Indexed In

- Open J Gate

- RefSeek

- Hamdard University

- EBSCO A-Z

- Scholarsteer

- Publons

- Euro Pub

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Research Article - (2021) Volume 9, Issue 7

Expectation Issues Regarding the “Emergent Roles” of the Professional Accountant with in South African SMEs

Yaeesh Yasseen1* and Freddie Crous22Department of Industrial Psychology, University of Johannesburg, Johannesburg, South Africa

Received: 02-Jun-2021 Published: 23-Jul-2021, DOI: 10.35248/2472-114X.21.9.212

Abstract

The purpose of this research is to explore how professional accountants and SMEs owners experience the ‘emergent roles’ of the professional accountant within South African SMEs. A qualitative research approach within an interpretivist paradigm was therefore employed. To address the research question, the interpretivist design was executed using a thematic analysis of data collected through semi-structured interviews with 20 professional accountants and 20 SMEs owners. The study revealed mismatched expectations concerning the value and role expectations of the professional accountant rendering ‘emergent roles’ within South African SMEs. Expectation gap issues were further uncovered through divergent role expectations. Regulators need to understand that the role of the professional accountant within the SMEs environment is still predominately driven from the need for statutory traditional compliance roles. Caution needs to be exercised by professional regulators when expecting professional accountants to render emergent services to SMEs. Relatively little attention has been given to the role of the accountant in the SMEs environment. This study is original and pioneers within the SMEs environment where the role of the professional accountant is often unexplored. Strategies are offered from a developing economy perspective for SMEs owners, professional accountants, and stakeholders within the accountancy profession to position the role of the professional accountant within the SMEs environment.

Keywords

Advisory; Business rescue; Developing economy; Integrated reporting; Professional accountant

Introduction

SMEs are expected to play a major role particularly in developing countries in the creation of employment. In developing economies, most formal jobs are found within SMEs, which also create four out of five new positions. SMEs have been identified as productive drivers of inclusive economic growth and development in South Africa and around the world. Global trends indicate that the SMEs sector has sustained growth and is consistently the largest employer across developed and developing nations. However, these trends are contradictory to the South African context, where SMEs are experiencing stagnation in terms of turnover generated and employment growth. This is of grave concern since the large economic sector in South Africa continues to consistently shrink employment and decrease its employment absorption rate. SMEs, therefore, have an urgent and critical role to play in promoting economic growth, increasing employment, and reducing poverty in developing economies such as South Africa. Furthermore, SMEs in South Africa are expected to function within and contribute to the social and economic transformation of the country, by improving the quality of life for citizens and improving growth in the economy. The lack of success of SMEs in South Africa is further attributed to factors such as the absence of planning by the SMEs, shortage of experience to manage an SMEs, the difficulties posed by the socio-political climate and economic stability, and sociocultural complexities. If these factors are not properly mitigated, it could have an impact on the success of an SMEs. SMEs, therefore, need access to relevant expertise to address the challenges that they face to improve their chances of success.

Previous studies indicate that there are several benefits experienced by SMEs owners, making them receptive to services sourced from professional accountants. SMEs owners benefit from being able to share their concerns with professional accountants, who were found to spend more personal contact time with SMEs relative to other external advisors. Professional accountants were perceived to be the most trusted amongst external advisors available to SMEs [1].

Based on the research problem is that although SMEs play a key role in a developing economy and are struggling in South Africa and although professional accountants are active in the SMEs environment, firstly, very little is known about the emergent role they currently play the SMEs environment.

The purpose of this research is to explore how professional accountants and SMEs owners experience the ‘emerging roles’ of the professional accountant within South African SMEs?

Literature Review

The role of the professional accountant in the broader economic and social setting has previously been given scant attention. In the three decades since this observation was made, most accountancy studies have remained focused on the technical aspects of the profession. The role of the professional accountant has become integrated with many facets of an SMEs, which encompass social, political, and economic factors and tensions, and this poses several challenges. For example, the profession may provide not only the traditional compliance services to the SMEs, its role may transcend this function and move into various advisory roles within a SMEs. These advisory roles may be influenced by political and economic factors that the SMEs has to contend with, such as Black Economic Empowerment (BEE), consumer protection, and credit protection legislation within South Africa. The professional accountant, being a service provider to the SMEs, is therefore not confined to a single defined role. Moreover, the discipline of accountancy is constantly evolving, and is not limited to a set of rules but responds to changes in economic, social, environmental, and political circumstances. This implies that the role of the professional accountant requires regular up skilling. The role of the professional accountant, particularly within the SMEs environment, is influenced by many factors and is not limited to the technical nature of the work. However, relatively little attention has been given to how the role of the professional accountant has changed over time, and, in turn, how this role is experienced by SMEs owners. The literature will therefore focus on the emergent roles of the professional accountant. There scoped literature will, therefore, focus on two such roles being a business rescue and integrated reporting [2].

Busineess Rescue Roles

The South African Companies Act 71 of 2008 provides for professional accountants to act as business rescue practitioners when a company is placed under financial distress and cannot meet its obligations to third parties. Other professionals may also fulfill this role of business rescue practitioner. The role of a business rescue practitioner is also subject to many other requirements and it is heavily legislated. The applicable legislation is not part of this study, however, and as such, the researcher will not delve into these legislative requirements.

Considering the statistic that South African SMEs have the lowest survival rate in the world, the business rescue provides SMEs in financial distress with the opportunity to reposition themselves by appointing a business rescue practitioner to assist them in coming up with turnaround strategies that will improve their chances of survival. However, one needs to keep in mind that despite the provisions of the Act, business rescue proceedings do not always succeed in rehabilitating a business, as only 12%-13.6% of businesses that enter into business rescue conclude business rescue proceedings successfully.

Professional accountancy organizations have been positioning professional accountants to take on the role of business rescue practitioners due to the lucrative financial opportunities it presents. Professional accountants are not guaranteed that the SMEs they service will survive or grow to support fee generation, as the factors that lead to SMEs success and growth are not always understood. In this complex environment, there are also other roles expected of the professional accountant by SMEs owners and in the next subsection the integrated reporting role [3].

Integrated Reporting Role

The second role that can be regarded as an emergent role is related to Integrated Reporting (IR). Compared to traditional annual financial reporting, IR represents one of the most innovative concepts introduced in the reporting arena in the last decade or more. An integrated report is a coherent report about how an organization's strategy, governance, performance, and prospects lead to the creation of value over the short, medium, and long term. The objective of the integrated report is to incorporate financial and non-financial information succinctly, thereby enabling users to understand how this affects performance and value. The output of the IR process should result in greater accountability, transparency, and a reduction in information asymmetry for stakeholders. In this context, SMEs have globally been encouraged by the International Integrated Reporting Council (IIRC) to also embrace IR.

It has been argued that an integrated report should be prepared by all enterprises utilizing resources as this is the basis of determining how a sustainable society is formed. It could therefore be implied that IR speaks directly to the ethical responsibility of owning and running a business and could therefore be linked to the role of the accountant in terms of serving the public interest. An IR approach supposedly facilitates SMEs to build a better understanding of the factors that determine their ability to create value over time. Supporting this view is the argument that SMEs form part of the value and supply chain for larger entities and therefore need to prepare integrated reports [4].

An integrated report is underpinned by a process called integrated thinking. Integrated thinking can be defined as the information flow process within a company to enable holistic approaches, better decision making, and reporting. Integrated thinking further encourages the development of a long term strategy that will take into account the impact that the business has on society using its resources.

Integrated thinking relates directly to the usage of different forms of capital. Six different categories of “capital” can be identified, financial capital manufactured capital, human capital, intellectual capital, natural capital, and social capital. Based on the literature it can be suggested that SMEs can make informed decisions on the usage of the different forms of capital, and truly understanding the interconnected nature of these different forms of capital and applying this understanding holistically could potentially result in better business outcomes.

In terms of SMEs, integrated thinking can be applied as a connected view of how an SMEs uses its various forms of capital, including its use of and effect on other forms of capital central to its business model and future strategies also stresses that this approach enhances strategic planning, execution, and evaluation. IR could provide valuable information to SMEs that could assist in planning, budgeting, and implementing strategies that could give rise to the efficient and effective consumption of resources [5].

Professional accountants are being positioned to embrace IR and adopt integrated thinking, the rationale is that no other external service provider knows an SMEs better than its professional accountant, who is equipped with a deep understanding and knowledge of the SMEs. It is further claimed that IR provides the ideal basis for successful SMEs to become a global engine of growth and recovery. The foremost concern is whether IR would be acceptable to SMEs and whether there is any contradiction between two processes, namely the need for IR for SMEs on the one hand and the requirement to simplify financial reporting on the other hand. Cost, lack of resources, and no buy-in to the concept from SMEs manifest as potential challenges for SMEs to adopt IR.

In the context of the roles of professional accountants fulfill in the SMEs environment, it is important to bear in mind that these roles are interrelated. It should be noted that the body of knowledge in terms of the emergent roles within the SMEs environment is limited and non-existent. Most of what is known in the literature is that these non-traditional roles exist and their utilisation by SMEs owners is limited, and this is mainly based on quantitative research and therefore does not delve deeply into the respective roles [6].

An interpretivist research methodology was adopted in the present study, with the researcher maintaining the position that there is no singular reality. Reality is therefore subjective, divergent, and multiple which is socially co-constructed through the actions of social actors (professional accountants and SMEs owners) and personal experiences of social phenomena (service relationship to the SMEs) within a South African context, the decision to conduct qualitative research, despite quantitative research being the dominant form of research in the field of accounting, is selected. Thirdly, a key consideration is the nature of the research question and determining what kind of data and data analysis would best provide answers to the research question. The researcher epistemological position aimed to search for knowledge and meaning created by the professional accountants and SMEs owners, which may be multiple and divergent, yet which hold expositions of the world that are of comparable benefit. Therefore, the researcher maintains a subjectivist view and becomes part of the knowledge creation procedures. It is therefore argued that a qualitative approach which necessitates the adoption of an interpretivist epistemology, was best suited to find answers to the research question.

A purposive sampling strategy of 20 professional accountants and 20 SMEs owners was employed for the current research. This involved firstly, the preselection of criteria relevant to particular research and secondly to consider whether or not to pre-determine the precise sampling number prior to the data collection process. Thematic analysis of data collected through semi-structured interviews was deemed the most appropriate method. This allowed participants to share their lived experiences and for the researcher to gain access to rich information. The semi-structured interviews provided a natural setting where participants could engage in a meaning-making process and freely reflect on the various roles of the professional accountant. The data that was collected was then analysed thematically to understand what the current roles of the professional accountant are to SMEs in South Africa [7].

The themes were subjected to further interpretive analysis. This involved a deeper analysis of the themes that transcend the identification of apparent elements to infer the underlying meaning within these elements. This analysis examined the themes across the entire sample in a process of interpretive reconstruction and expansion which took into account the unique perspectives of the professional accountant and the SMEs owner.

Findings

These findings are structured according to two themes of business rescue and integrated reporting.

The South African Companie’s Act allows professional accountants to embark on the role of business rescue practitioners when a company is placed under financial distress and cannot meet its obligations to third parties. Professional accountancy organizations have thus been positioning their members to take on this role within their business advisory capacity. South African SMEs have the lowest survival rate in the world and the business rescue option provides SMEs in financial distress with the opportunity to reposition them by appointing a business rescue practitioner that can assist them to come up with turnaround strategies that will improve their chances of survival. The current study revealed that SMEs owners are cognisant that professional accountants seem to have a very low success rate within this area. This concurs with prior research which found that business rescue proceedings do not always succeed in rehabilitating businesses as only 12% to 13.6% of the businesses that entered into business rescue concluded business rescue proceedings successfully. This does not necessarily imply that all business rescue proceedings were administered by professional accountants. The findings are however indicative of the lack of success of a rehabilitating a business that is in financial distress [8].

Findings from the data indicate an unequivocal consensus among SMEs owners that professional accountants could not play the role of a business rescue practitioner. Further analysis of the data revealed the following reasons for the sentiments expressed by the SMEs owners.

Firstly, some of the SMEs owners were of the opinion that professional accountant’s skill set is limited to technical compliance and regulatory obligations. SMEs owners cited that business involvement in the industry as well as within the operational side of the business is of key importance to successful business rescue. Based on the data, one can infer that professional accountants are generally valued for their technical ability in terms of accounting skills and taxation but are not deemed fit to add value beyond this function. SMEs owners indicated that professional accountants have a general understanding of SMEs however lack the practical business acumen to execute the operations and provide strategic foresight to save a business that is failing [9].

Secondly, the data suggests that some SMEs owners questioned the relevance and value of the financial reporting process as it relates to predicting financial distress. The sentiment expressed was that, if their professional accountants did not have the foresight to pick up the indicators of financial distress in the preparation of financial statements, they would be very doubtful whether these same accountants could turn around a failing SMEs.

Thirdly, the data indicates that SMEs owners regard professional accountants as being risk-averse by nature and as such would not make successful business rescue practitioners. Many SMEs owners maintained that to run a successful business one has to take risks, and were of the opinion that the professional accountant could potentially play a supporting role in compiling the financial, strategic, and operational information for a business rescue practitioner, but would not be suitable to manage the business rescue process.

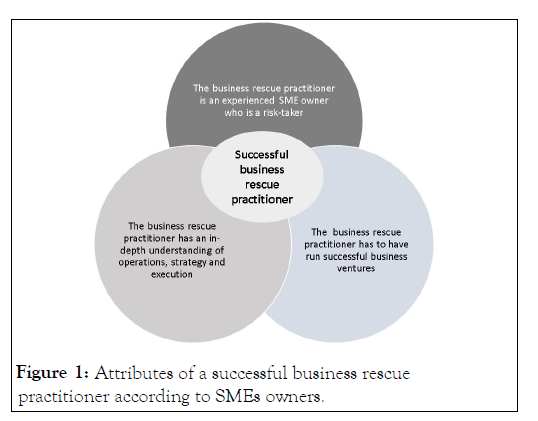

As such, the role of the professional accountant as a business rescue practitioner was rejected by many of the SMEs owners. The data gathered from the SMEs owners indicate that the following skills are fundamental for someone fulfilling the role of business rescue practitioner and that a professional accountant who would wish to fulfil this function would need to display the attributes summarised in (Figure 1) [10].

Figure 1: Attributes of a successful business rescue practitioner according to SMEs owners.

The majority of the professional accountants indicated that embarking on the role of business rescue practitioner provide lucrative financial opportunities. It could however be inferred from the data that the majority of professional accountants considered the role as a business rescue practitioner to be a specialized service that needed to be evaluated in accordance with the competence and experience as per the guidelines of the Companies Act 71 of 2008. This is supported by the literature which indicates that SMEs owners experience professional accountants’ services to be very general in terms of their offerings and therefore lack a specialized approach to their respective SMEs. This general approach is further substantiated by the limited impact of professional accountants’ recommendations in areas outside of compliance. Prior research also indicates that professional accountants are perceived to be good providers of operational advice to SMEs owners, however, they are not valued for being able to render strategic services.

The small group of professional accountants who were confident that they could fulfil the role of business rescue practitioner in most cases tended to agree with the SMES owners who questioned the fulfillment of this role by professional accountants.

They strongly argued that their success in the role of a business rescue practitioner was based on their ability to prepare financial and non-financial reports. However, the data reveals that the skills set as identified by the professional accountants to embark on the role of a business rescue practitioner was different from those recognized by the SMEs owners.

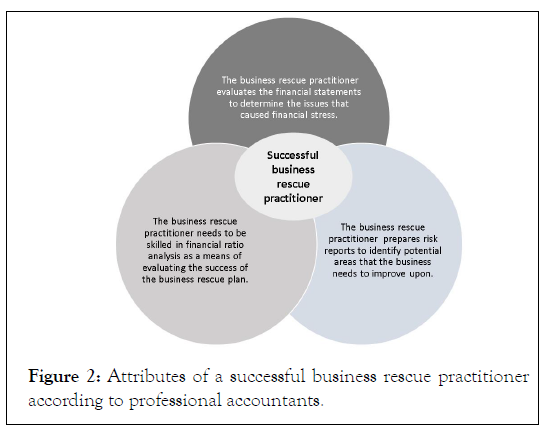

Professional accountants identified the skills of a business rescue practitioner as summarized in (Figure 2) [11].

Figure 2: Attributes of a successful business rescue practitioner according to professional accountants.

Professional accountants regard the role of a business rescue practitioner to be driven from the financial reporting process which was heavily criticized by SMEs in the context of traditional roles. As stated, a contradiction exists between the view of the professional accountants and the SMEs owner’s view as to the skill set needed to embark on the role of a business rescue practitioner. They represent this contradiction by contrasting the two diagrams it becomes clear that the professional accountant is still very much focused on financial reporting and risk management which SMEs owners regard as a support function as opposed to the skills that SMEs owners identified which focus on the practicalities of running a business. This could further indicate that SMEs owners are risktakers and action-orientated, and professional accountants are risk-averse and analysis-orientated. Even though professional accountancy organizations have been positioning professional accountants to take on the role as business rescue practitioners due to the lucrative financial opportunities this presents, these organizations would need to ensure that the requirements of the Companies Act in terms of who can embark on this role are adhered. They also need to carefully draft a competency framework in consultation with SMEs owners and consider creating a separate designation for professional accountants who fulfill this role. This study only investigated the experience of SMEs owners and professional accountants on the professional accountant’s ability to embark on this role. Further investigation is needed to ensure that the spirit of the Companies Act achieves its intended purposes and does not result in SMEs being set up for failure while professional accountants gain financially [12].

It can further be inferred from the data that professional accountants who wish to fulfill the role of business rescue practitioner might be motivated by the lucrative financial opportunities this involvement could offer whilst knowing that the successes of business rescue endeavors are low in the SMEs environment. It has further been reported that professional accountants were more often consulted after the fact when SMEs were already experiencing financial distress. This confirms the importance of timing in terms of the professional accountant’s involvement in the business. The data indicate that professional accountants are the first line of defence and should focus on the quality of financial reporting so that the early warning signs can be picked up when a firm is under financial stress

Integrated reporting role

IIR is defined as a communication process regarding the results of an organization with respect to how it creates value over time. Compared to traditional historic financial reporting, IR is said to represent one of the most innovative concepts introduced in the communication of business results.

SMEs have globally been encouraged by the IIRC to also embrace IR. The current status within South Africa is that SMEs are not required to prepare integrated reports. Notwithstanding that, South African listed companies were amongst the first globally to prepare integrated reports. Professional accountants within the SA listed environment had since 2012 embarked on the role of the preparer of integrated reports.

The data revealed that SMEs owners had a very negative perception of the concept of IR as well as integrated thinking. As discussed in the literature review in terms of SMEs, integrated thinking can be applied as a connected view of how SMEs uses its capitals, including its use of and effect on other forms of capital central to its business model and future strategies. Professional accountants affirmed that they had a potential role to play in the preparation of integrated reports provided that SMEs chose to embrace the process of IR and integrated thinking. The affirmation of professional accountants can be substantiated by current literature. According to current literature, there are six different categories of “capital’: Financial capital, manufactured capital, human capital, intellectual capital, natural capital, and social capital. The argument is that SMEs could potentially make more informed decisions if they considered the impact of these capitals. Integrated thinking is therefore defined as a connected view of how SMEs utilizes these capitals, including its use of and effect on all the capitals central to its business model and future strategies that enhance strategic planning, execution, and evaluation. Integrated thinking and IR could, therefore, provide valuable information for SMEs to assist in planning, budgeting, and implementing strategies that could give rise to the efficient and effective consumption of resources [13].

However, since IR is a voluntary reporting process in the SMEs environment, SMEs owners stated that the concept of IR has never been fully explained to them nor did they take the time to better explore the usefulness of the process. Furthermore, it was revealed that professional accountants who participated had not prepared integrated reports themselves as there was currently no demand for the service. This could be due to misconceptions regarding the meaning of IR and the concept of integrated thinking which was reflected in the data. SMEs owners’ main concerns centered on whether IR would become statutory as is the case with financial reporting, as the cost of producing the integrated report would, according to the SMEs owners, not justify the perceived benefit that they would receive. The SMEs owners were concerned that the current South African economy poses bigger challenges such as unemployment, transformation, and the survival of SMEs that need urgent attention. It is stated in the literature that integrated thinking facilitates behavioral change within organizations. A paradox thus emerged as the current challenges identified by SMEs owners could be addressed by integrated thinking and reporting at a macroeconomic level.

The professional accountants who were interviewed embraced the concept of integrated thinking, however, had mixed feelings towards the actual implementation of IR within SMEs. These mixed feelings could be due to the dismissive attitude of SMEs owners of the entire IR communication process and that they perceived it to be of no relevance to their compliance needs or their decision-making ability. This has been supported by literature that claims that cost, lack of resources, and no buy in to the concept from SMEs manifest as potential challenges for professional accountants to convince SMEs to adopt IR [14].

The data furthermore revealed that the SMEs owners who had reflected on the IR process raised concerns regarding the professional accountant’s skills, competencies, and experience to prepare such an integrated report. The data revealed that the SMEs owners’ view of the role of the professional accountant was confined to preparing financial reports and communicating the information to the SMEs owner. These reports are strongly number-based and prepared according to structured accounting standards. Concern was expressed by both SMEs owners and professional accountants that evolving into a preparer of integrated reports required a skill set to effectively communicate all the capitals identified in the literature in non-numerical terms that have meaning to the business as well as its stakeholders. The data suggested that SMEs owners and professional accountants within their current role in the SMEs environment do not feel that they possess such skills. The data also revealed that professional accountants’ exposure to IR is limited to information conveyed at CPD seminars and felt that the spirit of integrated thinking at this stage would be more beneficial to the SMEs rather than IR. This was confirmed in the literature review which indicates that professional accountants are being pressurized by professional accountancy organizations to implement IR and adopt integrated thinking. The rationale of the accountancy organizations is that no other external service provider knows a SMEs better than its professional accountant, who is equipped with a deep understanding and knowledge of the SMEs.

Some of the negative perceptions experienced by SMEs owners towards professional accountants embarking on the IR role have been confirmed by prior studies. One of the concerns is whether IR will be acceptable to SMEs and whether there is any contradiction between two objectives the one being the need for IR for SMEs in order to understand and reflect the business results holistically and the requirement to simplify financial reporting within the SMEs environment [15].

The attitude of participants towards IR was very clear from the very negative metaphors that were used when the concept of IR was discussed. For example, the metaphor “devil child” of the accounting profession was one of the metaphors used. This metaphor suggests that the concept of IR had the potential to deceive the SMEs owners to pay for the report without obtaining any benefit, while the word “child” could be interpreted as IR still being in its early stages. Furthermore, SMEs owners perceived IR to be a foreign concept that had no place within the current South African context. It could be inferred that the perception is that IR was being imposed by larger bodies that did not understand the SMEs environment. This view can be supported by literature that argues that IR has the backing of an economy’s regulators, governance councils as well as the large accountancy firms who elevate the significance of IR [16].

Conclusion

It has been claimed that professional accountants play an important role in the success of any organization. Several recent commentaries in the professional accountancy literature have highlighted emergent non-traditional roles for professional accountants in organizations. Some claim to be describing the actual tasks in today’s accounting practice, while others claim to present tasks that professional accountants should assume. The emergent role of the professional accountant within the SMEs environment remains undefined. The value of the business rescue of the professional accountant in providing these services was questioned. This is particularly alarming as the literature has argued that the automation of the profession will have a drastic impact on the traditional role of the professional accountant and has placed emphasis on the development of advisory competencies of the professional accountant. The integrated role explored the concept of IR and integrated thinking. The integrated reporting role is in its infancy and has no relationship with the current role of the professional accountant within the SMEs environment. This research has con contributed to the c SMEs accountancy literature in two ways. Firstly, it extended accounting research focused on the SMEs environment, which is relatively sporadic and not dealt with in mainstream accounting journals but rather seen as a by-product of business advice in general. Secondly, an in-depth understanding of the roles played by professional accountants will provide a framework for understanding how accountancy contributes to the successful functioning of SMEs.

This study goes beyond analysing traditional descriptive statistics on SMEs since the researcher applies qualitative methodologies to address key gaps in the existing literature and find answers to crucial questions that have remained unanswered until now. There are restrictions and constraints when undertaking to investigate a research problem. Neither a particular epistemology nor a method is therefore without limitations. It is therefore acknowledged that these limitations could always be improved upon through further research. Further research may expand upon the nature and impact of role confusion between the roles of the professional accountant within the traditional compliance roles.

REFERENCES

- Adams S, Simnett R. Integrated Reporting: An opportunity for Australia's not for profit sector. Aus Account Rev. 2011; 21(3):292-301.

- Haji AA, Anifowose M. Audit committee and integrated reporting practice: Does internal assurance matter? Manag Audit J. 2016; 31(8): 915-948.

- Haji AA, Anifowose M. The trend of integrated reporting practice in South Africa: Ceremonial or substantive? Sustain Account Manag Policy J. 2016; 7(2):190-224.

- Barth ME, Beaver WH, Landsman WR. The relevance of the value relevance literature for financial accounting standard setting: Another view. J Account Economics. 2001;31(3):77-104.

- Barth ME, Landsman WR, Lang MH. International accounting standards and accounting quality. J Account Res. 2008; 46(3):467-498.

- Berry AJ, Sweeting R, Goto J. The effect of business advisers on the performance of SMEs. J Small Bus Enterprise Dev. 2006; 13(1):33-47.

- Boyatzis RE. Transforming qualitative information: Thematic analysis and code development. Sage. 1998.

- Brown J, Dillard J. Integrated reporting: On the need for broadening out and opening up. Account Audit Account J. 2014; 27(7):1120-1156.

- Burns J, Baldvinsdottir G. An institutional perspective of accountant's new roles–the interplay of contradictions and praxis. Eur Account Rev. 2005; 14(4):725-757.

- Creswell JW, Clark VLP. Designing and conducting mixed methods research. Sage. 2017.

- Devilries C, Rinaldi L, Unerman, J. Integrated Reporting: Insights, gaps and an agenda for future research. Account Audit Account J. 2014; 27(7):1042-1067.

- Dumay J, Dai T. Integrated thinking as a cultural control? Meditari Account Res. 2017; 25(4):574-604.

- Eccles RG, Saltzman D. Achieving sustainability through integrated reporting. Stanf Soc Innov Rev. 2011; 9(3):56-61.

- Engelbrecht L, Yasseen Y, Omarjee I. The role of the internal audit function in integrated reporting: A developing economy perspective. Meditari Account Res. 2018; 26(4):657-674.

- Flower J. The international integrated reporting council: A story of failure. Critical Perspect Account. 2015; 27:1-17.

- Franco-Santos M, Lucianetti L, Bourne M. Contemporary performance measurement systems: A review of their consequences and a framework for research. Manag Account Res. 2012; 23(2):79-119.

Citation: Yasseen Y, Crous F (2021) Expectation Issues Regarding the “Emergent Roles” of the Professional Accountant with in South African SMEs. Int J Account Res. 9:212.

Copyright: © 2021 Yasseen Y, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.