Indexed In

- Open J Gate

- RefSeek

- Hamdard University

- EBSCO A-Z

- Scholarsteer

- Publons

- Euro Pub

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Research - (2021) Volume 9, Issue 6

Determinants of Financial Inclusion in Small and Medium Enterprises: Evidence from Ethiopia.

Goshu Desalegn*Received: 24-Jan-2020 Published: 25-Jul-2021, DOI: 10.35248/2472-114X.21.9.215

Abstract

The study examines the determinant factors that influence financial inclusion among small and medium enterprises in Ethiopia. The study uses explanatory research design and mixed research approach with both primary and secondary source of data utilized. More specifically, the study adopts a multiple linear regression model. The finding of the study reveals that; supply side factors demand side factors, market opportunity, and collateral requirements have a positive effect on the firm’s access to finance. On the other hand, institutional framework factors, and cost of borrowing has a negative effect on the firm’s access to finance. This study suggests that the rate of interest charged by financial institutions shall be considered for harmonization to make inclusiveness among small and medium enterprises access to finance. And financial institutions shall consider providing training for small and medium enterprises before issuing them credit access.

Keywords

Small and medium enterprises; Access to finance; Collateral requirements; The cost of borrowing.

Introduction

One of the key components of inclusive development is financial inclusion, an area in which Africa has been lagging behind other continents. Less than one adult out of four in Africa has access to an account at a formal financial institution. Broadening access to financial services will mobilize greater household savings, marshal capital for investment, expand the class of entrepreneurs, and enable more people to invest in themselves and their families. Financial inclusion is, therefore, necessary to ensure economic growth performance. Financial inclusion refers to all initiatives that make formal financial services available, accessible, and affordable to all segments of the population.

In so doing, there is a need to harness the untapped potential of those individuals and businesses currently excluded from the formal financial sector or underserved and enable them to develop their capacity, strengthen their human and physical capital, engage in income-generating activities, and manage risks associated with their livelihoods.

Financial inclusion goes beyond improved access to credit to encompass enhanced access to savings and risk mitigation products, a well-functioning financial infrastructure that allows individuals and companies to engage more actively in the economy while protecting users’ rights. And one of the emerging financial institutions that have a problem of financial inclusion is small and medium-sized enterprises. Small and Medium-sized Enterprises (SMEs) have typically been supposed as the dynamic force for sustained economic growth and job creation in developing countries. They play a multifaceted role such as boosting competition, innovation, as well as the development of human capital and the creation of a financial system. Additionally, they have played and continue to play significant roles in the economic growth, development, and industrialization of developing countries.

Accordingly, most developing countries have formulated and implemented a wide variety of SME development strategies to support the growth of the sector, thereby transforming economies and generating substantial employment opportunities (Small and Growing Businesses in Ethiopia, by ADA asbl and First Consult PLC, 2016). The need for SMEs considers as a means of ensuring self-independent, job creation, import-substitution, effective and efficient utilization of local raw materials, and participation in the economic development.

SME sector is one of the principal driving forces for economic growth and job creation. This is particularly true for many lowincome countries in Africa where SMEs and the informal sector represent over 90% of businesses, contribute to over 50% of GDP, and account for about 63% of employment.

Accordingly, most developing countries considered the enormous potentials of the SMEs sector, and the significance, contribution, and potential of the SMEs to job creation, poverty reduction, and economic growth. SMEs have become important urban economic activities particularly in providing urban employment. Similarly, in cities and towns of Ethiopia, SMEs are the predominant income-generating activities and thus they have a significant contribution to local economic development and used as the basic means of survival. But, despite the acknowledgment of its immense contribution to sustainable economic development, its performance still falls below expectations in many developing countries including Ethiopia. This is because the sector in these developing countries has been hindered by several factors militating against its performance, and leading to an increase in the rate of SME's failure. To gain a better understanding of firms’ access to finance in Africa, data from the World Bank Enterprise Surveys which cover more than 130,000 firms in 127 countries, is analyzed that; on average, the percentage of enterprises with a bank account (across all firm size groups) in Sub-Saharan African countries is comparable to or greater than the percentage of enterprises with a bank account in all other developing economies.

For instance, 83% of small-sized enterprises and 94% of medium-sized enterprises in Africa report having a bank account as compared to 87% of small-sized and 93% of medium-sized enterprises in other developing economies. Yet, firms in Sub-Saharan Africa have notably limited access to external funding , the data from WBES, show that on average, only 22% of enterprises have a loan or a line of credit. In comparison, the average of enterprises with a loan or a line of credit in other developing economies excluding Africa is 43%.

Like elsewhere, small firms in Sub-Saharan Africa are at a relative disadvantage in accessing external credit. With this regard, numerous studies have been discussed that SMEs are financially more constrained than larger firms in both developed and developing countries.

In developing economies including Sub-Saharan Africa, SMEs are typically more credit-constrained than large firms, severely affecting their possibilities to grow [1,2]. Calomiris and Hubbard noted that when the company is smaller, the restrictions on credit are greater. Furthermore, according to [1,3] cited in El-Said et al. Small firms consistently report more financing obstacles than medium and large enterprises.

In the context of Ethiopia, medium and small enterprise development holds a strategic place within Ethiopia’s Industrial Development Strategy. All the more so as SMEs are the key instruments of job creation in urban centers, whilst job creation is the centerpiece of the country’s development plan.

The role of SMEs as the principal job creators is not properly promoted. Because a lot of empirical studies show that; SMEs lack confidence, appropriate products, rigid policies, and requirements, as well as very high bank charges and interest rates in most financial institutions, are were the main influences for their failure to transact through the formal channels. Additionally; the SME sector in Ethiopia is taken as an instrument in bringing about economic transition by effectively using the skill and talent of the people particularly women and youth without demanding high-level training, much capital, and sophisticated technology .However, evidence from different empirical studies shows the reverse [4].

Therefore, improving SMEs’ access to finance is significantly important in promoting performance and firm productivity in the country. In addition to this, despite the enormous importance of the SMEs sector to the national economy with regards to job creation and the alleviation of abject poverty, many of the SMEs are unable to realize their full potential due to the existence of different factors that inhibit their growth and performance. One of the leading factors contributing to the unimpressive growth and performance of the enterprises in Ethiopia are limited access to finance and the financing gap to SMEs can be attributed to both the demand side and supply side. This regard, a lot of studies was conducted in Ethiopia [5].

were conducted studies on SMEs in Ethiopia from different perspectives but fails to identify the main Determinants of Financial Inclusion in Small and Medium Enterprises.Hence,by considering the above research gap, this study focus on what essentially the Determinants of Financial Inclusion in Small is and Medium Enterprises: (Evidence from Ethiopia). Therefore, the general objective of this study is to investigate the determinant factors that affect the financial inclusion of small-medium enterprises in Ethiopia. The following hypotheses are formulated for the study.

H1: Institutional framework factors have a negative and significant effect on financial inclusion.

H2: Supply-side factors have positive and significant effect on financial inclusion.

H3: Demand-side factors have positive and significant effect on financial inclusion.

H4: Market opportunity has positive and significant effect on financial inclusion.

H5: cost of borrowing has negative and significant effect on financial inclusion.

H6: Collateral requirement has negative and significant effect on financial inclusion

Review of Related Literature

Generally speaking, financial inclusion, or broad access to financial services, is defined as an absence of price and non-price barriers in the use of financial services. Improving access, then, means improving the degree to which financial services are available to all at a fair price. It is easier to measure the use of financial services since data of users can be observed, but the use is not always the same as access. Access essentially refers to the supply of services, whereas use is determined by demand as well as supply.

Assessment of Access to Finance and Its Availability for SMEs in Addis Ababa Conferring to Wikipedia Access to finance is the ability of individuals or enterprises to obtain financial services, including credit, deposit, payment, insurance, and other risk management services. Those who involuntarily have no or only limited access to financial services is referred to as the unbanked or under banked, respectively. Access to finance can be broadly defined as access to financial products (e.g. deposits and loans) and services (e.g. insurance and equity products) at a reasonable cost. Given the widely recognized link between access to finance, growth, income smoothing, and poverty reduction, many countries have adopted the goal of universal financial access [6].

Benefits from Increasing SME Financial Inclusion

This section illustrates the nature and magnitude of potential macro-financial benefits from greater SME financial inclusion. According to IMF, SME financial inclusion has a benefit on economic growth, job creation, the effectiveness of the macroeconomic policy, and macro-financial stability.

Financial inclusion can reduce moral hazard and adverse selection problems, both of which tend to align returns to assets with the initial stock of assets available for individuals in a generation. Thus, financial inclusion opens up investment opportunities irrespective of parental wealth. Moreover, on one hand, financial inclusion enables households to invest in human capital. On the other hand, firms accessing finance improve productivity by not only investing in physical but also employing highly skilled individuals. Since high skills attract higher wages; highly skilled individuals can only be engaged in firms that are skill-intensive and highly efficient.

A study conducted by suggests two primary causes for the failure of small and medium business enterprises in the world. These failures are classified as a lack of appropriate management skills and inadequate capital (both at start-up and continuingly). Additionally, the study conducted by Goodwin et al. Indicated that the level of employment in any country cans influencefinancialinclusion. The finding of the study reveals that; payment of wages and salaries through automated cash transfers is seen to influence financial inclusion in the United Kingdom. Other studies have also shown that payment of social security benefits, pensions, and other cash transfers through the cash system significantly promotes financial exclusion [7].

Aberaet.al. conducted a study on Contributions of Micro, Small and Medium Enterprises (MSMEs) to Income Generation, Employment, and GDP: Case Study Ethiopia. The objective of the study was to review the conditions of MSMEs, their contribution to employment creation, income generation, and poverty alleviation, contributions to the local, regional and national GDP, stimulating entrepreneurial climate and the challenges and opportunities in the design, implementations, marketing opportunities, linkages, financial sources, dynamics, survival, and policy landscape. The study was conducted through primary and secondary data through a survey, focus group discussions, and document reviews. Additionally, a qualitative and quantitative research approach was used to analyze the collected data using various statistical programs. The finding of the study reveals that lack of credit, weak market linkage, insufficient training, weak human resources development schemes, dependency on government and spoon-feeding mentality, oscillations in government policies, price variations, weak links and poor market and product development strategies were the main obstacles for the development of SMEs.

Nega and Hussien conducted a study on Small and Medium Enterprise Access to Finance in Ethiopia: Synthesis of Demand and Supply. The objective of the study was to analyze in-depth the demand and supply issues relating to Small and Medium Enterprises (SMEs) access to finance in Ethiopia. The study used primary data which is collected from 519 business firms drawn from the major towns in Ethiopia. And the finding of the study reveals that; banks and MFIs engagement in financing SMEs in Ethiopia is limited. The demand side findings and analysis revealed that access to finance is significantly influenced by the age of the firm, firm’s previous engagement with banks, the experience of the manager, and whether firms are managed by the owner (ownermanager) or not [8].

Fitane conducted a study on Factors Affecting Sustainability of Small and Medium-Scale

Enterprises: the Case of Addis Ababa, Ethiopia. The general purpose of the study was to identify the major internal & external factors that influence the sustainability of small and medium scale enterprises. The study used survey-based approach with Primary and secondary data were used for this study. The target population was manufacturing construction, trade and service existing and closed small and medium Government organized enterprises in Addis Ababa, Ethiopia the finding of the study reveals that; the most important internal factors that determine SMEs sustainability is work-related factor and marketing, financial and political-legal factors are major external factors that affecting SMEs sustainability. The major implication of the study is that improving financial and work-related problems is critical in guaranteeing the survival of SMEs.

Agebe and Amha conducted a study on Micro and Small Enterprises (MSE) Development in Ethiopia: Strategy, Regulatory Changes, and Remaining Constraints. The objective of the study was to examine the current business environment for the SME sector. The study used the primary source of data to collect data. The finding of the study reveals that there have been attempts by the government to liberalize and improve the policy, regulatory and institutional support environment for SMEs. Additionally, there was the divergence between stated policies & directives and the outcome on the ground. Capital shortage, inadequate business premise, inadequate/uncertain market, and high taxes remain major constraints to expand SMEs.

Seyoum conducted a study on Growth of Micro and Small Enterprises in Addis Ababa City Administration: A Study on Selected Micro and Small Enterprise in Bole Sub City. The main objective of this study was to investigate the factors that affect the growth of Micro and Small Enterprises (MSEs) in Addis Ababa City. The study used Primary data, through a structured questionnaire, which was collected through random samples from 165 Micro and Small Enterprises (MSEs). The finding of the study reveals that; Micro and Small Enterprises (MSEs) whose owners attained training, started the business with the high initial investment, engaged on the service sector, and established in non-cooperative form have better growth than those whose owners/operators did not attend training, who started with the low initial investment, those engaged on the production sector, and those working in cooperatives respectively [9].

Hadis and Ali conducted a study on Micro and Small Enterprises in Ethiopia; Linkages and Implications: Evidence from Kombolcha Town. The objective of the study was to examine the status of formal institutional linkages and their implications on SME's performance in Ethiopia, particularly in Kombolcha town. The study was employed mixed (quantitative and qualitative) research design and explanatory sequential analytic approaches. Using primary and secondary data. The finding of the study reveals that; locally produced raw materials are in a dearth of quality and affordability in the area. Despite having a favorable institutional linkage with TVET institutions in access to training and business improvement tools; technology transfer, credit access, and market link for their produces are currently encountered with challenges from administrative sides and lack of appropriate policy concerns. Credits accesses as a backbone of MSEs have been highly affected by collateralize issues and entrepreneurs failures to organize under micro-enterprise as a mandatory procedure. Unlike formal linkages, informal linkages have a significant role to play in access to the market.

Hezron and Hilario on their study conducted in Maputo central business district, Mozambique, there is a relationship between the structure of the financial sector and access to finance by SMEs; there is a relationship between awareness of funding and access to finance by SMEs; there is a relationship between collateral requirements and access to finance by SMEs, and there is a relationship between small business support and access to finance by SMEs.

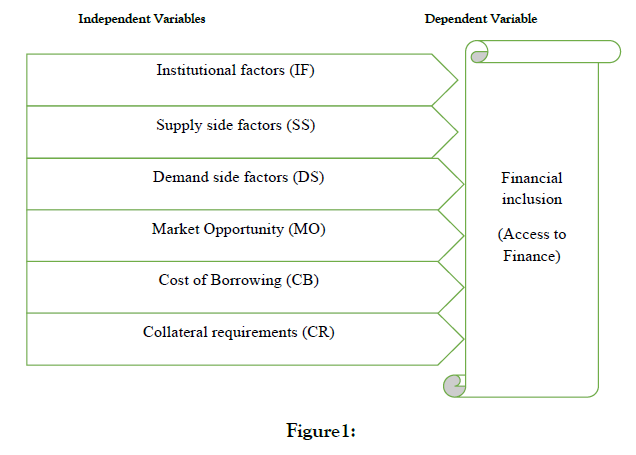

Negash and Kumera conducted a study on Barriers to Growth of Medium and Small Enterprises in Developing Country: Case Study Ethiopia. The main objective of this study was to determine the barriers to the growth of small and medium enterprises in Ethiopia. The study used cross-sectional, descriptive, and inferential designs in line with both primary and secondary data. The finding of the study reveals that; strong competition in the markets, high level of interest rates on loans, poor infrastructure, speed of debt payment by customers, unavailability of an appropriate property, state of the country’s economy, low market demand for firms’ products/ service, pricing of competitor products, in the availability of raw materials, the attitude of banks and low availability of finance from lenders were rated as high barriers for small and medium business growth. While, especially strong competition in the markets, a high level of interest rates on loans, and poor infrastructure were the highest barriers for small and medium business growth in a developing country. As a result of the empirical review and theoretical assumptions; the study has developed the following schematic representation of the conceptual framework.

Research Methodology

In this study, the researcher used mixed research approach; which includes both qualitative and quantitative research approaches. Furthermore, this study used an explanatory research design to identify determinant factors that influence financial inclusion among SMEs in Ethiopia.

The target population of the study includes all existing SMEs in Addis Ababa, Ethiopia. Furthermore, Ethiopian commercial banks and microfinance institutions are included in the target population of the study.Because the sampling frame for this research is unknown, then the probabilistic two-stage stratified sampling method is ideal when it is impossible or impractical to complete a list of elements composing the population. Thus the sampling technique for this study was probability sampling particularly two stages stratified sampling which involves dividing the population into homogeneous sub-groups called strata based on the geographical location of SMEs and then select samples from each sub-group using simple random or systematic procedures to ensure that an adequate number of samples were selected from the different sub-groups. Hence the different small and medium enterprises operating in Addis Ababa form the stratum and the list of each Semis used as a primary sampling unit for each stratum (PSU’s), an owner or employee in each SMEs also served as a secondary sampling unit (SSU’s).Accordingly, this study used the recommendation by in determining the standard deviation, 95% confidence interval, and a 5% sampling error in calculating the sample size. Thus the sample size for this study was determined with the use of Topman formula as presented below.

n = z2pqe2

n = required sample size

z = degree of confidence (i.e. 1.96)

p = probability of positive response (0.5)

q = probability of negative response (0.5)

e = tolerable error (0.05)

Therefore, n = (1.96)2 *0.5*0.5 = 384.16 =384 (0.05)2

Model specification and Description of Variables

To examine the determinant factors that influence financial inclusion of SMEs, there is an estimated equation where access to finance is reflected as a function of the following variables

ATF = f (IF, SS, DS, MO, COB, CLL)...................................(1)

ATF = Accesses to financial inclusion or access to finance

IF= Institutional framework factors

SS = Supply –side factors

DS = Demand-side factors

MO = Market opportunity

COB = cost of borrowing

CLL = Collateral requirements

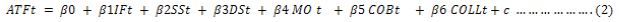

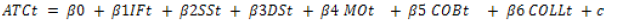

Model equation of the study

The above equation number (1) can be rewritten in the following econometric model with its functional forms.

Whereas; β0 is the intercept and βi (i=1, 2, 3, 4, 5, 6.) represents the coefficient for each of the independent variables.

ATF = Access to finance (measured by proxy questions ranked by Likert scale).

IF = Institutional framework factors (measured by questions ranked by Likert scale)

SS = Supply-side factors (measured by proxy questions ranked by Likert scale).

DS= Demand-side factors (measured by proxy questions ranked by Likert scale).

MO = Market opportunity (measured by proxy questions ranked by Likert scale)

COB = cost of borrowing (measured by proxy questions ranked by Likert scale).

CLL = Collateral requirements (measured by proxy questions ranked by Likert scale).

C = is the constant term of the regression.

Data Analysis

In this study, multiple regression analysis was carried out to get the predictive value of the variables considered. This was basically made to determine the linear combination of the constructs. The dependent variable of the study is access to finance (ATC) and independent variables are collateral requirements (COLL), market opportunity (MO), cost of borrowing (COB), institutional framework factors (IFF), demand side factors (DS), and supply side factors (SS).

(Tables 1 and 2)

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Durbin-Watson |

|---|---|---|---|---|---|

| 1 | .822a | .676 | .670 | .07094 | 1.847 |

| a. Predictors: (Constant), IFW, SS, DS, COB, MO, COLL | |||||

| b. Dependent Variable: ATC | |||||

Table 1: Result of Model summary.

| ANOVAa | ||||||

|---|---|---|---|---|---|---|

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 1 | Regression | 3.279 | 6 | .546 | 108.594 | .000b |

| Residual | 1.570 | 312 | .005 | |||

| Total | 4.849 | 318 | ||||

| a. Dependent Variable: ATC | ||||||

| b. Predictors: (Constant), IFW, SS, DS, COB, MO, COLL | ||||||

Table 2: Result of Anova table.

The model equation is

The regression model output was presented in below table 4.11 and it shows the coefficients, standard errors, t-values, and p-values for explanatory variables. The overall summary of the model is presented in the above table 4.10 which implies the R-squared, adjusted R-squared and standard error of the estimates. The ANOVA result table shows F-statistics and probability (F-statistics) for the regression. The R-squared and Adjusted R-squared statistic of the model were 67.6% and 67% respectively.

The explanatory power of independent variables such as collateral requirements, market opportunity, cost of borrowing, institutional framework, demand side factors , and supply side factors on the change in dependent variable (access to finance) was explained 67.6%. The result of Adjusted R-squared shows that change on dependent variable (ATF) was explained 67.6% by the independent variables employed in the study. Therefore, 33.4 % of change on dependent variable (ATF) was explained by other factors which are not included in the model.

The null hypothesis of F-statistic (the overall test of significance) which says the Adjusted R-squared is equal to zero was rejected at 1% significance level. F-value of 0.0000 shows strong statistical significance which enhanced the reliability and validity of the model. (Table 3)

| Coefficients | ||||||

|---|---|---|---|---|---|---|

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||

| B | Std. Error | Beta | ||||

| 1 | (Constant) | 9.956 | .075 | 132.923 | .000 | |

| IF | -.058 | .011 | -.202 | -5.251 | .000 | |

| SS | .139 | .011 | .468 | 12.631 | .000 | |

| DS | .113 | .012 | .361 | 9.703 | .000 | |

| MO | .050 | .016 | .118 | 3.109 | .002 | |

| COB | -.031 | .007 | -.170 | -4.445 | .000 | |

| COLL | .034 | .004 | .283 | 7.726 | .000 | |

| a. Dependent Variable: ATC (Access to finance) | ||||||

Table 3: Result of coefficients.

The result of regression out reveals that the variable institutional framework factors have a negative relationship with access to finance and statically significant. The coefficient on the variable shows that; 1 unit increase in institutional framework factors causes the access to finance to decrease by 0.058 units and statically significant at 5% significance level. The implication of their relationship implies that as increase in the statements stated in institutional framework factors a decrease in the firm’s access to finance. The conclusion drawn from this variable implies that; when the financial institution increase the institutional framework factors the small and medium enterprises access to finance will decrease. The finding of this variable is consistent with the study established.

Figure 1:

The variable supply side factors has a positive relationship with access to finance and statically significant. The result of regression analysis implies that; 1 unit increase in supply side factors cause the firms access to finance to increase by 0.139 units and statically significant at 5% significance level.

The implication of the positive relationship between variables shows that whenever financial institutions increases availability of credit to small and medium enterprises, the firm’s access to finance could also increases. The finding of this variable is consistent with the study established.

The variable demand side factors have a positive relationship with the firms access to finance and statically significant. The result of regression analysis implies that 1 unit increases in the demand side factors causes increases in 0.113 unit access to finance and statically significant at 5% significance level. The implication of positive relationship between the firm’s access to finance and demand side factors are that; increase in the statements stated on demand side factors (small and medium enterprises) causes increase in firms access to finance. The finding of this variable is consistent with the study established [10].

Additionally, the variable market opportunity has a positive relationship with the firms access to finance and statically significant. The result of regression out implies that 1 unit increase in the firm’s (small and medium enterprises) market opportunity results an increase in the firms access to finance by 0.050 units at 5% significance level.

The positive relationship between the firms access to finance and market opportunity implies that; if small and medium enterprises get more market opportunity to perform their business activities in the market; the financial institutions tend to facilitate the credit access to small and medium enterprises than normal circumstance.

On the hand, the variable cost of borrowing has a negative relationship with the firms’ access to finance and statically significant. The coefficient on the regression analysis of this variable implies that; 1 unit increase in cost borrowing causes the firms access to finance to decrease by 0.031 units and statically significant at 1% significance level. This implies that; once the financial institutions tend to increase a cost of borrowing by 1 unit; the firms (small and medium enterprises) access to finance decline automatically [11].

The last variable of the study is collateral requirements; as it is shown in the above regression analysis table. The relationship between collateral requirements and access to finance is positive and statically significant.

The result of regression output implies that; 1 unit increase in collateral requirement causes the firms access to finance to increase to 0.034 units and statically significant at 1% significance level. The implication behind is that; if the firms (small and medium enterprises) ability to provide collateral increases; the firms access to finance increases too.

On the other hand, the relationship between collateral requirements and access to finance can be interpreted as; when the firms (small and medium enterprises) collateral requirement decreases the firm’s access to finance also decreases because the two variables move in the same direction [12-14].

Conclusion

This study is conducted to examine the determinant factors that influence the financial inclusion among small and medium enterprises (Evidence from Ethiopia, taking as a sample of Addis Ababa city administration). In doing so, some variables measured as factors to the financial inclusion (which was measured by the firms’ access to finance) were included. The study was conducted through primary and secondary data conducted from SMEs and sampled financial institutions.

The study adopted explanatory research design and mixed research approach. In order to estimate the extent of the effects of each variable, several tests were needed to be done. Firstly, a multicollinearity test was checked through correlation matrix; in order to see, if there was any issue between variables. Then, other tests (such as the auto correlation, normality, and heteroscedasticity tests), were confirmed that a model is feasible.

To analyze the descriptive statistics, the researcher used the mean, maximum, minimum and standard deviation of all variables. Further, the researcher discussed regression analysis to determine the effect of independent variables on the dependent variable. Therefore, in line with the specific objective of the study the researcher reached at the following conclusion.

The finding of the study reveals that financial inclusion (access to finance) is positively correlated with the variables included in the study except two of the variables. Subsequently the following sections discuss the finding of each variable.

The result of regression analysis indicates that; the variable institutional framework factors (which is measured by, necessity of audited financial statements, the credit processing period, accessible information on government regulations, training, government support, political intervention, and finally deposit requirements) has a negative effect on access to finance and statistically significant at 1 percent significance level.

On the other hand; supply side factors (which is measured by; strategic business planning, clear mission and vision, availability of raw material, motivation, tolerance to work hard, selection of business partner, and management skill ) has a positive effect on access to finance and statistically significant at 1 percent significance level.

The variable demand side factor (which is measured by; availability of funds from banks, expansion plan, willingness of banks, customer handling system, availability working capital, availability of appropriate machinery and equipment, and selection proper new technology) has a positive effect on the firms access to finance and statically significant at 5% significance level.

Additionally, the variable market opportunity (which is measured by; availability of market information, awareness about the product/promotion, connection with successful and other business adaption for changing environment, and skills to handle new technology) has a positive effect on the firms access to finance and statically significant at 5% significance level.

The variable collateral requirements (which is measured by; if collateral affects access to finance, problems in accessing loans than big firms, and mandatory requirement of collateral) has a positive effect on the firms access to finance and statically significant at 1% significance level. However, the variable cost of borrowing (which is measured by challenges of profit in accessing credit, expensiveness of credit, business performance, and growth magnificent, and bank service charges) has a negative effect on the firms access to finance and statically significant at 1% significance level. Based on the study finding it is possible to conclude that factors like collateral requirements, market opportunity, cost of borrowing, institutional framework, demand-side factors, and supply-side factors have a high impact on determining the firm's access to finance.

REFERENCES

- Beck T, Cull R. Banking in Africa. In The Oxford Handbook of Banking AN 2015.

- Beck T, Demirgüc-Kunt A, Soledad M and Peria M. Reaching out: Access to and use of banking services across countries. Journal of Financial Economics 2007; 85: 234-266.

- Abbas K, Razak DA, Saad N. The perception of micro-entrepreneurs and petty traders on conventional and Islamic microfinance: a case study of Pakistan. Journal of Islamic Finance 2014; 3:38-48.

- Aker Jenny C, Isaac M. "Mobile Phones and Economic Development in Africa. Journal of Economic Perspectives 2010; 24: 207-32.

- Alem M, Townsend RM. An evaluation of financial institutions: impact on consumption and investment using panel data and the theory of risk-bearing. The Journal of Econometrics 2014; 18:91-103.

- Allen F, Demirgüc-Kunt A, Klapper L and Peria MSM.The foundations of financial inclusion: understanding the ownership and use of formal accounts. J Financ. Internet 2016;27:1-30

- Barr M. banking the poor. Yale Journal on Regulation 2004; 21:122-239.

- Barua A, Kathuria R and Malik N.The status of financial inclusion, regulation, and education in India.ADBI 2016; 568.

- Berger P. Molyneux JOS Wilson. Eds. Oxford University Press 2014.

- Berger AN , Udell GF. A more complete conceptual framework for SME finance. Journal of Banking and Finance 2006; 30: 2945-2966.

- Bruhn M and Love I. The real impact of improved access to finance: evidence from Mexico. J Finance LXIX, 2014; 1347-1376.

- De Koker L. Aligning anti‐money laundering, combating of financing of terror, and financial inclusion. Journal of Financial Crime 2011; 18: 361-386.

- De Koker L , Jentzsch N. Financial inclusion and financial integrity: aligned incentives? World Dev, 2013; 44.267-280.

- Zins A , Weill L. The determinants of financial inclusion in Africa. Review of Development Finance 2016; 6:46-57.

Citation: Desalegn G (2021) Determinants of Financial Inclusion in Small and Medium Enterprises: Evidence from Ethiopia. Int J Account Res 9:215.

Copyright: © 2021 Desalegn G. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.