PMC/PubMed Indexed Articles

Indexed In

- Open J Gate

- Academic Keys

- JournalTOCs

- ResearchBible

- RefSeek

- Hamdard University

- EBSCO A-Z

- OCLC- WorldCat

- Publons

- Geneva Foundation for Medical Education and Research

- Euro Pub

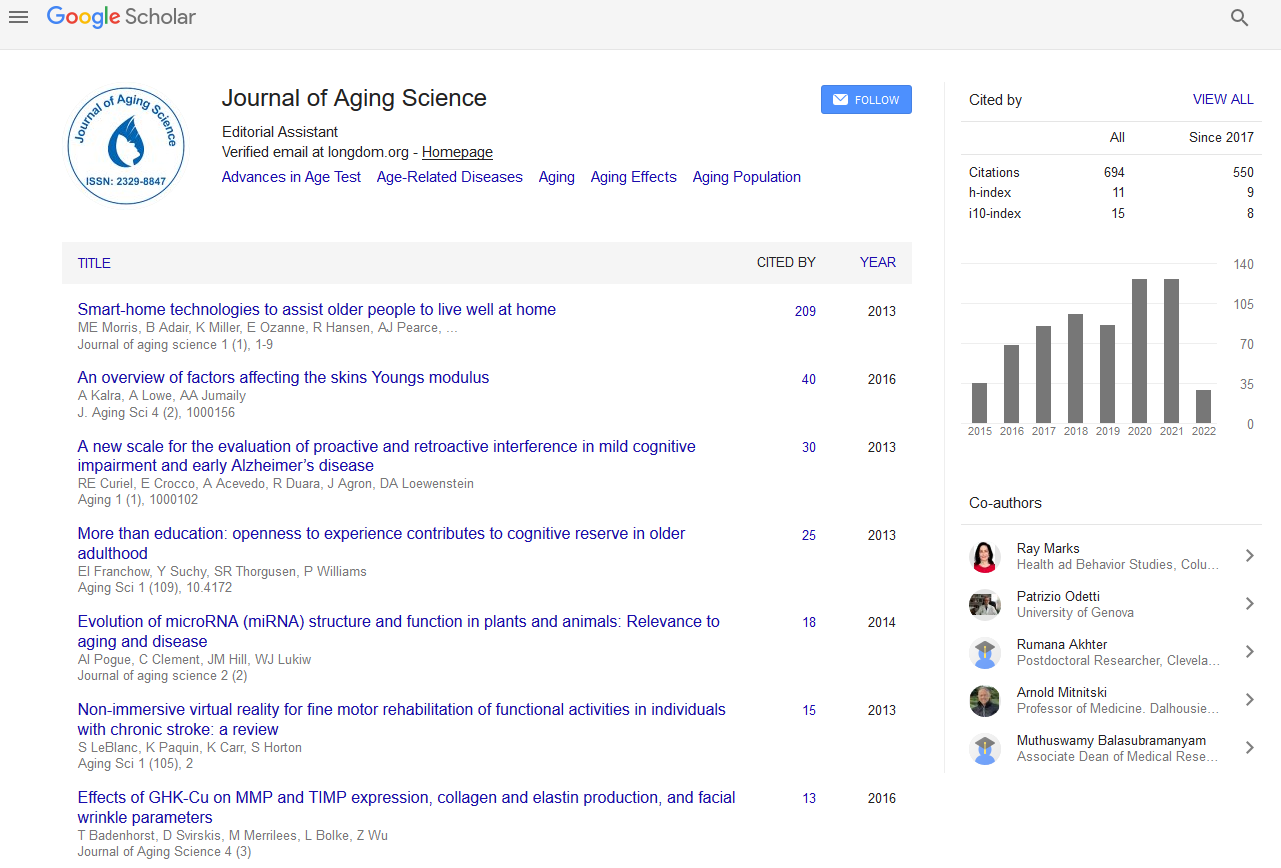

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Factors explaining the process of early and late retirement: A welfare regime analysis

3rd International Conference on Aging & Gerontology

July 18-19, 2018 | Atlanta, USA

Aviad Tur-Sinai, Ariela Lowenstein, Ruth Katz, Shosh Shahrabani and Dafna Halperin

The Hebrew University of Jerusalem, Isreal

University of Haifa, Haifa, Israel

The Max Stern Yezreel Valley College, Israel

Posters & Accepted Abstracts: J Aging Sci

Abstract:

The study attempts to determine whether the variance exists an array of factors that explain processes of early and late retirement among seniors in various welfare regimes in Europe. The study is using the SHARE database over sixteen European countries, where we categorized the countries into five welfare regimes: Continental, Social Democratic, Mediterranean, East European, and mixed (Israel) (Esping-Andersen�??s, 1990). Early retirement: in Continental and Social Democratic countries, the probability of early retirement depends positively on the employed senior's wish to spend more time with his/her family or to synchronize retirement with that of their spouse. In Continental countries, the probability of early retirement rises if the individual is a civil servant, and is negative if he/she are self-employed. Among employed elders in East European and Mediterranean countries, the probability is positively dependent on individual�??s poor health but is negatively influenced by the extent of a wish to enjoy life. Self-employment before the senior�??s retirement in Mediterranean countries has a negative effect. In Israel, it is positively influenced by elders' poor health and their wish to enjoy life. Late retirement: in East European countries and in Israel, poor health and wish to spend time with family, have a positive effect on individuals�?? wish to retire on time (not late); In addition, wish to enjoy life has the same effect in East European countries. In all other welfare regimes, however, no relation was found between these factors and individuals�?? decision to retire at the official age or retire late. In Continental and Middle East Mediterranean countries, self-employment has a positive effect on the decision to retire on the formal governmental retirement age; in East European countries, being a civil servant has a positive effect on this decision whereas self-employment has the opposite effect. In Israel being a civil servant prior to retirement negatively affect the decision to retire on time.