Journal of Stock & Forex Trading

Open Access

ISSN: 2168-9458

ISSN: 2168-9458

Research - (2022)Volume 9, Issue 3

The assessment and performance of national economy involves the aggregation of major economic indicators. The Consumer Price Index (CPI) is perhaps the most used indicator among the numerous statistical indicators that are available to the planners, administrators, policy makers and the general public at large to analyse the status of the national economy at any point of time. Additionally, the six core financial indicators of an Indian economy namely, foreign exchanges reserves, supply of money, nominal exchange rates, stock market index, country’s industrial production, and CPI rate have a significant relationship in the development of an economy. The aggregation of these indicators could imply that the change in one indicator may affect the other indicator. The relationship of the indicators was explored and it was concluded that there is a correlation between CPI rate and five specified key financial indicators (considering sub-components). Additionally, there is multicollinearity present in the specified key financial indicators. Furthermore, by using a comprehensive data science tool a predictive deep learning model was built to predict the CPI rate.

CPI rate; Deep learning; Indian economy; Financial markets; Data science; Quantitative finance

Consumer Price Index (CPI) numbers (until recently called cost of living index numbers) in our country dates back to the period immediately following the First World War. The consumer price index is also used for numerous reasons which include monitoring the overall rate of price inflation for all sectors of the economy, adjustment of government fees and charges, adjustment of payments in commercial contracts and formulating and assessing fiscal and monetary policies, and trade and exchange rate policies. Consumer Price Index (CPI) of India is categorized into two components i.e., CPI urban and CPI rural by the central statistics office under the ministry of statistics and programmed implementation. These indices act as a representative of entire urban and rural population that reflects the changes in the price levels of various goods and services [1,2]. Currently, CPI in India is calculated by taking a basket of 299 commodities, compared to 676 commodities in the Wholesale Price Index (WPI). The characteristics of each of the six indicators namely foreign exchange reserves, supply of money, nominal exchange rates, stock market index, country’s industrial production, and CPI rate have a significant relationship in the development of an economy. In an Indian financial system CPI rate vary to a large extent because foreign exchange reserves ensure that the government has backup funds if national currency depletes, similarly supply of money ensures that the nation economy remains vigorous and it regulates the circulation of money in the country. Nominal exchange rates depend upon the foreign reserves in order to intervene, accordingly stock market index propel and act as a driver in long term economy, consequently country’s industrial production guarantees resumption in growth, and CPI rate ensures the price stability in an economy. In India, foreign exchange reserves were segregated into four further sub- components, they are foreign currency assets, reserve tranche position, special drawing rights and gold. The past studies observed that when the CPI rate was low, a bank can cut interest rates in order to spur economic activity, whereas when the CPI rate was high interest rates may be raised to stabilize the prices. The increase in interest rates will put the consumer in saving the money, rather than spending it, hence a consumer can expect a return when rates are increasing. The study shows that the CPI rate was dramatically impacted the decision proposed by the banks on the monetary policies. However, when bank surges the interest rates to combat the CPI rate all indicators will start contracting. Although, changes in CPI rate will significantly make the currency value on the global market more volatile. According to various studies it can be concluded that money supply holds a high correlation with the CPI rate, because CPI rate will increase if money supply grows faster than economic output in any circumstances. To further discuss the relationship of money supply and CPI rate, the Quantity Theory of Money (QTM) was proposed also known as the fisher equation.

The quantity theory characterized two limitations they are, new money has to circulate to cause the impact on the CPI rate, and CPI rate is relative. Furthermore, in India money supply (M3) was an aggregation of public currency, other deposits of RBI, time and demand deposits. Examining the historical returns in the capital market (stock market) during the periods of high or low inflation may provide some clarity for investors. The past studies show that the impact of CPI rates on stock returns has produced conflicting results when diverse factors are taken into an account. Most studies conclude that the expected inflation can either positively or negatively impact the stock market depending on the investor’s ability to hedge the government monetary policy [3,4]. A definitive finding of unexpected CPI rate observed a strong correlation with stock returns during economic contraction which implied that the timing of an economic cycle will gauge the investors to make an impact on stock return [5]. Overall stock index seems to be more volatile when the CPI rate was surging, whereas income oriented or high dividend paying stock started plunging. In India, NEER was divided into two further indices, named as 6-currency and 36-currency. It is a weighted average index based on either term-based or trade-based where it signifies the country’s international competitiveness to the foreign exchange market. Study shows that the CPI rate was negatively correlated to exchanges rates of other country; however as CPI rate started increasing it will start positively impacting the country’s exchange rates. Furthermore, it has been observed that the foreign investors tend to attract when high interest rates were planned, these rates will pull out more foreign investors which is likely to increase the currency value hence the CPI rate will start increasing. Therefore, due to the relativeness in nominal exchanges rates which were noticed in domestic purchasing power can influence in CPI rate [4]. On the other hand, some study shows that exchange rates have an inverse impact on the CPI rate [6,7].

From the past numbers of IIP it shows a non-significant impact but in the past few months due a sudden contraction noticed in IIP because of the pandemic had an adverse effect on CPI rate. Due to a major disruption in Artificial Intelligence (AI) and data science technologies, a huge aspect of government finance can be leveraged using the diverse technological tools of AI where using either analytical or empirical results rigorous measures can be taken by the governments official to boost the economy. AI also provides efficiency, mitigation of risk, and operational insights that can ease the country’s economy process. The need to adopt an AI in the continued econometric study on a granular level will build digital capabilities to fully utilize the power of data science and ML which will be efficient and more capable. Government of India has been working on developing a comprehensive AI ecosystem for the country [5]. Thus, this study seeks to find more relationship between CPI rate and five core financial indicators, viz., foreign reserves, money supply (M3), stock market index, nominal exchange rates, and IIP (considering sub-components) and using these indicators CPI rate can be predicted through deep learning technology which can help the monetary policy committee and government to stabilize each indicators and minimized the problem. This study was divided into three sections, i.e., literature review, data analysis, and conclusion and findings of analysis.

Similar theoretical and practical papers related to the problem statement are compiled and brief analysis for each paper is as follows in Table 1.

| Paper | #1 | #2 | #3 | Remarks |

|---|---|---|---|---|

| Pami Dua, (2020) | Y | NA | M3, Foreign Reserves and NEER, CPI rate | Government Policy was discussed |

| Selcul A, (2011) | Y | VAR | PPI, CPI | Countries-wise analysis was conducted. |

| Kaur M, (2016) | Y | NA | Stock Market, NEER, CPI rate | Multicollinearity was computed among indicators. |

| Shah C and et.al (2016) | Y | VAR | NEER, M3, CPI rate, BSE index, IIP | Statistical analysis using VAR was conducted. |

| Du Y. -2018 | N | NN | M2, PPI, CPI Shanghai Index | CPI was predicted using these indicators. |

| Ge L and et.al (2012) | N | NN | Daily CPI | CPI sub-components was predicted. |

| Goel D., (2019) | N | VEC M | CPI and WPI | Multivariate time series Forecasting analysis was performed. |

| Zahara S et.al (2020) | N | NN | Daily CPI Food Movement | Sub-components of CPI were predicted |

| Ye Wang et.al (2012) | Y | VAR SVR | Stock market, housing price, real estate market, 6- month short term lending rates, exchange rates, Hushen 300 price index, M2 money supply and lags of CPI | A predictive model was built to predict the CPI using these indicators |

| S. Nugroho et.al, (2017) | N | SVR RF | 28 Commodit y prices and CPI | CPI was predicted using comparative model approach considering 28 commodity prices |

| Note: M3: Money Supply; NEER: Nominal Exchange Rates; CPI: Consumer Price Index; PPI: Producer Price Index; WPI: Wholesale Price Index; BSE: Bombay Stock Exchange; IIP: Industrial Production Index. | ||||

Table 1: Theoretical and practical papers related to literature review.

Research problem

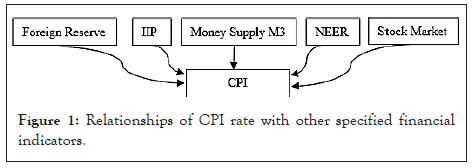

The past studies show that the variation in CPI can act as the dependent variable with several other key financial indicators such as foreign reserves, country’s Industrial Production Index (IIP), stock market, money supply (M3), Nominal Exchange Rates (NEER) and concludes that CPI rate holds a non-linear relationship with various financial indicators. Therefore, this research focus on analyzing and observing the changes occur in any of these financial indicators which may have an impact on variation in the next months of CPI rate. Furthermore, with the help of these financial indicators which acts as an independent variable, a model was developed through which future points of variation in CPI rate was predicted. Moreover, a revised CPI based effect on 2012 was considered in the research which was initiated in the year 2014 (Figure 1).

Figure 1:Relationships of CPI rate with other specified financial indicators.

Research gap

To conduct the research, gaps were identified from the past studies, and based on the research agenda certain questions were prepared to better analyse the problem statement. Research questions give better insight to the research problem. They are,

• What is the impact on variation in CPI rate of next year if changes occur in foreign reserves, IIP, stock market, money supply (M3), and nominal exchange rates?

• Are there any correlation present between CPI rate and five specified key financial indicators?

• Do these specified financial indicators hold multicollinearity and are they suitable to consider to predict the future points of variation in CPI rate?

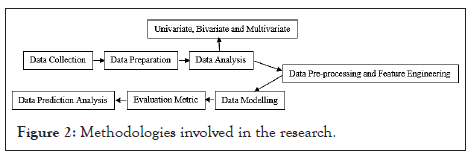

These questions were taken into the consideration in the research and based on the problem, the research was segregated into nine further sections and it is as follows in Figure 2.

Figure 2: Methodologies involved in the research.

Objectives and hypothesis

Based on the problem statement and research methodology, three objectives were proposed by which this research has been carried out;

Objective 1: To check whether the CPI rate holds a correlation with the composite and sub-components of foreign reserves, IIP, stock market index, M3 supply and nominal exchange rates.

Null hypothesis (H01): There is a correlation between CPI rate and five specified key financial indicators (considering subcomponents).

Alternate hypothesis (Ha1): There is no correlation between CPI rate and five specified key financial indicators (considering subcomponents).

Objective 2: To check the multicollinearity among the six input composite variables (considering sub-components), i.e., foreign reserves, IIP, stock market index, M3 supply, nominal exchange rate, and current month CPI rate. Therefore, two hypotheses were proposed in the objective, they are:

Null hypothesis (H02): There is multicollinearity present in the specified key financial indicators.

Alternate hypothesis (Ha2): There is no multicollinearity present in the specified key financial indicators.

Data collection

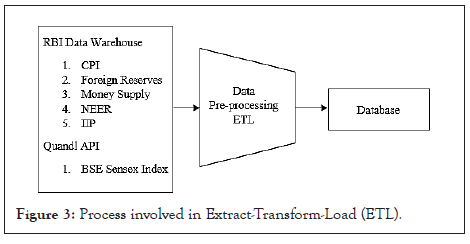

In this step, raw data of foreign reserves, CPI, IIP, NEER, and money supply (M3) was collected from the RBI Data Warehouse [8], and stock market data (BSE Sensex Index) was scrapped from Bombay Stock Exchange using the quandl library [9]. The data was collected month-wise from year January 2014 to August 2020.

Data preparation

The raw data which was collected were pre-processed in a structured format by applying the ETL (Extract-Transform-Load) techniques. From the foreign reserves four sub-components were selected which was provided by the RBI data warehouse they are, foreign currency assets, gold, Reserves Tranche Position (RTP), and Special Drawing Rights (SDRs). Similarly, from money supply (M3) four components were selected, public currency, other deposits of RBI, demand deposits and time deposits, adding to this M3 is dependent on these components. Furthermore, 36-currency index of weighted NEER with two sub- components, viz. tree-based and export-based NEER indices were selected. At the end of the filter IIP and stock market indices were extracted individually. CPI of current month was also incorporated in the resultant data. As the objective of the research was to predict next month’s CPI rate, hence the actual CPI rate was shifted by oneday behind and a new column named CPI Target was created. The pre- processed data was loaded to the cloud database where a new observation can be easily inserted or updated. To build the model, data was extracted from the cloud data base; this reduces the downtime and increases the scalability of the data (Figure 3).

Figure 3: Process involved in Extract-Transform-Load (ETL).

Univariate analysis

The data which was loaded into the database were analysed with two variants, first was univariate analysis which proved the statistical significance of each indicators with its sub-components followed by interpreting the statistical measures. The univariate analysis of each indicator which was shown in the Table 1 infers that all financial indicators are non-stationary, because their p-values are greater than 0.05 with 95% level of confidence, through which hypothesis got rejected. To compute the p-value and maximum lags, Augmented Dickey Fuller (ADF) Test was applied. This can be observed where each indicators and subcomponents holds trend as well as seasonality among the data. The change in each series was noticed due to the change in government policies each year to boost the economy. The ADF test also computes the maximum lags for the series to make the series statistical significance, from the table it can be observed that reserve tranche position, and NEER with its sub- components requires 0 lags due to minimal Akaike’s Information Criterion (AIC) which infers the major fluctuation in the data. CPI, IIP, and demand deposits of M3 carries seasonality components due to which 12 lags was considered to compute the p-value (Table 2).

| Indicator | p-value | Maximum lag | Mean | Volatility |

|---|---|---|---|---|

| CPI | 0.2033 | 12 | 4.8 | 1.66 |

| Foreign currency assets | 0.999 | 1 | 2406969 | 476116.2 |

| Gold | 1 | 3 | 148423.77 | 36842.59 |

| Reverse tranche position | 0.9986 | 0 | 16214.46 | 6733.18 |

| SDR | 0.4116 | 3 | 15296.89 | 7602.04 |

| Foreign reserves | 1 | 1 | 2586904 | 510130.1 |

| Public currency | 0.8641 | 1 | 1673783 | 403443.7 |

| Other deposits of RBI | 0.9751 | 6 | 20049.26 | 10393.4134 |

| Demand deposit | 0.9496 | 12 | 1176941 | 269823.3 |

| Time deposit | 0.9972 | 3 | 10087380 | 1693930 |

| M3 supply | 0.999 | 6 | 12958150 | 2318355 |

| Stock index | 0.6519 | 7 | 31036.46 | 5386.76 |

| Tree-based NEER | 0.4815 | 0 | 74 | 2.035903 |

| Export-based NEER | 0.5622 | 0 | 75.46 | 2.303802 |

| Average NEER | 0.5266 | 0 | 74.73 | 2.165979 |

| IIP Index | 0.4945 | 12 | 119.78 | 12.078185 |

Table 2: Statistical measures and significance of each indicator.

Similarly, the volatility shown and inferred that due to the outliers present in the data affected the mean and standard deviation of the population. IIP index and NEER captures low volatility in the data which deduced that the mean of these indicators was not much deviated from the data. Although, it can be observed that the foreign reserves contain lots of error, which can be seen in Gold, RTP, and SDRs, there were either a sharp decrease or increase in the data each year. This fluctuation affects the mean and volatility of the foreign reserves. The change in data depends upon the government policies and decisions they announced each year. Similarly, the fluctuation in the data can also be observed in the money supply M3 with its sub- components.

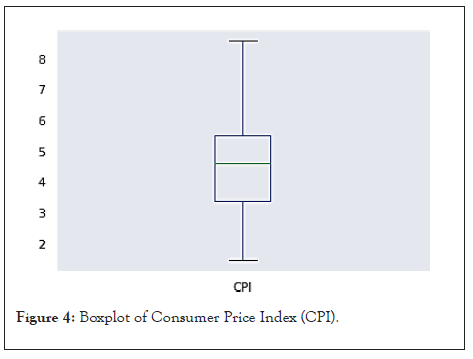

Due to a sudden change in the Government policies stock market will either increases or decreases, which conclude that high volatility of the market, will shoot up the risk of the market, it can be deduced that from the period of 2014 to 2020 the volatility of the market was minimal. Similarly, it can be observed that NEER of 36-days currency was fluctuating every year because the NEER always depends upon the international market currency through which the prices are impacted. It can be observed that IIP index contracted a sudden change in 2020 due to worldwide pandemic of coronavirus [6]. Furthermore, amid coronavirus there are several financial components, such as foreign reserves soared due to foreign assets and FPIs [7], even money supply uncertainly started surging due to more circulation of currency over pandemic [8]. But due to the coronavirus, stock index observed a contraction in the market with IIP index and NEER (Figure 4).

Figure 4: Boxplot of Consumer Price Index (CPI).

From the data, it can be observed that CPI was equally distributed with minimal errors and outliers, the mean and deviation from the mean was less, and the boxplot of CPI inferred that the data was skewed to left which inferred that most of the data falls in the range of 2% to 5% rate. In other context CPI rate has surged from March 2020 levels and has persisted above the tolerance band of the target due to the pandemic. According to the RBI’s Governor Statement on 10th October, it can be concluded that the supply disruption and associated margins are the major factor driving up the CPI rate in pandemic [9]. Furthermore, the distribution of each indicators can be observed in Figure 4 where the composite foreign reserves consists lots of outliers which can be noticed in the histogram, whereas the composite M3 was equally distributed skewed to left side of histogram. Similarly, NEER and stock prices are symmetric with some high outliers, followed by IIP index noticed a slightly skewed to right because of the sudden changes occurred in the year 2020.

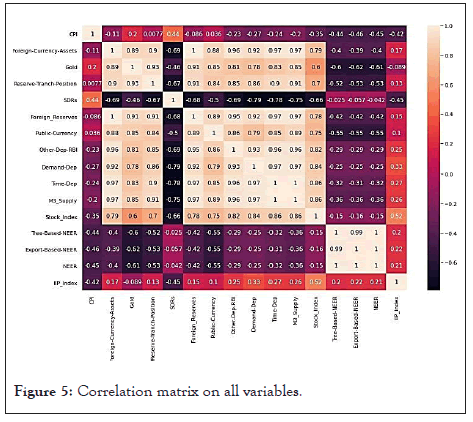

Bivariate and multivariate analysis

In bivariate and multivariate analysis, a comparative approach and correlation technique was performed on CPI rate with other core financials indicators with its sub-components. The past studies conclude that CPI holds a non-linear relationship with foreign reserves, M3, NEER, stock market and IIP [10]. To further elaborate the non- linearity on the data, overall and yearwise performance of each financial indicators are observed which showcased the impact of non-linearity affected on model that maximized the errors and results in poor predictions. However, the main reason behind the poor predictions was observed when the change in certain financial indicators affects the other financial indicators or its sub-components either statistically or any change occurred in monetary policies. Hence, the overall analysis on these indicators is erroneous because every year Government announces several schemes and decision on the policies. These changes in policies every year impacting the CPI rate and other indicators distinctively. It can be observed that CPI rate was negatively impacting on all core composite financial indicators, although the variability among the CPI rate and other indicators can be noticed extensively. It also inferred that due to an outlier present on the two variables make the correlation negatively impacted. This can be noticed in a composite foreign reserves where the outliers are present on a maximum point which model a low negative correlation coefficients, though in the sub-components of foreign reserves shows different results of correlation coefficients, where only foreign currency assets are negatively impacted on CPI rate, followed by RTP holds a small positive impact on CPI rate whereas gold and SDRs are highly impacted the CPI rate. The cause for high impact of SDRs on CPI rate was noticed over a span of time because CPI rate measure was represented in the basket of currencies that are used in SDRs 10. Similarly, it can be noticed for the M3 that it holds a high negative correlation coefficient because of outliers present on the maximum point due to which it causes the regression to plunge. But it can be perceived from that excluding the public currency, all other components of M3 including composite M3 holds a high negative correlation; however public currency holds a small positive correlation with CPI. Due to an imprecise statistical significance of CPI rate with foreign reserves and M3 has affected the overall model performance (Figure 5).

Figure 5: Correlation matrix on all variables.

Likewise, it can be observed from more variability and outlier present on the stock market caused a highly negative impact on CPI rate with a correlation coefficient of -35% which can be noticed in Figure 5. Though from the period 2014 to 2020 the stock index carried a low volatility but statistically shows that as CPI rate started increasing stock index started decreasing. Similarly, NEER was also negatively impacted the CPI rate with a coefficient of -45% though, tree-based and export-based NEER caused nearly same coefficients. Furthermore, it can be noticed from that NEER and CPI rate data are more spread out in the population and had more outliers on minimal point. It can be observed that in the year 2020, IIP index noticed a sudden drop in the economy thus it caused the CPI rate negatively impacted, because all manufacturing productions are halted due to the lockdown announced by the government, thus in April 2020 IIP contracted to 55.5% [11]. Hence, statistically it shows that the correlation between CPI rate and IIP was -42% because of unexpected change. Therefore, these coefficients of all composite indicators are imprecise because of overall analysis which was causing the model to be more bias.

Consequently, a composite multivariate analysis was performed on all indicators and its sub-components through which it can observed that statistically all composite variables excluding CPI rate are not significant because their p-value are less than 0.05 i.e., 95% level of confidence. Furthermore, the analysis inferred that sub-components of foreign reserves, total M3, and exportbased NEER were negatively impacting the CPI rate, followed by stock index which was having a small negative impact on CPI rate whereas, NEER and IIP index were having a small positive impact on CPI rate (Table 3).

| Columns | Impact | Significance (p-value) |

|---|---|---|

| Foreign reserves sub-components | -0.3782 | 0.888 |

| Foreign reserves | 0.3782 | 0.888 |

| M3 supply sub-components | 2.8444 | 0.228 |

| M3 supply | -2.8445 | 0.228 |

| Stock index | -4.04E-05 | 0.603 |

| Tree-based NEER | 0.275 | 0.751 |

| Export-based NEER | -0.2615 | 0.756 |

| Average NEER | 0.0067 | 0.729 |

| IIP Index | 0.053 | 0.026 |

| R-squared | 0.96 | |

Table 3: Co-efficients of each indicators CPI.

Hence, it can be observed that due to a non-linear relationship of overall CPI rate with other variables made the analysis non-statistically significant. Therefore, to further breakdown the bivariate and multivariate analysis, year-wise analysis was conducted to observe the impact in more depth.

The change in government new policies were finalized to improve the economy, a decline in crude oil in 2014 helped the new government to reduce the inflation as well as exchanges rates but by analyzing the data, inflation shows exactly opposite effect [12]. Hence it can be observed from that foreign currency assets, money supply, nominal exchange rates and stock market were negatively impacting the CPI rate because of opposite impact on the monetary policies and thus CPI rate started declining. Though, the sub-components of foreign reserves such as golds, RTP and SDRs noticed a positive correlation with CPI rate after the new government coming into the power there was a sudden rise in gold reserves which was noticed in the RBI yearly balance sheet. Similarly, IIP started contracting in the starting year of 2014 because of the base effect but in mid of the year it gradually started increasing due to the strict actions were taken by the new government, although the last two months of 2014 observed a contraction in IIP, this made a small positive impact on rise of CPI hence a low positive correlation was perceived [13]. Also, the composite multivariate analysis, result shown it can be observed from Table 3 that statistically foreign currency assets, gold, public currency, other deposits of RBI, M3 supply, and stock index are negatively impacted on the CPI whereas RTP, SDRs, total foreign reserves, demand deposits, time deposits, NEER, and IIP are positively impacted on the year 2014.

Similarly, after the new monetary policies of new government started initiated, the market gradually started to recover from opposite impacts in 2015. Despite a massive drop in gold prices and nominal exchanges rates the reserves of gold remain unchanged, even the SDRs started rising, although according to the data it shows a negative impact on CPI rate [5]. Overall, the foreign reserves highly plunged in the year 2015 therefore as assets starts decreasing there was a dropped in money supply which affected the CPI rate and hence it also started decreasing with minimal errors. A change in policy boosted the confidence of the investors which reflected in the marginal increase in the correlation with CPI rate remains negatively low. In spite of declining in CPI rate, it was noticed that factory output saw a big 2-year jump in last months of 2015 while the CPI rate was fluctuating which makes the IIP a highly positive correlated variable. The reason for the sudden rose in IIP was rise in manufacturing of consumer durables which highly impacted CPI rate. The composite multivariate analysis a small negative impact on SDRs, total foreign reserves, other deposits of RBI, total M3, stock index, and NEER was observed on CPI rate, whereas a small positive impact of foreign currency assets, gold, RTP, public currency, demand and time deposit, and IIP was noticed on CPI rate in the year 2015 (Table 4).

| Indicators | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|---|

| Foreign currency assets | -0.0019 | 0.0001 | 0.0002 | 0.0024 | -0.0033 | -0.016 | -4.4e- 05 |

| Gold | -0.0022 | 0.0003 | 0 | 0.0021 | -0.0034 | -0.0161 | -2.2e- 05 |

| Reverse tranche position | 0.0025 | 0.0004 | -0.001 | 0.001 | -0.003 | -0.0157 | 9.80E-05 |

| SDRs | 0.0026 | -0.0009 | -0.0006 | -0.0059 | 0.0193 | -0.0717 | 7.00E-06 |

| Foreign Reserves | 0.0021 | -0.0001 | -0.0003 | -0.0024 | 0.0033 | 0.016 | 3.90E-05 |

| Public Currency | 0 | 0.0001 | 0 | 0.0002 | -0.0004 | -0.007 | -1e- 05 |

| Other Deposits of RBI | -0.0007 | -0.0001 | -0.0001 | -0.0003 | -0.0002 | -0.0073 | 2.20E-05 |

| Demand Deposit | 0.0001 | 0.0001 | 0 | 0.0001 | -0.0004 | -0.007 | 4.00E-06 |

| Time Deposit | 0.0002 | 0.0001 | 0 | 0.0002 | -0.0004 | -0.007 | 9.00E-06 |

| M3 Supply | -0.0001 | -0.0001 | 0 | -0.0001 | 0.0004 | 0.007 | -3e- 06 |

| Stock Index | -0.0029 | -0.0005 | 0.0018 | -0.0006 | -0.0001 | 0.0006 | -2.4e- 05 |

| Tree- based NEER | 2.3609 | -0.0104 | -0.979 | -2.0047 | 1.4701 | -4.9769 | -4.25E-08 |

| Export- based NEER | 3.1712 | -0.0383 | -0.793 | -1.6139 | 0.3806 | -2.0199 | -11.97 |

| Average NEER | 2.7661 | -0.0243 | -0.886 | -1.8093 | 0.9253 | -3.4984 | -4.16E-08 |

| IIP Index | 0.2724 | 0.0825 | 0.0802 | 0.1222 | -0.049 | 0.2703 | 7.45-7 |

Table 4: Year wise composite impact of scaled core financial indicators on CPI.

2016 end saw foreign investors pulled out the investments from the Indian equity market and debt market which could have intervened the Reserve Bank [1]. With demonetization announcement in November 2016 circulation of currency declined impacting CPI rate with downward trend. With replacement of currency in the ongoing months put the CPI rate on track [1]. Further negative impacts of demonetization were observed in stock markets, IIP’s [2]. The RTP, SDRs, total foreign reserves, and all sub-components of M3 caused a small impact on CPI rate, whereas foreign currency assets, gold, total M3, stock index and IIP caused a small positive impact on CPI rate. Although, NEER with its sub-components precipitated a high negative impact on CPI because on y-o-y basis NEER rose by 0.7% whereas in 2016 CPI rate declining thus a high negative correlation was observed [2]. In the year 2017, the main reason behind the uprising of CPI rate was new banknotes of high values circulating. Additionally, in the mid of 2017, government announced a new taxation system, Goods and Services Tax (GST) hence the stock market impact was neutral to negative in a short run, however small and micro enterprises observed a rise in costs due to higher compliance in the tax system. India’s factory output also started rising due to manufacturing activity expanded after the implementation of GST, each sector pharmaceuticals, medical chemical, botanical product, computer, electronics and optical product, machinery, coke and refined petroleum products, motor vehicles observed a sharped rise in 2017 though the CPI rate was steady. In the last months of 2017, IIP started declining hence the correlation between CPI and IIP was high which can be observed. The economic survey of 2018 tabled by the government has stated, that India’s foreign reserves continued to soar in excess of USD 400 billion. According to the survey, the exchange rate in 2018 has been more volatile than in the previous year, due to more volatility in crude oil prices, though in October 2018 NEER has depreciated from 65-68 per USD to 70-74 per USD making India’s exports potentially more competitive. Therefore, foreign reserves caused a highly negative impact on CPI rate which can be observed, although depreciation in the exchange rates caused a positive impact on CPI. The effect of demonetization was started observing in 2018, as post note ban a huge amount were deposited in the banks within a stipulated time, reflecting that it has contributed in reducing the currency in circulation. Thus, due to an uncertain effect of the demonetization M3 with its sub-components caused a negative impact on CPI rate. The industrial activity rose in an early 2018 because of the volatile capital goods segment [7] but in the mid of 2018 IIP plummeted due to the rallying of fuel prices and higher interest rates. By the close of the year Ministry of Finance saw some revival in factory output by recording growth of 2.4%. From the composite multivariate analysis on the data of year 2018, it can be observed from that only SDRs, total foreign reserves, total M3, and NEER were positively impacting the CPI rate, whereas all other financial indicators were negatively impacting the CPI rate. In 2019, the trend of raising the foreign reserves started after the Ministry of Finance, India announced a sharp cut in corporate tax rates from 35% to 25.17% in the yearly budget. It can be observed that in the year 2019 a major surged was detected in foreign assets, gold, and RTP hence the value of these reserves holding shot up. Due to the increase in foreign reserves more supply of money was issued by the central bank. Therefore, as money supply in the economy started increasing CPI also starts rising. Although, NEER with its sub-components started depreciating thus negatively impacting the CPI rate [9]. Due to a sudden hike in foreign reserves and higher surcharges caused the CPI rate to hover above 6% which can be observed due to which industrial output contracted in mid of 2019, although, by the end of the year IIP started expanding, hence it caused a small negative impact on CPI rate. After performing the composite multivariate analysis which can be noticed in Table 5, the results are imprecise therefore it could be inconsequential. The impact of COVID-19 pandemic on the core indicators was severe, though, India’s foreign reserves started surging, making it a fifth largest holder of reserves in the world. During these crises when the economy was under stress and growth was expected to contract, surging in foreign reserves covers India’s import bill of more than one year [3]. But, statistically the results shows that the foreign reserves were negatively impacting the CPI rate because of RBI rate cuts, thus CPI inflation softened marginally, though in April 2020 CPI rate increased to 7.22% due to a pause in the movements [1]. Hence, foreign reserves were increasing CPI rate started declining due to an ease in prices. Due to uncertainty and hoarding of cash due to loss in employment opportunities a rise in money supply was seen because of growth in consumption and business investments, and this surging can be unlikely to bolster. Thus, as money supply with its sub- components excluding time deposits was surging, CPI rate started declining thus a negative impact was observed which can be noticed. Due to an unexpected change in CPI rate racked the time deposits investors which also forced the RBI to keep the key policy rates unchanged by giving a preference to inflation over growth concerns, hence a small positive impact was observed by time deposits on CPI rate which can be observed. Likewise, NEER with its sub-components fell by average of 1.55; accordingly exchange rates started surging which resulted in negative impact on CPI rate [3]. Due to a pandemic stock market observed a sudden dropped during the lockdown, consequently crashing the market for long period. Statistically, the result shows that stock index caused a positive impact on CPI rate, because for the last two months of mid 2020 a recovery in the market was noticed. A steep fall in industrial output was observed due to a nationwide lockdown which affected industrial work during April and May 2020, thus a major contraction was noticed in IIP index on that period. The primary reason for fall was lower output on manufacturing, mining, and power generation sectors. In addition to monetary policy, fiscal policy has a major role in combating the economic effects of the COVID-19 pandemic because government implemented various fiscal measures to provide a boost to the economy [8]. Hence, a small negative impact was observed by IIP index on CPI rate. Although, the composite multivariate analysis inferred that all financial indicators are negatively impacting the CPI rate because in the year 2020 a non-linear relationship was observed.

| Indicators | VIF before PCA | PCA | VIF after PCA |

|---|---|---|---|

| components | |||

| CPI | 23.708078 | CPI | 1.002615 |

| Foreign currency assets | 1731.070625 | 1 | 1.046812 |

| Gold | 779.93528 | 2 | 1.003148 |

| Reverse tranche position | 265.446326 | 3 | 1.000274 |

| SDRs | 29.131522 | 4 | 1.004261 |

| Public currency | 135.819522 | 5 | 1.000481 |

| Other deposits of RBI | 74.453116 | 6 | 1.005184 |

| Demand deposit | 573.400262 | 7 | 1.000324 |

| Time deposit | 4746.598785 | 8 | 1.003755 |

| Stock index | 300.789533 | 9 | 1.001973 |

| Average NEER | 784.370016 | 10 | 1.000207 |

| IIP Index | 301.111624 | 11 | 1.069034 |

Table 5: Validating multi-collinearity on the data.

Data pre-processing and feature engineering

From the analysis it can be observed that each financial indicator was either impacting positively or negatively irrespective of the year or changing monetary policies by the government. This showcases the variables to be considered to build a model. From the three variants of analysis, it can be deduced that composite foreign reserves and M3 are aggregation of their sub-component; hence exclusively their sub- components were chosen for the modelling. Likewise, rather than considering tree-based and export based NEER, their average NEER was chosen for the model. Therefore, for the modelling 11 financial indicators as an independent variable were selected including current month’s CPI rate. From the univariate analysis it can be observed that these indicators excluding current month’s CPI rate incorporated with some outliers and the unit of each indicators are different, therefore these indicators are normalized to remove the mean and scaled to unit variance. To normalize the data, standard scaling was applied independently on each indicator by computing the proper statistics on the sample.

After normalizing the data, it can be observed from the analysis that each indicator which acts as an independent variable holds a multicollinearity which can be noticed in Table 5 where the Variance Inflation Factor (VIF) was computed. From the correlation matrix and it can be observed that all independent indicators which are selected for model are either highly positively or highly negatively correlated with each other and contains similar information about the variance. In the Table 5, it can be observed that all independent variables are less reliable for regression because their VIF contains a large value. The multicollinearity among the data concludes a non-linear relationship with independent and dependent variables which will impact the model performance and maximizes the errors. Therefore, in the research two comparative models are built, one model without multicollinearity and other with multicollinearity present in the data (Table 5).

To remove the multicollinearity from the data, Principal Component Analysis (PCA) was applied on all the independent variables excluding CPI rate, which changes the orthogonality and direction of the data from non-linear to a linear function. The VIF values after applying the PCA on a normalized data where it can be observed that multicollinearity was removed from all indicators as the VIF values are in range of 1-5 which inferred they are moderately correlated with each other because CPI rate was not included in the PCA components. The reason for excluding the CPI rate in standardization and PCA because CPI rate was statistically normally distributed hence the model performance will not be impacted. The errors in the VIF values after applying the PCA, example VIF of foreign currency assets inferred that the variance of particular variable coefficient was 4% bigger than expected if there was no multicollinearity, likewise a small error was also present on other independent indicators.

The PCA analysis which was conducted on the input data inferred that PCA component one and two covered 70% and 16% of variability on the data respectively, and nine other PCA components holds a small variability on the data which can be noticed. Similarly, the Eigen vector or PCA loading shown deduced that a positive loading between a variable and PCA component are positively correlated, and negative loadings are negatively correlated. Large positive or negative loading indicates that a variable has a strong effect on that principal component. It can be observed that PCA components 3, 4, 8 and 9 hold a large loading on foreign reserves sub-components. Likewise, PCA components 5 to 10 contain a large loading with M3 sub-components. Moreover, PCA component 5 holds a large negative loading with stock index, and PCA components 1 and 2 are highly correlated with NEER and IIP index. The variable which has a larger loading contributes to supplementary information and it regarded as an important variable to that PCA. Thus, the PCA reduces the dimensionality which helps to identify the patterns and shared features among the financial indicators.

After applying the PCA on the data excluding current month’s CPI rate, the correlation matrix was computed which can be noticed which inferred that the correlation between the input data (PCA components) are no longer highly correlated i.e., multicollinearity between the variables is not present except current month’s CPI rate. Though the current month’s CPI rate contains a correlation with the PCA components, it does also hold a high positive correlation between next month’s CPI rates. These PCA components and current month’s CPI rate considered as an input data for the non- multi-collinear model, likewise a normalized data was considered for the model build on multi-collinear data.

The resultant multi-collinear and non-multi-collinear data was split into three sets, viz., training, validation and testing set. The training and validation set consists of 80-10% of total data respectively, whereas 10% of total data was under testing set. The testing set was unseen to the model to test the model performance through over-fitting and under-fitting.

Data modelling

The next month’s CPI rate of India was predicted through two comparative models, model without multicollinearity and with multicollinearity data, and the results of both models are compared simultaneously. A deep learning fully-connected dense network model in a kite shape which was shown and was built to train the data. The model consists of three segments, first was input layer, second segments contain 7 hidden layers in a diamond shape, and third layer was an output layer. The first fully connected input dense layer consists of 12 neurons of an input variables, i.e., for model without multicollinearity the variables were PCA components and CPI rate, and model with multicollinearity specified variables were considered, these variables was allocated in the 12 neurons. These data will be passed to further 7 hidden layers, which consist of Relu activation function for training. The objective of the model was to minimize the next month’s CPI rate, therefore a model with a diamond shape inferred that the hidden layers was started finding the patterns and shared feature from a small bunch of perceptron operations which introduced small weights followed by increasing the neurons such that the number of perceptron operations ended with same neurons which it was started. Thus, the model was designed in diamond look-alike shape. Each hidden layer neurons were fully connected with next hidden layer neurons.

As it can be observed from the multivariate analysis that when a simple regression was performed on a financial data considering the indicators were multi collinear, the results were imprecise and empirically it shows an erroneous impact. The reason for erroneous impact was due to the variability present on the data, a simple regression would be outperformed, and model performance was negatively impacted. Therefore, the fully connected neural network was proposed where each neuron calculated the output using the back propagation, the primary operation of back propagation was gradient descent. This operation was applied through activation function or non-linear transformation to a weighted aggregation of an input values. These 7 synthetic layers learned in each iteration and have minimized the erroneous impact which was noticed in multivariate analysis.

After computing the optimized weights and bias for each neuron in hidden layers, activation function (relu) passed the weighted sum of the results to the next layers.

In the given above Table 5, number of parameters in 7 hidden layers was computed. It inferred the number of weights and bias in each layer that will be processed through gradient descent approach. To avoid the underfitting and over fitting hidden layer was started from less neuron, so that more variability in the non-linear transformation would be captured. It was found that the number of parameters was at peak in the middle of hidden layers besides parameters started decreasing to further contract the variability. All these parameters were trained using an optimizer RMSprop with a learning rate, RMSprop is a form of stochastic gradient descent where the gradients are divided by a running average of their recent magnitude. In total 1000 epochs were running on the entire training dataset such that each financial indicator observation has been seen once. After running the model in each epoch, losses were computed which deduced the measure of fitness of the model on training and validation data. These below configurations were applied on the both models (Table 6).

| Layer (type) | Neurons | Params |

|---|---|---|

| Input | 12 | - |

| Dense–1 | 4 | (12*4)+4=52 |

| Dense–2 | 16 | (4*16)+16=80 |

| Dense–3 | 32 | (16*32)+32=544 |

| Dense–4 | 64 | (32*64)+64=2112 |

| Dense–5 | 32 | (64*32)+32=2080 |

| Dense–6 | 16 | (32*16)+16=528 |

| Dense–7 | 4 | (16*4)+4=68 |

| Output | 1 | - |

| Total Trainable Parameters | 5469 | |

Table 6: Number of parameters in the proposed model.

The losses in terms of mean squared errors can be noticed, where it was computed for both proposed models. It can be observed that the loss curve for the model without multicollinearity started exponentially decreasing, though after 350 epoch training loss firmly started increasing but from 550 epoch a significant loss was found on both sets, hence model was not either over fitting or under fitting on the validation set. Likewise, for model with multicollinearity, it can be observed that training loss was decreasing but the model was not significant on validation set which inferred that model was under fitted on the validation set. The reason for underfitting the model was non-linear relationship and outliers present on both sets, thus it was impacting the model performance.

Evaluation metrics

From the proposed comparative model which was built on the training set and validated on a validation set can be evaluated based on the measure of fitness (R2) and root mean squared error. The accuracies were computed on a complete unseen data referred as the testing set, additionally it can be observed that the period considered for the testing set was from January 2019 to August 2020 where the CPI rate was started increasing, moreover, due to the coronavirus each indicator has also been impacted. Therefore, the major challenge for the model was to predict the CPI rate where Indian economy faced a worst hit. Though, from the results which can be noticed in which inferred that the model built on non-multi-collinear data performed competently as the losses for both the sets are minimal and from the R2 it can be deduced that the model was not either fully over-fitted or under-fitted on the testing set. However, on multi-collinear data the model was under-fitted on the testing set which can even noticed in validation loss curve shown, also the error was not minimal on the testing set. Therefore, from the results that have been found, it can be deduced that the model built on non-multi-collinear data performed efficiently whereas it was outperformed on the multi-collinear data (Tables 7 and 8).

| Model Parameters | Value |

|---|---|

| Loss | MSE |

| Optimizer | RMSprop |

| Learning rate | 0.005 |

| Hidden layers | 7 |

| Epochs | 1000 |

Table 7: Proposed model configuration.

| Operations | Without Multi collinearity | With Multi collinearity | ||

|---|---|---|---|---|

| Metrics | Training Set | Testing Set | Training Set | Testing Set |

| R2 | 75% | 77% | 69% | 56% |

| RMSE | 0.78 | 0.73 | 0.86 | 1.15 |

Table 8: Model comparison on testing set based on accuracies.

Data prediction analysis

To further elaborate the comparative model analysis, the prediction on the testing set was compared between the true values and predicted values of the CPI rate which was shown where it can be observed that the predictions by model built on non-multi-collinear data was reasonably well as majorly all points are in linear fashion, also the errors between actual and predicted CPI rate distribution deducted that error extremely lies between -0.5 to 0 range. However, it can be observed that prediction by model built on multi collinear data are not reliable and are predictions are pruned; even their error distribution was left skewed and more prominent on negative values.

The predictions computed for training (considering validation) and testing set by both the models. It can be observed that the trend of CPI rate was gradually decreasing, though from the training loss curve shown and it can be noticed that there was a slight difference occurred on the training set whose impact can be seen in training prediction of the model built on non- multi collinear data, whereas, a significant loss curve was captured on multi collinear data hence the training predictions are closed to an actual CPI rate (Table 9).

| Year | Proportional | CPI Rate |

|---|---|---|

| 2014 | Inversely | Foreign currency assets, total foreign reserves, composite and sub-components of M3 supply, stock index, and overall NEER |

| Directly | Gold, RTP, SDRs, and IIP | |

| 2015 | Inversely | Foreign currency assets, SDRs, total foreign reserves, other deposits of RBI, time deposits, total M3 supply, stock index, and overall NEER. |

| Directly | Gold, RTP, public currency, demand deposits and IIP | |

| 2016 | Inversely | Foreign currency assets, gold, RTP, total foreign reserves, other deposits of RBI, demand deposits, time deposits, total M3 supply, stock index, overall NEER, and IIP. |

| Directly | SDRs and public currency | |

| 2017 | Inversely | RTP and overall NEER |

| Directly | Foreign currency assets, gold, SDRs, total foreign reserves, public currency, other deposits of RBI, demand deposits, time deposits, total M3 supply, stock index, and IIP | |

| 2018 | Inversely | Foreign currency assets, gold, RTP, SDRs, total foreign reserves, public currency, other deposits of RBI, demand deposits, time deposits, total M3 supply, stock index, and IIP |

| Directly | Overall NEER | |

| 2019 | Inversely | Overall NEER and IIP |

| Directly | Foreign currency assets, gold, RTP, SDRs, total foreign reserves, public currency, other deposits of RBI, demand deposits, time deposits, total M3 supply, and stock index | |

| 2020 | Inversely | Foreign currency assets, gold, RTP, SDRs, total foreign reserves, public currency, other deposits of RBI, demand deposits, total M3 supply, and IIP |

| Directly | Time Deposits, stock index and overall NEER | |

| Overall | Inversely | Foreign currency assets, total foreign reserves, other deposits of RBI, demand deposits, time deposits, total M3 supply, stock index, overall NEER and IIP |

| Directly | Gold, RTP, SDRs, and public currency |

Table 9: Findings of objective number.

Similarly, the predictions of the testing set without multicollinearity were closed with an actual CPI rate, though a firm error was noticed on starting period of the testing set, whereas with multi-collinearity the predictions for the period of year 2020 were not closed and consists lot of errors between an actual and predicted CPI rate. Thus, in conclusion these sequential analysis processes were conducted throughout the research to predict the next month’s CPI rate based on the core financial indicators. These findings and results from the analysis was found throughout the research and it can be concluded that statistically and empirically CPI rate holds a symbiotic relationship and can be predicted through five core financial indicators, viz. foreign reserves, M3 supply, stock market index, nominal exchange rates, and IIP with its sub-components, such that the data should be non-multi collinear.

[Crossref] [Google Scholar].

[Crossref] [Google Scholar].

[Crossref] [Google Scholar].

[Crossref] [Google Scholar].

[Crossref] [Google Scholar].

[Crossref] [Google Scholar].

[Crossref] [Google Scholar].

[Crossref] [Google Scholar].

[Crossref] [Google Scholar].

Citation: Hungund B, Rastogi S (2022) A Predictive and Empirical Analysis of CPI Rate on Key Financial Indicators. J Stock Forex. 09:211.

Received: 11-Aug-2022, Manuscript No. JSFT-22-18545; Editor assigned: 15-Aug-2022, Pre QC No. JSFT-22-18545 (PQ); Reviewed: 29-Aug-2022, QC No. JSFT-22-18545; Revised: 05-Sep-2022, Manuscript No. JSFT-22-18545 (R); Published: 12-Sep-2022 , DOI: 10.35248/2168-9458.22.09.211

Copyright: © 2022 Hungund B, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.