PMC/PubMed Indexed Articles

Indexed In

- Open J Gate

- Genamics JournalSeek

- JournalTOCs

- China National Knowledge Infrastructure (CNKI)

- Electronic Journals Library

- RefSeek

- Hamdard University

- EBSCO A-Z

- OCLC- WorldCat

- SWB online catalog

- Virtual Library of Biology (vifabio)

- Publons

- MIAR

- Euro Pub

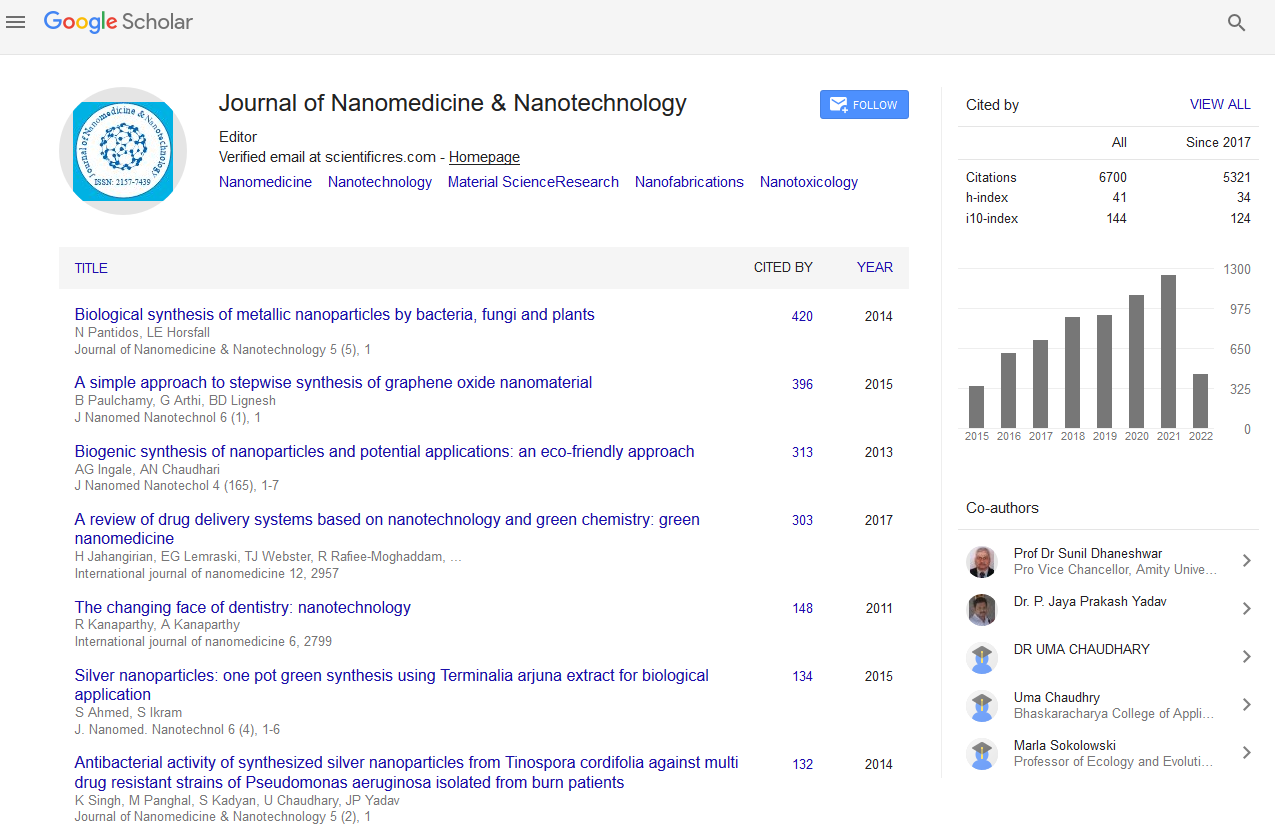

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Comparative analysis of Nigeria petroleum fiscal systems using royalty and tax optimization models to drive investments

6th International Conference on Petroleum Engineering

June 29-30, 2017|Madrid, Spain

Diji, Chuks J and Wahab Lukman

University of Ibadan, Nigeria

Scientific Tracks Abstracts: J Pet Environ Biotechnol

Abstract:

The adoption of any petroleum arrangement - concessionary or contractual - is a financial issue that is centered on how costs are recovered and profits divided, which is at the heart of taxation and economic rent theories. Hence countries are expected to make the tax system attractive for the IOCs in order to encourage inward investment. The effectiveness of any petroleum arrangement depends largely on the attractiveness of its underlying tax regime which, in turn, depends on the effectiveness of its design and implementation. The uncertainty created by the non-passage of the proposed Nigeria Petroleum Industry Bill (PIB) over the years has continued to impede investments in the oil and gas sector in Nigeria. Oil Producers Trade Section (OPTS) and other stakeholders in the sector in Nigeria have expressed concerns over the Federal Government�??s intention to change the laws governing the oil and gas industry including the fiscal terms. The aim of the study is to critically examine whether the Nigerian petroleum tax system is appropriately designed and effectively implemented to achieve the benefits the country desires from its petroleum taxation arrangements. The study reviews the current and post PIB upstream fiscal regimes and undertook a comparative examination of Nigeria�??s fiscal regime against selected world fiscal arrangements. The study also determined how Nigeria�??s fiscal regime holds up against key features of importance to government and prospective investors, which include degree of stability, flexibility, neutrality and how the regime distributes the burden of risk between the resource owner and the oil companies. The study concluded from preliminary studies that there is a correlation between fiscal terms (tax and royalty) and various profitability indexes (DCFR, PIR, AVP, PVP, MCI & payout). The global comparative analysis result also shows that Nigeria fiscal terms (pre & post PIB) are outside the competitive window and will invariably discourage foreign direct investments.

Biography :

Diji, Chuks J obtained a PhD in Mechanical Engineering from the University of Ibadan in 2008, Master of Science degree (MSc) in Mechanical Engineering from the University of Ibadan in 1997 and a Bachelor of Science (BSc) from the Obafemi Awolowo University (Formerly University of Ife) in 1987. He has a professional postgraduate qualifying Diploma in Management Consultancy Practice and Organizational Transformation of the International Professional Managers Association (IPMA–Uk). He is currently a Senior Lecturer and the Head of Department of Mechanical Engineering, University of Ibadan, Nigeria. He currently teaches courses in thermofluids, material science, production technology and entrepreneurship as well as energy studies at both undergraduate and postgraduate level. He also serves as an Associate Lecturer in two major academic Centres of the University of Ibadan: Centre for Sustainable Development (CESDEV) and the Centre for Petroleum, Economics, Energy and Law (CPEEL). His core competences are in energy studies, environment and small business development.

Email: chuksdiji@hotmail.com