Indexed In

- Open J Gate

- RefSeek

- Hamdard University

- EBSCO A-Z

- Scholarsteer

- Publons

- Euro Pub

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Research - (2021) Volume 9, Issue 7

An Investigation of Construction Company Overhead Costs in Guyana

Ferzon Aziz* and Christopher WillisReceived: 14-Jan-2021 Published: 25-Jul-2021, DOI: 10.35248/2472-114X.21.9.216

Abstract

This study investigates construction company overhead (OH) on government projects in Guyana using a questionnaire survey. The survey examines contractors’ awareness of OH costs, perception of OH costs, and the methods adopted by contractors to allocate and control OH costs. The questionnaire consists of 12 questions developed from literature. A total of 47 contractors participated in this study. The results indicate that company OH costs have increased in the last five years and are generally high among contractors mainly because of cost inflation, payment delays and government regulations. Direct project cost is used as the principal allocation base for company OH costs and the type of contract; project complexity, size, and location affect the allocation of company OH costs to projects. The main contributors to company OH costs are automobile and equipment expenses, financing costs, insurances and taxes. However, many contractors are taking steps to reduce OH cost levels to remain competitive and in their business. The contribution of this paper is the first study of OH costs in Guyana that identified the key attributes of company OH. This paper will be of interest to OH costs researchers and practitioners managing finance for government projects.

Keywords

Company overhead costs; Construction industry; Guyana

Introduction

Overhead (OH) costs management is a key issue for contractors because it can impact their operation due to issues such as, increase competition, decrease in market share, and lower in profit margins [1]. OH costs have many interpretations resulting in numerous definitions. For example, defines OH cost as “the general construction cost for a project that cannot be directly link to the work process’’ [2]. Defines the term ‘overheads’ as costs that “relates to off-site costs, which need to be recovered to maintain the head office and local office facilities’’ [3]. Defines OH as “comprising of indirect materials, indirect employee costs and indirect expenses, which are not directly identifiable or allocable to a cost object in an economically feasible way’’ [4]. Moreover recommended, as a rule, that if the benefits are less than the cost for performing more precise measurement, then the cost should be treated as an OH expense. Overhead (OH) costs can be placed into company OH and project OH costs [5]. This study focuses on company OH costs. Company OH costs also have many interpretations resulting in several definitions. For example, defines company OH (general and administrative OH) as the costs sustained by a construction organization in maintaining its business and supporting its production process, but are not related to a specific project [6]. Defines Company OH (general OH or Home office expense) as the costs used to maintain the contractor’s business, but cannot be directly linked to a particular project. These definitions highlight the importance of OH costs in managing of construction organizations and projects. OH costs can vary widely between construction organizations and projects and proper accounting and management is essential [7].

Recently many public sector projects in Guyana have encountered problems that affect the outcome of the projects, which lead to early failure. Some of the major problems include poor quality of work, termination of contracts by clients, and delay of project completion due to contractors’ low productivity. In addition, there is a lack of technical, financial, and managerial capacities in majority of local construction companies. This resulted in issues such as; inadequate skilled personnel to manage projects, unavailability and use of incorrect equipment, poor planning, lack of finance during project, high insurance premium for project, extension of time, poor bid preparation, and deliberately bidding low to win contract. These problems are related to company OH costs and if not taken into account will result in contractors failing to make a profit. This usually force contractors during the project to make claims, use substandard material (if unchecked) and unskilled labour to perform skilled labour jobs. In addition, contractors do not understand and properly account for company OH costs in bids which have resulted in many of the problems faced by Guyana’s construction industry. Consequently, the objective of this paper is to investigate contractors’ company OH costs practices in Guyana. This includes investigating contractor’s awareness, perception, and allocation of company OH costs. This is the first study of OH costs in Guyana. The audiences for this paper are researchers and financial managers in the construction industry.

Literature Review

Company OH costs are usually neglected by contractors and can affect contractor’s profit or produce a loss. Failure to recover company OH can cause financial loss and force them out of business [7]. Pointed out that by not knowing their company OH costs contractors will find it difficult to control OH costs [8]. Company OH according to depends on many factors such as time, market condition, number of projects, project size, nature and company objective and goals such as growth [9]. Pulver also identifies that company OH range between 8% and 15% of the total annual construction volume. Reported that in the United States, company OH generally accounts for 2.5% to 10% of annual construction volume [7]. The issue of OH cost recovery is important since if it cannot be identified and controlled then there will be a loss in revenue to the company. To properly account for these costs, the ideal thing to do is to charge each project the expenses sustained by the company for that project. This will ensure recovery in company OH once it can be estimated or allocated properly during bidding. However, this practice is not often employed on construction projects and it becomes essential that contractors allocate their OH between undertaken projects [9].

It has been reported by the most contractors find it difficult to identify the various components of company OH, which makes it difficult to allocate across all of the company’s projects [1,5]. In addition, point out that for future growth and diversification of construction operations attention needs to paid to the aspects of company OH cost that should be increased, by how much, and when to include additional staff [7]. If the company OH costs can be estimated and allocated within realistic limits then it can be applied to projects with the same accuracy as direct costs. If this cannot be achieved then there will be distortion in the company financial statement equal to the unallocated amount known as under applied OH costs [5]. This raises the issue, why should forthcoming projects pay back company OH expenses. First, if there is no administrative help to run the project, there will be no project. Second, projects need to absorb company OH in order to keep the business successful, how much is absorbed by a project depends on the level of competition surrounding the project [5, 1].

Cost allocation is used to determine company OH in projects, but its use should be limited to those cost items that cannot be estimated directly. This is because cost estimation, which is more accurate, should be used as much as possible to ensure accuracy in the project costs and make bids more competitive. Contractors using the allocation process to recover company OH costs must decide on the basis for allocation and the means by which the OH costs will be applied to each project [6]. The basis used by contractors consist of labour cost, labour and material costs, total cost of labour, material, and equipment, estimated project duration, or the number of projects the company anticipated in the current year. For example, pointed out that contractors can use time as a base to allocate company OH into the bid price because company OH is a function of time [6]. If the project duration is extended it will result in an increase in the company OH costs. This method is not widely used, but can increase the accuracy of company OH in projects if there is accurate estimation of project duration. According to the means of applying company OH to projects is to use last year construction volume and the current expected work to calculate the recovery percentage [6, 10]. This rate is affected by the construction volume, the company general expenses and the gross margin and should be rechecked regularly to ensure it reflects the company general expenses. If the general expenses are not recovered the company will lose money, if the rate is too high the company will lose its competitive ability, or if it is low the company can lose some or all its profit [6, 5]. A common allocation method is to sum all company OH for a given period (fiscal year) and divide it by the total direct cost for the same period. This will give the percentage of company OH that can be applied to forthcoming projects [6, 5].

Methodology

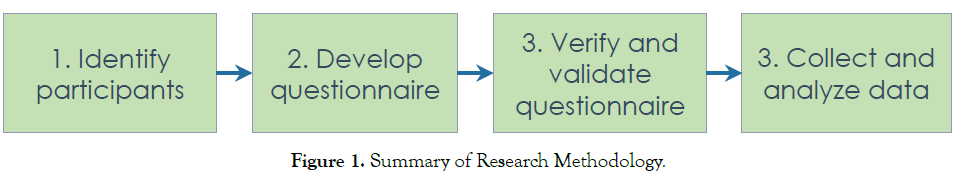

The research methodology in Figure 1 shows the process used to determine the Company OH costs in Guyana. (Figure 1)

Figure 1. Summary of Research Methodology.

Identify participants

A total of 83 general contractors that perform work for the government (Ministry of Works) were contacted and 47 participated in this study.

Develop questionnaire

This research uses a questionnaire survey as suggested by [11,12]. The steps used to develop the questionnaire were similar to those suggested by [5,1,1,14]. The questionnaire was designed to be a wide framework that was deep enough to pursue the various cost estimation methods likely used by local contractors. This is because contractors’ decisions regarding OH costs may be based on experience and judgment rather than well-established policies resulting in difficulty acquiring quantitative responses. The developed questionnaire consists of 12 questions on company OH costs to identify contractors’ awareness, perception, allocation, and factors affecting specific company OH costs within the company. The sub-headings in the results section represent the questions used in the survey. A combination of open-ended and close ended questions was used to develop the questionnaire. The open-ended question was used to define company OH cost. The closes-ended questions consist of multiple choice and Likert-Scale questions that were used to collect the remaining attributes of OH costs. The multiple-choice questions used five-item options. The Likert scale questions used a five-point scale (i.e., strongly disagree, disagree, neutral, agree, and strongly agree) with each point coded as 1, 2, 3, 4, 5, respectively to rate the appropriateness of the metrics for OH cost measurement, based on the assumption that adequate level of details was provided for the metrics [15]. The Likert scale was selected because of the advantages described by [15-17].

Verify and Validate Questionnaire

The questionnaire was initially verified by the authors to ensure clarity and conciseness and later validated through a pilot test of a small sample of six contractors to ensure the questions were easily understood by the contractors and that each question had the same meaning to each contractor. The feedback was used to revise the questions and refine the questionnaire.

Collect and Analyse Data

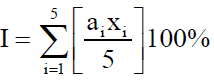

Data was collected through a questionnaire survey using a telephone interview of senior representative in each organization. Telephone survey was used due to the ease and convenience to reach the contractors that participated in this study. The survey took approximately 90 minutes to complete. Response from the questionnaire were coded and entered into spread sheet for analysis. The analysis used for this study include: percentage (rounded to the nearest whole number), frequency (number of participants), importance index, and rank. To analyse the related Likert-scale (agreement scale) questions the importance index was calculated using equation 1 [1]. This involves ranking the attributes in each related question based on importance index to reveal the comparative significance of the criteria under assessment.

Where

I=Importance index

ai= A constant expressing the weight of the ith response where, ai = 1, 2, 3, 4, 5 for i=1, 2, 3, 4, 5, respectively.

xi= The frequency of the ith response given as a percentage of total responses for each cause or factor; i=1, 2, 3, 4, 5, where x1= Frequency for strongly disagree agree response, x2=Frequency for disagree response, x3=Frequency for neutral response, x4= Frequency for agree response, x5=Frequency for strongly agree response.

Results

This section presents the data analysis from the survey.

Company OH cost definition

This open-ended question seeks contractors understanding of OH costs. A total of 34 contractors (73%) define Company OH costs as the expenditures for delivering a service that does not include direct costs. Of the remaining 13 contractors; 10 (21%) provide no definition and 3 (6%) contractors provide incorrect definition, indicating that contractors do not fully understand OH costs.

Ratio of company OH cost to project direct cost

This ratio represents the amount of company OH costs assigned to a project. Providing the direct costs are viable, by reducing the proportion of company OH can result in a more competitive bid. This ratio can be lowered by reducing company OH and distributing company OH costs to more projects (as stated in the literature). The responses from this question are presented in table 4-1. There is no fixed ratio of company OH to project direct cost, but Goldman (1990) indicates that between six percent (6%) and ten percent (10%) is an acceptable range. From the survey, 32 contractors (68%) have a company OH cost to direct project cost greater than ten percent (10%), while 15 contractors (32%) have a ratio lower that ten percent (10%). This indicates that contractors are unsure if their company OH to project direct cost is acceptable (Table 1).

| Ratio of Company OH Cost to Project Direct Cost | Frequency | Percentage |

|---|---|---|

| 0-5 | 8 | 17 |

| 6-10 | 7 | 15 |

| 11-15 | 7 | 15 |

| 16-20 | 5 | 11 |

| Above 20 | 4 | 9 |

| Not calculated | 16 | 34 |

Table 1. Ratio of Company OH Cost to project direct cost.

Ratio of company OH cost to annual construction volume

The ratio of company OH costs to annual construction volume can vary widely and can range between eight percent (8%) and fifteen percent (15%) Pulver. The ratio of company OH to annual construction volume from the survey is given in table 4-2. The results indicated that the ratio of company OH cost annual construction volume for 19 contractors (40%) is 15% or below, while 12 contractors (26%) have a ratio of above 15%. However, 16 contractors (34%) do not know the ratio of company OH levels to annual construction volume (Table 2).

| Ratio of Company OH Cost to Annual Construction Volume | Frequency | Percentage |

|---|---|---|

| 0-5 | 5 | 11 |

| 6-10 | 8 | 17 |

| 11-15 | 6 | 13 |

| 16-20 | 9 | 19 |

| Above 20 | 3 | 6 |

| Not calculated | 16 | 34 |

Table 2. Ratio of Company OH Cost to Annual Construction Volume.

Perception of company OH levels

Contractors’ perception of company OH cost was surveyed to provide insight into their management approach to these costs. This was done by asking questions about the changes in company OH costs in the last five years, the reasons for the changes, and the distribution of OH costs. The responses to these questions are presented as follows:

Changes in company OH cost in the last five years

The responses from the contractors to determine the variation of company OH costs in the last five years are given in table 4-3. Thirty-five of the contractors (75%) indicated that company OH costs increased by more than 15% in the last five years, while 12 contractors (25%) do not know if their company OH costs increased, decreased or remained the same (Table 3).

| Changes in Company OH Cost in the last five years | Frequency | Percentage |

|---|---|---|

| Increase | 35 | 74.5 |

| Decrease | 0 | 0.0 |

| Did not change | 2 | 4.3 |

| Don’t Know | 10 | 21.3 |

Table 3. Changes in Company OH Cost in the last five years.

Reason for changes in company OH costs

Knowing the reasons for company OH cost increase can help to allocate scarce company resources to reduce company OH cost levels. This question uses nine metrics to assess company OH levels and the results are evaluated as shown in table 4-4.

| Reason for Increase in Company OH Costs | Strongly agree | Agree | Neutral | Disagree | Strongly Disagree | Total | Importance Index (%) | Rank |

|---|---|---|---|---|---|---|---|---|

| Cost inflation | 27 | 9 | 7 | 2 | 2 | 47 | 84.3 | 1 |

| 57% | 19% | 15% | 4% | 4% | 100% | |||

| Payment delay | 13 | 16 | 13 | 4 | 1 | 47 | 75.3 | 2 |

| 28% | 34% | 28% | 9% | 2% | 100% | |||

| Government regulations | 13 | 15 | 12 | 5 | 2 | 47 | 73.6 | 3 |

| 28% | 32% | 26% | 11% | 4% | 100% | |||

| Marketing expenditure | 13 | 17 | 10 | 2 | 5 | 47 | 73.2 | 4 |

| 28% | 36% | 21% | 4% | 11% | 100% | |||

| Client related needs | 5 | 15 | 21 | 5 | 1 | 47 | 67.7 | 5 |

| 11% | 32% | 45% | 11% | 2% | 100% | |||

| Lack of new projects | 8 | 13 | 14 | 7 | 5 | 47 | 65.1 | 6 |

| 17% | 28% | 30% | 15% | 11% | 100% | |||

| Lack of staff training | 5 | 14 | 17 | 7 | 4 | 47 | 63.8 | 7 |

| 11% | 30% | 36% | 15% | 9% | 100% | |||

| Company Strategy | 2 | 16 | 19 | 6 | 3 | 46 | 63.5 | 8 |

| 4% | 35% | 41% | 13% | 7% | 100% | |||

| Internal Mistakes | 7 | 4 | 16 | 15 | 5 | 47 | 57.0 | 9 |

| 15% | 9% | 34% | 32% | 11% | 100% |

Table 4. Reason for Changes in Company OH Costs.

Some of the reasons for company OH cost increases are interconnected and can affect each other for example; company growth can be affected by marketing expenditure. The reasons for increase in OH costs are given in order of importance;

Cost inflation: Many items used to support business operations are affected by rise in prices due to inflation.

Payment delays: Make contractor seek external financing, which results in rise of company OH costs. It can also affect the contractor’s future business by affecting whether the contractor bid or not bid for new projects, because of delayed cash flow due to delayed payment. If a contractor does not bid, it means fewer future projects will have to recover the company OH costs at a higher rate.

Government regulations: Such as awarding projects using the lowest bid prevent company from effective company OH costs recovery.

Marketing expenditure: During slow down or recession most contractors usually seek new marketing opportunities, which can increase company OH costs.

Client related needs: There are occasions where a project may require specialized equipment or other items and not all the costs can be recovered from this project. In such a case, the costs that cannot be recovered from the project are treated as company OH and recovered from future projects.

Lack of new projects: The lack of new projects for example, during a recession can reduce contractors’ ability to recover company OH costs and increase competition. Fewer projects coupled with payment delays can cripple a construction company future operation. Lack of new projects will increase project OH costs and can results in downsizing of the company and liquidation of assets resulting in economic loss to the contractor.

Lack of staff training and development: Staff training and development can be used to reduce company OH costs. Staffs that are more qualified can perform better and be more productive.

Company strategy: When a company is expanding, it will require more office equipment, recruitment of more personnel, etc. for its operation, which may increase company OH costs.

Internal mistakes: Mistakes such as wrong management decisions and errors can increase company OH costs levels. (Table 4)

Distribution of Company OH Costs

This question uses eight metrics to determine how company OH costs are distributed so that areas that require more attention are identified. The results are given in table 4-5 and discuss in order of importance as follows:

Automobile and equipment expenses: Consists of vehicles and equipment operating, maintenance and depreciation costs and is affected by high fuel prices. Sixty percent (60%) of contractors identify this metric comprise in excess of 10% of their company OH costs.

Insurances and taxes: Consist of company insurance and government taxes. Forty seven percent of contractors indicated that this metric comprise in excess of 10% of their company OH costs.

Financing costs: Consists of delayed payments and high interest rates on loans. Forty-three of contractors identified this metric comprise in excess of ten percent (10%) of their company OH costs.

Office staff salaries: Consist of head office staff. Thirty- eight percentage of contractors indicated that this metric comprises in excess of ten percent (10%) of their company OH cost.

Labour: Consist of costs such as, recruitment costs, training costs, worker health related costs, and temporary housing costs, but do not include wages. Twenty three percent of contractors indicated that this metric comprise in excess of 10% of their company OH costs.

Office rent, supplies and utilities – majority of the contractors (97%) indicated that this cost metric comprise less than ten percent (10%) of their company OH costs.

Travelling: Include the costs incurred when travelling to conduct company business. Thirteen percent of contractors identified this metric comprise in excess of 10% of their company OH costs, which is due to remote projects.

Marketing: Includes the costs of advertisements and the costs of finding and entering new markets. Fifteen percent of contractors indicated that this metric comprise in excess of 10% of their company OH costs (Table 5).

| Distribution of Company OH Costs | 0-5% | 6-10% | 11-15% | 16-20% | Above 20% | Total | Importance Index (%) | Rank |

|---|---|---|---|---|---|---|---|---|

| Automobile & equipment expenses | 11 | 8 | 10 | 7 | 11 | 47 | 59.6 | 1 |

| 23% | 17% | 21% | 15% | 23% | 100% | |||

| Insurances & taxes | 11 | 14 | 11 | 7 | 4 | 47 | 51.1 | 2 |

| 23% | 30% | 23% | 15% | 9% | 100% | |||

| Financing costs | 14 | 13 | 12 | 3 | 5 | 47 | 48.1 | 3 |

| 30% | 28% | 26% | 6% | 11% | 100% | |||

| Office staff salaries | 17 | 12 | 9 | 4 | 5 | 47 | 46.4 | 4 |

| 36% | 26% | 19% | 9% | 11% | 100% | |||

| Labour (e.g. training costs) | 23 | 13 | 8 | 3 | 0 | 47 | 36.2 | 5 |

| 49% | 28% | 17% | 6% | 0% | 100% | |||

| Office rent, supplies & utilities | 23 | 19 | 2 | 2 | 1 | 47 | 34.0 | 6 |

| 49% | 40% | 4% | 4% | 2% | 100% | |||

| Travelling | 32 | 9 | 2 | 1 | 3 | 47 | 31.9 | 7 |

| 68% | 19% | 4% | 2% | 6% | 100% | |||

| Marketing | 31 | 9 | 4 | 2 | 1 | 47 | 31.5 | 8 |

| 66% | 19% | 9% | 4% | 2% | 100% |

Table 5. Distribution of Company OH Costs.

Allocation of Company OH cost

In order for contractors to remain competitive they must be able to properly allocate and recovery company OH costs. Questions were asked about the base used to allocate company OH costs, why a specific base is used, what factors affect the amount of company OH cost carried by each project, and perception of OH cost allocation. The answers are presented as follows:

Allocation Base for Company OH Costs

Seven bases (metrics) were used to determine how contractors allocate company OH costs to projects, as shown in Table 4-6. Ten contractors (21%) identify a predetermined percentage of estimated material, labour and equipment costs as the most used base for company OH cost allocation. Nine contractors (19%) use a of direct cost including project OH cost as the allocation base for company OH costs to projects. Project bid value, number of projects, pre-determined percentage of material and labour cost, project duration, and estimated material cost are used by 23 (49%) of the contractors as their company OH allocation base. Five contractors (11%) indicated that they are not sure if they include company OH costs (Table 6).

| Allocation Base for Company OH costs | Frequency | Percentage |

|---|---|---|

| Estimated material, labour, and equipment cost | 10 | 21 |

| Direct cost including project OH | 9 | 19 |

| Project bid value | 7 | 15 |

| Number of projects | 6 | 13 |

| Estimated material and labour cost | 5 | 11 |

| Duration of project | 4 | 9 |

| Estimated material cost | 1 | 2 |

| Company OH is not included | 5 | 11 |

Table 6. Allocation Base for Company OH Costs.

Motivation for using a Particular Method

This question seeks to find out why contractors use a particular allocation base and the results are shown in table 4-7. The results indicate that sixteen contractors (34%) deem their projects as similar in nature and allocate company OH costs across a number of projects over a specific time. Fifteen contractors (33%) feel that company OH cost is a direct cost related expenditure and use direct cost as their allocation base. Eleven contractors (34%) use a particular allocation base because it is easy to use that method, and five contractors (11%) see company OH costs as a time related expenditure (Table 7).

| Motivation for using a Particular Method | Frequency | Percentage |

|---|---|---|

| Similar type of projects | 16 | 34 |

| Company OH is primarily direct cost related expenditure | 15 | 32 |

| Ease in using this method | 11 | 23 |

| Company OH is primarily time related expenditure | 5 | 11 |

Table 7. Motivation for using a Particular Method.

Factors affecting Company OH Costs Allocation

Based on the nature of the project some contractors may choose not to use the value given by the cost estimator and may decrease or increase their company OH costs in projects. The factors affecting company OH costs allocation was investigated and the results are given in table 4-8 and discussed as follows:

Project complexity, size and location: The contractors indicated that this factor has the most influence on allocation of company OH costs. Large projects and projects in remote areas usually have high levels of company OH costs. Contractors should carefully review the bid document and site conditions before bidding to ensure all OH costs can be recovered.

Type of contract: This was identified by contractors as the second most influential factor that affects the allocation of company OH costs to projects. The type of contract between clients and contractors can affect company OH allocation, while different contracts have different conditions concerning OH costs.

Payment schedule: Contractors see this as the third most important factor that affects allocation of company OH costs. Depending on the contractor’s financial strength, this factor along with payment delays can force contractors to seek external finance for projects.

Availability of contractor’s cash: This factor can affect contractors’ competitiveness. It determines how much a contractor can underestimate company OH costs without any serious long-term negative effect on the company. Contractors with good financial support can vary the amount of company OH costs allocated to a specific project to win the contract and can recover OH costs on future projects whereas, contractors with no financial support will have to recover company OH costs on each project making them less competitive.

Number of competitors: Based on the competition, contractors usually decrease or increase company OH costs to win bids although the project may not recover all the company OH costs assign to it.

Need for work: When there is a period of few projects, contractors usually under-estimate their company OH costs to remain competitive and win contracts.

Strictness in client supervision: Twenty-three contractors (49%) agreed that this factor affects company OH cost allocation although there is no direct relationship between client supervision and company OH costs.

Percentage of work subcontracted: This factor was identified to have the least influence on company OH allocation. This can be because subcontracted work is project related and does not have a significant effect on company OH costs (Table 8).

| Factors affecting Company OH Costs Allocation | Strongly agree | Agree | Neutral | Disagree | Strongly Disagree | Total | Importance Index (%) | Rank |

|---|---|---|---|---|---|---|---|---|

| Project complexity, size & location | 25 | 11 | 8 | 2 | 1 | 47 | 84.3 | 1 |

| 53% | 23% | 17% | 4% | 2% | 100% | |||

| Type of contract | 23 | 14 | 7 | 1 | 2 | 47 | 83.4 | 2 |

| 49% | 30% | 15% | 2% | 4% | 100% | |||

| Payment schedule | 8 | 19 | 14 | 4 | 2 | 47 | 71.5 | 3 |

| 17% | 40% | 30% | 9% | 4% | 100% | |||

| Availability of Contractor’s cash | 13 | 12 | 13 | 4 | 5 | 47 | 70.2 | 4 |

| 28% | 26% | 28% | 9% | 11% | 100% | |||

| Number of competitors | 13 | 9 | 15 | 5 | 5 | 47 | 68.5 | 5 |

| 28% | 19% | 32% | 11% | 11% | 100% | |||

| Need for work | 7 | 13 | 19 | 6 | 2 | 47 | 67.2 | 6 |

| 15% | 28% | 40% | 13% | 4% | 100% | |||

| Strictness in client supervision | 7 | 16 | 15 | 4 | 5 | 47 | 66.8 | 7 |

| 15% | 34% | 32% | 9% | 11% | 100% | |||

| Percentage of work subcontracted | 5 | 9 | 15 | 11 | 7 | 47 | 57.4 | 8 |

| 11% | 19% | 32% | 23% | 15% | 100% |

Table 8. Factors affecting Company OH Costs Allocation.

Perception regarding OH cost allocation

Contractors’ perception of company OH costs allocation was investigated using four factors (metrics); these factors along with the results are shown in table 4-9. The results show that thirtysix contractors (77%) of the participants agreed that a good OH allocation system is vital for contractors. Thirty-four contractors (72%) of contractors agreed that by using activity-based costing (ABC) method, company OH can be allocated more accurately to projects. However, contractors do not use this method because it is a time-consuming process. Twenty-five contractors (53%) agreed that cost pools could also improve company OH allocation, while twenty-one contractors (45%) agreed that their current allocation system is effective (Table 9).

| Perception regarding OH cost allocation | Strongly agree | Agree | Neutral | Disagree | Strongly Disagree | Total | Importance Index (%) | Rank |

|---|---|---|---|---|---|---|---|---|

| Correct OH allocation system is vital for contractors | 25 | 11 | 6 | 2 | 3 | 47 | 82.6 | 1 |

| 53% | 23% | 13% | 4% | 6% | 100% | |||

| Using activity-based costing (ABC) can ensure that company OH are allocated more accurately | 15 | 19 | 8 | 3 | 2 | 47 | 77.9 | 2 |

| 32% | 40% | 17% | 6% | 4% | 100% | |||

| Using more cost pool as allocation base can ensure better company OH allocation | 7 | 18 | 17 | 3 | 2 | 47 | 70.6 | 3 |

| 15% | 38% | 36% | 6% | 4% | 100% | |||

| Present OH allocation system is effective | 8 | 13 | 16 | 8 | 2 | 47 | 67.2 | 4 |

| 17% | 28% | 34% | 17% | 4% | 100% |

Table 9. Perception regarding OH cost allocation.

Frequency of Checking Company OH Costs

The results in Table 4-10 shows that 30 contractors (64%) check their company OH cost annually, while the six contractors (13%) check it when necessary. However, 11 contractors (23%) do not check their company OH, which indicates that they do not fully understand their OH costs (Table 10).

| Frequency of Checking Company OH Costs (in years) | Frequency | Percentage |

|---|---|---|

| 0.5 | 16 | 34.0 |

| 1 | 14 | 29.8 |

| 1.5 | 1 | 2.1 |

| 2 | 4 | 8.5 |

| Over 2 | 1 | 2.1 |

| Do not check Company OH Costs | 11 | 23.4 |

Table 10. Frequency of Checking Company OH Costs (in years).

Measures to reduce and control company OH cost

Twenty-five contractors (54%) indicate that measures taken to reduce company OH costs include: maintain core staff, monitor performance of staff, and reduce current expenditure, such as, transportation, and utilities. Eight contractors (17%) indicate that employing more temporary staff close to the project site is used to reduce company OH costs. Seven contractors (15%) reduce errors/ rework, and improve performance and productivity by employing technical and qualify staff. Five contractors (11%) avoid projects in remote areas, and two contractors (4%) did not provide reasons to reduce company OH costs.

Conclusion

This study investigates contractors’ awareness and ability to effectively manage construction company OH costs in Guyana. The survey results indicate that the average company OH costs are higher than the ratio found in literature. The main causes for the increase in company OH are Cost inflation, Payment delays, Government regulations, Marketing expenditure, Client related needs, Lack of new projects, Lack of staff training and development, Company strategy, and Internal mistakes. Plans to reduce OH costs include: maintain core staff, monitor performance of staff, and reduce current expenditure, employing more temporary staff close to the project site, reduce errors/rework, employ technical and qualify staff, and avoid projects in remote areas. Although most contractors are aware that OH costs consist of company OH costs, they fall short of having a clear understanding of company OH costs. Many contractors find it difficult to identify the various components of their company OH costs and its impact on projects and their company. Company OH costs are especially difficult for many contractors to identify and allocate to projects. This is because each project is different and often carries a different amount of company OH, which is generally the maximum company OH costs that will allow the project bid to remain competitive, providing a good allocation process exists. Generally, contractors use a percentage of the total direct costs especially material costs as a base to estimate OH and profits. This is because contractors see OH as a cost and time related expenditure, that is easy to calculate, and this method may be appropriate for small projects. However, it does not allow for the proper identification and allocation of company OH costs which in turn negatively affects the absorption of all OH costs by the company. Using direct cost as the allocation base for company OH costs can affect the recovery of OH costs from projects largely because of cost inflation. In addition, poor supervision of projects and poor management of project site resources can result in cost and time overruns which will increase OH costs.

Recommendations

Contractors should be educated about company OH costs and the benefits to their company for the proper management of these costs. Contractors should implement mechanism to reduce company OH costs, which will lower unnecessary spending and make the company more competitive. Cost control plans should be used to monitor company OH costs and allow the necessary remedial actions to be taken according to the company objectives. The use of activity-based costing (ABC) should be implemented, which can optimize total project costs.

Contractors need to understand that company OH costs can be reduced by good safety records which can reduce insurance premiums; staff training which can increase productivity; good quality work which can improve company reputation; and proper utilization of resources which can optimize company OH. Contractors should have a good cost accounting system, which can help to identify and manage OH costs.

REFERENCES

- Assaf AS, Bubshait AA, Atiyah S and Al-Shahri M. The management of construction company overhead costs. Int J Project Manag. 2001;19:295-303.

- Pieplow R. Overhead Compensation: TRO Caltrans’ Innovative Approach, Division of Construction. 2006.

- Brook M. Estimating and Tendering for Construction.2004;7:1-334.

- Bupathy R. Cost Accounting Standard on Overheads. 2003;1:1-7.

- Mohammad HA. Overhead Costs in Building Construction in Saudi Arabia. MSc. Thesis. King Fahd University of petroleum & minerals. 1997;7:1-178.

- Adrian JJ. Construction Estimating: An Accounting and Productivity Approach. 1982;1:1-534.

- Popescu MC, Phaobunjong K and Ovararin N. General Overhead Contingencies and Profit. 2003;4:1-766.

- Lew EA. Means Interior Kingston. 1987.

- Pulver EH. Construction Estimates and Costs. 1989.

- Dagostino RF. Estimating in Building Construction. 1989.

- Fellows R, Liu A. Research Methods for Construction. 2008.

- Dawson C. Introduction to Research Methods.2019.

- Iarossi G. The Power of Survey Design: A User’s Guide for Managing Surveys, Interpreting Results, and Influencing Respondents. 2006.

- Pickard JA. J Research Methods in Information.2007.

- Kothari C. J Research Methodology: Methods and Techniques. 2nd ed.2004.

- Oppenheim A. Questionnaire design, interviewing, and attitude measurement.1992.

- Libor RM, Morgan L, Bockius LLP. Overview of Potential Construction Claims and Damages. 2002.

Citation: Aziz F, Willis C (2021) An Investigation of Construction Company Overhead Costs in Guyana. Int J Account Res 9:216.

Copyright: © 2021 Aziz F, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.