | 18.09 | -81 | Bearish condition |

| 4 | Mahindra | 37.65 | -21.24 | 31.92 | -68 | Bearish condition |

| 5 | Maruti Suzuki | 34.32 | -248 | 26.46 | -73.53 | Bearish condition |

| 6 | Nestle India | 54.27 | 107.12 | 61.26 | -38.76 | Bullish condition |

| 7 | Asian Paints | 49.56 | -2.54 | 51.06 | -48.93 | Bullish condition |

| 8 | Britanniya | 46.31 | -40.97 | 42.58 | -57.41 | Bearish condition |

| 9 | Titan Company | 49.24 | -8.48 | 48.21 | -51.78 | Bearish condition |

| 10 | Hindustan Unilever | 61.32 | 24.72 | 60.62 | -39 | Bullish condition |

Table 3: To analyze the performance of the stocks in the given time period using Technical analysis.

| S. no | Company | BETA | E (rm) daily | E (rm)Quarterly | E (Rstock)daily | E (rSTOCK) Quarterl | Rf | MRP | E (R STOCK) |

|---|---|---|---|---|---|---|---|---|---|

| 1 | Eicher Motors | 0.7775 | -0.63% | -90.14% | -0.81% | -94.93% | 6.40% | -7.00% | 0.90% |

| 2 | Bajaj Auto Ltd | 0.7308 | -0.63% | -90.14% | -0.68% | -91.82% | 6.40% | -7.00% | 1.30% |

| 3 | Tata Motors | 1.1362 | -0.63% | -90.14% | -1.63% | -99.75% | 6.40% | -7.00% | -1.60% |

| 4 | Mahindra | 0.7844 | -0.63% | -90.14% | -1.10% | -98.23% | 6.40% | -7.00% | 0.90% |

| 5 | Maruti Suzuki | 1.0597 | -0.63% | -90.14% | 0.85% | -95.71% | 6.40% | -7.00% | -1.10% |

| 6 | Nestle India | 0.6145 | -0.63% | -90.14% | 0.09% | 41.31% | 6.40% | -7.00% | 2.10% |

| 7 | Asian Paints | 0.732 | -0.63% | -90.14% | -0.19% | -49.22% | 6.40% | -7.00% | 1.30% |

| 8 | Britanniya | 0.8548 | -0.63% | -90.14% | -0.34% | -70.91% | 6.40% | -7.00% | 0.40% |

| 9 | Titan Company | 0.8549 | -0.63% | -90.14% | 0.33% | -70.18% | 6.40% | -7.00% | 0.40% |

| 10 | Hindustan Unilever | 0.6781 | -0.63% | -90.14% | 0.20% | 105.40% | 6.40% | -7.00% | 1.60% |

Table 4: To determine returns using CAPM.

The study focuses only on the 10 stocks of the market. So further analysis on different markets in India can be done. Different subdivisions can be made. In this thesis, researching with different subdivisions: Big companies versus small companies. The consequences and study outcomes can be different. Finally, the same research with the same methodology shall be done on annual announcements. It might provide different results. Same study with the same methodology can be done for the long time period by taking the annual closing and average annual earnings of the different group of stocks.

The study is a try to degree the efficiency of NSE throughout duration. After applying the statistical like run it can be finish that the price motion of stocks of companies of NSE are random that nobody may be a hit in predicting a future facts on the basis of historical data. The null hypothesis is being accepted. There is no significant difference between observed runs lies between ‘upper’ and ‘lower’ limit in all selected companies. In the study after applying technical analysis we found that all the stocks of automobile industry have bearish condition and consumer goods industry has more number of stocks of bearish condition. The study shows that calculated returns from CAPM for automobile industry shows that two out of five stocks shows negative returns and in consumer goods industry all the stocks shows positive returns. By the support of findings we can conclude that Indian capital market has no significant difference between observed runs lies between upper and lower limit and according to the analysis and tests we can conclude that consumer goods industry stocks especially Nestle, Asian paints, Hindustan Unilever shows are good quality of stocks and are safe for investors to start investing with good returns.

[Crossref] [Google Scholar].

[Crossref] [Google Scholar].

[Crossref] [Google Scholar].

Citation: Kumar P, Namratha R (2022) A Study on Efficient Market Hypothesis and Technical Analysis of Automobile and Consumer Goods Industry Stocks. J Stock Forex. 9:213.

Received: 10-Aug-2022, Manuscript No. JSFT-22-18791; Editor assigned: 12-Aug-2022, Pre QC No. JSFT-22-18791 (PQ); Reviewed: 26-Aug-2022, QC No. JSFT-22-18791; Revised: 02-Sep-2022, Manuscript No. JSFT-22-18791 (R); Published: 12-Sep-2022 , DOI: 10.35248/2168-9458.22.09.213

Copyright: © 2022 Kumar P, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.